👋 Hey friends!

I’m Akash and welcome to Missives, where I write about software, fintech and go-to-market strategy. You can reach me at akash@earlybird.com.

Thank you for reading! If you enjoy these Missives, please share them with your friends and colleagues 🙏🏽. Have a great week!

Current subscribers: 2,945, +30 since last week

Monday.com’s Q2 results presented an opportunity to affirm the company’s trajectory upmarket into the enterprise and reposition Monday as a modular platform with a robust open API as the foundation of an interoperable product that permeates industries and sizes.

Pinjalim Bora (Analyst, JPMorgan Chase):

It seems like the percentage of apps that are being monetized are kind of going up steadily. I see it about 45%. You recently launched the API version, and one of your partners said it could accelerate third-party development. You are exposing the AI layer, as well as the workflow engine, seems like, to the partners. Do you think marketplace starts emerging as a material growth driver in 2024?

Roy Mann, Co-CEO

It's hard to say how much material it would be because we have our core product, the CRM, the dev, the work management, which is the main growth driver. We do believe that the marketplace will help us close larger deals.

There's a lot of, like you mentioned, partners are working on it and making each of those products more complete, more suited for long-term solutions. And so, we put a lot of emphasis on the marketplace and a lot of investment in the ecosystem. And I think it's a very -- it's a longer-term play rather than just like making the numbers for next year.

