Hey friends!

As we see the markets tumble, I think it’s an interesting time for introspection. Venture, as an asset class, owes most of its return over the last two decades to software.

If we think in the very long run, that poses some existential questions. Will the 2020s and 2030s present equally lucrative opportunities, or has the low-hanging fruit in software investing been picked?

I suppose one way to think about the answer is whether the die has already been cast in software - are the Microsofts of the world so large and all-encompassing that we shouldn’t even bother funding new companies attacking these markets?

That’s a meaty question and this post is the tiniest sliver of an answer, but it’s an attempt.

As always, thanks for reading and sharing your feedback, it always means a lot to me.

Let’s dive in!

Only two ways to make money in business: One is to bundle; the other is unbundle.

Jim Barksdale, then CEO of Netscape, spoke off the cuff in response to a question from an investment banker in London as part of the final leg of a roadshow to take Netscape public. The question was something along the lines of '“How do you know that Microsoft isn’t just going to bundle a browser into their product?”

Rewinding to 1995 is a fruitful exercise, as we see the law of bundling cement Microsoft Teams' unassailable leadership over Slack.

Slack remains the quintessential product-led growth case study, with remarkable execution that translated to excellent growth rates, margins, net dollar retention, and success going up-market to enterprise. Post-acquisition synergies with Salesforce were meant to elevate distribution capabilities even further.

This makes the reading of this chart even more stark; the endgame of the instant messaging market presents a timely reminder to revisit the concept of bundling versus unbundling.

Against a backdrop of the current economic climate, many are making the case that CTOs and CIOs are going to favour bundled suites of SaaS products over the fragmented ecosystem of point solutions - cost cutting is paramount and if you can get Teams as part of your Office 365 subscription, well why wouldn’t you save some money there? For one, that CTO/CIO has a workforce to keep happy, and those employees are going to favour best-of-breed point solutions that allow them to do their job to the best of their abilities.

This is handy vignette we can use to unpack a far bigger, philosophical problem that’s of relevance to technologists, entrepreneurs and investors. If bundles are inevitable, will we not see huge concentration of market share in the hands of a few companies for each category of software, negating the potential of new entrants to become platforms in their own right?

Building software companies has never been easier, much of the playbook has been written, capital is still cheaper than ever - all combusting to produce saturation in SaaS, with Sales & Marketing spend overtaking R&D as innovation withers away. There is a semblance of a power law visible in existing categories of software, sure.

But hold on. Just as the arc of startups becoming incumbents is an accepted wisdom, so should the arc of best-of-breed point solutions presenting an entry wedge into a market, for the company to later bundle other products. Scale and focus is always a double-edged sword, whereby someone else will come and serve your underserved customers better than you can. New GTM playbooks will be written this decade too. Entire categories haven’t been eaten by software yet.

That’s the optimism I’d like to leave you with.

Power to the people

Ben Thompson of Stratechery wrote a seminal essay on the unbundling of media, namely in print, music labels and TV - think Google, Facebook, Spotify, Netflix. This unbundling was only made possible by the internet and how it drove the cost of distribution to zero.

Marc Andreessen generalised this principle to form a mental model through which to think about the 'why now' for unbundling:

The way we think about it is sort of what I said before about music and newspapers, applied to many other industries. Often, a key characteristic of large incumbents in any industry is, they have a bundle that is accumulated over time, for the reasons that Jim described — reasons that made total sense at the time. And then what we look for is for something to have changed in the underlying technology. The arrival of the Internet was a big one. The arrival of mobile distribution. The arrival of social networks. The arrival of Bitcoin is a current example.

So, we look for something to change in the underlying technology, and then basically say, “Well, you know, gee, if you were to sit down today with a clean sheet of paper, and you knew that the technology was changing, then what would be the proper form of the product, if you were starting from scratch?”

As disruptors become incumbents, they grow a suite of software solutions around their core beachhead product (think Microsoft Office 365), where the nth product in this suite is less and less compelling versus best-in-class point solutions (Slack, Zoom et al.) built by a startup with a singular focus on one, narrow problem for a precise Ideal Customer Profile.

