Reflections On The European Payments Landscape

Regulation-driven innovation, fragmentation and APMs, and the opportunity ahead

👋 Hey friends! To the regular readers, thank you for reading as always.

To the new readers, I’m Akash and welcome to my newsletter, Missives. Every week I analyse trends and GTM strategies in SaaS and FinTech. I always love hearing from readers; you can find me on akash@earlybird.com. Join 2,500+ others below for regular Missives.

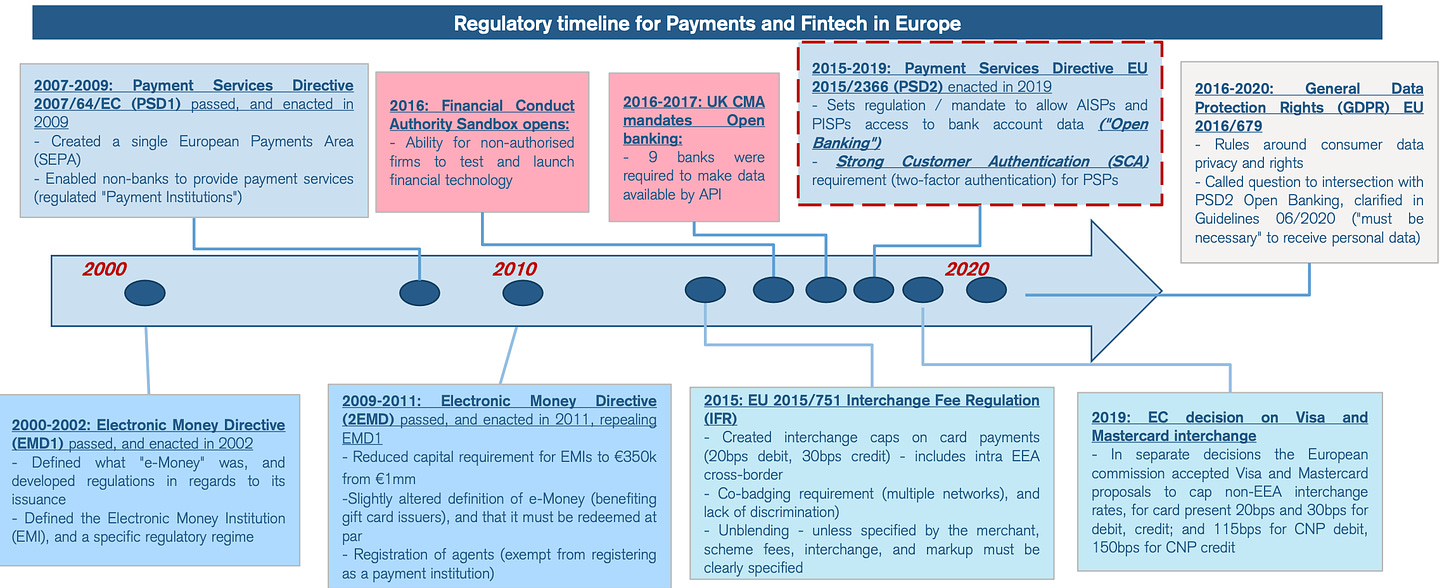

Regulation-Driven Innovation

Regulation-driven innovation has been a key driver of the European fintech landscape to date, compared to the market-driven innovation observed in the US. Regulation in Europe has shaped business models (mix between subscription and interchange revenues), moat trajectories (commoditisation of APIs and coverage, elevating importance of value added services and SLAs), and market structures (regional leadership vs Pan-European market concentration).

Last week, the European Commission (EC) unveiled a set of proposals that would frame a new Payment Services Directive, PSD3, addressing the shortcomings of PSD2. Since we’re a few years into PSD2’s implementation, it’s a good time to take stock of how the European payments landscape has evolved over the last two decades and the opportunity ahead.

The narrative around fintech’s emergence in Europe generally traces back to the Global Financial Crisis in 2008, but the Electronic Money Directive in 2002 provided the foundation for Electronic Money Institutions that could hold funds, issue wallets and accounts (there are nearly 600 EMIs in Europe today, including Wise, Pleo, Modulr, Swan, Lydia and many other notable fintechs).

