R&D leverage in software: Multi-product greatness to drive terminal FCF

Hubspot's R&D leverage and inescapable gravity of product suites

👋 Hey friends! To the regular readers, thank you for reading as always; thanks to some of the readers that have reached out with comments and feedback on recent pieces, it’s immensely gratifying. If you enjoy these Missives, please share it with your friends.

To the new readers, I’m Akash and welcome to Missives. Every week I analyse trends and GTM strategies in Software and FinTech; you can find me on akash@earlybird.com. Join over 2,600 leading VCs, founders and operators reading Missives every week.

Current subscribers: 2,676, +32 since last week

In a rebuttal to Chamath Palihapitiya’s cynicism of software businesses’ pathways to durable free cash flow, Jamin Ball of Altimeter laid out the principle assumptions underpinning software investing: terminal FCF margins of 30% accrue to scalable software businesses that graduate from growth mode to maturity mode by building defensible product suites that deliver both margin expansion and growth.

If we had to break apart software companies into two phases of life I’d call those two phases growth mode and maturity mode.

In growth mode software companies are early in their S Curve and market penetration. They’re often rapidly hiring engineers (to build more features) and sales reps (to sell the product) in attempts to capture the majority of a market against their competition (both other startups and incumbents). Investing in growth is not only normal, is essential. But there’s a downside to investing in growth: FCF is generally negative.

This brings us to maturity mode. The promise of software companies is that as they capture market share and further penetrate their S Curve, growth will start to slow (there’s less new business to sell). As growth slows companies will hire fewer sales reps, and the ratio of ramped to un-ramped reps will heavily skew towards ramped. This should really push profitability and FCF generation up.

Jamin goes on to recite the example of Salesforce, who are stacking multiple S Curves in ‘growth mode’ on top of their core CRM product where they’ve graduated with 20% market share to maturity mode.

Just about every business looks to stack S Curves. Let’s look at Salesforce - they may be in maturity mode in their core CRM business, but they also have marketing, commerce and data cloud products that are not in maturity mode.

Effective capital allocation of R&D budgets between maturity mode in a core product, and growth mode in additional SKUs, is the driver of ‘compound startups’ and ‘platforms of compounding greatness’, concepts describing the inescapable gravity of multi-product companies.

Salesforce is acting on this insight by investing heavily in multi-cloud adoption as a means to improve their gross retention from 93% to the levels of other systems of record vendors, i.e Workday’s 98%:

Today, Salesforce has ~93% gross revenue retention, which is good but not exactly best-in-class, especially for a tool that’s often considered to be mission-critical for companies.

The implication is that the company with a lower churn rate will structurally have higher long-term margins, and ergo, the value of their revenue stream and installed base is higher.

Much like all GTM roads leads to steak dinners, point solution excellence eventually evolves into multi-product greatness or secular decline (approximately ⅓ of the public single-product companies as of the end of 2016 were acquired by the end of 2022).

