Fintech bundles beget subscription revenue

Evaluating consumption quality and bundling to graduate beyond consumption

Hey friends! I’m Akash 👋

Welcome to Missives, where I write about software, fintech and go-to-market strategy. You can always reach me at akash@earlybird.com.

Thank you for reading! If you enjoy these Missives, please share them with your friends and colleagues 🙏🏽. Wishing you a great week!

Current subscribers: 3,025, +40 since last week

This week we hit 3,000+ subscribers! Thank you to each and every one of you!

I was speaking to an executive of a payments company a couple of weeks ago and he raised the notion that fintechs with consumption-based pricing models will (re)introduce platform fees as a bulwark against consumption volatility.

The revival of platform fees is apropos for the new normal of spend optimisation.

‘However, as UBP is inherently volatile, we expect to see significant fluctuations and much higher ranges in net dollar retention in parallel with market changes.’ ICONIQ Growth

Consumption models correspond to demand trends at much better latency than subscription models, and it’s not yet clear whether deceleration has bottomed (though the signs are positive). Q2 earnings gave us inklings of green shoots in consumption patterns and the degree of optimisation that’s already behind us.

Earlier this year we discussed product suites in fintech and revenue quality. Before we address the fusion of subscription and consumption models, it’s important to delineate the quality of different consumption models.

Consumption Model Quality

One way to bifurcate consumption models is by the nature and frequency of usage. Infrastructure like MongoDB that supports live applications is always-on and hence harder to ration than Snowflake where consumption is human-driven and episodic.

The other way to bifurcate these categories of software is by the criticality of that service to the business. Although data analytics workloads are ostensibly easier to ration, the criticality of the insights generated may be a bigger priority for a business than commissioning new applications.

Morgan Stanley defines these dimensions as time and magnitude.

We distinguish between timing – which consumption models are easier for customers to ration spend as a downturn begins; and magnitude – which speaks to the severity and duration of lower usage.

Let’s overlay this analysis on the fintech universe.

Infrastructure software like Temenos, Jack Henry, and nCino is always-on by nature, whereas workflow automation software like spend management or AP automation relies on humans and is by extension episodic.

The second dimension is mission criticality of the product and hence the implications for demand patterns: what are the secularly attractive product categories that are priorities for different lines of business in an enterprise?