The first Payment Services Directive (PSD1) came along in the late 2000s to introduce the ‘Payment Institution’ (PI). Payment Institutions had most of the capabilities of E-Money Institutions with the benefit of having far lower capital requirements and faster time to market, at the expense of being able to hold funds and issue e-money. For fintechs that ‘touch’ money and are in the flow of funds, a PI license is often just the first step on the regulatory journey - e-money licenses follow typically whilst the merits of full banking licenses are well demonstrated by Adyen.

The second Electronic Money Directive was introduced in 2011 and paved the way for Banking-As-A-Service as e-money license holders were able to provision infrastructure for embedding financial services products (e.g. companies like Modulr, Swan, and Railsr).

Interchange fee regulation, intended to reduce the cost of card payments and drive digitisation of payments, capped interchange for issuers at 0.30% and 0.20% for CP transactions (card present, in-store) credit and debit cards respectively and improved transparency for merchants via unblending (breaking down Merchant Discount Rates into its components of interchange, scheme fees, acquirer mark ups, and any markups by ISOs). In 2019, the EC imposed caps of 115 bps and 150 bps for CNP (online) debit and credit transactions (compared to the typical 1.95% interchange for credit card transactions in the US).

The second Payment Services Direct (PSD2) paved the way for Open Banking by allowing regulated Third Party Providers to access bank account information (AISPs) and initiate payments from bank accounts (PISPs). Banks had to expose customer data via APIs, unlike the US where access via APIs remained market-driven, thereby obviating the need for screen scraping. PSD2 also meaningfully reduced fraud volumes through Strong Customer Authentication (SCA), which mandated two-factor authentication for ecommerce transaction (the trade-off of lower fraud is lower conversion, as merchants found).

The EC’s proposals for PSD3 and the accompanying Financial Data Access and Payment Services Regulation, has several goals, including but not limited to:

Further mitigate fraud and build upon SCA via data sharing - just in the last few weeks we’ve seen several announcements of data-sharing consortiums including SardineX, Plaid Beacon, and Unit21’s Fintech Fraud DAO.

Improve adoption of Open Banking - lack of enforcement of regulatory technical standards has meant that APIs are of varying quality.

Open Finance - access to banking data is seen as just the first act of creating an open data ecosystem. In keeping with the spirit of other legislation like the Digital Markets Act, Data Governance Act and Data Act, consumers and businesses ought to be able to provide access to other types of data that can drive better service delivery and competition.

Improving access for non-bank fintechs - fintechs without bank licenses have had to historically depend on intermediaries to access European payment systems.

Just as the preceding waves of regulation were largely responsible for the evolution of the European fintech landscape, each of these measures will have massive ripple effects on business models, moats and market structures across payments and fintech.

