The Nuance Of Platformisation

Not all product suites are created equal, ft. MongoDB, Datadog, Palo Alto Networks

Hey friends! I’m Akash, an early stage software & fintech investor at Earlybird Venture Capital, investing across Europe.

I write about startup strategy to help founders navigate their company-building journeys, from inception to PMF and beyond. You can always reach me at akash@earlybird.com if we can collaborate or to share feedback.

Current subscribers: 4,060

With enough scale, there is a truth about modern public tech companies: you either die a single product company, or live long enough to be multi-product or a platform.

The swings between best-of-breed and suites are almost reflexive in software and fintech, even if the exact order and timing of sequencing can vary. Long-time readers will know that the journey from mono-product to multi-product is a recurring theme on this blog.

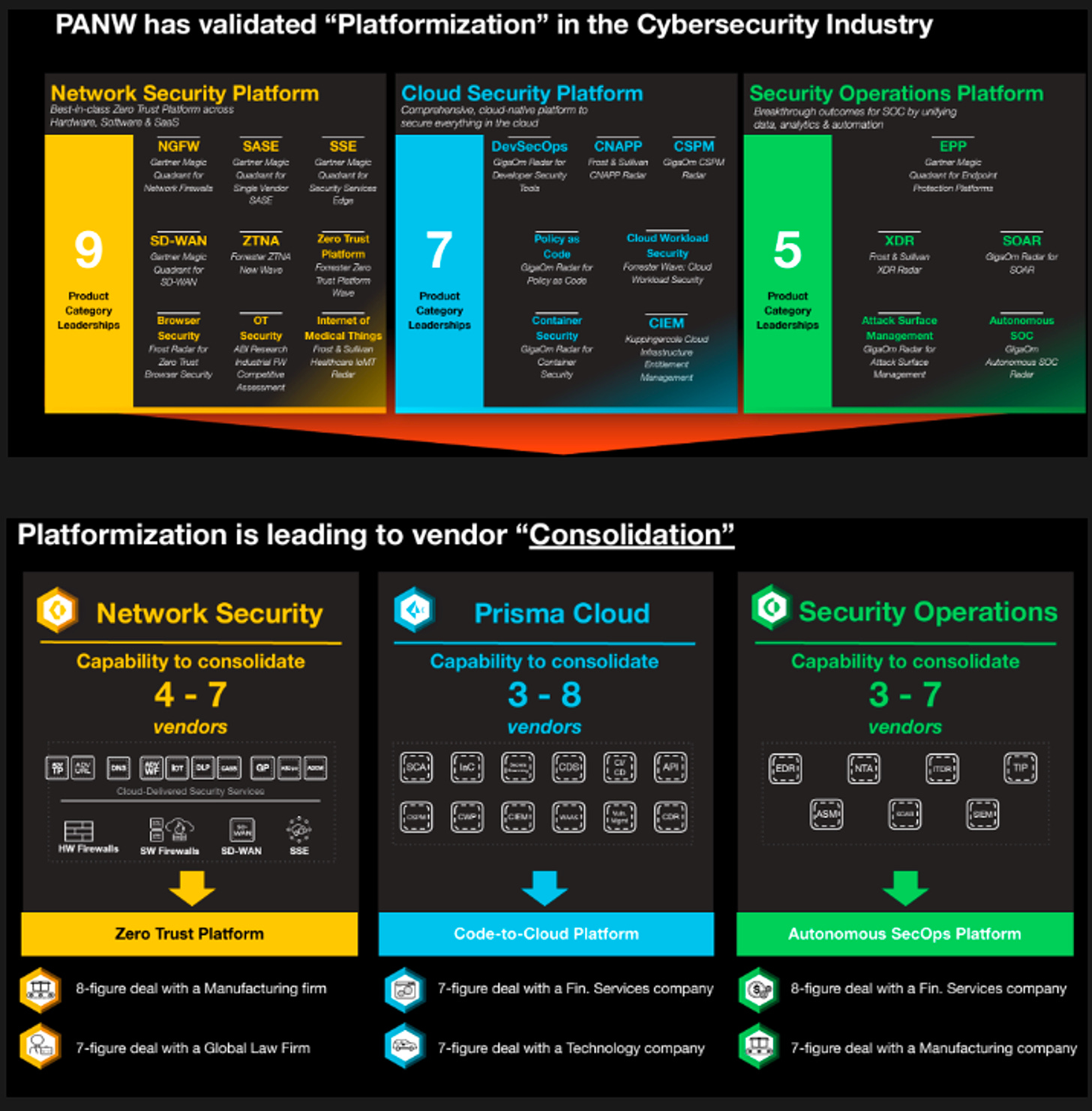

Palo Alto Networks stirred the public markets a few weeks ago by announcing their platformisation strategy, which precipitated a 28% sell off. Citing point-solution sprawl and demand fatigue from CISOs, management intend to ease the transition from best-of-breed to platforms for buyers by giving product away for free until existing contracts expire. This naturally impacts near-term top-line growth, even if its a sound strategy to capture market share in the long-term.

