Nexi, Satispay, Viva Wallet and the frontlines of the cash-to-card conversion

Italy, Greece and the tailwinds behind one of the largest payments companies in Europe

👋 Hey friends! To the regular readers, thank you for reading as always! If you enjoy these Missives, please share it with your friends and colleagues.

To the new readers, I’m Akash and welcome to Missives. Every week I analyse trends and go-to-market strategies in software and fintech. You can find me on akash@earlybird.com.

Join leading Founders, Operators and VCs reading Missives every week.

Current subscribers: 2,736, +60 since last week

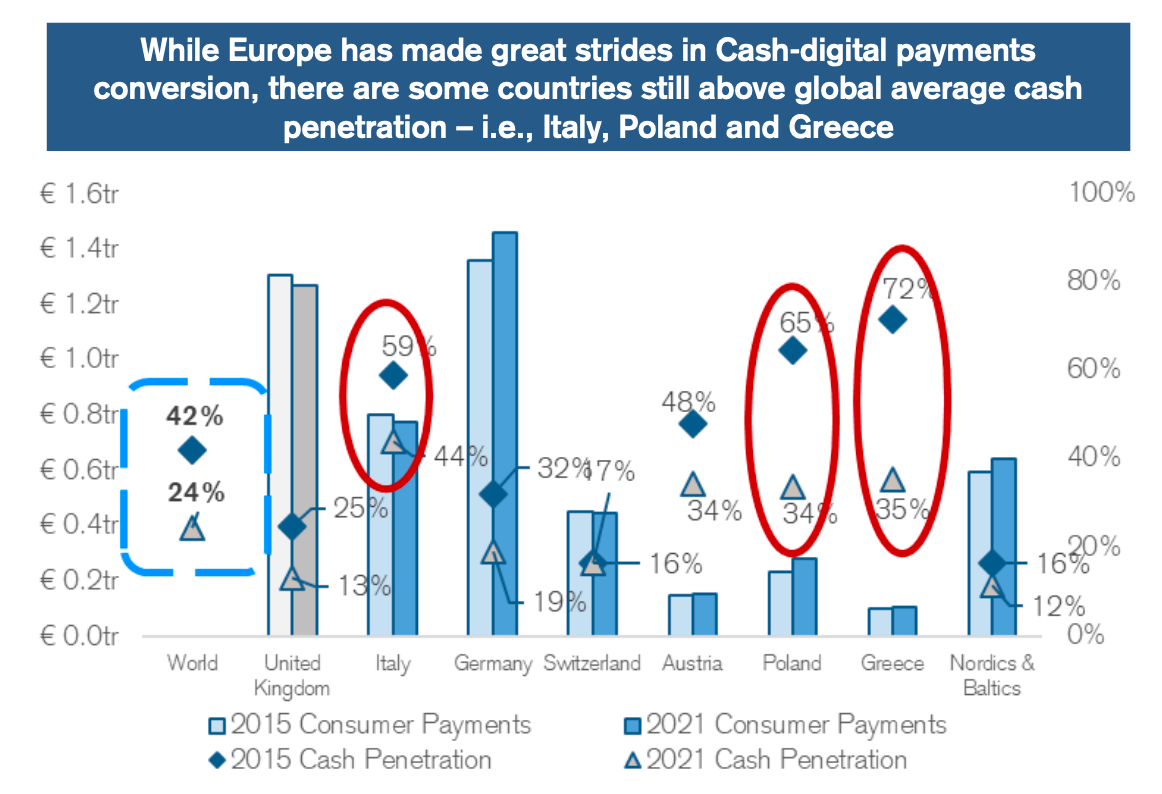

A few weeks ago, we covered the contours of the European payments landscape, reflecting on the remaining headroom in the cash-to-card conversion and how it continues to represent a powerful secular tailwind for merchant acquirers in several European markets.

Italy stands out even among its peers Austria, Poland and Greece in how far it lags the global cash penetration average. In December, Giorgia Meloni’s government relented and scrapped plans to give merchants the right to refuse card acceptance for transactions under €60, an earnest effort to appease retailers who felt frustrated by Mario Draghi’s efforts to accelerate digitalisation of payments.