Secular Tailwinds

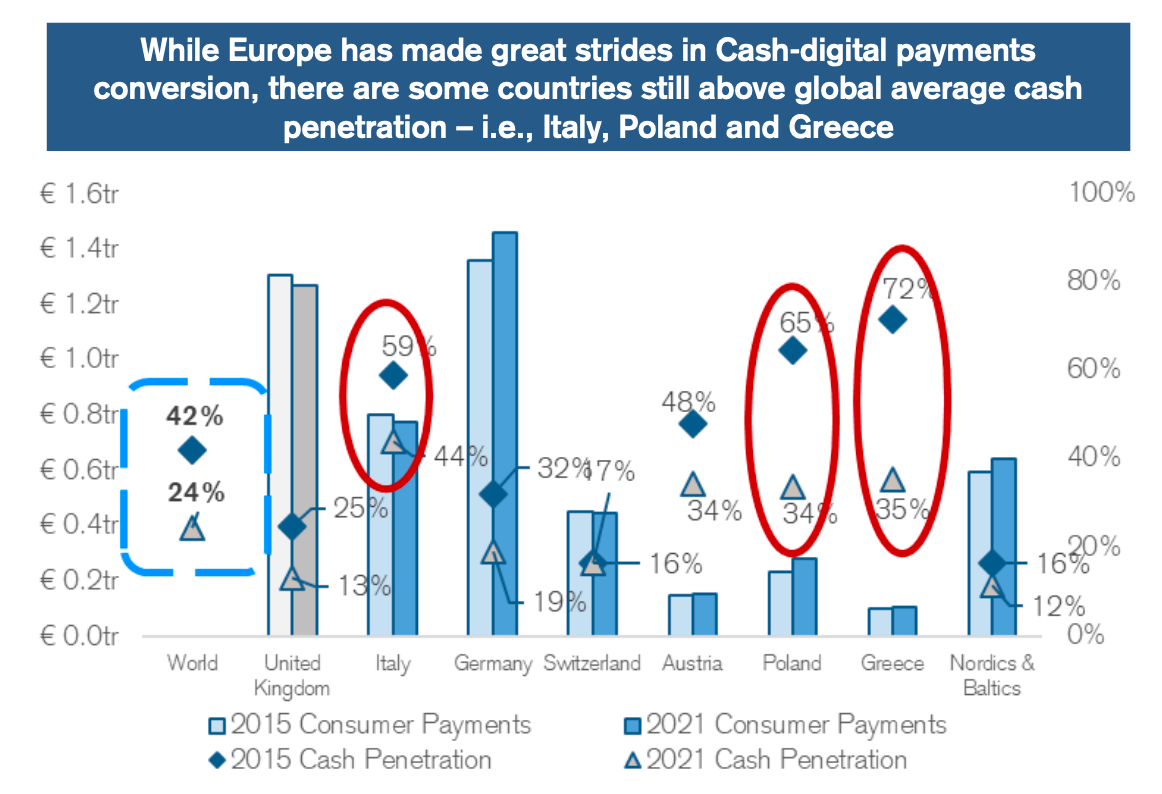

The global TAM for payments is in the hundreds of trillions, larger than global GDP. Europe alone has a TAM of $60tr, with the majority addressable for digitisation. Interchange caps in Europe result in acquirers accruing the lions share of the revenue pool (the merchant discount rate), compared to the US.

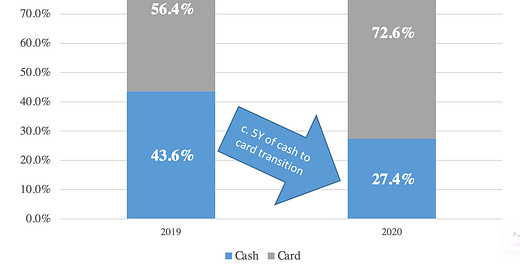

The cash-to-card conversion is the biggest secular trend behind this large TAM - prior to COVID, the ECB estimated that 73% of transactions in Europe were made using cash.

Despite the pandemic accelerating this transition by 5 years, several countries continue to lag the global average, presenting considerable headroom for growth.

In addition to the velocity of the cash-to-card conversion, another unique dimension of Europe is the proliferation of local payment methods, outside of card rails.

In Europe, alternative payment methods (APMs) account for 47% of digital payments, compared to 15% in the US. Card payments in Europe are only 53% of digital payments, far less than the 74% in the US. Within Europe alone, the heterogeneity in payment methods is stark.

PPRO, an API-first provider of APM integrations, estimates that there are over 1,000 payment methods globally - a figure that has been only increasing in recent years.

The secular tailwind of cash-to-card conversion gave rise to modern payment service providers and merchant acquirers, but the fragmentation of European payment methods makes it challenging to lay claim to being a European leader, let alone a global one (with Flutterwave in Africa, Razorpay in India, Stripe in the US each dominating their markets).

Consumers and consequently merchants value breadth of payment methods in order to increase conversion, hence PSPs looking to increase payment method coverage can choose to build these integrations themselves or work with providers like PPRO. Adyen is the closest to incumbents in coverage of payment methods and currencies, with Stripe and Braintree still some way behind.

This fragmentation is the premise behind payments infrastructure categories like payment orchestration. Payments orchestrators offer a single API to multiple acquirers and PSPs (by extension, more payment methods), smart routing capabilities to increase authorisation rates (authorisation rates are higher when the payment is routed through a local acquirer in the same market as the issuer), modularity when it comes to fraud and payouts providers, and reconciliation. A scaled example is IXOPAY from Austria, which counts DeliveryHero, DHL, eToro and more enterprise merchants as its customers. Given that orchestrators primarily price their product as a SaaS product with subscription pricing (rather than the typical usage model in payments), significant value creation across these features is paramount to scaling.