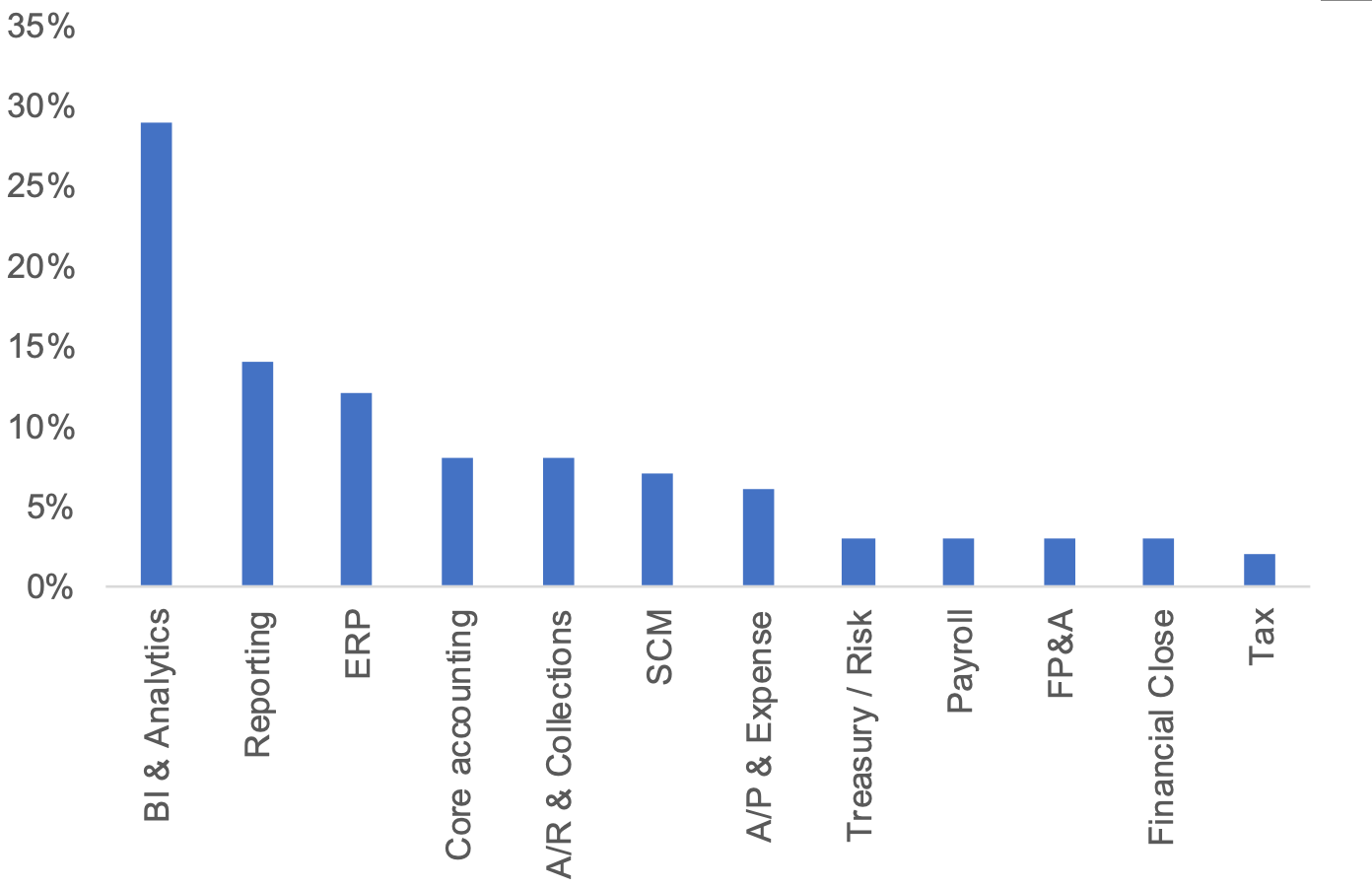

Let’s take a look at the budget of the CFO.

Many of these categories are subscription-based, but some are heavily reliant on consumption.

Let’s take the ‘AP/Expense’ category.

Nearly 70% of Bill’s revenue is transactional, compared to c. 30% at IPO. Bill isn’t always-on, but the criticality of the spend it touches (supplier payments) means that the magnitude of any consumption deceleration is less severe.

Navan (Fka TripActions) was agile during the pandemic and launched their expense management product Liquid to expand beyond T&E spend into other categories of spend that were critical, allowing it to recover from a complete nullification of it’s value proposition in early 2020.

This gives us another lens to look at consumption-based models through: the criticality of the spend flowing through the product.

Indirect spend is the bigger expense for technology and services companies, whilst direct spend is the majority for manufacturing and goods industries.

The former is far more vulnerable to shelfware optimisation, hence intake-to-pay vendors (e.g. Zip) are more vulnerable so long as they only address discretionary spending (indirect spend software purchases) compared to mission-critical spend on direct purchases; vendors like SAP Ariba and Coupa play in both camps.

Let’s make a brief departure from the office of the CFO and examine the scaled payments giants. Stripe has historically been indexed to more volatile SMB consumption patterns while Adyen has always been indexed on more predictable enterprise consumption (which is by no means related to win-rates and margin pressure as we recently learned).

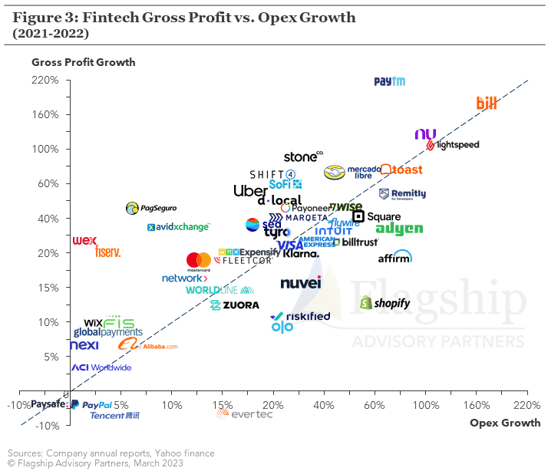

Even here, the legacy incumbents are extracting commendable operating leverage on their consumption models, growing gross profits faster than opex.

