Hey friends! I’m Akash, an early stage software and fintech investor. I write about startup strategy for founders & operators.

You can always reach me at akash@earlybird.com to exchange notes and share feedback!

Current subscribers: 3,680

‘To go public, companies need to be at least $200-400M ARR, insanely efficient with >30% growth at scale, generating free cash flow, and have the beginnings of a multi-product engine to upsell like Datadog, Crowdstrike, Palo Alto Networks and others.’

Ed Sim

‘As of this writing, again according to Lone Pine’s work, 78% of public companies with > $5bn of market cap are multi-product.

Those that aren’t multi-product will have to resign themselves to bounded outcomes and acquisition by a Platform of Compounding Greatness. Based on Lone Pine’s research, approximately ⅓ of the public single-product companies as of the end of 2016 were acquired by the end of 2022.’

Tidemark

I’ve written before about how going multi-product is destiny for companies aspiring to become compounders at scale as they transition from private to public markets.

As we see point solutions become share donors to multi-product platforms, it’s easy to forget the beginnings of these compounders.

I recently came across the ‘Wayback Machine’, an archive of webpages, which helps us travel back far enough to see just how yesterday’s David became today’s Goliath.

I found it a useful exercise to do this for a handful of companies across different investing vintages that are generally considered successful multi-product platforms, namely:

ServiceNow

Datadog

Hubspot

Stripe

Rippling

Lattice

Snapshots of each company’s website at specific points in its history as it graduated from single product to platform are instructive for founders at the earliest stages plotting their own path from their first product to the second, third, and nth product.

For some companies like Hubspot the next product came post-IPO, whilst recent examples like Rippling intentionally pursued a compound startup strategy from inception. Cookie-cutter advice on timing product expansion is marginally helpful, as the right timing can vary widely across software categories.

What matters is to have a plan and reflect on what that next product should be and when is the right time for it.

Markets may gyrate, but multi-product companies’ ability to generate free cash flow is evergreen.

ServiceNow

ServiceNow IPO’d in 2012 and drew scepticism about its TAM, then perceived to be restricted to a sluggish IT Service Management market.

Frank Slootman catalysed ServiceNow’s multi-product journey in 2014, and the results of this were materialising by the time he left in 2017 - non-IT workflows comprised over 20% of revenue.

For a company projected to reach nearly $11bn in revenue in 2024 (that derived over half its revenue from non-IT services in 2021, a ratio that only continues to increase), that is flawless execution.

