Consumer GTM insights for B2B software

As retention comes into focus, consumer playbooks have lots of lessons to impart

If you aren’t subscribed, join 1,800+ founders, operators and investors for Missives on software, fintech and GTM strategy by subscribing here:

Today we’re examining what consumer growth playbooks have to teach B2B software companies. As always, I look forward to reading your comments.

Gross and net dollar retention have become the most prized genes in software. This has several implications for GTM teams, including the reframing of Customer Success from a cost-centre to a revenue-generator, product usage analytics as a means to defend budget allocations, and the role of wall-to-wall expansion inside an organisation.

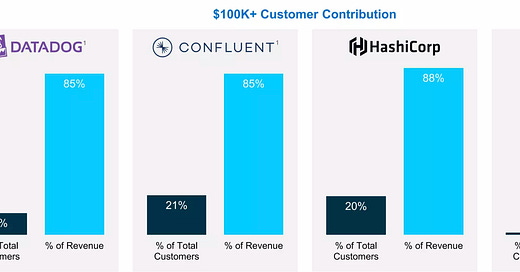

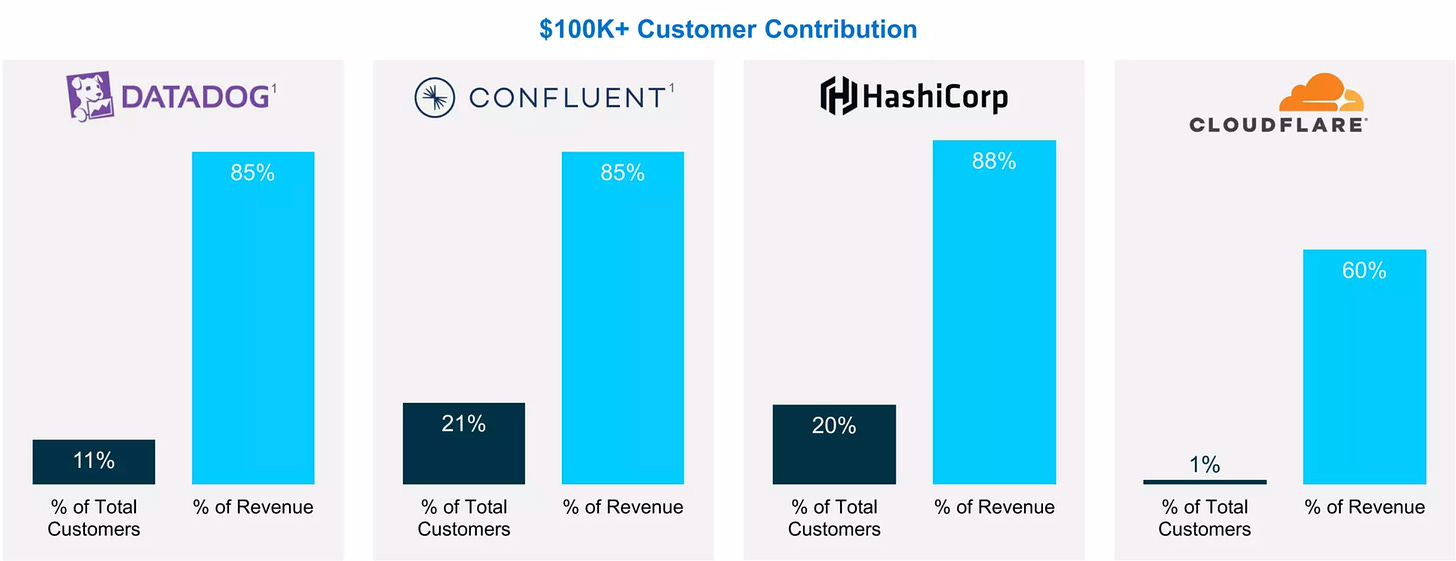

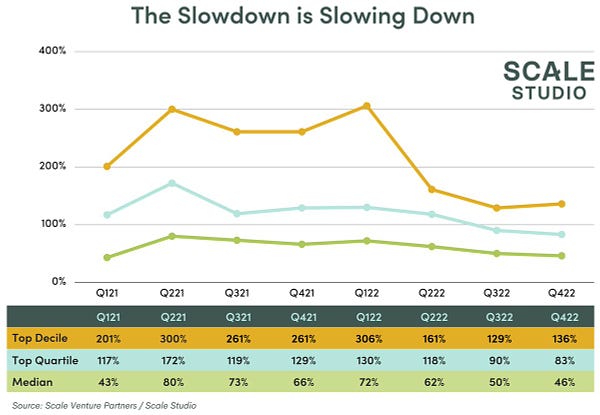

The team at Toplyne conducted an analysis of 1.8 million users of PLG products and found that the inflection point for net retention rates is 10 seats; expand to this point and the risk of churn falls sharply. This becomes all the more significant