A few days ago, a deal was struck between Italian banks, payment providers and retailers’ associations to increase competition and drive lower cost of acceptance for purchases below €30. Conscientiousness aside, impetus for the deal largely stemmed from the threat of a windfall tax on payment providers if they didn’t fall in line. The chief signatory of the deal and purported target for the tax is Nexi, now one of Europe’s largest payments companies.

Nexi’s original incarnation was Istituto Centrale delle Banche Popolari Italiane (ICBPI), a joint undertaking by six Italian cooperative banks in 1939. CartaSi was founded in 1985 as an initiative of the Italian Banking Association, 16 credit institutions and 4 central banks. ICBPI would acquire CartaSi in 2009, and embark on a consolidation path to eventually rebrand in 2017 as Nexi with the ambition of leading the future of digital payments in Italy.

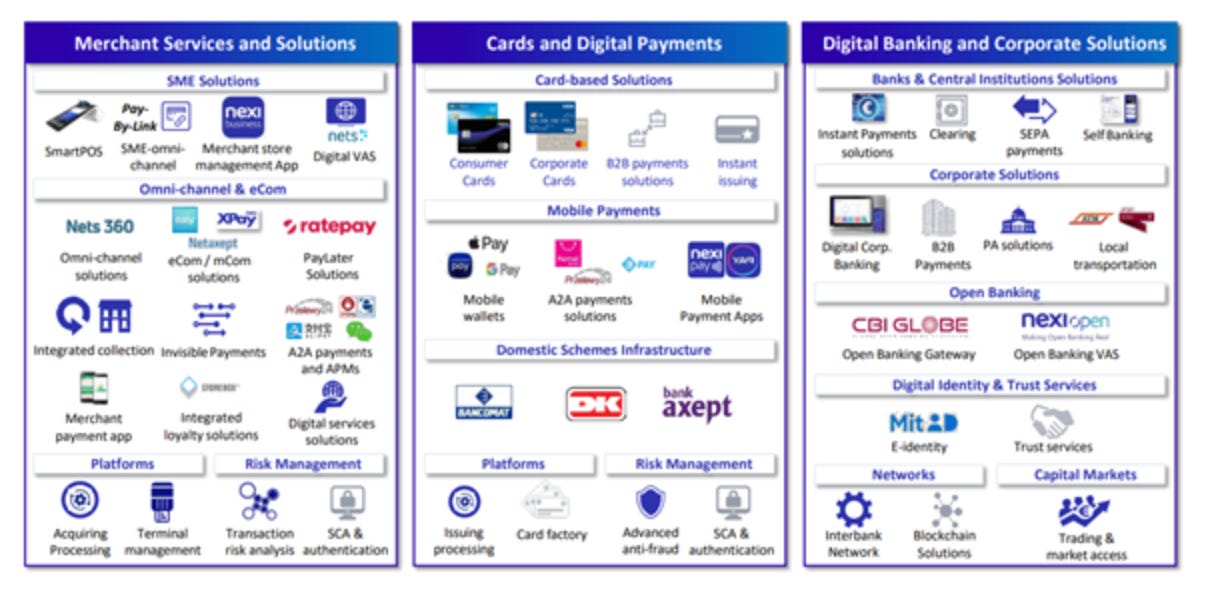

The buy-and-build strategy included several notable acquisitions, not least Nets and SIA in 2021 (Nexi’s net take rate improved significantly once it insourced acquirer processing with SIA, whilst Nets improved Nexi’s back-end core payment processing), accelerating the path towards a product suite with 3 key pillars:

Merchant Services and Solutions: Pay-ins for merchants

Cards and Digital Payments: Issuing

Digital Banking: Corporate Banking

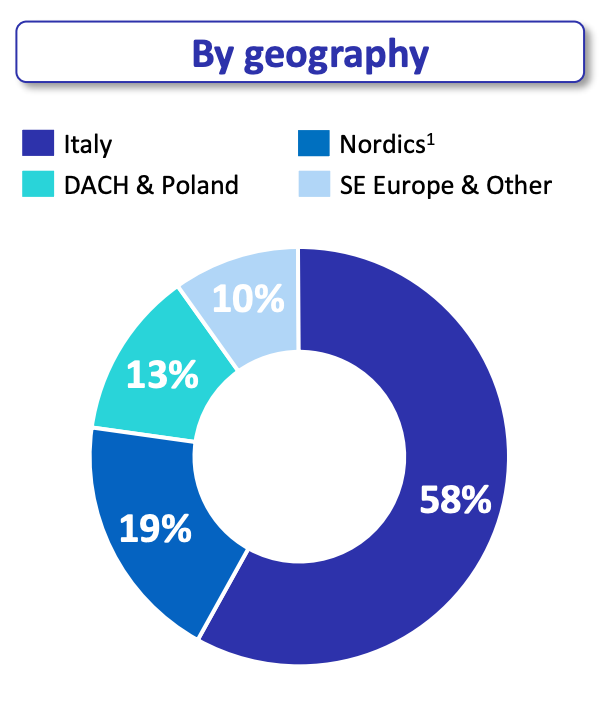

At the time of IPO in 2019 Nexi was fully exposed to Italy; 4 years later, helped by the acquisition of Nets (with its presence in the Nordics), Nexi’s revenue mix by geography is looking more and more like a pan-European payments leader. In February Nexi announced a partnership with Banco Sabadell to make inroads into Spain, intending to acquire 80% of Sabadell’s merchant acquiring book.

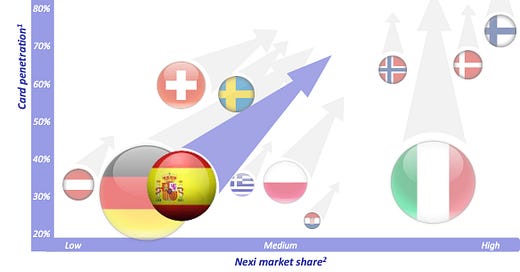

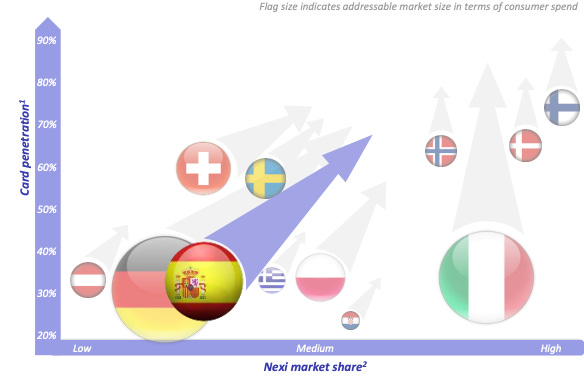

In its annual report, Nexi projected that the Sabadell partnership would propel the group to €5.0tn in consumer spend, 2.6m merchants, and €814bn in acquiring volumes (for reference, Adyen and Stripe will cross a trillion in volumes this year). Management sees considerable opportunity for expansion in Germany, Switzerland, Sweden, Austria, Croatia, Poland, and Greece.

Nexi’s scale is even starker when considering its efficiency - EBITDA grew 14% in 2022 to €1.6bn; again, for context, 2023 EBITDA expectations for Adyen are €843m, whilst Stripe pitched a $100 million target during its recent fundraise.

Only 10% of Nexi is exposed to online acquiring, making it less vulnerable to market share transfer to modern acquirers and in fact more likely to win share over from bank acquirers - after all, Nexi was initially started by an association of banks. Nexi’s pure play focus on payments ought to have negated the ossification that bank acquirers are susceptible to with their focus on other business lines. Nexi leverages relations with c. 150 partner banks as a pure distribution channel or as a value added service provider to bank acquirers.

Nexi’s market share, bank network, and the composition of its merchant base are formidable barriers to entry for a disruptor. Enter Satispay.

