Displacing Systems Of Record: Systems Of Action As A Wedge To Integrate And Surround

Relegating legacy SoRs to obsolescence, module by module

👋 Hey friends! To the regular readers, thank you for reading as always.

To the new readers, I’m Akash and welcome to my newsletter, Missives.

Every week I analyse trends and GTM strategies in SaaS and FinTech.

I always love hearing from readers; you can find me on akash@earlybird.com.

Join 2,500+ other founders, operators, and investors below for regular Missives.

Within application SaaS, no category comes close to matching the moats protecting legacy systems of record from invading startups.

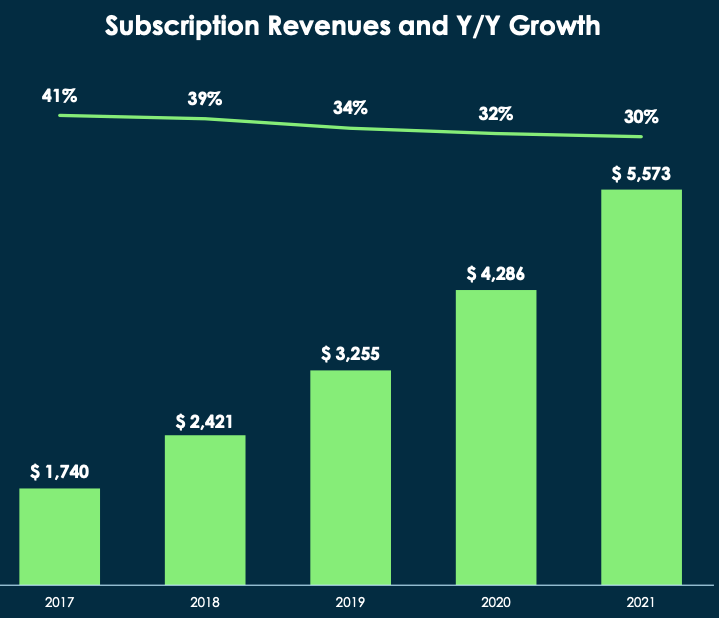

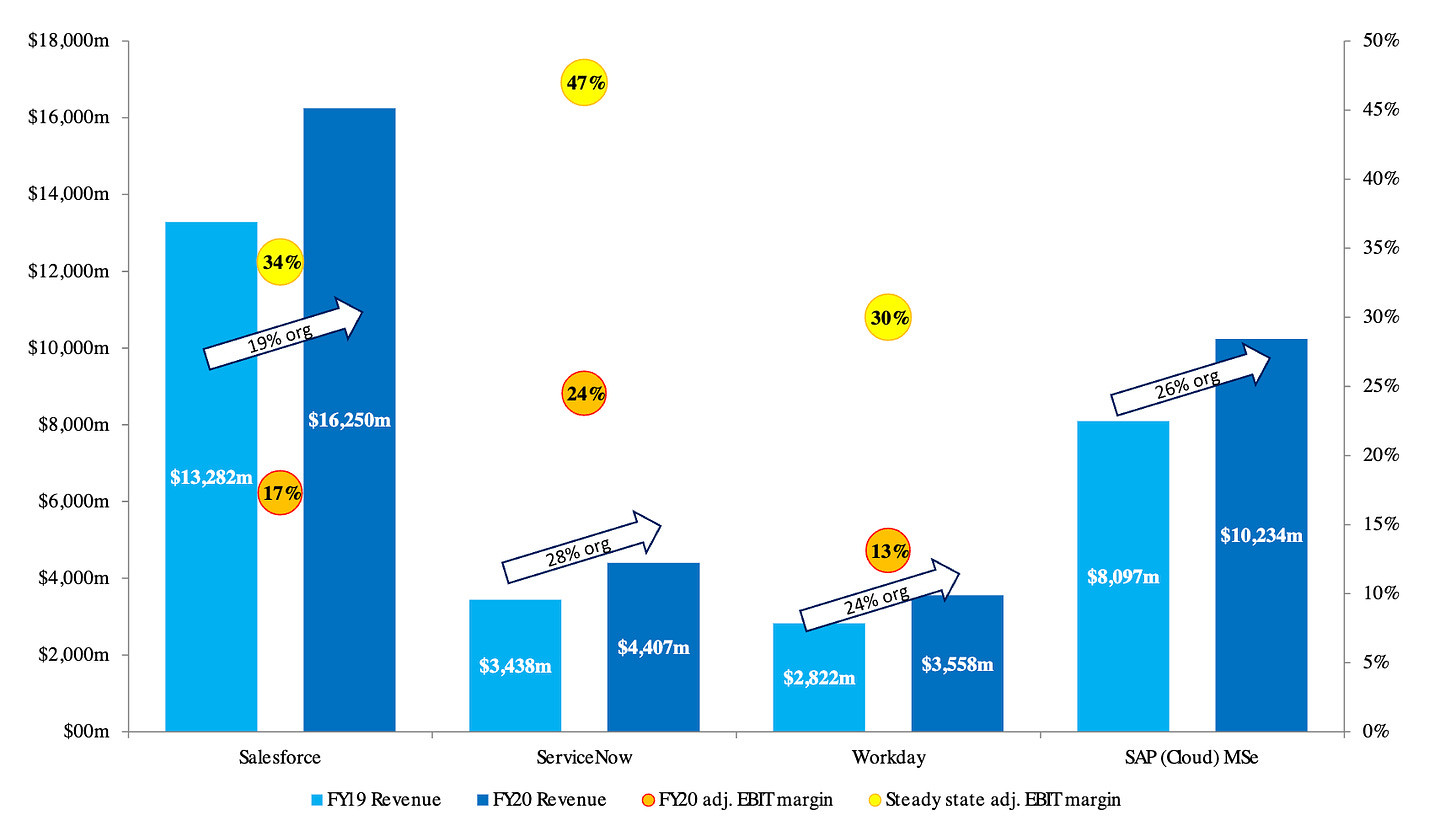

Vendors like Salesforce, SAP, ServiceNow and Workday enjoy steady state EBIT margins of 30%+ and continue to grow 20%+ at billions of dollars in revenue.

The inertia to switch from legacy SoRs is partially attributable to the painstaking deployments at the outset; former NetSuite CEO Zach Nelson likened an ERP deployment to a heart transplant (as we’ve discussed before). Professional services agents like system integrators and consultants drive 25 year lifetime values with laborious integrations, training, modelling and business process configuration.

Another variable is the half life of data stored in these systems of record. On one end of the spectrum is data like recruitment data, relating to specific recruitment cycles for a specific quarter, and on the other end is CRM data, which has a much longer half life in terms of relevance to the organisation, given that it pertains to customers and prospects. The Salesforce customer ID, or SFID, is the foundational customer unit that all other Salesforce/third party apps in the GTM org link back to.

And if you are up for renewal, you're thinking about your software, your application again, what's the switching cost as much if that's true? We've got three months of stuff to move.

Whereas Lattice, it was everyone's performance management. It was all of the annual and quarterly or half year feedback cycles. So the half-life, I think, is probably on the order of 12, 24 months.

I think a CRM half-life is pretty great.

Miles Grimshaw, Benchmark

As resolute as these moats may be, high switching costs for legacy SoRs induce hubris that startups can capitalise on; certain shifts and angles of attack are inspiring confidence in the long-run spoils for startups.

Integrate and surround

‘Data might have gravity, but relying on the primacy of your system as the data store at the expense of user experience is a dangerous proposition.’ Matt Slotnick

The ascendancy of Salesforce as a cloud-native CRM relative to Siebel and Oracle sparked a wider transition among legacy SoR vendors to the cloud, coinciding with the first wave of SaaS.