Crowdstrike CEO George Kurtz was forthright in his assessment:

As you might imagine, I heard a lot about platformization over the last week. To me, it's kind of a made-up fugazi term. But what I believe our competitors are talking about is bundling, discounting, and giving products away for free, which is nothing new in software and security software.

Compound startups with product suites benefit from an array of product packaging scenarios that allow them to absorb market share through penetration pricing.

That insight is not new.

Not all product suites are created equal, though.

First, product suites either have or don’t have a core product with sufficient gravity to compels buyers to consolidate around it.

The second differentiator is when the whole is greater than the sum of its parts - said differently, adoption of additional SKUs enhances the overall experience for the buyer.

Here is Nikesh Arora, PANW CEO, on the merits of consolidation where data is stitched together rather than fragmented:

To steelman the argument, a single pane of visibility leads to faster remediation than having multiple siloed point solutions that delay it.

Datadog, trading at 15x NTM revenue, invested heavily in its platform early (h/t

for his great analysis here):We built Datadog from day 1 as an open-ended unified platform. All of our products are tightly and deeply integrated at the architectural, at the data and at the user interface layer. And the same platform serves end-to-end use cases from one data set to another, from one product to another and across team boundaries.

Oliver Pomel

The platform is basically a data store where you store your data, layers when you actually collect that data and then visualization layer like dashboard or just being able to expose that data, all of that be able to serve a specific use case or a product.

Yrieix Garnier

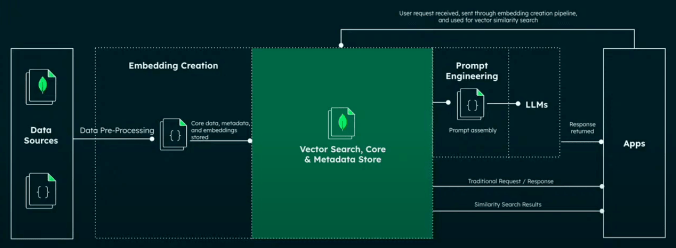

It was inevitable that MongoDB would roll out Vector Search - every incumbent database will look to win RAG workloads.

Multi-modal databases have a right to win these workloads because they already act as the store of core data and documents for their customers - co-locating documents and their embeddings just makes sense. At scale, with RAG use cases in production, costs will be scrutinised and moving embeddings between multi-modal and pure-play vector databases will be prohibitive.

A key benefit of MongoDB’s implementation of vector search support is that it supplements their other database functions as the core data and metadata stores. These are all delivered through a single platform, promoting the consolidation of AI data workloads. This simplifies the infrastructure set up for developers and provides a single interface for access.

Much of the arguments for platformisation come down a lower total cost of ownership without compromising value. Here’s Burt Podbere, Crowdstrike’s Chief Financial Officer:

And at the end of the day for us, you know, we're here to help customers get the greatest amount of outcomes at the lowest TCO.

PANW, Datadog and MongoDB are just a sample of infrastructure companies that invested heavily in building platforms that are truly greater than the sum of their parts. There is some nuance around whether additional SKUs are acquired or organically developed in-house, but both approaches succeed when a suite is stitched together effectively to drive tangible value. The terminal TCO benefits are clear to see, with each well positioned to continue expanding their TAMs.

This doesn’t mean going after everything. PANW is staying clear of email security and IDAM (h/t

) and focusing on the competencies that it has a right to win.Not all product suites are created equal.

Founders across stages should obsess about the winning playbook in their category by studying the sequence that confers the highest gravity and platform value at scale.

