Revenue Quality: Product Suites in Fintech

Business model quality, transactional and subscription revenue, and going deep to go broad

Welcome to the 80 new Missives subscribers who have joined us this week! As always, please feel free to comment, reply and share. If you aren’t subscribed, join 1,680 curious readers by subscribing here:

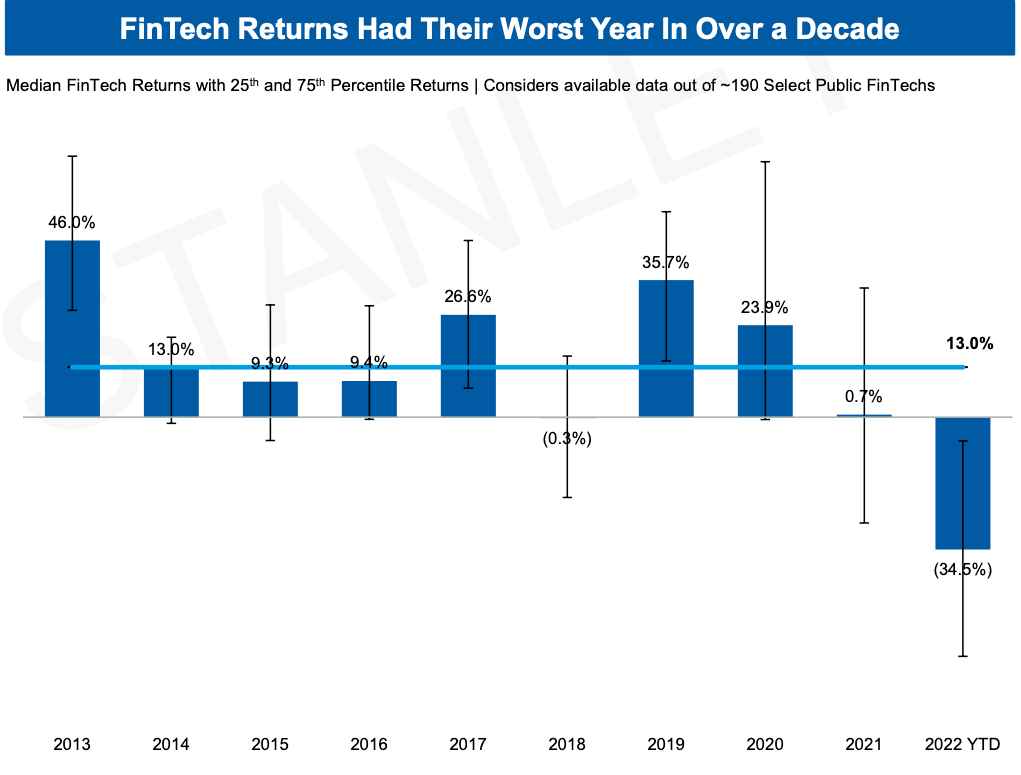

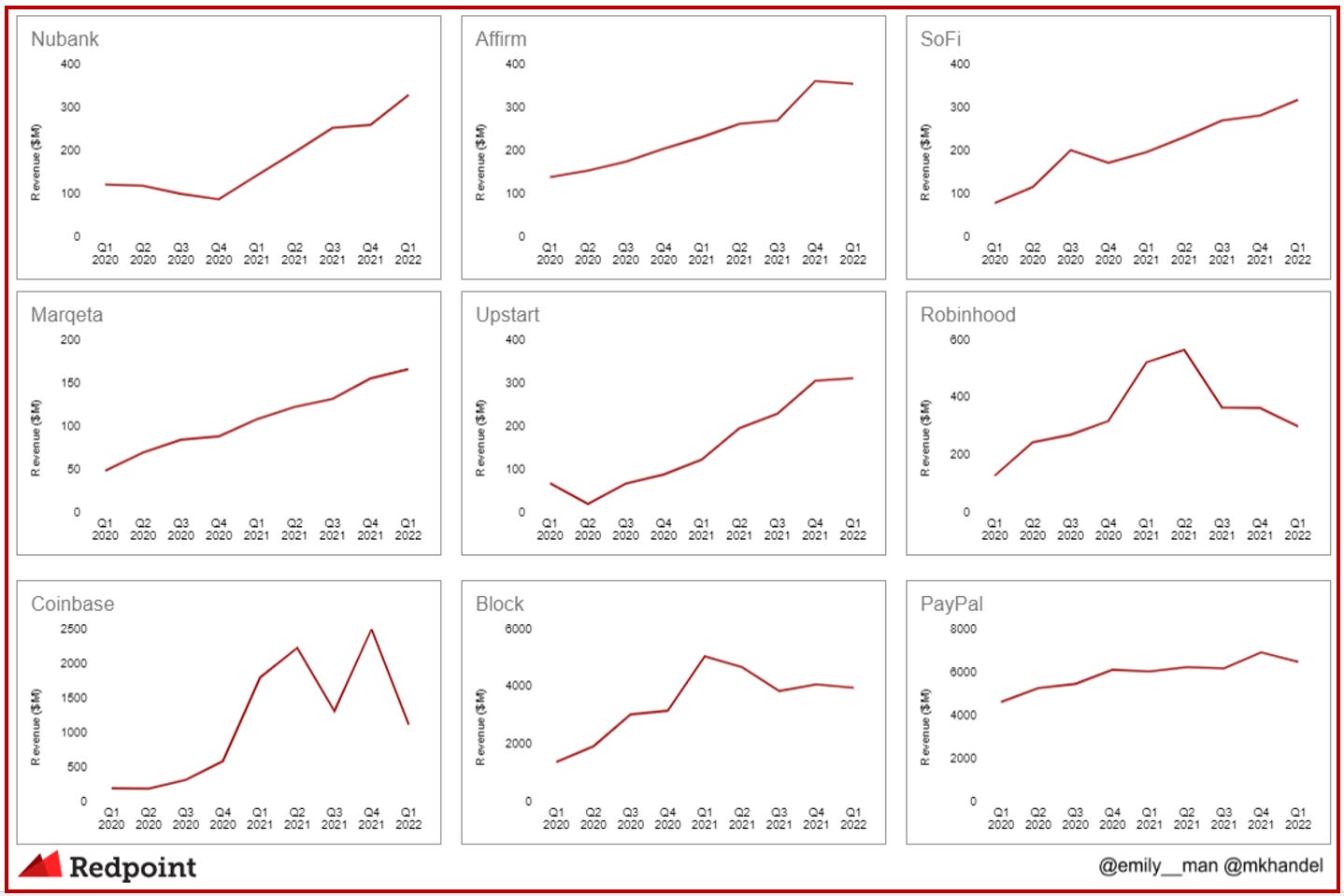

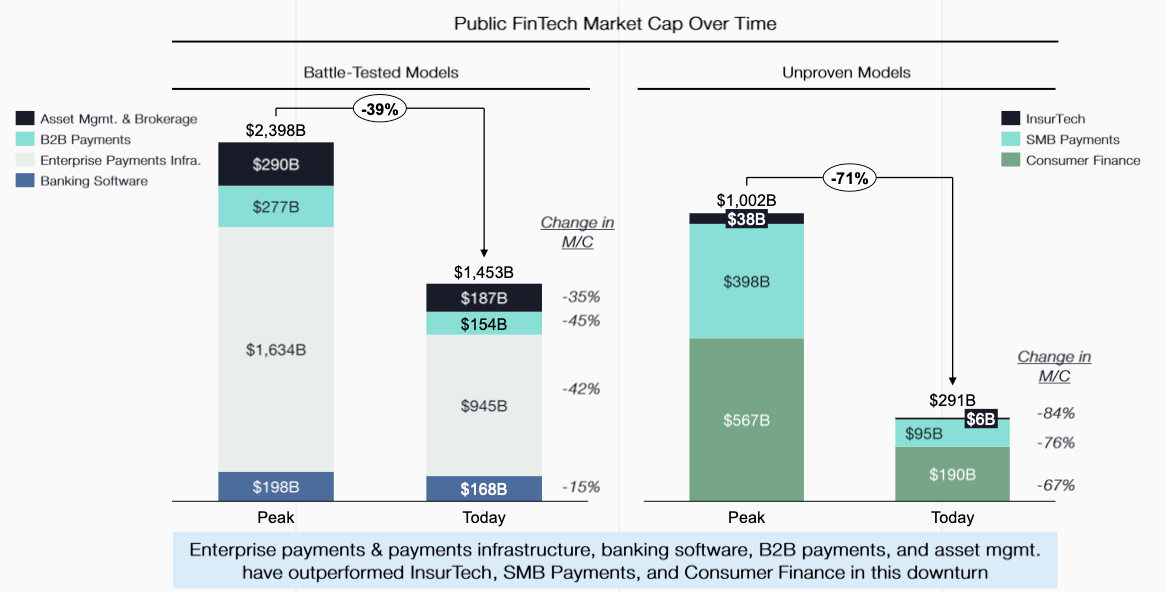

Fintech has been one of the hardest hit verticals in the market correction, delivering bruising returns to investors.

Public Fintechs with transactional business models have always trailed the lofty multiples ascribed to SaaS companies; the volatility of transactional revenue was particularly stark relative to the predictability of subscription revenues in 2022.