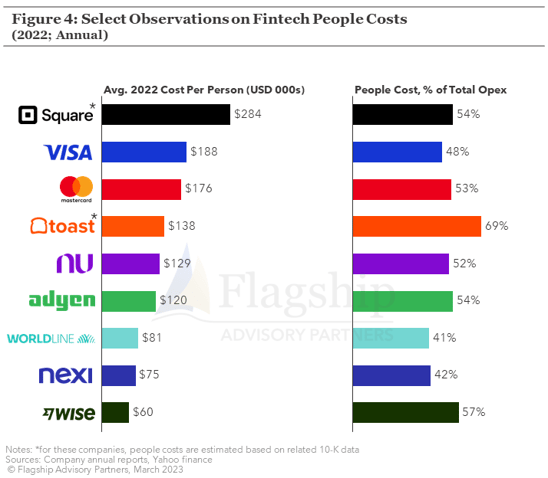

Adyen’s 65% EBITDA margins are already remarkable but as both they and Stripe have learned, labour is the biggest cost line to optimise for.

We deviated from the key insight here, which is that payments acquiring is always-on and that the magnitude of any consumption shift is dictated by the underlying end markets the acquirer is exposed to (e.g. airlines versus gaming versus crypto), which can vary in criticality.

Zooming out, we can observe consumption-based fintechs along a spectrum of business model quality depending on the frequency and nature of the usage and the magnitude of any usage deceleration.