Let’s take the example of a business model that’s music to the ears of VCs: Systems of Record. Clement Vouillon, in his analysis of the evolution of SORs, noted that whilst SORS were once a monolithic 'source of truth about a particular department or company', they eventually decomposed into narrower and narrower point solutions.

Plenty of “ business records” that were once bundled in one software have now their dedicated solution. For example you can find many standalone SORs for the “Finance / HR” function: Expensify for expenses, Docusign for contracts, eShares for cap tables etc… A consequence is a much more fragmented SOR landscape.

We can partially attribute these developments to two powerful tailwinds: consumerisation of enterprise software, combined with the advent of product-led growth.

Steve Ballmer, then Microsoft CEO, articulated the promise of consumerised software:

Fantastic devices and services for end users will drive our enterprise businesses forward given the increasing influence employees have in the technology they use at work — a trend commonly referred to as the Consumerization of IT.

Best of breed products like Notion and Figma empower end users with truly differentiated, superior products, to the extent that purchasing decisions shift from the CIO to business owners and employees. That's where product-led growth comes in - products are designed with a focus on the end user who eventually champions the product internally to drive activation and expansion.

Openview presented a neat evolution of software distribution, starting with traditional outbound sales by sales reps to CIOs, all the way to today's age of modular, interoperable API-first products that excel in specific domains.

The final catalyst for the emergence of best-of-breed point solutions is that, frankly, it's never been easier to build a software company.

The gravitational force of bundling

As Packy wrote in 'The Good Thing About Hard Things':

It’s easier than ever to build the average software company – plug into AWS, snap in a bunch of APIs, follow established playbooks – and harder than ever to make it really big. Modularized inputs and playbooks lead to more competition, smaller opportunities, and lower margins.

So, it's easier to launch and scale software, and the GTM playbooks have been open-sourced by every VC and ex-VP of Sales under the sun. The result? Established software companies are spending more on sales as a percentage of revenue than on R&D. In a world where actualisation for any conceivable idea is a click away, true product innovation becomes incremental: 'But cheap cash, big teams, and playbook dependence come at a cost: incrementalism.'

When product innovation stalls and the main vector of competition is distribution, tried and tested marketing channels saturate and costs rise. This is made several times worse by VCs who throw good money after bad into companies that desperately search for product-market fit by deploying as much capital on marketing as possible. Those times are over, and in the conditions we've described, these acquisition channels simply won't scale, with many businesses likely hitting a wall.

Christoph Janz of Point Nine Capital wrote about this inevitable wall in his post describing how much easier it has become to build a SaaS company and get initial traction in a small niche, yet how hard it is to scale this:

In order to go from a $1–2 million in ARR to $10 million and eventually $100 million, you’ll have to find highly repeatable and reasonably profitable ways to acquire customers at huge scale.

The non-trivial part of what I’m saying is that 5–10 years ago, many of these companies wouldn’t have gotten to a few million dollars in ARR. Put differently, there are more $100 million ARR SaaS companies today, but the number of companies in the $1–10 million ARR range has grown disproportionately faster.

If we play out this logic over a longer time scale, we're faced with a profound possibility: software companies exhibit a power law distribution. Unable to raise further capital under the conditions we’re in, many companies will suddenly see the post-acquisition synergies that consultants draw up as far more realistic - fundamentally solid, efficient businesses will scoop them right up and bundling will be a natural byproduct.

John Luttig of Founders Fund spoke to this in his post on Rippling:

An expansive product portfolio should lead to higher terminal margins, as Microsoft has demonstrated, suggesting the end-game of software companies will have a stark power law distribution

There’s evidence of various shades of power law dynamics in software, whether that’s in software monetisation and customer concentration, or outright market concentration in some of the biggest categories.

We’ve examined why there’s been a flourishing of point solutions that are able to unbundle legacy software suites, why this is necessary in the first place, and the powerful economics that can accrue from rebundling. That begs the question.