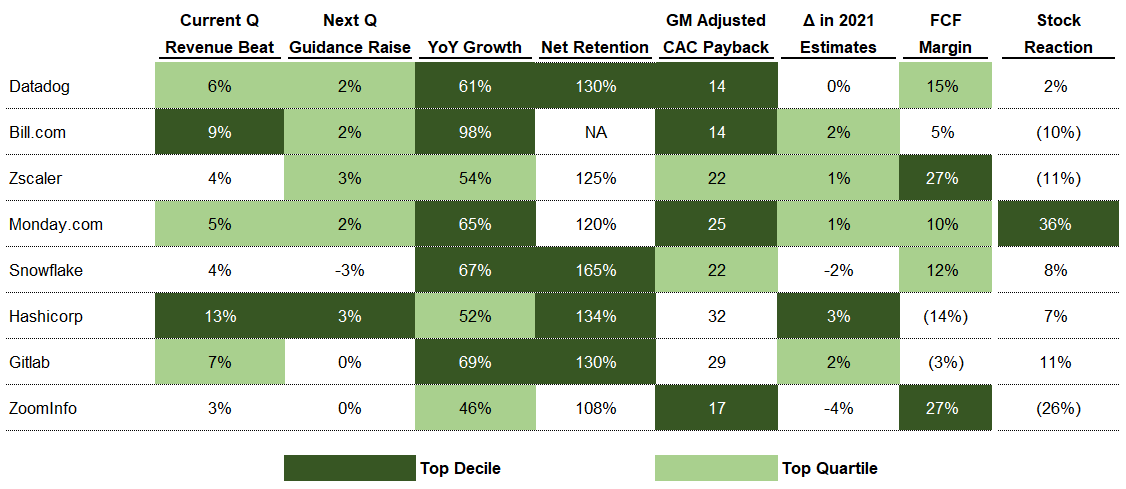

Prior to the correction, SaaS businesses were already trading at 2-3x higher multiples than fintechs, owing to the variance in business models. The ensuing correction has hit SaaS and fintech businesses equally hard, despite many fintechs delivering strong beats in Q2/Q3 and positive forward guidance.

As a consequence, investors are casting a sharp light on the prevailing business models in fintech, calling for more durable revenue streams.

Revenue quality and diversification away from being a tollbooth on transactional volume to predictable annual subscriptions with upfront billing is top of mind.

This coincides with Parker Conrad and Rippling demonstrating how having a product portfolio approach from inception builds a compound company with hundreds of millions in ARR. Parker recently described how the suite strategy is at the core of 'compound' companies:

If you look at the history of business software and you look at the really big outcomes from 20 or 30 years ago, most of them are what we would call compound companies. You look at businesses like SAP and Oracle and Microsoft, that's what they're all doing. They all have very broad product portfolios. And I actually think there's a misconception that the way to build product quality is to focus very narrowly. And that's the thing that I disagree with the most.