when you consider the fat tails of enterprise software monetisation. Enduring software businesses have built on this foundation of retention to accrue 10-50x expansions over time (in the current environment, even strong gross retention rates and slowing NRR is positive, as Cloudflare is seeing).

Knowing that empirical evidence suggests 10 seats is a catalyst for sustained expansion, B2B software companies with PLG motions can take a leaf out of consumer growth playbooks when designing expansion processes.

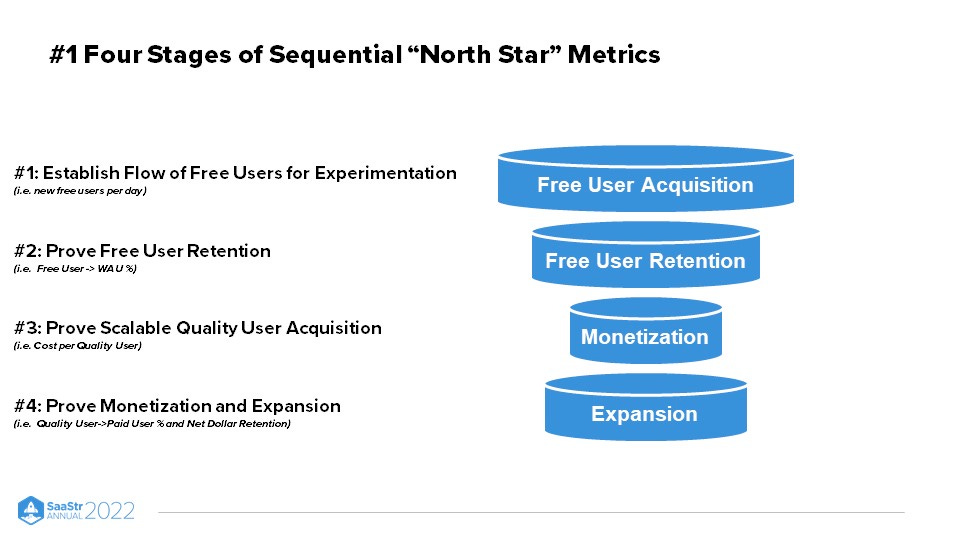

The starting point is how consumer growth teams think about the adoption funnel.

Consumer growth teams focus a great deal more on acquisition and retention, running data-driven experiments to optimise for scalable acquisition channels and product engagement that tightly correlates with retention. As such these teams are comprised of engineers sitting across marketing and product, iterating with the objective of converting users into power users (h/t Sean Ellis' 40% test for PMF). These power users then champion the product internally and drive team adoption.