The Acquiring Prize

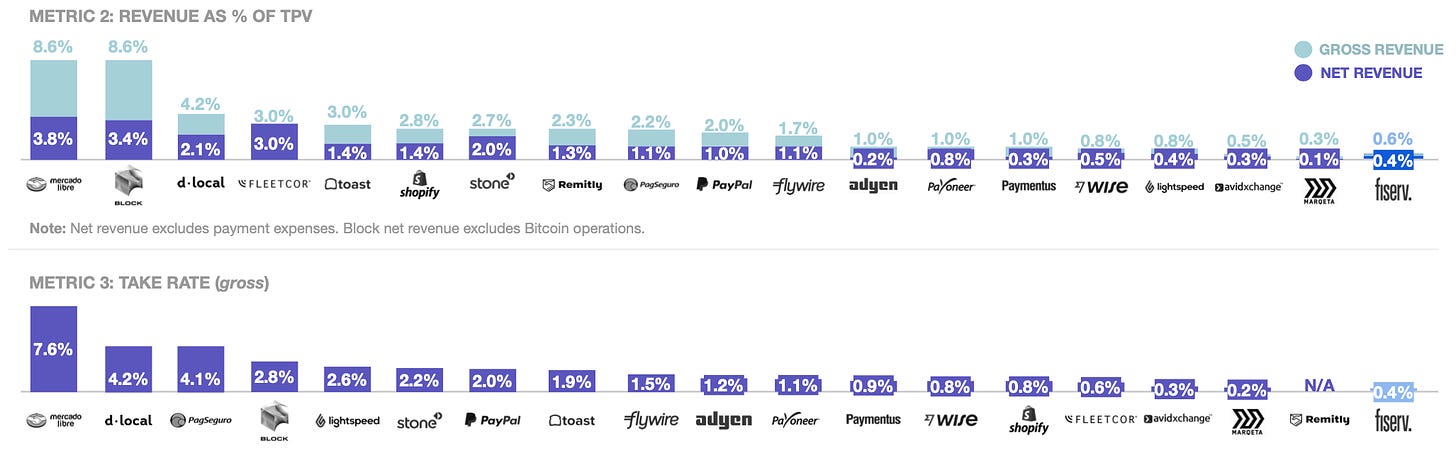

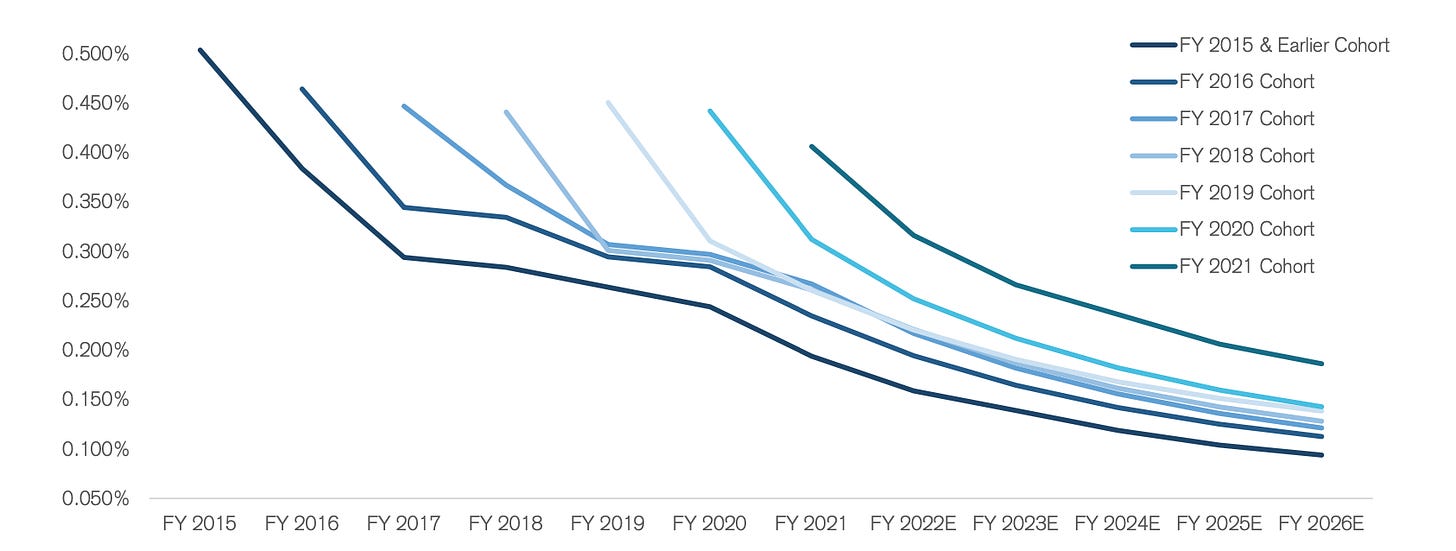

Looking at the gross and net take rates for merchant acquirers, the net take rate evolution of Adyen and Fiserv compared to newer competitors underlines Patrick Collison’s admission that payments is a scale business:

This really is a scale business, and you can just go arbitrarily deep in improving the product in all sorts of incredibly detailed ways that would never be worthwhile for any individual business.

Given the economies of scale, it’s no wonder that European merchant acquiring is still dominated by banks; banks accounted for 42% of the top 10 acquirers’ volumes in 2022.