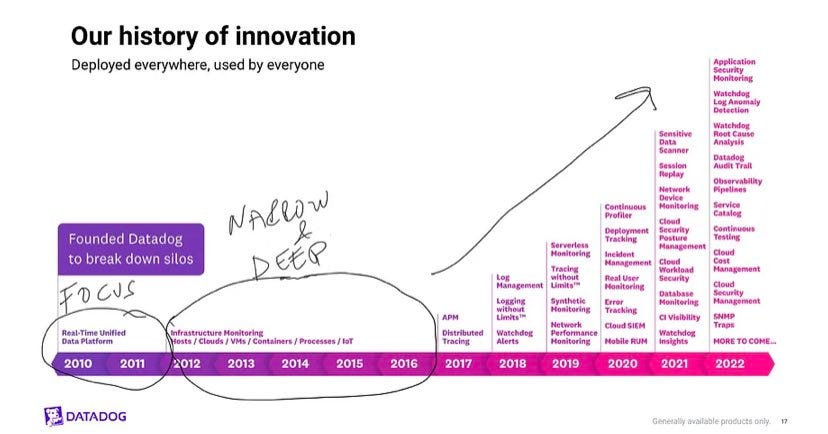

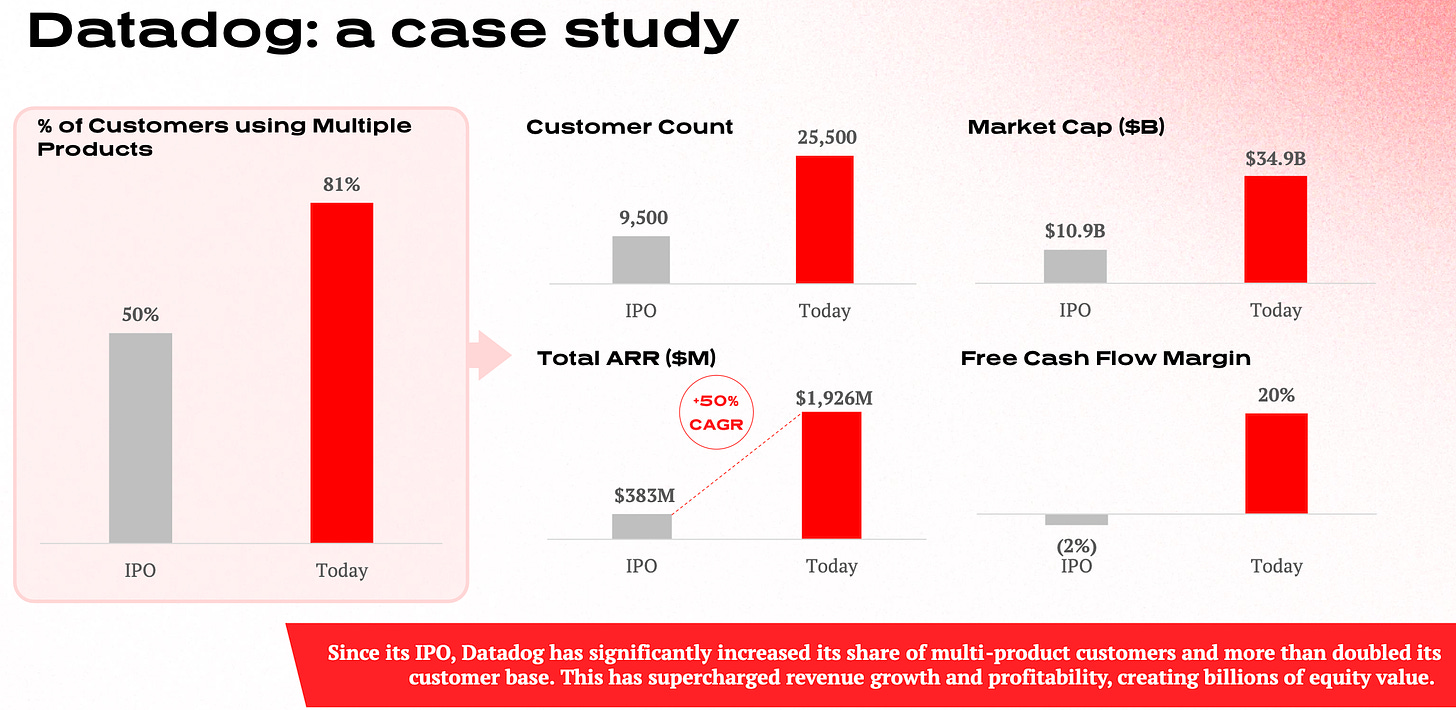

Datadog

Datadog is the archetypal multi-product company that has to go slow to go fast - the mission criticality of Datadog’s product meant that the opportunity cost of allocating R&D dollars into new products prematurely was too high.

Datadog earned a right to expand at a certain point - that point varies by the proximity to mission criticality. The closer to mission critical your software is, the longer incremental R&D dollars will have to be invested into the core product.

When that point does come though, few vendors will have the same gross retention and right to consolidate.