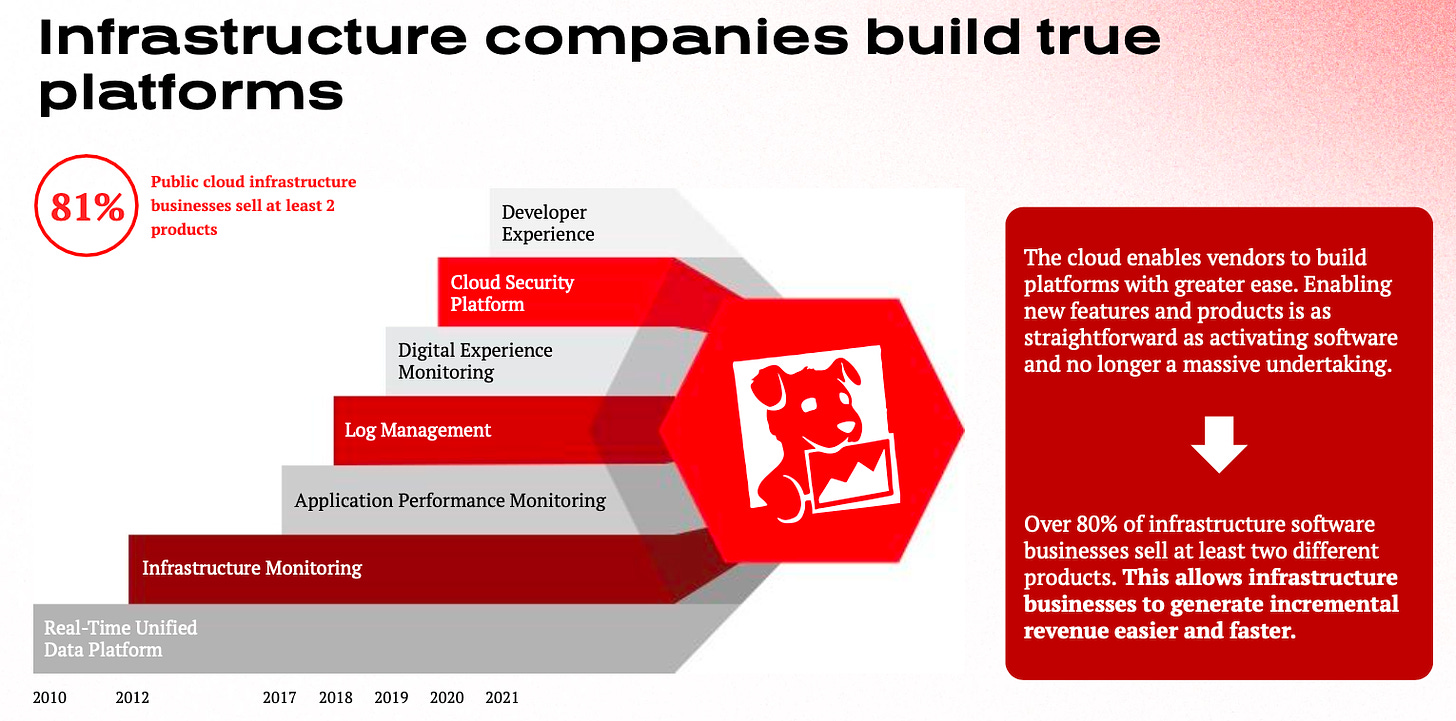

There’s a valid debate to be had about which of application or infrastructure SaaS has stronger foundations to successfully execute on a multi-product trajectory (h/t to Redpoint for the numbers: 113% NDR for a basket of App SaaS companies vs 120% NDR for Infra SaaS).

The general rule of thumb for long-term operating targets is that 15 cents for every dollar of revenue is invested into R&D, with considerable variation in the interim journeys from growth mode to maturity mode.

Deviations can be driven by GTM motions or investments in transitions from on-prem to the cloud (i.e Atlassian whose R&D spend climbed to 38% in 2016 as it commenced a multi-year transition in order to more effectively cross-sell on the cloud vs on prem).

On the surface, it’s logical to conclude that application SaaS vendors don’t enjoy similar levels of switching costs or R&D leverage as infra SaaS vendors (ripping out infrastructure is significantly harder than churning from point solutions when buyers typically have nearly 300 of them).

Margin expansion in the form R&D leverage for infra SaaS vendors is only attainable by dint of their initial excellence in R&D which confers true differentiation and category leadership. 80% of R&D is people after all, and Snowflake’s initial R&D advantage was unassailable as we’ve discussed before:

“Snowflake didn’t have 1000 coders or 1000 generalists. It had probably 5 of the world’s 20 database experts build it from scratch. That’s what makes Snowflake unique”. Nandu Anilal

In light of this, a scientific approach to R&D allocation is paramount for application SaaS builders to successfully traverse multi-product expansion.