Directionally, however, the data is promising - the proportion of volumes processed by banks among the top 10 acquirers in 2021 was 56%. A plausible theory for continued transfer of market share away from leading bank acquirers like Barclays, Credit Agricole, and JP Morgan is that payments is non-core as they face intense pressure from fintechs for their core products (bank accounts, lending), which ultimately leads to depressed R&D investment.

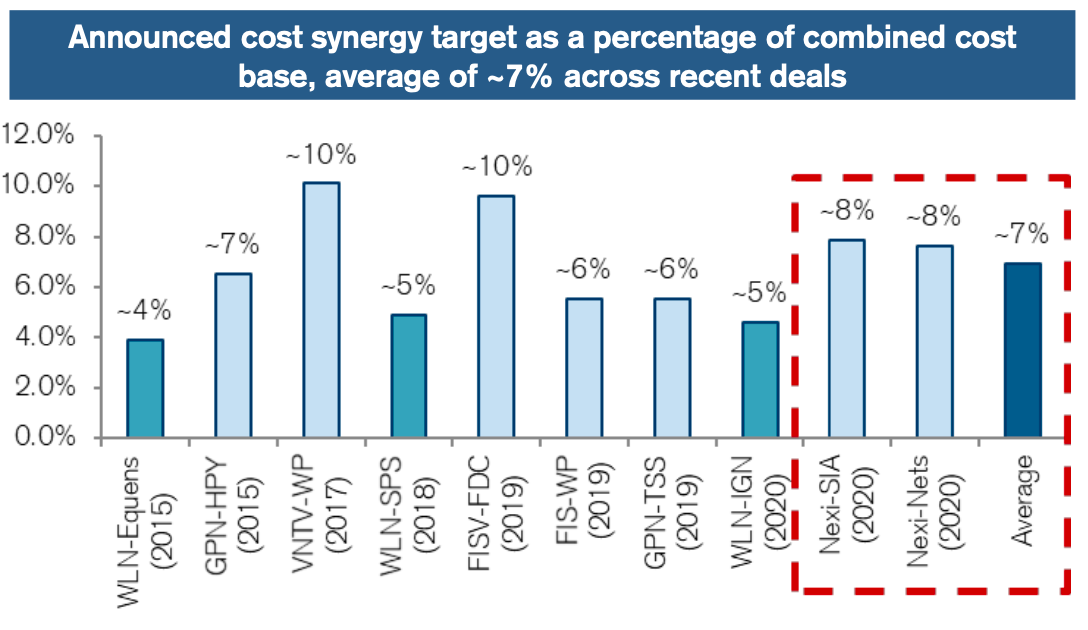

The inherent cost and revenue synergies in acquiring also rationalised the frenzy of M&A among incumbent non-bank merchant acquirers like Nexi, Worldpay, Wordline, FIS and Fiserv. Cost synergies are the primary rationale for M&A in merchant acquiring, with purported cost savings of c. 7% (compared to revenue synergies of 3%).