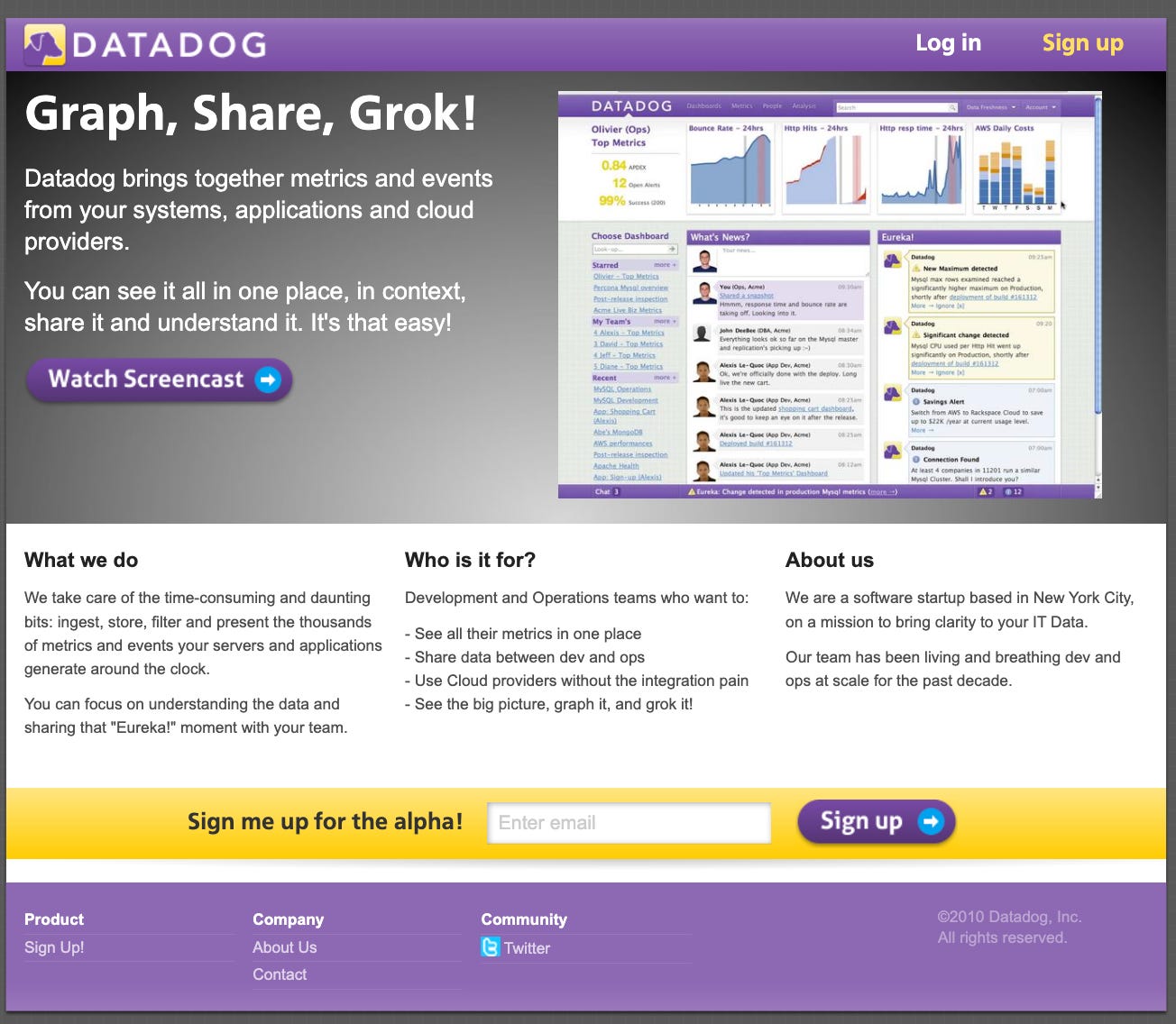

Datadog’s earliest days betray modest ambitions..

Fast forward to 2017, their multi-product engine kicked into gear, and it’s continued to hum along nicely to this day with a new shift to build for.