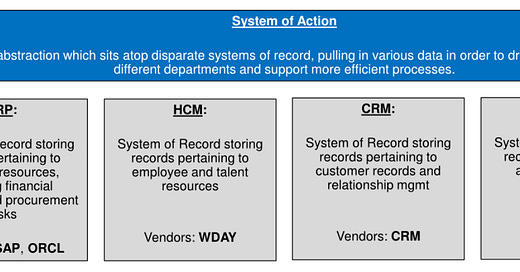

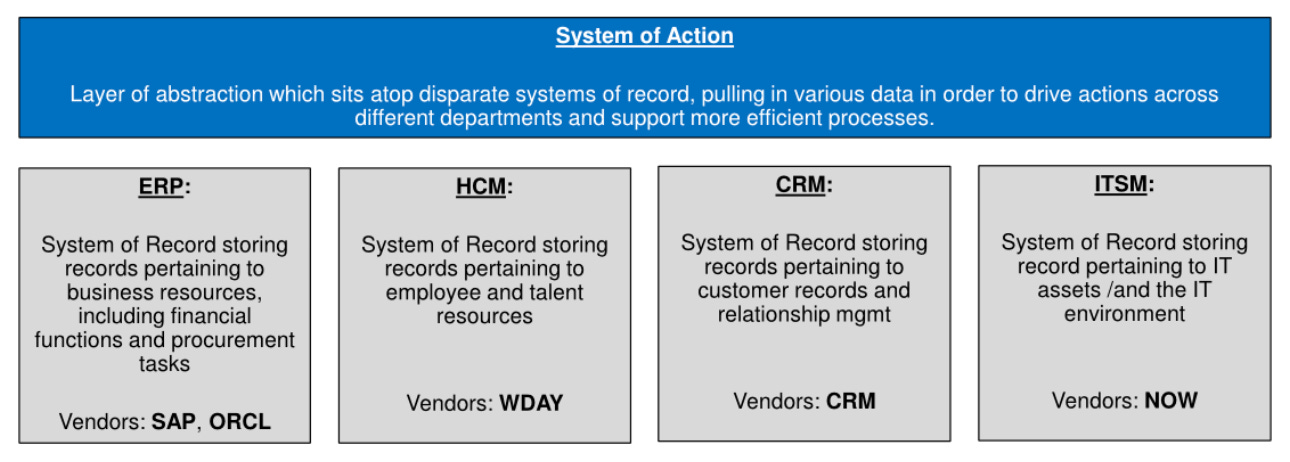

The next leg of SaaS was the emergence of systems of action, i.e. software that activated the data held in your systems of record for specific workflows such as marketing, sales and customer service. These ‘middleware’ companies integrated with the respective systems of record to maintain near-perfect fidelity of the static customer data stored in these relational databases, as well as capturing any new interaction data. If we take the Salesforce example, attributes like location, size, industry are far less salient for the modern B2B SaaS Account Executive to hit their quota than product usage patterns and PQLs, which several modern PLG CRMs provide actionable workflows for.

Systems of action that act as metalayers on top of systems of record with read/write capabilities will obviate the need to log-in to clunky software to update customer or employee records. On this premise, frontline workers across sales, HR, finance and IT departments have higher engagement with these systems of action as they automate workflows rather than simply being stores of static relational data. Some argue that subsequent waves of SaaS include systems of intelligence that leveraged analytics and AI to drive more intelligence and scaling efficiencies, and possibly systems of cognition with LLMs that enhance workflow productivity by unprecedented orders of magnitude. For the purposes of this essay, we can focus purely on the inherent advantages of a system of action and how they are positioned to unseat SoRs.

Startups originally positioned as systems of action or middleware derive an unfair advantage to eventually supplant SoRs from their proximity to data that not only has at least the same half life but also higher value than the data stored in the system of record.

Customer interactions drive business value, while the underlying database decisions very rarely do. The modern company seeks to innovate at the top of the stack, close to the customer, not the bottom. Matt Slotnick

Few systems of record have successfully transitioned to becoming systems of action, as Procore did. The opportunity for de novo vertical SaaS vendors in underserved verticals to act as both a system of action and record with LLM capabilities is also a new development.