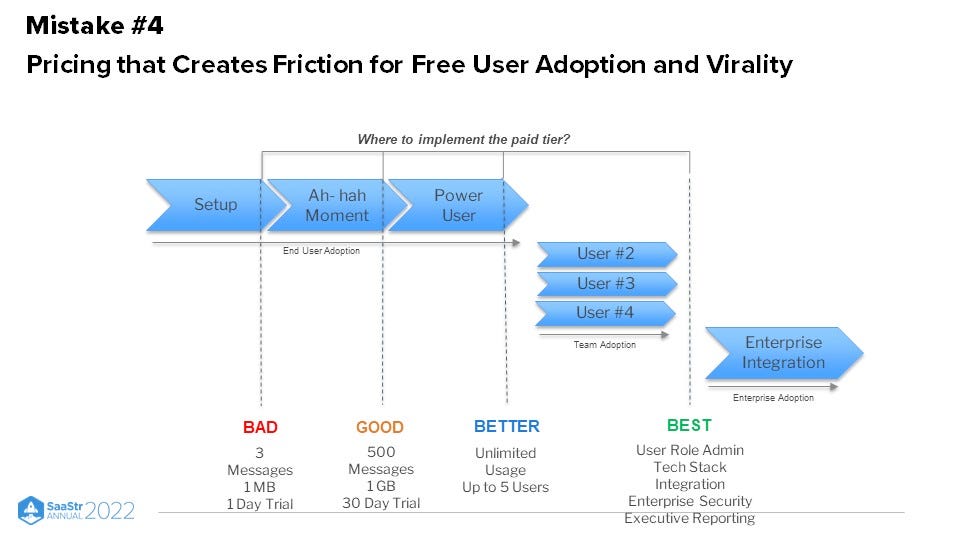

Timing pricing is key, and a common subject of divergence between consumer and B2B businesses. By focusing on acquisition and retention, we're removing friction on the glide path from user to power user, single-player to collaborative, multi-player adoption, at which point sales can begin capturing the value created with a department-wide contract.

B2B software virality (internally and externally) is another vector suitable data-driven experimentation where consumer playbooks are valuable. The prerequisite for virality is activation. Loom famously redefined its 'aha' moment between its Seed and Series A rounds and managed to double activation rates; iterating on the definition of activation is the foundation for growth motions that are eventually channeled towards it. The product-led onboarding trend is all about shortening time to value and anchoring activation at the point at which users have derived enough value to begin sharing your product.

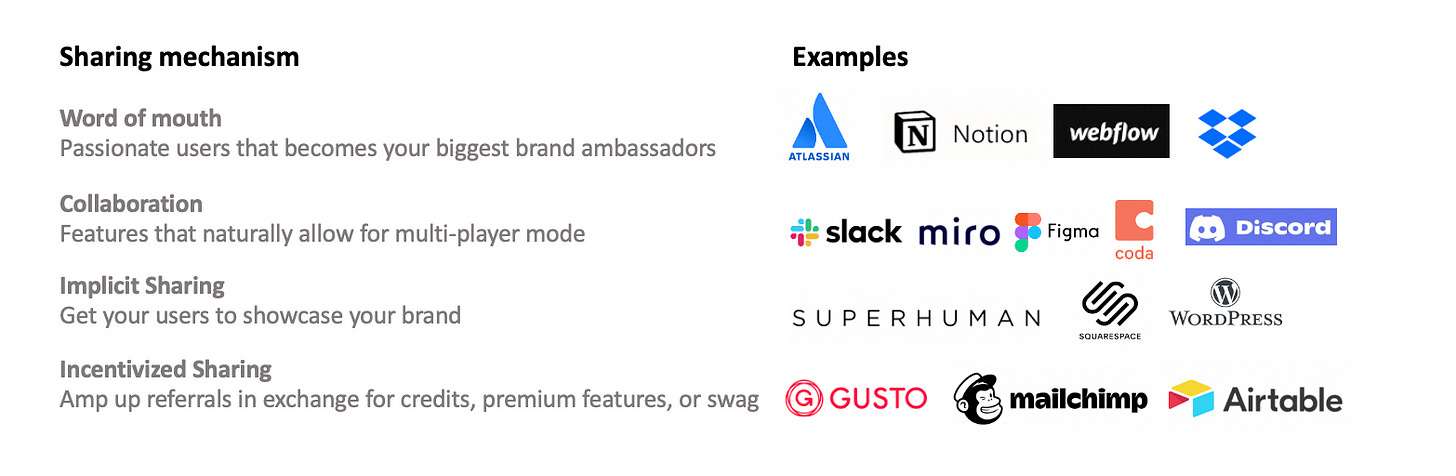

Having found the right measure of activation, the next step is to invest in a portfolio of virality channels (internal and external). These can roughly be distilled down to four key channels:

Notion has set the high water mark for community-driven growth and word of mouth. We're beginning to see API providers for multi-player mode (e.g. Liveblocks) and referrals (e.g. Cello). Every email sent by Superhuman users is implicitly sharing the product by exposing it to recipients (via the footer); Louis Coppey defined exposure as “the number of people exposed each activated user brings to your platform during a specific time period”. Many companies invest in all four sharing mechanisms; it's important to also invest in converting these leads via data-driven experimentation (again, a growth discipline that requires engineers to work with marketing).

Key questions to analyse when designing for in-team virality are:

Is there a compelling single-player use case for the product?

If so, what is the trigger for individuals to bring in teammates?

Who are the best individuals within a team, to introduce a product for team activation?

What if you sit at the intersection of two personas, and one persona, or one leader resists?