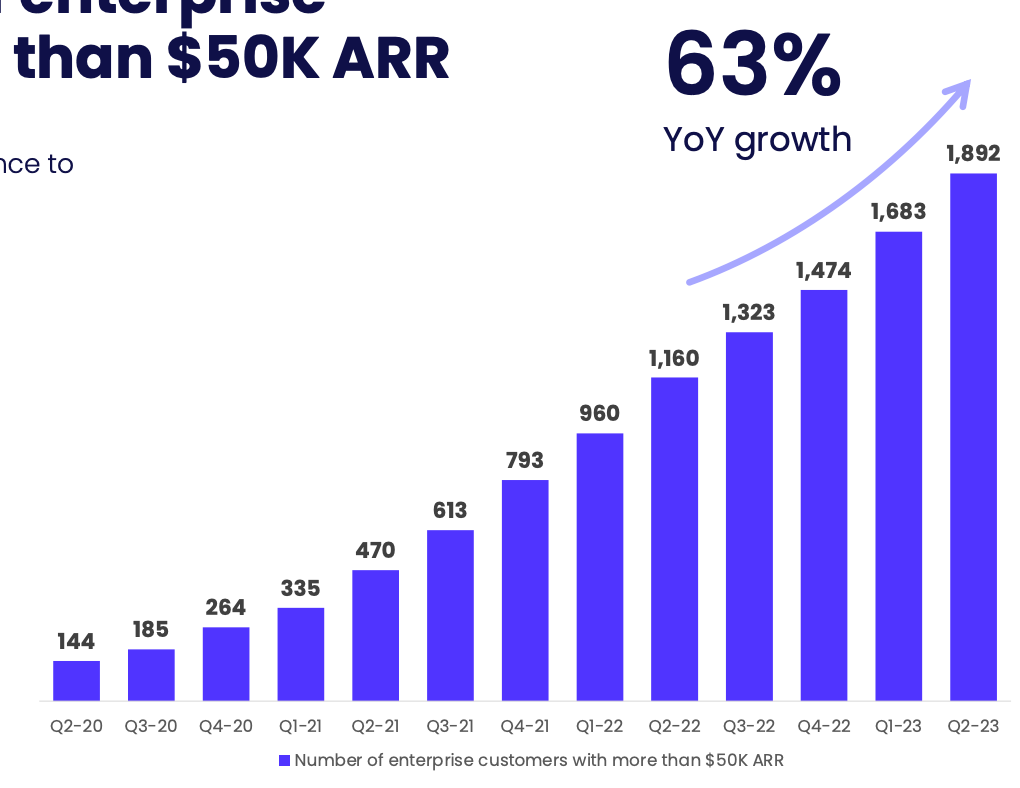

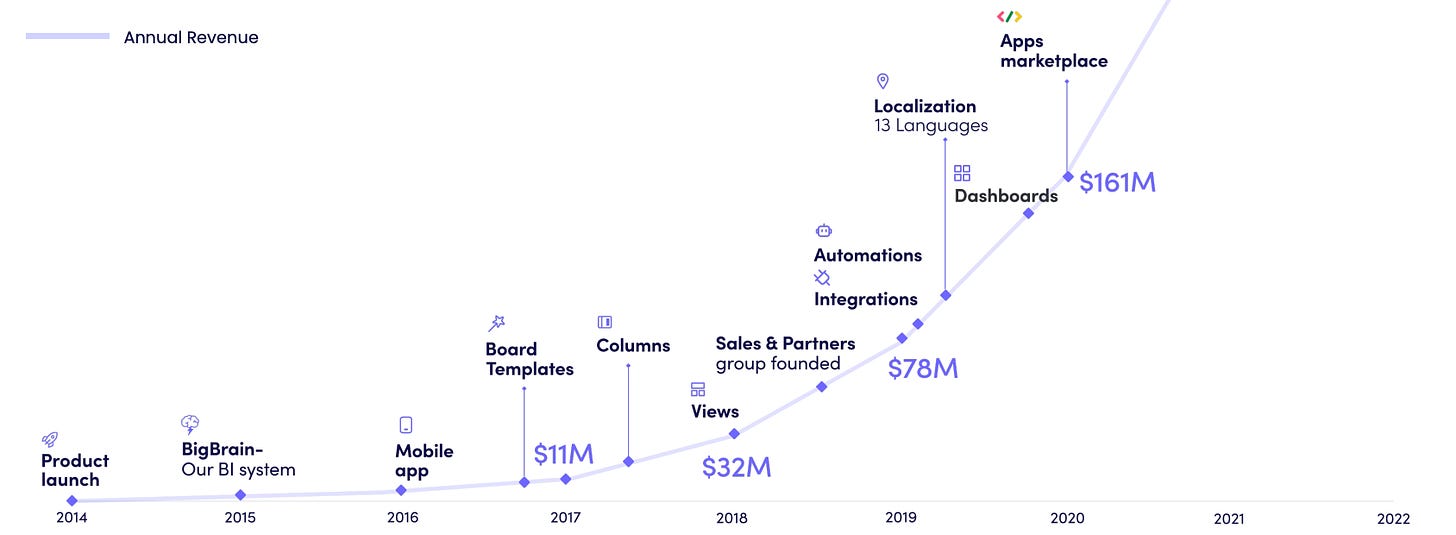

Roy’s emphasis on the long-term outlooked needed for partnership and ecosystem investments is something we’ve discussed before, but the acceleration in enterprise customer count after Monday began prioritising integrations and its app marketplace is clear to see.

We’ve also talked a lot about the importance of integrations as moats for incumbent software vendors.

Per data from Okta, companies with over 2,000 employees have 211 applications across as many as 29 categories.

Interoperability between applications in each of these categories is paramount for buyers, posing a continuous strategic decision for founders: which integrations to prioritise and invest scarce engineering resources into, when it can take months to ship integrations.

Sales enablement software lives or dies by its CRM (and primarily Salesforce, followed by Hubspot et al.) integration, whereas FP&A software has to exchange data with ERP, HRIS, and eventually CRM and other systems of record. Before the proliferation of SaaS apps brought about by the ZIRP era in the 2010s, a native integration into Salesforce was sufficient to land whale contracts for Jason Lemkin’s EchoSign:

2007 - We launched in the first AppExchange class in late 2006 with the first true, deep Salesforce integration. We built the template that everyone else then copied. There were rougher approaches to Salesforce integration before us. But for about 2 years, we had the only native, seamless integration here. We won Dell, Comcast, Verizon, Qualcomm, and a ton of other leaders just because of this 10x Feature.