Satispay became a unicorn in September 2022 when it raised a €320mn Series D from Lee Fixel’s Addition, Greyhound Capital, Coatue and returning investors Square and Tencent. Founded in 2013, Satispay is pursuing the holy grail of payments: a closed loop payments network that can take on Visa and Mastercard. The funding announcement gave a sense of its scale, with offices in Milan, Luxembourg and Berlin, the Italian scale-up has 3 million consumers and 200,000 sellers in its ecosystem (for context, Cash App has somewhere in the range of 50+ million MAUs and 3 million sellers).

Satispay’s closed loop model disintermediates the card schemes by banking merchants and consumers, in the mould of what PayPal and Block have achieved with Square and Cash App. This allows them to be extremely competitive on price, particularly for smaller purchases: free on transactions up to €10, and a flat €0.20 on transactions above this amount (offline).

Many Italian merchants did not even countenance an alternative to cash until Satispay’s competitively priced offering came along, precisely the kinds of merchants that last week’s Memorandum of Understanding was signed to support. The density of merchants and consumers required to scale a closed loop payments network and drive share of checkout as the preferred payment method is a massive undertaking for which the playbook is still being written (a prize worth pursuing when you consider the 70% EBITDA and 50% NI margins of Visa/MC).

If we look to Greece (where cash penetration is 35%), there is another challenger that exemplifies distinct characteristics from the M&A buy-and-build approach of Nexi: Viva Wallet. Viva Wallet became a unicorn at the end of 2021 when JP Morgan took a majority stake in a transaction that valued the company at c. $2bn; prior investors included Hedosophia.

Viva Wallet is a cloud-native acquirer and issuer that has built its tech in-house, operating in 24 European countries with an EMI license from the Bank of Greece and a Greek banking subsidiary. In 2022 the company processed €17.5bn in volumes, 46% of these being in Greece, generating €122m in revenue. Viva capitalises on its relationship with both merchants and consumers with an intriguing business model. Merchants work with Viva to process payments from consumers, and are able to reclaim up to the entire Merchant Discount Rate through cashbacks by spending with their Viva issued business bank account/card. How? Well, the interchange rate on a business debit card is sufficiently high enough to leave a healthy margin on top of a full reimbursement of the MDR.

We’ve talked previously about how cloud-native acquirers should ostensibly benefit from faster product velocity and release cycles; it’s intuitive that Viva running on Azure makes them significantly more capable of meeting their merchants omni-channel payments and value added services needs. That being said, Viva is a fairly old company, but recent conversations with leadership at payments companies of a similar age has given me some evidence for their ability to be freed of tech debt. Whether that be moving from a monolithic architecture to a microservices one, or moving from on-prem to the cloud, the transformation this entails may be overstated.

The frontlines of the cash-to-card conversion are brimming with activity.

What I’m Reading

AI, Efficiency, and All Things Fintech in 2023: A Q&A with the CEOs of Adyen, SoFi, and Wise

I found it quite remarkable that even at its current size, Adyen continues to have a final interview of candidates with at least one board member. That might explain Adyen’s talent density.

Modern Meditations: Sam Lessin

Sam’s a first-principles contrarian and I’ve enjoyed reading his essays on Twitter; the answer that most resonated with me here: ‘True craftsmanship, where you go from being directionally right to specifically right, is not just “let’s just do the first seed” — but doubling, tripling, and quadrupling down throughout.’

Seed investing isn’t coming back

Sam’s framing of venture as a capital factory line is useful mental model for assessing the psychology of bull and bear markets - at this point in time, public markets don’t want to buy what late stage investors have to offer, just as the latter doesn’t want to buy the quality of companies early stage investors have to offer them.

We’re surrounded by technologies that were once at the frontier of AI research, until they weren’t.

AI and The Burden of Knowledge

A machine that never dies and continuously learns will surpass any of the frontiers of knowledge that humans have reached to date. What our relationship be like with such omniscient entities?

Great read mate thanks!

Hey Akash! Great analysis of the European payments landscape and the impressive growth of Nexi, Satispay, and Viva Wallet. Your insights on their strategies and potential for expansion are spot-on. Looking forward to reading more from you! Cheers! - Adam