Is it a cycle?

Let's revisit the canonical interview with Marc Andreessen and Jim Barksdale:

MA: One of the patterns I think that you see is that the insurgents often end up reforming themselves into a version of the company they took down.

Oracle is an example. Larry [Ellison] has spoken openly about his attempt to basically recreate IBM by adding applications and services and hardware to what had been an infrastructure software business. And so, ironically, even the people who take down an incumbent through unbundling then come back and try to do the rebundle.

JB: Well, because it’s an effective growth strategy. Once you try to grow the business, it’s an easier out to stay focused on your core and then add things to it. And you become a big bundle again.

The software market in that respect resembles a complex adaptive system, whereby we're constantly oscillating between software suites and point solutions in different categories depending on the relative differentiation of the latter over the former. Success breeds complacency - as startups become scale ups, they overlook certain customer segments and product-first DNA diminishes, which leaves a wide surface area for sharp founders to tackle. That fate is likely bestowed on the founder at some point by the next founder - the ultimate beneficiaries are us, the consumer.

Why is this arc so repetitive? John Luttig spelled out the case for bundling by giving the example of Rippling:

Bundling is Rippling’s accumulating advantage that offsets classical diseconomies of scale. This means that, unlike most growth-stage companies, Rippling’s core metrics improve over time. CAC paybacks decrease. Growth accelerates. Retention improves. Cross-sell rates increase.

As Christoph Janz noted, one of the only levers to avoid the $1m ARR wall is to grow ACVs, and bundling naturally grows contract sizes. Perhaps even more importantly, a wider product suite delivers sales and marketing leverage as it widens the aperture of potential champions for different use cases within the buying organisation.

It's worth dwelling here for a moment on Rippling, as it truly deserves the plaudits it's receiving. The ability to expand a company's TAM by successfuly introducing new products is no small feat, a capability described as 'economies of scope' by Bucco Capital. In this regard, Rippling pushed the envelope from day one by setting up a modular org structure, whereby each product has an autonomous GM and engineering team who leverage the strengths of the larger company. No wonder CEO Parker Conrad managed to recruit over 50 founders to work for Rippling..