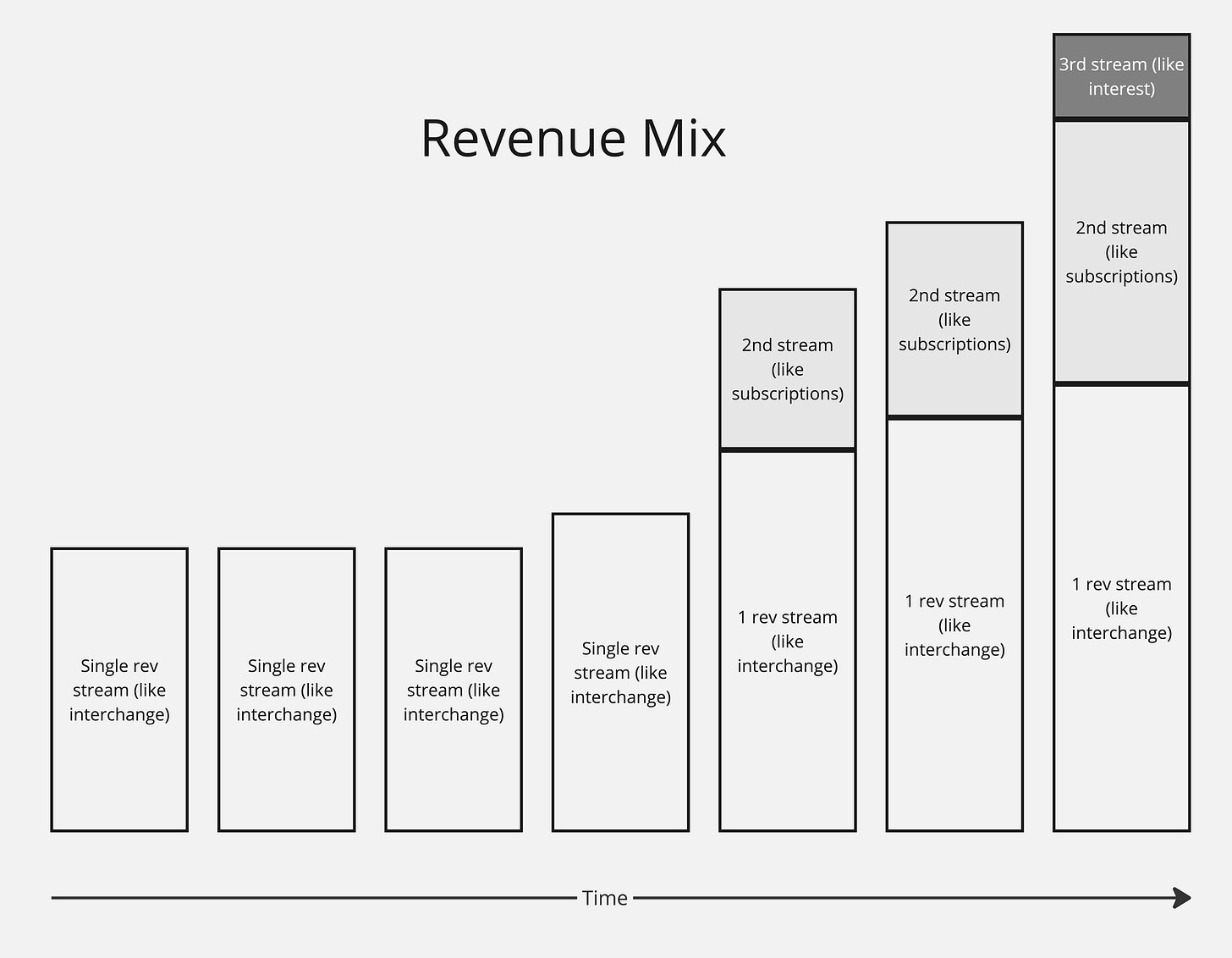

Stacking revenue streams

Circa 80% of the Datadog ARR base is on a subscription contract. MongoDB and Confluent both operate subscription models alongside their managed service usage based models. The universe of pure-play consumption models is not as large as we think.

Just as in application and infrastructure software, the predominant business model in fintech is likely to be a hybrid one.

penned a great essay on how fintechs stack together different revenue streams as they mature.

There are a few tailwinds behind this.

The most well known one is the premium multiple ascribed to recurring revenue models; another tailwind is the finitude of interchange fee pools.

Interchange – and particularly debit interchange – itself was never meant to support multiple large businesses. Similarly, acquiring is not nearly as lucrative as many think, and especially not with an increasingly crowded fee pool.

Then, there’s bundling.

