JPM Chase: Paragon of Innovation and Migration

Confluence of core banking infrastructure, AI/ML and the Cloud

Join 2,400+ Founders, Investors and Operators for weekly Missives on software strategy and technology trends below.

As always, if you enjoyed this please share it with your friends and colleagues.

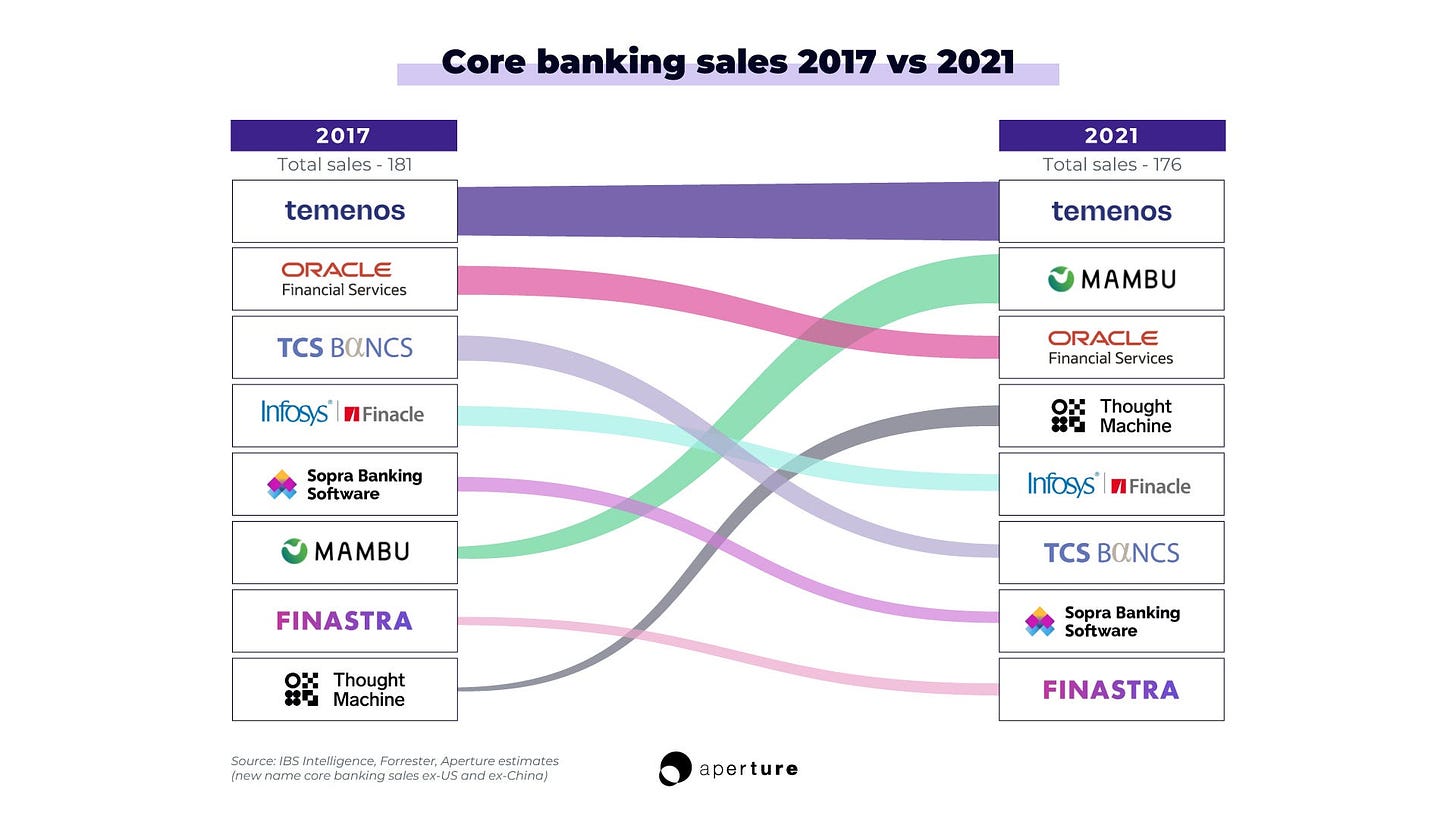

I was at a dinner this week with some senior fintech execs, and the discussion turned to the modest gains of modern core banking infrastructure vendors in recent years.

The ‘Big 3’ core banking vendors of FIS (1968), Jack Henry (1976) and Fiserv (1984) are on average 47 years old yet account for 78% of market share in the US, generating billions in revenue and earnings.

The merits of migrating from legacy vendors to modern cloud-based core banking infra are manifold: faster time to market for new products, robust APIs for internal meshing and external partnerships with fintechs, the foundations for digitising customer journeys, and more scalable, cheaper infrastructure.