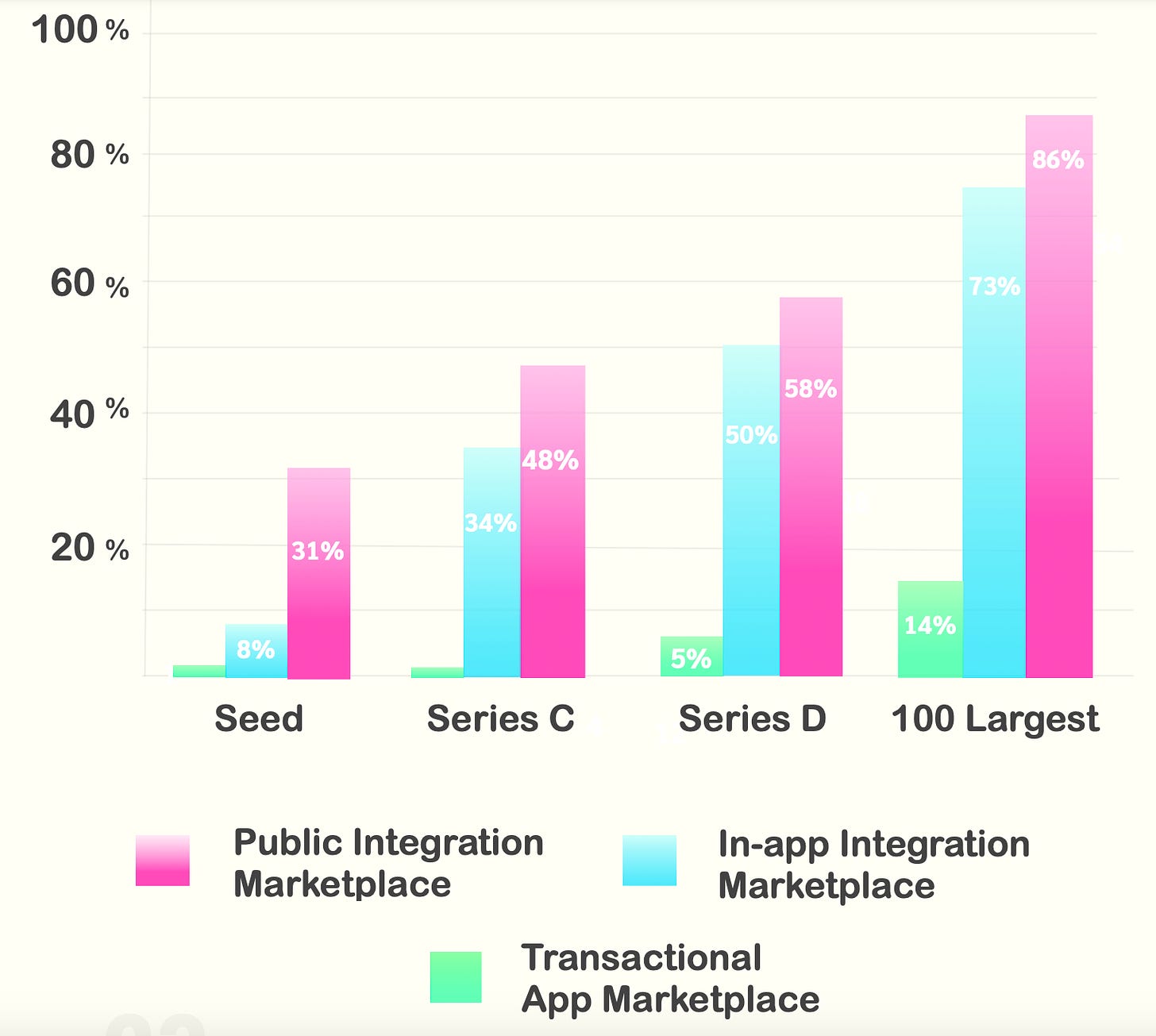

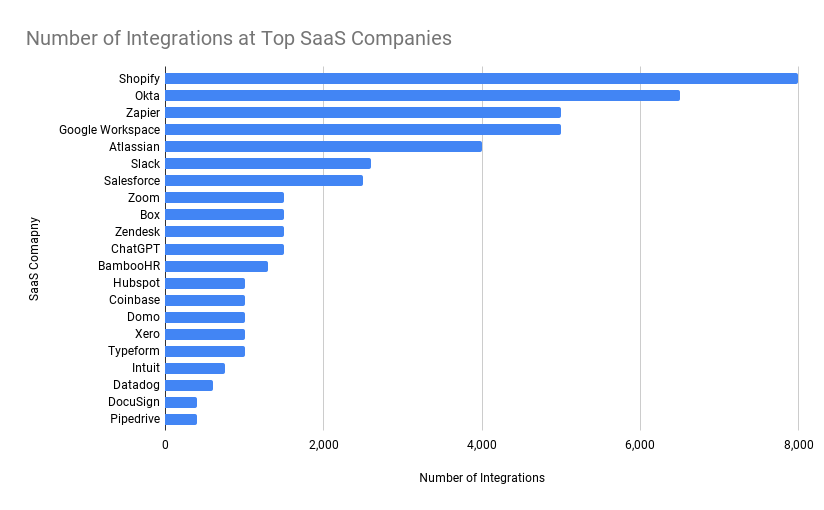

Pandium pulled the data on all things integrations in their analysis of 400 SaaS companies (looking at the 100 largest SaaS companies, 100 Series D, 100 Series C, and 100 Seed stage SaaS companies).