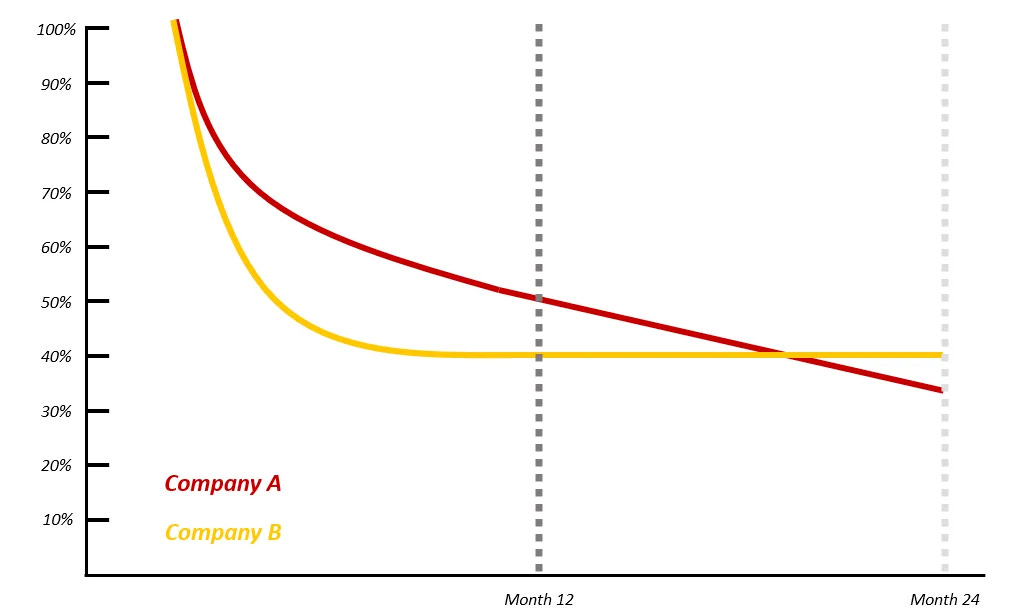

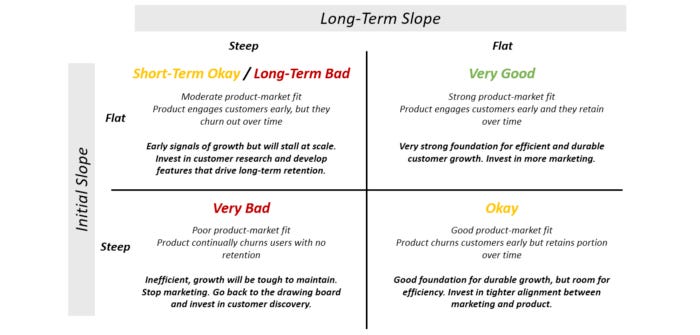

One more concept we can borrow from consumer growth playbooks is retention slopes. 12 month retention for consumer companies can be useful, but in isolation it can hide concerning trajectories. Company A with stronger 12 month retention than Company B at a point in time would look ostensibly better, but the slope of Company B's retention curve asymptotes whilst Company A's is continuing to decay linearly over a longer timeframe.

The gradient of the initial and long-term slopes dictates where one should invest (e.g. onboarding, product features). Steep initial slopes suggest customers might be churning because the time to value isn't short enough, whilst steep long-term slopes suggest the product is not delivering enough value for an activated user, which provides ample ground for the product team to explore.

Interesting Reads

2023 Product Led Revenue Predictions from the team at Correlated

One trend I also expected to accelerate more was the emergence of the ‘Product Led Sales’ role. MongoDB and Canva have paved the way here.

Accel interviewed Monzo CEO TS Anil

Clear first principles thinking, particularly the rationalisation of securing a banking license early on.

Product-led growth is a continuum, not a category

Written by Matillion’s Director of Growth, this is a handy step-by-step breakdown of how to set up the infrastructure and tooling to implement a PLG motion.

Modern Meditations: Josh Wolfe

Josh Wolfe, GP at Lux Capital, is becoming one of the most erudite investors I know of. In an age of conformity, Josh also demonstrates original thinking more than most.

Customer Success - Pre-Sales or Post-Sales with Allison Pickens

Allison Pickens speaks to Pocus CEO Alexa Grabell about the role of CS in a PLG company, and how the type of talent required at different stages of the funnel varies.

Tweets