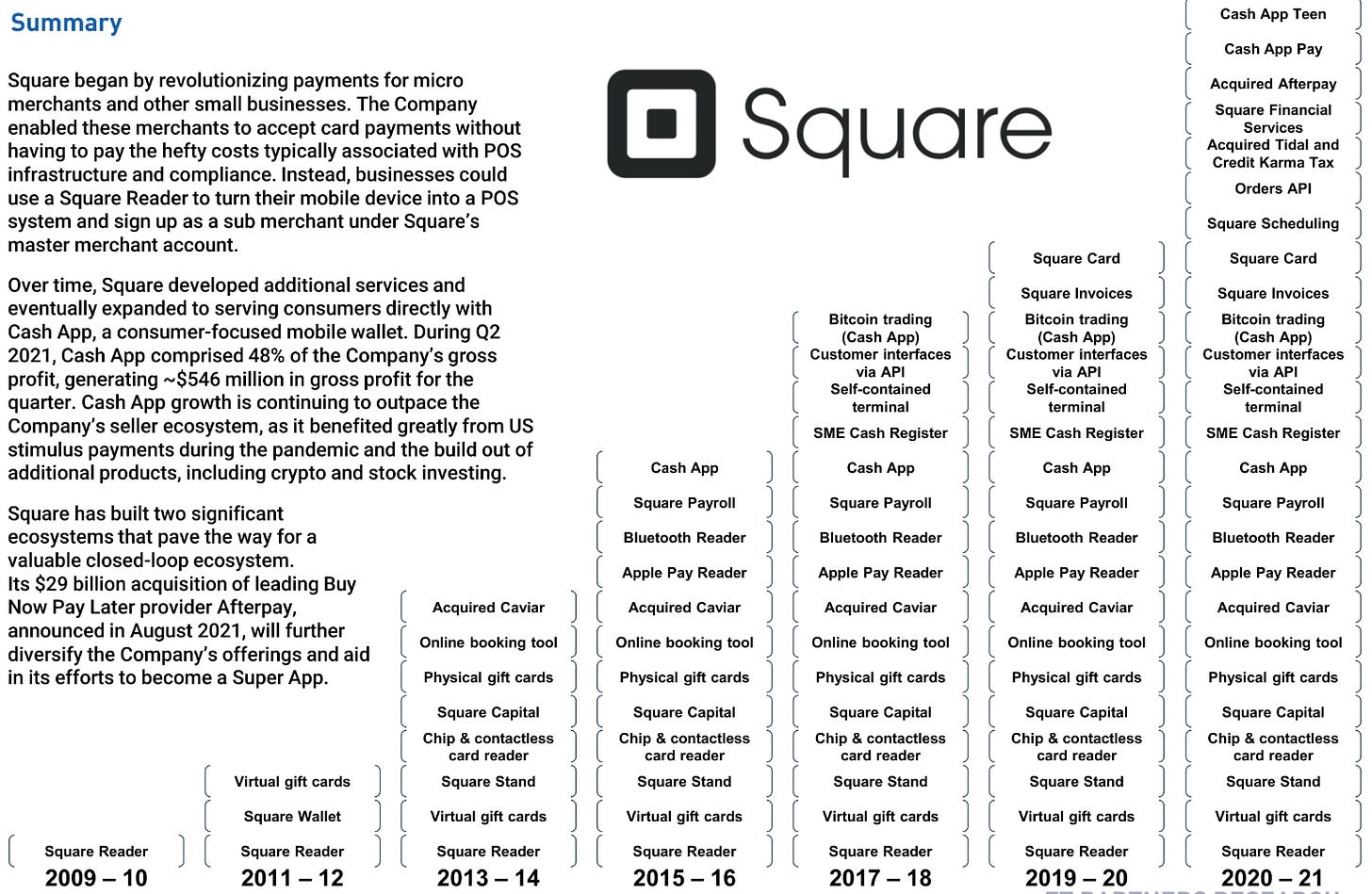

Although we’re still in the early innings of fintech penetration (in aggregate fintechs have captured less than 10% of FS revenue), we’ve already compounded multiple waves of innovation. Financial services were digitised, unbundled, and embedded. B2B infrastructure and consumer applications flowered.

Which brings us to the present.

The gravity of bundling is as strong for software as it is for fintech.