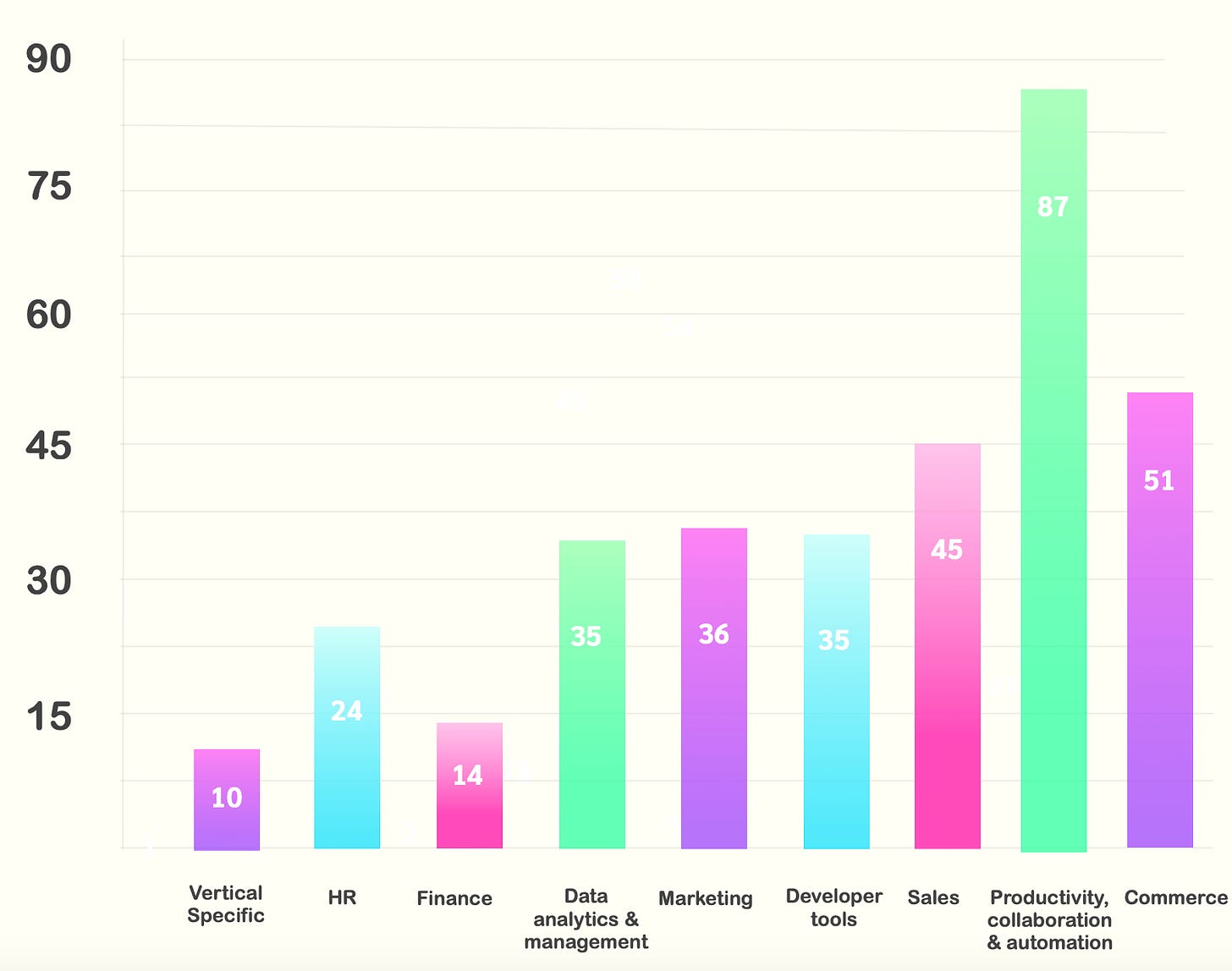

The variation by budget/category speaks to the degree of consolidation for each line of business around compound startups or systems of record versus fragmentation by dint of best-of-breed solutions.

What becomes evident is that there is clearly an integration ladder that startups climb as they progress through stages, catering to a wider range of integrations as they expand outside their core TAM. To get a sense for what the end state looks like, Pandium found that 84% of the largest SaaS companies have public API documentation and provide customers with an average of 621 product integrations.

What’s more, companies invariably improve their posture to third party developers over time by releasing more public API documentation.

Publicly documenting APIs opens the doors for prospects, customers, partners, and third party developers to scope out the possibilities for an integration or extension and determine whether they can be used to accomplish their objective

Public documentation will result in increased integration builds, and a wider scope of feedback from the community of potential partners and builders.

Only 24% of seed companies published public API docs, whereas 68% of Series D companies have public API docs.

Public API documentation acts as a Schelling Point for third parties to explore the surface area of interoperability, as was the case with Xero:

It is a bit of inbound and outbound, right? You kind of create a platform and an attractive proposition, the developers love to build with you, and you open up for people to come and work on your platform. Then you have good governance processes around ensuring that they can build their integration, that they can have it security certified, that they can manage the listing in our app store, that we can present it to customers.

Damien Tampling, Chief Strategy and Corporate Development Officer, Xero

I guess it’s about creating surface area on the API so that partners can build with you, but also being thoughtful about what those use cases and categories are.

Nick Houldsworth, Executive GM of Ecosystem, Xero

Take the example of expense management software that lacks public API docs and hence forgoes the opportunity for travel booking platforms to build integrations - that’s forsaken pockets of spend for the vendor as buyers would be reluctant to incur the burden of reconciliation incurred by applications that lack interoperability. Investing in public API docs is an example of the distribution capex mindset.