You can find great analysis of platforms vs pure-plays from

here.Charts of the week

The recent recovery in software is rebalancing the growth and profitability weightings

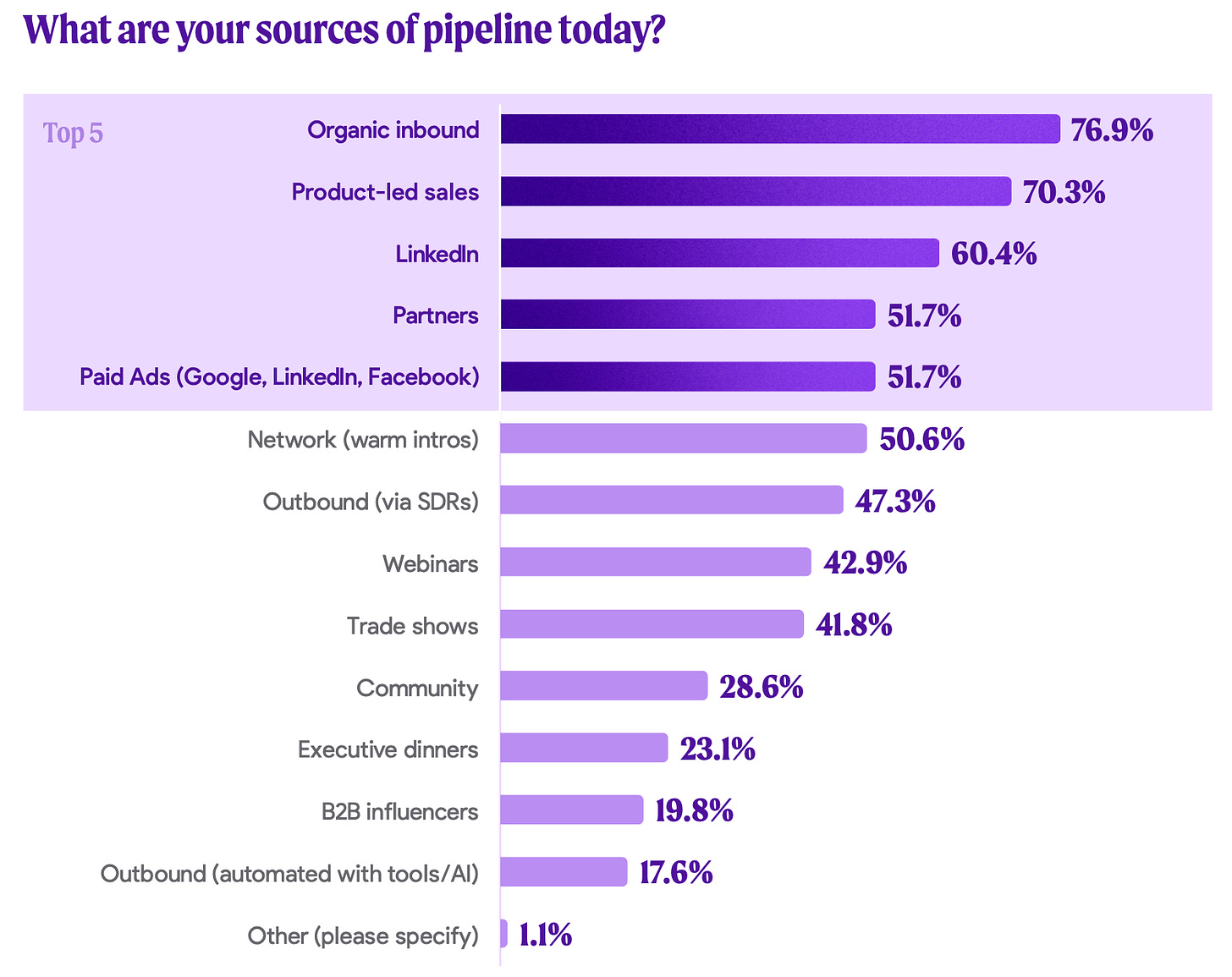

More companies are converging around Product-Led Sales

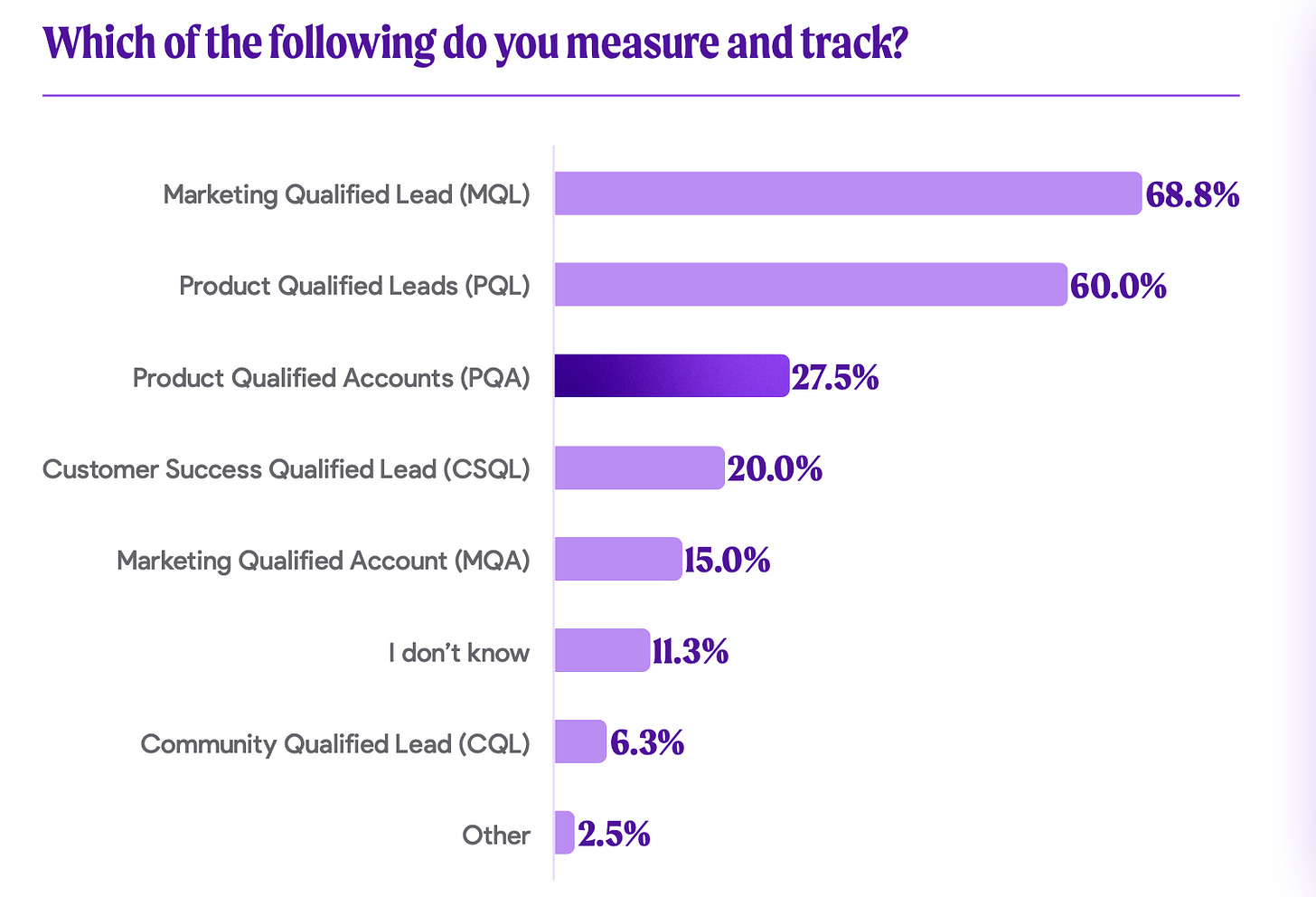

Tracking Product Qualified Accounts (activated users inside an account) is key to PLS

Reading List

The koan of an open-source LLM

Lessons from Axonius — $100 million ARR and beyond Bessemer Venture Partners

Aggregator’s AI Risk Stratechery

On the moat of vertically integrated software businesses

From Flagship Back to Fledgling: Lessons on Going Multi-Product From an Early Stripe PM First Round Review

Quotes of the week

This does, in many respects, make the risk for the Aggregators — particularly Google — more grave: the implication of one AI never scaling to everyone is that the economic model of an Aggregator is suddenly much more precarious. On one hand, costs are going up, both in terms of the compute necessary and also to acquire data; on the other hand, the customers that disagree with the AI’s morals will be heavily incentivized to go elsewhere.

This, I would note, has always been the weakness of the Aggregator model: Aggregators’ competitive positions are entrenched by regulation, and supplier strikes have no impact because supply is commoditized; the power comes from demand, which is to say demand has the ultimate power. Users deciding to go somewhere else is the only thing that can bring an Aggregator down — or at least significantly impair their margins (timing, as ever, to be determined).

Ben Thompson

Thank you for reading. If you liked it, share it with your friends, colleagues, and anyone that wants to get smarter on startup strategy. Subscribe below and find me on LinkedIn or Twitter.

Thanks for the mention and great analysis!

Pretty wild how crowdstrike called them out on their conference call

I also think it will be important to watch Palo Alto’s bookings vs Billings vs rev vs collections to see if the numbers track their story

I also wrote a detailed analysis on their Billings and financial services segment: https://breakingsaas.substack.com/p/panw-wheres-the-billings