Professional services beget high quality enterprise software revenues

Services are a prerequisite for enterprise sales, driving adoption and lifetime values

Join 1,800+ founders, operators and investors for Missives on software, fintech and GTM strategy by subscribing here:

Today we’re studying the importance of services in enterprise sales. If you enjoyed today’s piece, please share it with friends, comment and subscribe!

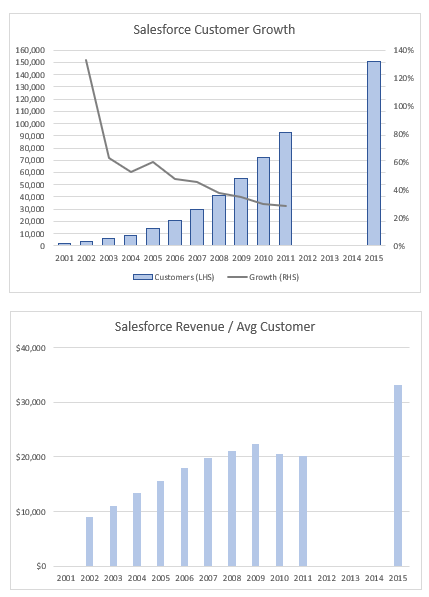

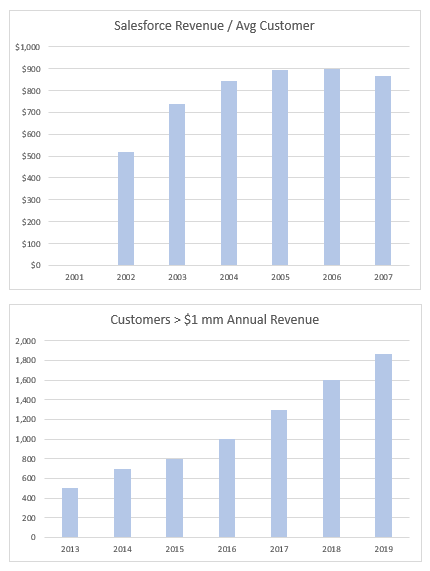

Headwinds and belt tightening will inevitably result in consolidation and higher churn for software companies. Vendors are increasingly recognising the importance of Customer Success in preventing the snowballing effects of gross churn. Customer Success' transition from a cost centre to profit generator is particularly pronounced for bottom-up, PLG motions; last week we discussed how expanding to ten seats precipitated escape velocity in NRR and the product-led means to do so.

In the PLG zeitgeist, founders must not lose sight of the importance of professional services in moving upmarket to enterprise. Services like implementation, training, maintenance and support are paramount to driving retention, expansion, and second order revenue (e.g. referrals, references).

Chetan Puttagunta has previously described the role of professional services in acting as a bridge to enterprise adoption and multi-year recurring software revenues (emphasis mine):

And two examples that I think are really instructive are one Workday and Veeva, which in the early days of both companies, nearly 50% of their revenue was from services, and it was because they were going into enterprises that had very entrenched systems.

And so, to migrate from that into a cloud application required a lot of handholding, required a lot of training, required a lot of data migration. And these professional services contracts actually allow you to build these customer training tools and customer migration tools that then can be used against the next customer to help with that migration and training process go much faster.

An analogous bridge is how companies develop new GTM muscles: layering PLG onto a sales-driven GTM motion (or the inverse) is best executed in gradations, with a hybrid approach acting as a bridge in the interim.

The same principle applies to how professional services are a bridge to multi-year recurring revenue contracts; 'lower' quality professional services revenue begets high quality subscription revenue.

As we've discussed previously, platforms like SAP, Oracle, and Salesforce have maintained unassailable category leadership in their respective markets over decades. Startups have laid siege on these incumbents from many angles, but enterprises rarely countenance churning from implementations of systems of record. The longer the half-life of information flowing through a system of record, the higher the inertia to switch.

‘You either got real center of mass and just high inertia to -- you put a lot in the database and moving it out is really painful.’ Miles Grimshaw

Implementation and activation for enterprise software requires integrations, configurations, training, and a host of other jobs-to-be-done for a team of project managers, solution architects, integrations engineers. Former Netsuite CEO Zach Nelson compared an ERP deployment to a heart transplant, given the volume of change management entailed in implementing a system of record.

‘ERP systems like SAP and Netsuite are hard to displace as each implementation is a unique, multi-quarter process to integrate the ERP system with many other vendors inside an enterprise.’ Elad Gil

Once business-critical software is deployed, a range of variables (workflows, integrations, user training) compound to lock customers in:

‘If we expect to get 15, 20, or 25-year lifetime values, it’s the regrooved business processes, extensive configuration, data conversion, integrations, and enterprise-wide training that will ensure the software sticks around.’ Zac Bookman

Margins on professional services can vary from break-even (e.g. Confluent, Workday) to 35% (e.g. Qualtrics) - hardly software-like margins, but that's beside the point.

Best-in-class professional services teams share the same north star as customer success teams - the goal is to align the success of the customer with the software. This manifests in performance reviews that evaluate a professional services’ team’s success against leading indicators of retention and expansion, i.e. NPS, activation, second-order revenue.

Companies hunting elephants and whales can deliver professional services in-house (e.g. Qualtrics) or via service partners (e.g. Salesforce, Workday), but as long as professional services revenue is less than 25% of the overall revenue base, the market will continue to value the company as a SaaS business with commensurate premiums. UiPath accrues as much as 38% of its revenue from maintenance and support, though with a traditional license-based model.

The effectiveness of professional services goes beyond driving adoption and retention; bundling professional services with your software is imperative to unseating existing systems of record and lowering the cost of switching. As much as a buyer can complain about legacy ERPs, CRMs and HCM software, the various dimensions of lock-in we’ve discussed can induce obstinance.

A superior software product without the requisite professional services to deploy and activate it wouldn’t be able to challenge for those budgets. Investing in a best-in-class services offering increases conversion of both segments that have incumbent software and greenfield opportunities.

Interesting Reads

Apertures by Spencer Peterson

Technology builders and investors are all pursuing the vision of a platform - Spencer’s articulation of apertures captures this motive succinctly.

The Alchemy of Fintech Valuations by Ansaf Kareem

Lightspeed GP Ansaf Kareem analyses fintech subverticals and how to value late-stage private fintechs relative to public comps, with variability in payments and software business models.

X1’s Path to Product-Market Fit by First Round

Consumer credit is a notoriously challenging category to build in. CEO Deepak Rao’s recounting of the pivot from student lender to a consumer credit card has many lessons on product design.

Vertical APIs by Ricardo Sequerra Amram

APIs providing access to data for specific verticals have proliferated in recent years, but the playbook on building enduring businesses is still being written.

The Incremental Bid and Shareholder Transitions by Arda Capital

As deep pockets of capital leave the private markets for the foreseeable future, many companies are going to have a tougher time meeting expectations as they navigate transitions in its shareholder base, from venture >growth > IPO and beyond.

Tweets