It's tested, it's true, it's already in implementation. But we're delighted by the fact that it's got a lot more open APIs, it facilitates many more integrations, not only with their own modules, but with other partners, which will allow us to partner with FinTechs where we want to, with other providers, allows us to choose best-in-breed services and facilitate a true omnichannel experience.

Jason Bender, COO, First Republic Bank, 2019 Investor Day

The pandemic’s acceleration of fintech adoption cast the inadequacies of legacy core banking vendors under sharper light; incumbents are unequipped to protect market share from fintechs operating on modern cloud banking infra. Leading European and US banks, with IT budgets of c. ~€23bn and $40bn respectively, are well aware of the importance of operating their core banking infrastructure on the cloud to meet the rising expectations of consumers.

Despite the rising discontent with existing solutions, as Ben Robinson pointed out, modern core banking infra vendors have struggled to increase penetration in recent years. Only ~1-2% of US / EU banks switch their core providers each year, vs ~20% that come up for contract renewal. The primary reason for this is the cost and length of the migration - the switching and implementation process can last multiple years.

As we’ve discussed before with application SaaS, buyer psychology is key. In core banking infra, the buyer is naturally averse to approving a multi-million dollar migration that will take years to yield tangible top and bottom-line benefits - and by extension, to his/her career (a point enunciated to me by a friend who was a former Senior VP of a leading European bank). The downside is too high relative to the potential upside in the distant future.

One bank that shirked this myopic mindset is JPM Chase.

As of the end of May 2023, Chase UK recorded 1.6 million customers in the UK, tripling YoY and growing faster than neobank peers Revolut and Monzo in 2022. JPMorgan will extend Chase with as much as $1bn in patience as the UK acts as a petri dish for the ARPU expansion strategy via Nutmeg and other FS products.

There are a few variables that have coalesced to propel Chase to such success.

Fresh off the acquisition of First Republic, the bank unveiled an unrivalled $15.7bn budget for investment, encompassing hiring, marketing and technology. Within technology, JPM has already delivered $500m of productivity gains in software development and infrastructure and increased cloud adoption to 38% of infra.

The migration of Chase to AWS yielded the following attributable product velocity gains: 15 Chase.com releases weekly, 2 mobile app releases monthly, and 22% increase in change volume.

Additionally, JPM began a migration of their consumer banking core system to cloud vendor Thought Machine in 2021. Thought Machine’s Vault Core enables banks to configure new financial products easily, encompassing secured and unsecured lending, deposits, Shariah-compliant products and wallets.