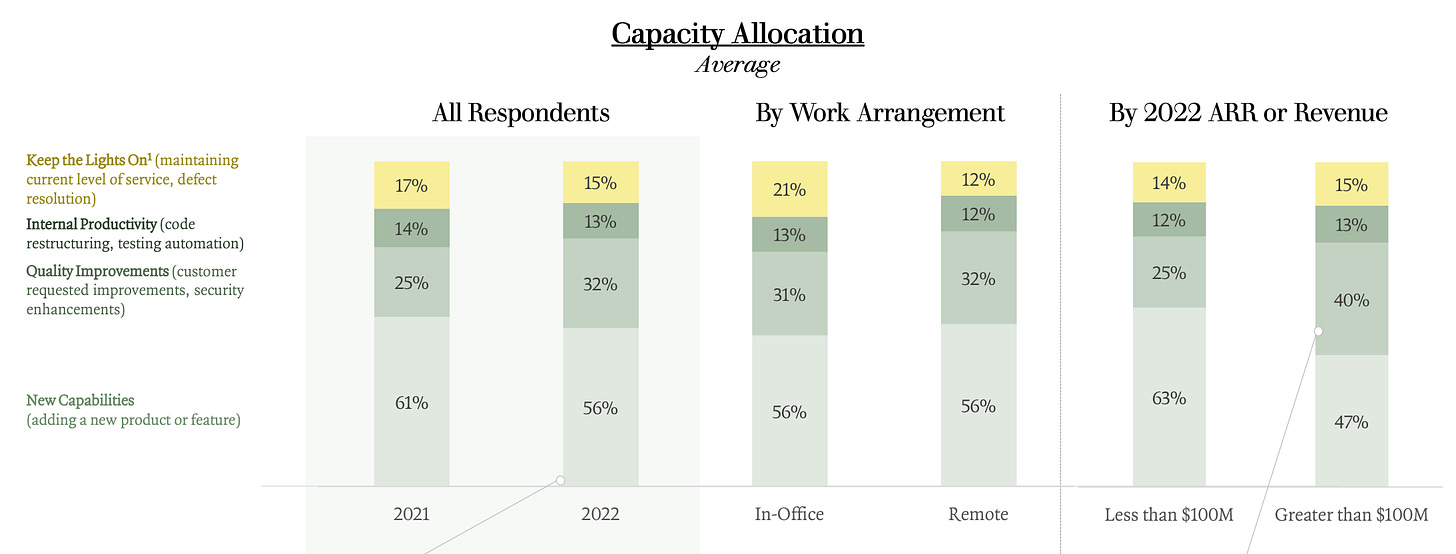

The data on engineering capacity allocation shows that companies spend c. 50-60% of R&D on new capabilities and invest more in quality improvements of existing products as they scale.