Hubspot

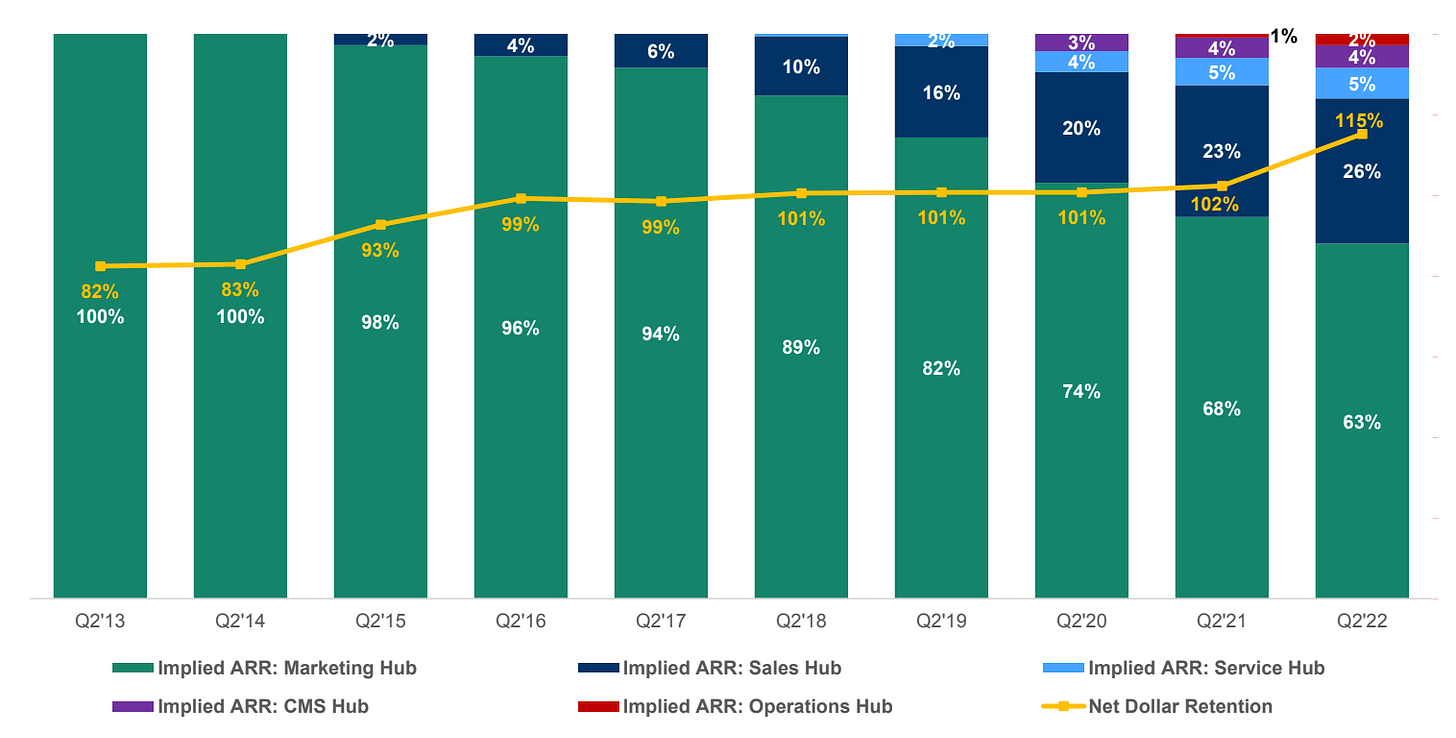

Meritech’s case study on Hubspot’s multi-product journey is worth your time, if only to come away with the lesson that companies can ride sheer GTM excellence into the public markets.

Hubspot’s additional products only kicked in from 2015 onwards, after its IPO in October 2014, and only crossed > 20% of ARR in 2019..

At the earliest stages, message-market fit precedes product-market fit (and various other pieces of the puzzle that need to fit together).

You can see what parts of the message are constant and which change as a company morphs into a multi-product suite..

Stripe

Stripe, like Datadog, belongs in the camp of mission-critical vendors, and has therefore seen a similar multi-product trajectory of going slow to go fast.

Stripe’s minimalist landing page in 2011 underlines the singular importance of its core product: payment acceptance.

Once a company reaches ‘Gartner Leader’ status in mission critical categories, the time to expand is near - in 2015, Stripe expanded into serving a wider range of merchants and verticals with solutions like billing.

After that, the multi-product engine was turbocharged to arrive at the suite we see in the ecommerce boom times of the pandemic.

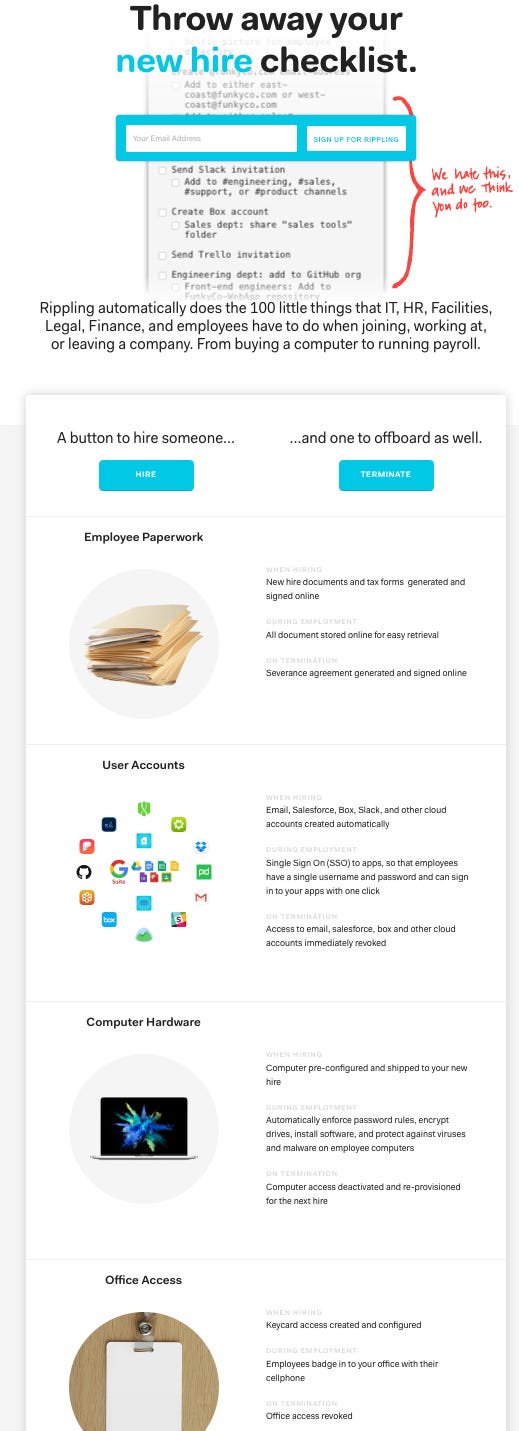

Rippling

Few software companies this decade come close to Rippling in championing multi-product earlier on in a startup’s trajectory.