The inevitable decline from relying on M&A for synergies rather than R&D investment that address the evolving needs of merchants are best demonstrated by none other than Worldpay, as summarised amusingly by Jareau Wade:

So imagine Worldpay, Inc. is a very tall gentleman wearing a trench coat. You approach the man hoping to introduce yourself only to realize that he’s actually several children sitting on each others’ shoulders pretending to be an adult. Instead of maintaining the illusion that it’s just one very tall adult when you reach out to shake their hand, Worldpay opens up the trench coat and you have to shake hands with each individual kid.

Given these dynamics among incumbent bank and non-bank acquirers, it’s compelling to underwrite continued penetration for developer-first, cloud-native payment processors. Ultimately, Stripe, Adyen, PayPal and Braintree cumulatively are less than Fiserv’s volumes - the global TAM and secular tailwinds of cash-to-card and APM growth support continued acceleration of the first cohort of modern PSPs/acquirers as well as the next generation.

Looking Ahead

In 2018, Stripe published benchmarks on software engineering efficiency claiming that 13.5 hours of a developer’s time per week is spent maintaining technical debt, or ‘bad' code. The same survey of developers found that maintenance of legacy systems/technical debt was the biggest hindrance to developer productivity (52%).

Replatforming requires committing to a long project that only pays off at the very end. This long-term thinking is more common in smaller founder-led organizations, and less common at larger corporations that demand quarterly performance.

Adyen, Stripe, Braintree and the remaining companies that make up the first cohort of modern, native acquirers/processors have organically reached a scale and maturity that leaves them vulnerable to the classic innovator’s dilemma.

Merchants’ needs are evolving with new payment methods, fraud patterns, multiple currencies, omni-channel experiences, compliance hurdles, complex payouts, onboarding and more. Value-added services like credit solutions, BaaS, front-end and back-end software, are becoming increasingly important dimensions in payment processor shopping.

If you’re exploring opportunities that address the evolving, complex needs of merchants, I’d love to hear from you - you can find me at akash@earlybird.com

What I’m Reading

How Christina Cacioppo Built Startup Vanta Into A $1.6 Billion Unicorn To Automate Complicated Security Compliance Issues

Vanta is a successful example of a tech-enabled services company with impressive velocity and pricing power, extracting software-like margins. This profile on CEO Christina Cacioppo is a glimpse into some of the qualities of exceptional founders - customer obsession, insatiable curiosity for learning, and a drive for solving problems.

Consumption Pricing Models Are Here to Stay

Consumption based software companies have faced considerable volatility in recent months, but the model is here to stay and will continue to permeate more application SaaS companies. Battery Ventures share some practical advice on managing investor expectations by using proxies for committed revenues and aligning cloud compute and storage with usage to keep margins high.

The Rise of Composable the CDP

The first generation of customer data platforms created additional costs by relying on their own data warehouses, passing on the cost to their customers. Modern CDPs architectures and vendors like Hightouch and Census seek to empower non-technical users by allowing them to write natural language to query their data warehouses.

General Catalyst to invest up to $150 million to help Lemonade acquire new customers

This is an interesting financing product that allows a neoinsurer like Lemonade to raise the capital needed to finance the high CAC outlay that is typically recouped over many years.

Your guide to PLG pricing 201

PLG pricing mistakes range from neglecting the importance of SSO when serving SMBs to creating enterprise features not only for admins but also the end user.

Nice analysis! Whilst Europe’s bank owned acquirers still have a reasonable share of the volumes, there is an opportunity to better integrate acquiring into their customer facing propositions.

Often the collaboration between the internal parts of a bank are quite limited as acquiring has historically been seen as less glamorous than other elements of banking especially if a bank has a large corporate or IB arm. However acquiring offers steady recurring revenues and if there is no delayed shipment or delay in provisioning services then there is no RWA allocation.

In short banks have a good opportunity to maintain market share but they will need to consider integration of their offerings more as neo-banks are definitely thinking in this way and younger consumers and business owners don’t mind so much whether they use a Revolut or a Barclays.