A plausible thesis is one where a system of action builds upon its foundation of higher engagement and more relevant data to develop product parity with systems of record, chipping away at $20m ACVs, module by module.

Looking at the product portfolios of the legacy SoRs, they continue to stack multiple S-Curves of growth on top of their key modules.

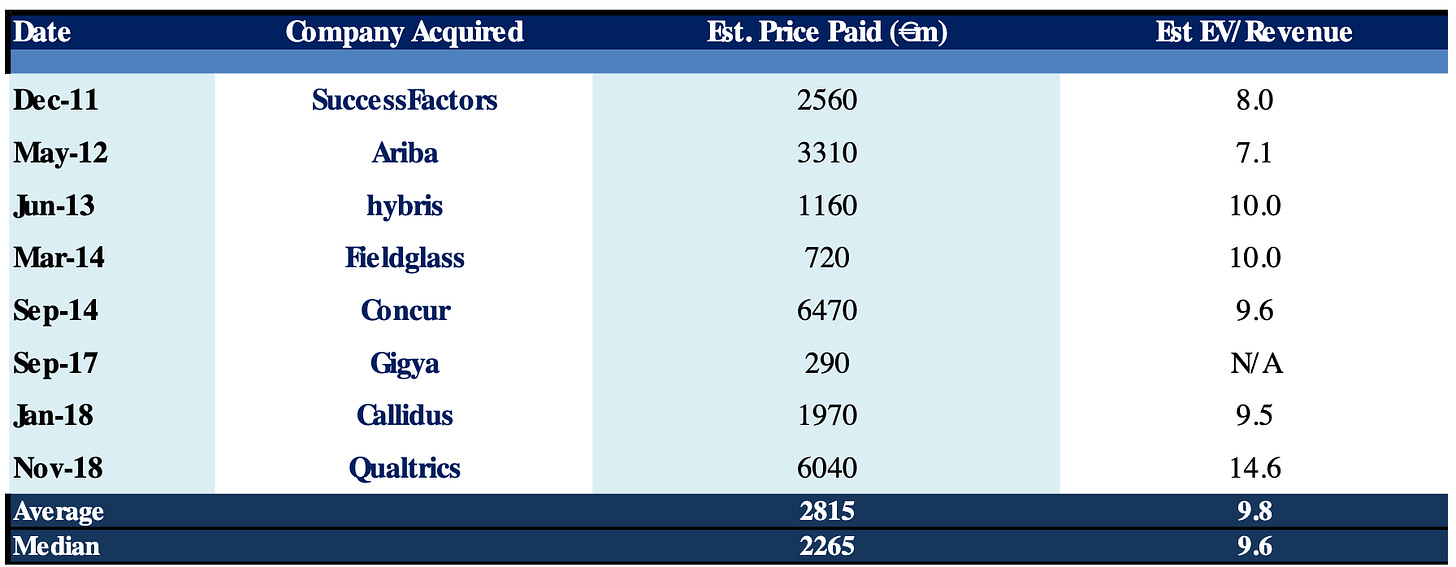

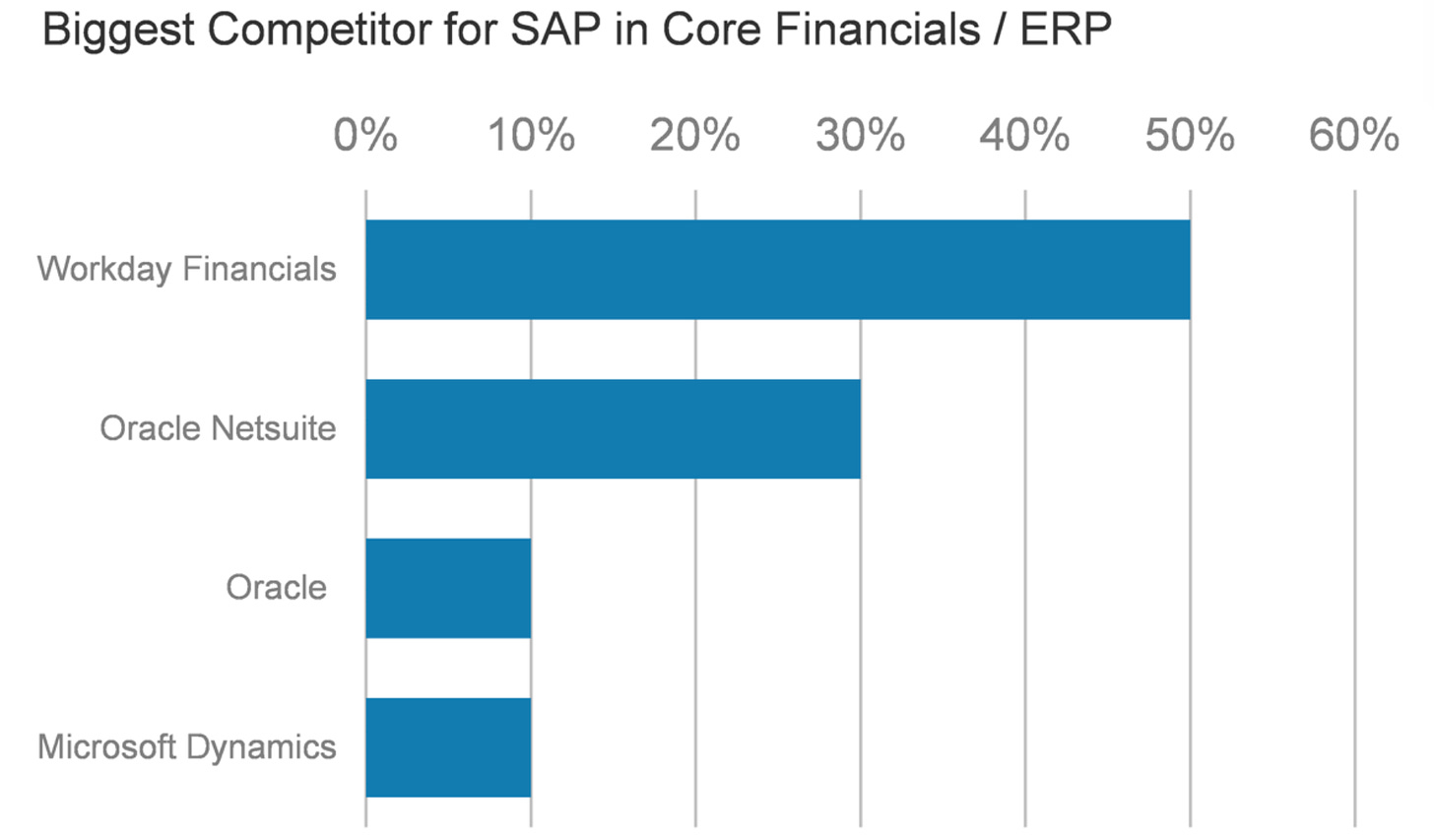

Not only are these legacy vendors offering extensive product portfolios within specific business functions like HR and Finance, but they also harbour ambitions of owning all other business functions too. Workday is not content with just HCM leadership, but also wants to cross-sell its ERP and financial planning software modules. ServiceNow has similar ambitions of taking on Salesforce with customer-facing modules. SAP’s S/4 HANA ERP solution is but one component of a wider product portfolio that also encroaches on other lines of business. New ARR for these vendors is primarily driven by cross-sells of these SKUs, further increasing switching costs and inertia.

These sprawling product portfolios are instructive to startups; at the outset, the correct posture is to ‘integrate and surround’ as Dave Yuan of Tidemark told Patrick O’Shaughnessy:

Your choices are either fight the fight and try and slug it out and slowly over time, displace this legacy software or you could do something like, the language they use is integrate and surround, which is you integrate into the legacy software, but you provide surrounding functionality that's disruptive.

This can dictate initial engineering decisions around which integrations to prioritise, which can depend on the market structure and degree of concentration around SoR vendors.