‘I think now that there's a little more stability in the underlying vectors for how we deliver software, I think the overwhelming product and commercial advantages of deeply integrated software and bundled contracting and pricing are going to start to re-dominate and a new generation of megopoly business software vendors are going to emerge. And I think that one great example of this is Salesforce. And I think that Rippling is another.’ Parker Conrad

Although Rippling initially positioned itself around all tasks relating to employees, it was explicit about the functions this would touch (HR, IT, Finance), paving the way to the strong gravitational force of its suite in 2024.

Lattice

This conversation between Miles Grimshaw and Jack Altman on Lattice’s journey from the perspective of board member and founder is well worth your time, not least for the following passage on going multi-product:

‘My hope for Lattice is that we end up with a suite that treats employees with that level of respect for how valuable they are and is warm, not cold and is sort of human not process-oriented. And so to me, I think that is what we need to build towards, but it still is full suite build because you want to own as much of that employee journey in life as possible.’ Jack Altman

Can you imagine in five, seven years from starting, being at the board meeting? Having interesting product arcs still ahead of us? I think that's the exciting place to be.

‘Single products can go further than anyone necessarily thought. And again, I do think sort of in terms of organizational DNA, it is painful trying to bring mediocre V1s to market, right? You have to be able to say, hey, we have all these customers, but the thing we just built only works for this some subset of it, but we know we're going to go on that arc.’ Miles Grimshaw

I mentioned earlier that one of the two principal questions in the journey is what second product to launch.

Here is Miles asking Jack pointedly how he cracked this (timestamp 14:33) and decided to launch employee engagement surveys after performance reviews:

Miles: How did you decide what the second product would be? Like literally, what were the tactical engagements with that customer segment that made you confident that you should pick this thing versus the second best option or something?

Jack: At that point in time, one of the things that we did -- I did that was unbelievably helpful was I would do probably two or three dinners with customers per week. Like I was just talking to customers constantly.

Miles: But you never know as someone who was never an HR leader. But I always think it's interesting the question of how many customer cellphone numbers does the CEO have probably? And I was always really surprised by the number of HR leaders Jack would be on text with.

….

Jack: I can see where there's smoke and go look for the fire. And they were just raving about just the ability to do that. You open up what's in that product. And you're like, well, it's not that complicated of a product. And maybe more importantly, it's the exact same buyer as Lattice's current performance management product.

Parting Thoughts

One thing I’ve been discussing with friends is whether the new class of software companies will invariably go multi-product earlier in their trajectories.

Product velocity has always been a differentiator of generational companies. Against a backdrop of point solution ubiquity, will the Darwinian adaption be to allocate more R&D dollars to new products earlier on? Is that the only way to avoid the black hole of vendor consolidation?

Investors across private and public markets are pricing in different levels of rate cuts, but whatever the macro environment, we have to produce fitter companies.

This will mean fewer dollars to allocate to additional product builds, but that is the normalisation necessary post-ZIRP. Let me know what you think.

Reading List

Capex & Opex supercycles — the dusk of SaaS and the dawn of AI-SaaS Hemant Mohapatra, Lightspeed India

New VC in town: “MANG” Apoorv Agarwal

Welcome Back to the Unicorn Club, 10 Years Later Cowboy Ventures

Is 2024 Vertical AI’s breakout year?

Enabling Magicians, Not Magic ✨

Quote of the week

‘Over the last 60 years, a lot of R&D has gone to bring the cost of compute down to near zero. This led to a personal device in every hand. We also have had the cost of distributing this compute down to near zero as well. That brought the marginal cost of software down to zero, which is basically the reason the internet exists. The next 30 years is going to bring the cost of intelligence down to zero. What would the world of software look like if everything ran on “insights” instead of “compute”? If you are a founder building in SaaS, this is what you should be gearing up for.’

Hemant Mohapatra

Thank you for reading. If you liked it, share it with your friends, colleagues, and anyone that wants to get smarter on startup strategy. Subscribe below and find me on LinkedIn or Twitter.

Good stuff.

I covered the customer experience side of multi product in here with some primary research:

https://www.saasletter.com/p/platforms-vs-pure-plays