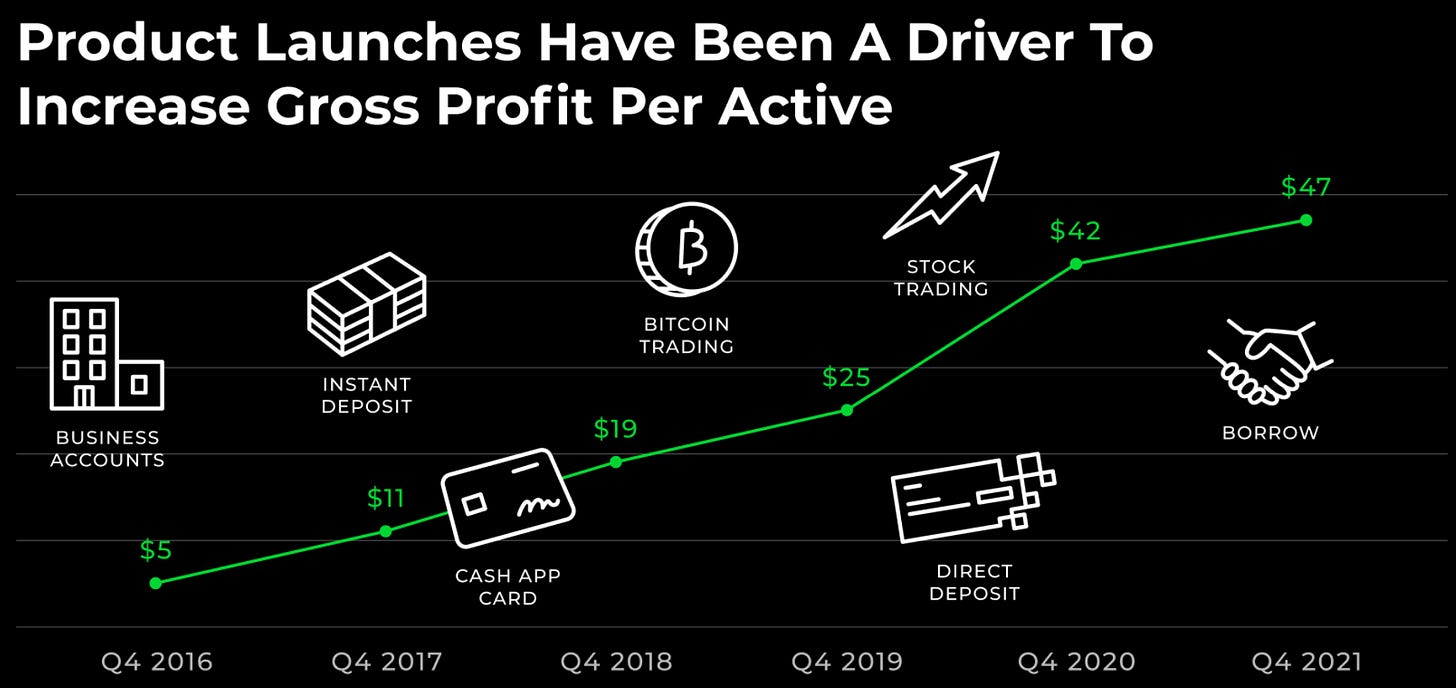

Back to bundling. Let's look at Cash App's Q2 investor presentation to see a flawless execution of building a product suite in consumer fintech that manages to drive down CACs and increase ACVs, precisely as John Luttig posited.