Depending on your product and what your customers are asking for, it may make more sense to build a large catalog of product integrations, or to build deeper integrations for a smaller number of providers. Do you need to support a long tail of CRMs, or is it more important to access more features within Salesforce?

The integration to the legacy SoRs with read/write access is key to shifting engagement away from these vendors to the workflow automations, system of action vendors, where increased engagement and higher value data act as a foothold to sustain R&D investment in new modules.

The sequencing after an effective wedge is more science than art, influenced by the data that’s being collected by the wedge and how it confers an unfair advantage to build the next module.

‘It’s a more logical product strategy to go from expense management –> A/P automation –> procurement –> forecasting –> working capital loans, or a similar path that builds on the data a CFO tool has already acquired.’ Bain Capital Ventures

Another way of tackling sequencing is to study the utilisation of the respective modules in a given system of record and prioritise subsequent SKUs based on the order of utilisation, going from lowest utilisation to highest. This strategy follows a path of least resistance to eventually surrounding the existing system of record with a 10x better, consumerised SaaS vendor that has achieved product parity.

In parallel with the path to product parity, the secular tailwind is the generational handover in the offices of the CFO, CIO, CTO, and CMO. The generation that will inherit these budgets will not be wedded to legacy SoRs, having risen through the ranks relying on consumerised enterprise software. There will undoubtedly be some inertia even in their ranks, but it’ll be far less pronounced than with the previous generation that oversaw multi-year Workday implementations.

The new generation will likely evaluate vendors on a first principles basis without a sunk cost mindset, prioritising best of breed solutions that assist the evolving nature of their role. At that point, faced with middleware solutions that have accumulated product parity, higher engagement and proximity to more salient data, the only ostensible bottleneck will be the burden of migration - I would argue this last bottleneck does not get enough attention. Providing the requisite professional services to deliver near-perfect fidelity of data modelling/structures and catering to edge cases is what’s required to break down the moats protecting the billions of dollars in revenue accruing to legacy SoRs.

A big thanks to Ayush, Aditya, Marton and many others for providing rich conversations that helped form some of these thoughts.

I’d love to hear from you if you’re also thinking about the pathways to disrupting legacy SoRs - you can always find me at akash@earlybird.com.

What I’m Reading

🔥 vs. ❄️: Databricks and Snowflake Face Off as AI Wave Approaches

Snowflake and Databricks are both exceptional, distinct businesses; value accrual for training and fine-tuning larger models like LLMs will likely be going to Databricks due to their unstructured data heritage.

John Luttig crisply breaks down the biases of those who are seeking to cope, mope, or hope that GenAI platform shift benefits them. VCs have their own predispositions that rationalise investing in nascent categories like LLMOps.

Beyond Payments for High-Risk Industries

A16z run through the lack of attractive payment processing solutions available to ‘high-risk’ industries like gaming, gambling and dating, each requiring bespoke methods of mitigating fraud.

Anshul Ramachandran, founder of Codeium, makes a compelling case for how to position UX as a moat for LLM apps; the analogy with Spotify and how it delivered on all three Ps of Presence, Practicality and Power is a handy way to think about the untapped potential of helping users derive more value from AI.

The economic impact of the AI-powered developer lifecycle and lessons from GitHub Copilot

Developer productivity gains from code copilots like Github Copilot could add $1.5 trillion to global GDP, effectively adding 15 million developers to the projected total of 45 million in 2030. These findings, one year into adoption, are profound. Less experienced developers benefit significantly more. AI pair programming will become standard in interviews, which were tools like Codeium (above) come into play.

Thanks for sharing Akash, this is very topical for me at the moment. I found particularly interesting and comforting the idea about studying the utilisation of the respective modules and prioritising the modernisation by selecting the least utilised or path of least resistance. This is my belief as well however the challenge I face here is that the change appears to outsiders to take longer. The C-suite want bing bang and this is more like metamorphosis. I suppose the magic lies in how you can do both.

Great read!