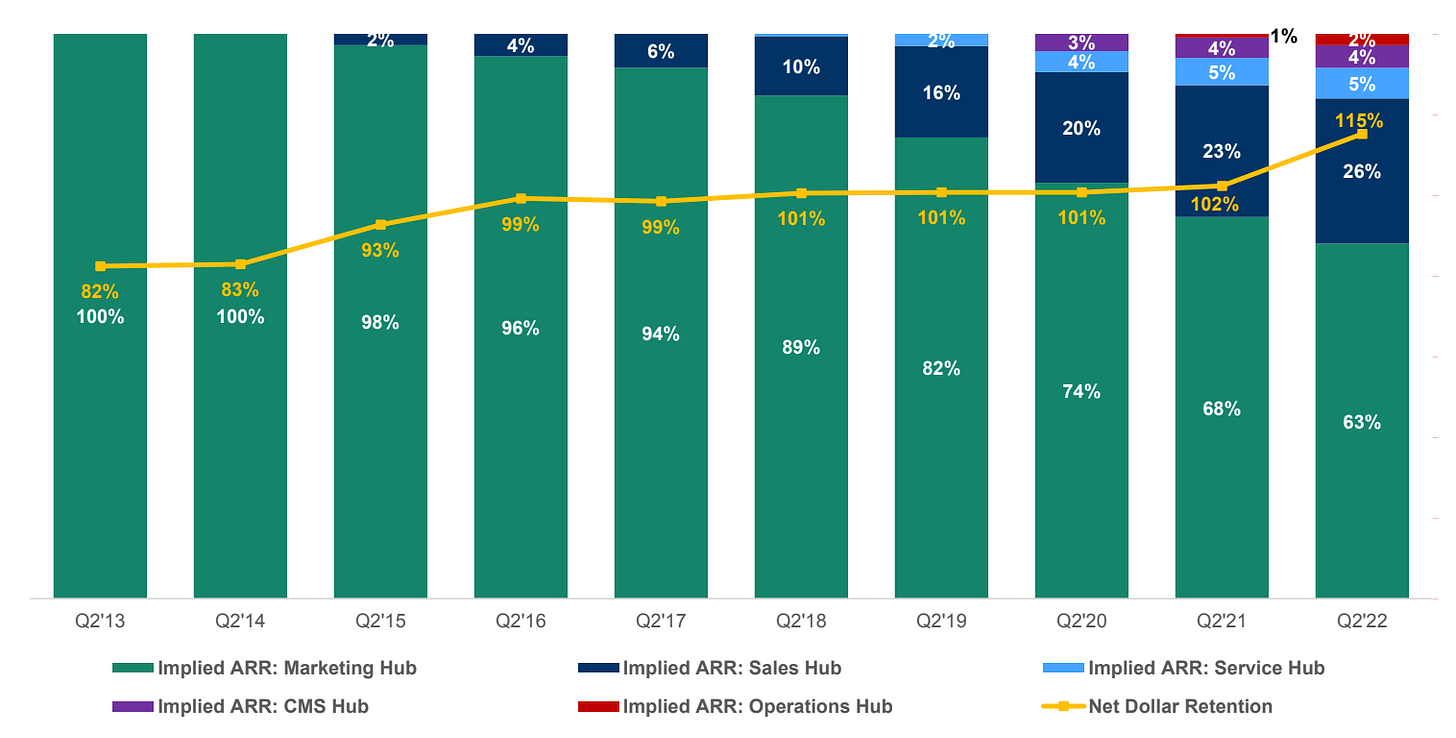

These are helpful heuristics, but the effectiveness of the R&D spend on new capabilities can vary drastically. Hubspot successfully executed a multi-product expansion strategy post-IPO with R&D spend as a % of revenue increasing only slightly as the company accrued operating leverage in S&M and meaningfully increased NDR.

Hubspot likely invested roughly the same % of R&D into new capabilities as the median of 60%, but extracted significantly more R&D leverage as it executed on its multi-product expansion. What separates Hubspot from others is its ability to hone in on the right new capabilities/products.

We talked a couple of weeks ago about how systems of action can approach sequencing of product roadmaps, either through their inherent data gravity or by studying utilisation of system of record modules. Another important framework to overlay is the Clydesdale rule, where additional SKUs create compounding value:

However, the ideal second product is even more impactful – something where 1 + 1 = 5. In a perfect world, the second product not only leverages the product benefits mentioned above, but also inherently improves your core product.

The excellent team at Tidemark published a very helpful matrix of products categorised by various dimensions of attractiveness for expansion, including the impact on ARR, gross margin, customer adoption, retention, and level of effort.