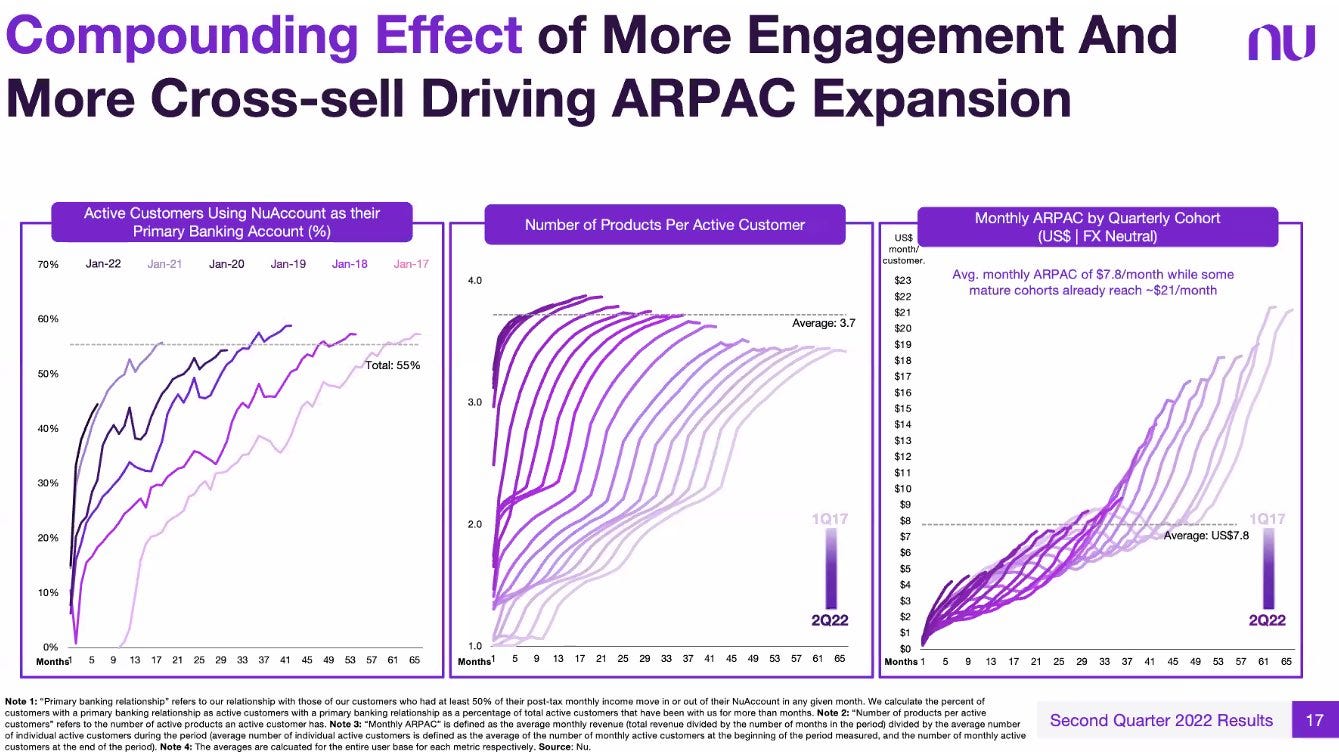

Nubank's recent results further underscored the lucrative ARPU gains from successful product expansion.

The enterprise example is staring us in the face with Microsoft, who will likely thrive in a recessionary environment as business seek to consolidate spend.

An Oracle for the future

One's belief system as a software investor rests on taking a position on whether unbundling is a cycle, or if the current composition of platform concentration is a fait accompli with the power law having anointed the winners in several categories.

Kyle Harrison argued that although founders continue to pitch the unbundle > bundle vision today, those platforms are hardly ever built. Take the ERP market as an example, where Oracle and SAP's on-premise ERP solutions remain unassailable with market caps of $210b and $112b, despite many sieges from different angles over the years: Bill.com and AR/AP automation, Coupa and expense management, Avalara and tax compliance, Blackline and accounting, Anaplan and FP&A. These are all worth several billions of dollars, but pale in comparison to the ERP goliaths.

Let’s not despair. There are grounds for optimism. Okta's 2022 Businesses at Work survey, which tracks app usage across its 14,000 customers, concluded that:

The days of being a loyal, one-vendor shop are gone.'

Among Okta customers deploying Microsoft 365: 45% also deploy Zoom, 33% also deploy Slack, 38% also deploy Google Workspace, up from 36% in 2020.

Employers are certainly leaning into software suites, but they're also equipping their employees with best of breed software where the products are truly differentiated enough to move the needle for the end user.

The olden days of a company choosing to be a “Microsoft shop” are long gone, as many companies that deploy Microsoft 365 add on advanced functionality from non-Microsoft providers such as AWS and Salesforce.

These point solutions have to outweigh the benefits of opting for a suite (ease of procurement, integrations, training). The writing is on the wall - the unbundling playbook requires relentless execution towards a truly differentiated product. Add a new chapter to the GTM playbook - PLG, influencer marketing, content marketing and other recent developments in GTM are just that, recent. For all the decacorn software leaders, there are entire swathes of customer segments that are underserved - perform a gap analysis to identify these opportunities and build a product to meet this need. Or start with a powerful wedge as a workflow application with a view to becoming a system of record (e.g. Zendesk).

A few years ago, angel investor Jerry Neumann told Patrick O'Shaughnessy that when it comes to the IT revolution, we have to believe that we're in the Installation Phase of Carlota Perez’s framework, where financial capital (VCs) continue to have a role to play in high risk endeavours. This isn't at odds with financial capital also being directed towards new waves such as blockchains and AI, but rather affirms the believe that software still has many corners of the world left to eat.

Unbundling and bundling is at the core of this belief. Another Oracle will be built.

Thanks to Ming You See, Amin Mirzadegan, Zeynep Yavuz, Kartik Gupta, Kirill Tasilov, Asif Moosani, Adrian Bjurefalk, Alex Oppenheimer, Jens Lapinski, Gloria Baueurlein, Jeremy Zhu and Apoorva Goyal for their feedback and comments.

great read, tied together so many relevant ideas 😄

Great article Akash!