Against a backdrop of declining returns in software for vanilla SaaS, Parker and Rippling's worldview of bundling is particularly cogent (as we've discussed before). From its inception, Rippling has built a product portfolio around the atomic unit of employee data, amassing over two dozen SKUs. The results are lower CACs, better retention, and higher ARPUs - all of which are only made possible when the suite strategy delivers the most value for the end customer:

The best products for customers is actually to build in this compound way and to have these megopoly business software vendors that cover a broad swath of territory.

As fintech investors clamour for higher quality of revenue and business models, employing a suite strategy to develop a product portfolio and become a compound company will inevitably be on the agenda.

The question is not if, but when to move beyond a core competency to adjacent products. In fintech, it truly varies.

Let's take the corporate card and expense management category. Ramp is renowned for its product velocity and has been transparent about embedding themselves deeply inside a customer's finance stack through their corporate card, which likely operates at little to negative gross margins based on interchange. As Ramp shipped new software products, the thesis was that they'd be able to effectively cross-sell higher margin software products. As Matt Brown of Matrix Partners observed of fintechs diversifying away from interchange:

Smart fintechs and platforms are recognizing the limitations of this model. But rather than abandoning it, they’re using it as the foundation for other higher-margin and more attractive business models.

Airbase has already transitioned to software revenues from interchange, citing 'higher quality, more durable' revenue.

Another company in the CFO suite is Bill.com, which began by automating Accounts Receivable (AR) and Payable (AP) workflows but has since moved into expense management with the acquisition of Divvy (as well as strengthening its AR product with Invoice2Go). In 2022, 30% of revenue came from subscriptions, whilst a large chunk of the remaining transactional revenue is recurring in nature (more predictable B2B transactional volume than discretionary). Bill's growth, retention and margins were in the top decile of public cloud companies in Q3.

Product and revenue diversification is a hallmark of great companies, but a key consideration is the appropriate timing for expansion, which can vary considerably for different categories.

Stripe focused on its core product (payments for merchants and platforms) for the first six years before a suite of products emerged.

Looking at Stripe's website today, there are 24 products (roughly the same number of SKUs as Rippling) across 3 categories: Global Payments, Revenue and Financial Management, and Banking-as-a-service. Stripe could have pursued a suite strategy earlier on, but deliberately decided to focus on payments before rolling out a broader offering.

Why? Well, Stripe is in a high velocity category and part of the Central Nervous System of its customers, where there's simply no margin for error. Years of focus and R&D investment yielded a product that had 99.99% uptime through spikes in volume such as Black Friday sales. Only when this was achieved did Stripe begin cross-selling higher margin products to its customers to great success, with 94% of enterprise customers adopting multiple Stripe products.

We see a similar tale with Adyen, who focused R&D effort on its core payments product for many years, before recently allocating investment into new financial services products, spanning onboarding & compliance, issuing/payouts, accounts, capital and FX services. Jareau Wade described how Adyen viewed the trade-off between focus and product expansion as:

Part of remaining disciplined for Adyen has meant being late to certain categories due to their relatively focused R&D. For example, they didn’t add platform payments, card issuing, or Banking-as-a-Service capabilities until they were at risk of losing volume from existing customers (see #2) or losing out on a meaningful number of new deals (see #1). Instead, Adyen waits to see if there is a business need (not just a general market trend) for new services, then goes all in if there is.

If we come back to the wonderful interview of Miles Grimshaw describing product suites at companies like Segment, Datadog, Hubspot, the kernel of his argument is that it's important to start thinking about your second act early.

And there is this adage of focus, focus, focus. Now you don't want to do silly things.

You also shouldn’t assume success of the second thing and over-resource it and building a doc for a long time. But I think the muscles that you end up building by asking yourself, where else we go, what else we can do and starting that curiosity early, earlier than you might imagine is powerful because it's not going to happen instantaneously.

Fintech builders heeding this advice must do so through the lens of revenue and business model quality, taking a view on how the mix of transactional and subscription revenue will evolve over time. Fintech subverticals where the product is business-critical should think carefully about when is the right time to begin investing in a suite, whereas in other categories it may be wise to ship adjacent products from inception in order to diversify revenue streams.