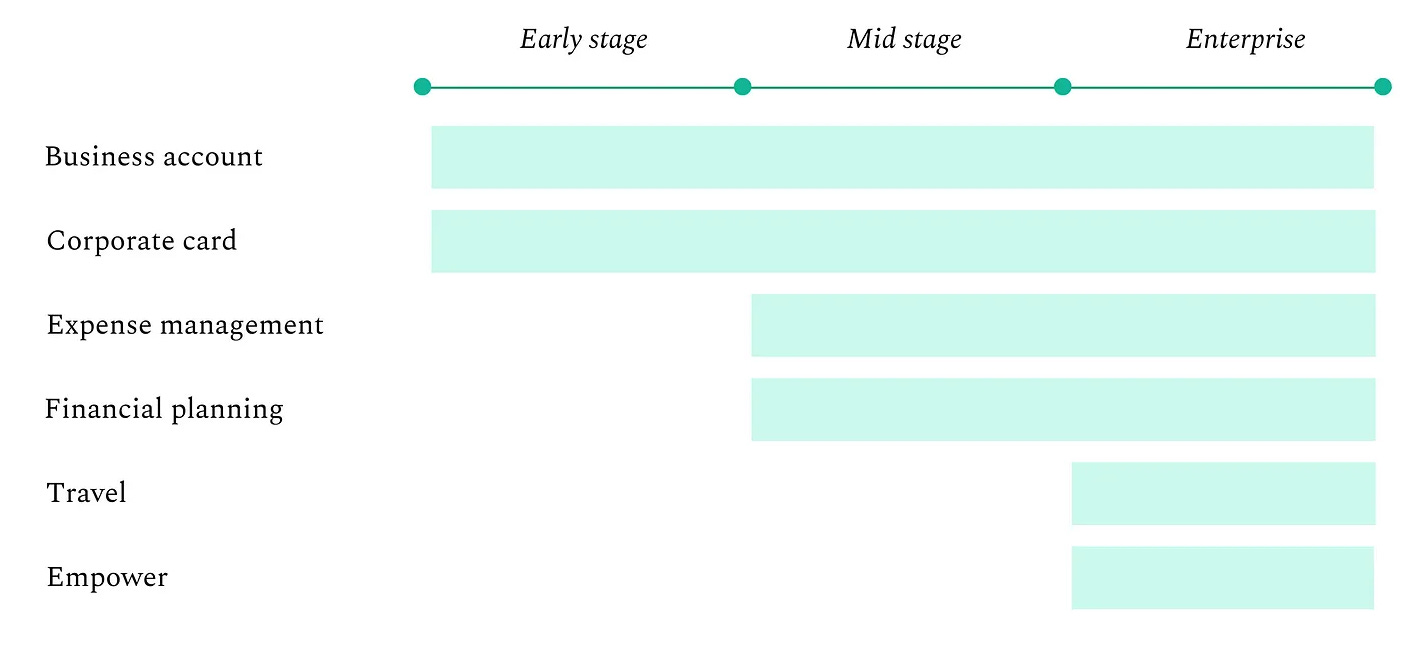

‘Ramp* moved from a corporate card (taking on American Express) to expense management (Concur), bill pay (Bill.com), working capital financing, and SaaS buying. Zip started from intake-to-procure and expanded into payment. Tropic started in procurement then moved into SaaS management and contract management. Rippling started in HR and IT management before releasing a suite of finance products, including corporate cards and expense management.’ Contrary Research

Bundling is the basis for the transition to a subscription business model.

Both consumer and SMB neobanks have to offer table stakes products as well as innovative products to entice customers to adopt subscription plans.

‘As we look at what would be included in an “optimal” neo bank bundle we’ll break it down into two camps (i) Table Stakes & (ii) Innovation.’ John Street Capital

The Overton Window of table stakes products is constantly expanding and fintechs will need both a short and long-term strategy to deliver a comprehensive bundle. The right to subscription revenue is obtained by bundling ‘innovative’ products that go beyond what’s table stakes. This varies by sub-vertical.

Rippling initially partnered with other spend management and corporate card companies before it launching its own competing products.

Rippling’s HR, IT and Finance cloud are sold on a subscription model, starting at $8 per employee in addition to a platform fee.

Brex’s enterprise SaaS product, Empower, is the glue that binds its financial workflow products together.

:Empower is the base layer upon which all Brex products sit.

Chief Product Officer Karandeep Anand joined to support Brex as it evolved from a pure fintech into a fintech-enterprise-SaaS hybrid. The shift required Brex to make operational changes, hire more software-focused talent, and adjust its culture.

Of Brex’s $500m in annualised revenues, the SaaS Empower product is already projected to represent $100m in just one year. Empower is a meta layer that specifically addresses the needs of enterprises using Brex’s core financial services products: Empower is the outcome of bundling.

BaaS vendor Unit charges a platform fee for its bundled offering of embedded accounts, cards, lending and payments, as do most BaaS vendors.

The dual secular trends of bundling and increased subscription revenues in fintech will not permeate every sub-vertical equally, nor will it attain the kinds of top decile multiple ascribed to incredibly sticky infrastructure software on multi-year contracts.

Nonetheless, fintechs are adapting their business models to offset their fundamental disadvantages vis-a-vis incumbents (e.g. higher cost of capital) and become long-term compounders with robustness through downturns.

Further Reading

The Alchemy of FinTech Valuations

Revenue Mix and Interest Income

Interchange is a burning platform

The (Neo) Bank Bundle & Transition to Subscription Revenue

Reading List

When It Comes to Enterprise Tech Spending, Buyer Enthusiasm is “Not Dead Yet!”

European Accounting Platforms Have Huge Opportunity in Payouts

Thoma Bravo’s Acquisition of Coupa Highlights the Value of B2B SaaS and Embedded Payments

Quote of the week

‘Frank Slootman recently said, “You get a much better sales organization when you have entire alignment in the company….Great sales people can’t sell a bad product, lousy sales people can sell a great product’ Javier Molina

Thank you for reading. If you liked it, share it with your friends, colleagues, and anyone that wants to get smarter on SaaS, Fintech and GTM. Subscribe below and find me on LinkedIn or Twitter.