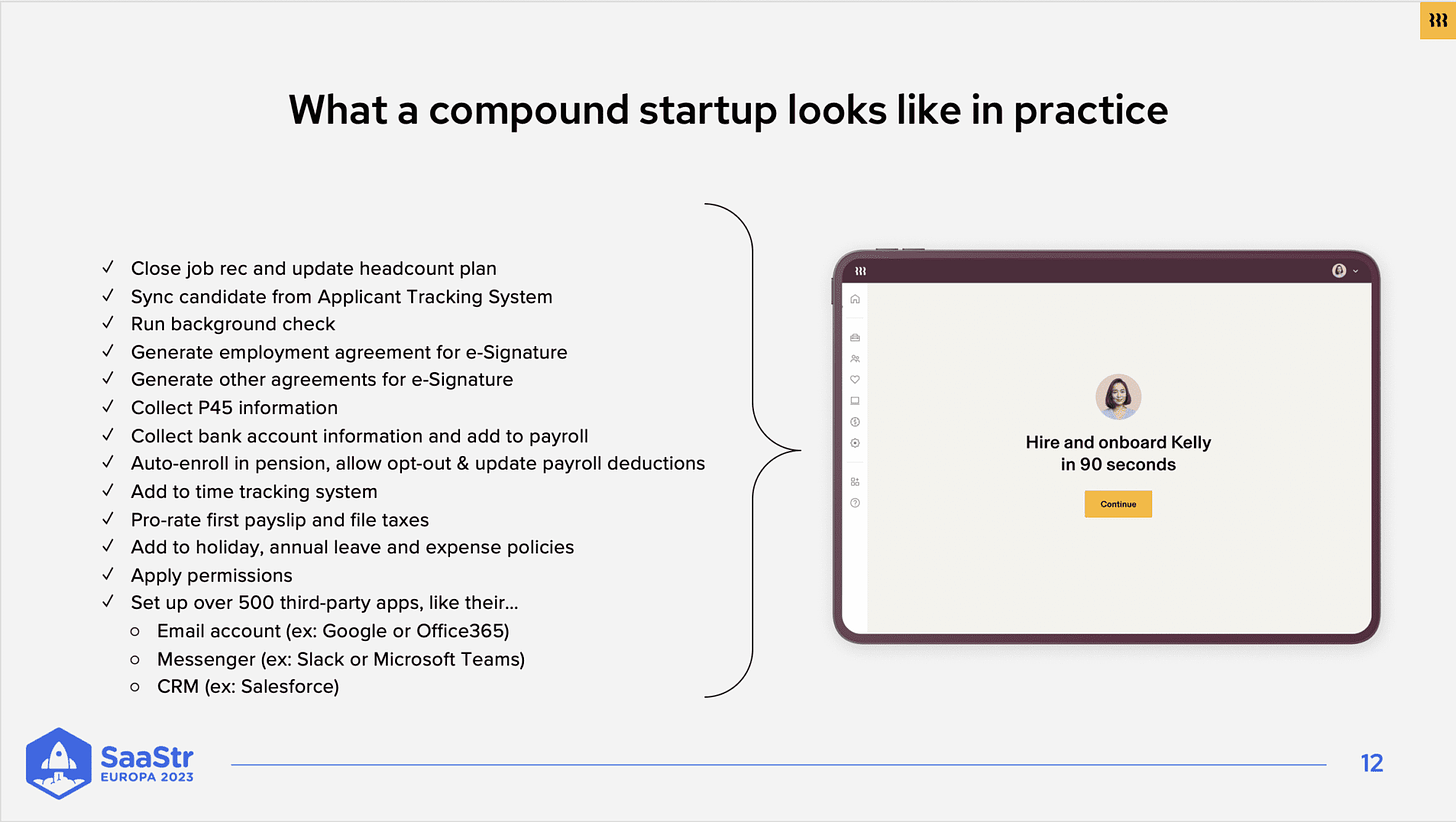

Deeply integrated, interoperable products built around a control point will naturally have higher attach rates as users will be familiar with workflows, UI/UX, and how the atomic unit of data is synced across different SKUs.

As Rippling launches in the UK, the gravity of their bundled product suite combining HRIS and payroll will result in Rippling being the vendor that buyers consolidate ‘to’, not ‘from’. Product suites are greater than the sum of their parts, hence producing pricing mechanics to reap maximum upside from the bundle.

Founders and management teams bear most of the responsibility for effective capital allocation of R&D budgets, prioritising SKUs that compound the value of the product suite as a whole. Amping up the intensity across the organisation, especially among developers, and measuring developer productivity, are pathways to R&D leverage and multi-product greatness. Lagging indicators of R&D effectiveness are measures like the Research and Development Index, which measure revenue growth as a function of R&D spend. Leveraging the board for oversight and governance over R&D investment is key to staying clear of naval-gazing and allocating capital efficiently to the highest ROI SKUs.

Thanks to Jon Galitzer, a friend and sparring partner, for the rich conversations that informed some of my thinking here.

Thank you for reading! As always, you can find me on akash@earlybird.com to discuss these ideas or to share topics you’d like me to cover. If you enjoyed it, please share Missives with your friends!

What I’m Reading

This was an authentic take on the role of luck in success and how one can maximise their ‘Luck Surface Area’; Missives is one of the ways I’ve tried to widen my LSA. The nugget on Richard Feynman in here also resonates - collecting insights throughout the week to incorporate into your thoughts in a Bayesian manner.

The story of a cap table: Gitlab

An insider look at how Gitlab’s funding rounds came together; what’s interesting is how August Capital managed to revisit the deal at the Series B with new partner Villi Iltchev the driving force behind it, fighting for the deal.

The Rapidly Decreasing Costs of AI and Why Databricks Bought Mosaic

As LLM costs are added on top of cloud costs, it’s clear that we’ll see a wide range of gross margins across application layer companies, given the frequency of certain use cases (code completion vs note-taking).

Land vs. Expand: Growth formula shifts during downturns

The contrast in new ARR from the existing instal base versus new logos compared to a couple of years is stark; repositioning Customer Success as a revenue generator rather than a cost line is key.

Survey: Open-Source Distribution of AI-Native Products

Community market fit must come before product market fit; it can taken more than 2 years of community building before monetisation is switched on.