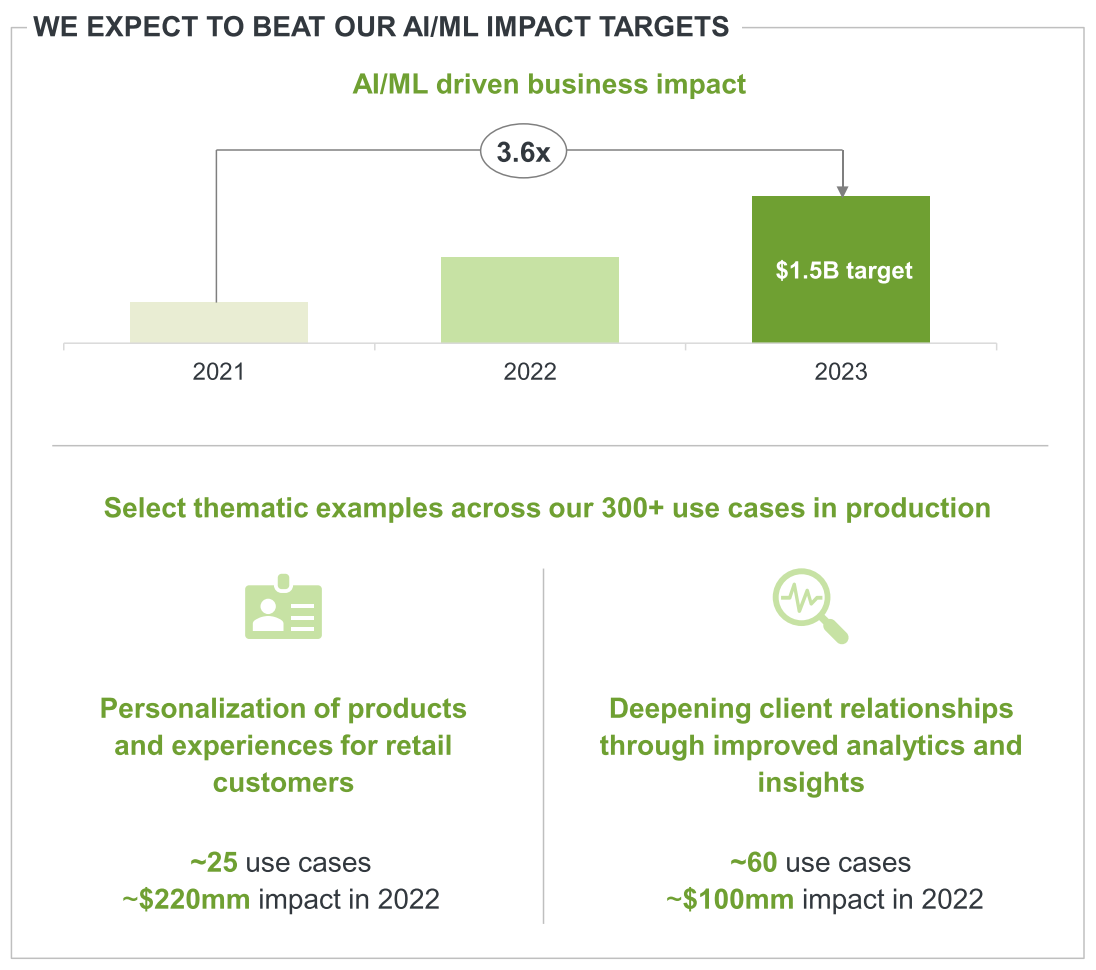

Finally, JPM Chase has invested heavily in AI and ML, ranking first by a long margin in the Evident AI Index which assesses AI maturity at the largest banks in North America and Europe.

JPMorgan Chase’s dominance - for it is a strikingly strong performance compared to the rest in the Index - has been based on a long-term commitment at the most senior levels, backed up by significant and sustained investment in talent and research.

The bank has adopted the approach taken by tech firms - enabling industry-leading talent to combine ongoing publication of academic research with the opportunities of working at a bank, such as rich data sets, attractive remuneration packages, and the opportunity to address real-world challenges.

Evident

The bank highlighted the specific metrics of AI/ML deployment success in its Investor Day presentation:

In sum, the move to a public cloud (AWS), migrating core banking to a cloud-based vendor, and heavily investing in AI/ML have combusted to deliver the technology foundations that JPM Chase needs to mount a sustained resistance to fintechs invading for market share.

There’s a lesson in here for execs at banks about the long-term rewards of R&D investment in the right areas to take advantage of secular technology trends - it’s coming one way or another.

Switching costs in SoR

A final element worth dwelling on is the switching costs in core banking infrastructure, and how these are representative of switching costs in general for core systems of record.

As we mentioned, a Chief Innovation or Technology Officer is not going to countenance a multi-year migration project that only starts to yield benefits long after they’ve left the organisation (more likely than not given average tenure). Tuum’s purported 7 month average implementation time is already a considerable compression on what’s come before; they support on-premise migrations, migrations to private clouds and to the public cloud.

Migrations and implementations of systems of record (SoR) will always include plenty of professional services, likely with an Implementation Analyst, Solution Architect, and Integration Engineer. What are some other novel ways that multi-product SaaS apps on product/SKU parity with incumbent SoRs like Workday, Netsuite, and SAP can reduce the burden of migration, and by extension, the inertia to switch?

I’d love to hear your thoughts.

What I’m Reading

SaaS Metrics 2.0: The Case For Next Era Metrics Playbook

Kyle Poyar of OpenView presents a refreshing range of metrics spanning Discovery to Scaling that are more accurate proxies of SaaS business health in the age of PLG. Tracking Net New ARR relative to burn accounts for the wider distribution of ownership for revenue across the org.

Safeguarding Enterprise Adoption of LLMs

Aditya Naganath of Kleiner Perkins proposes enablers for enterprise adoption of LLMs such as role-based access control to preserve privacy for internal search use cases across business functions. The analogy with SOC-2 compliance is worth further discussion - will future generations of models remain inherently probabilistic to an extent that necessitates compliance standards for hallucination?

Building AI-powered sales software with product integrations - Supaglue | Open Source Unified API

The integrations-as-a-service category (e.g. Merge.dev) has grown rapidly in the last few years and the emergence of LLMs has been yet another accelerant; given that Sales software vendors have been some of the first adopters of LLMs in their products, there are critical questions that de novo applications must ask themselves about the depth of their integrations with Salesforce versus the long tail.

Jared Franklin of Costanoa Ventures looks the revenue mixes of PayPal, Mindbody, Square, Toast and Bill.com at IPO and today. Square and Bill.com inverted respectively to low and high % reliance on transactional revenues, whilst PayPal and Toast have been pretty consistent. It’d be interesting to conduct this analysis on a wider range of vertical SaaS companies and platforms.

Generative AI Companies Have Moats (Eventually)

Brandon Gleklen of Battery Ventures defends the absence of initial moats in Generative AI applications with the hypothetical example of an aid to lobbyists. Earlier this week, EvenUp announced their $50m Series B with Bessemer to scale up its AI-enhanced software for personal injury claims. EvenUp personifies the dream for application layer investments in AI, i.e. verticalised software with proprietary data, and a workflow automation that is radically enhanced with AI.