For founders just starting their journeys today, the emergence of unified API providers like Merge can accelerate time to parity with incumbent vendors, expediting the time it would take to build critical integrations into systems of record/databases. Merge recently announced a new LLM-enabled product, Blueprint, which allows customers to request new integrations and speed up the process, as

wrote about.Along with unified API providers, we’re seeing a strand of vertical iPaaS vendors that help their customers stand up the requisite integrations in a specific industry.

covered the significance of Agave’s role in developing a common data scheme and thus rendering construction software interoperable:Unified APIs decrease the surface area that founders have to trek in order to build net new things. With approachable and transparent data models like what Agave has built, I think we will witness a new construction tech era unfold.

Procore is pursuing precisely this opportunity of unifying construction data through investment in its public APIs, with verticalised vendors like Agave betting that a de novo integration layer is better placed to solve this:

Procore is making it possible for all the key stakeholders in a construction project to collaborate. It is delivering an open API with pre-built third-party integrations. And it is making it easy for developers to build applications on top of Procore. The company’s long-term vision is for the entire construction process to be run on Procore. Its prize is to be the dominant platform for the $10 trillion-dollar global construction industry.

The embedding of LLMs into vSaaS adoption has been tipped for several months to accelerate software penetration as LLMs compress time to value and sell work rather than productivity improvements.

‘Gorilla: Large Language Model Connected with Massive APIs’ is a paper published in May 2023 by UC Berkley researchers that presents a fine-tuned Llama 2 model that’s capable of taking natural language as an input and generating API calls as an output, performing better than GPT-4 and Claude. Palantir CTO Shyam Sankar spoke to the aperture this opens with Elad Gil and Sarah Guo:

When I think about the integration layer, when you look at the Gorilla's paper and can you fine-tune an LLM to basically tell you what API to call with what parameters, like yes it turns out and so okay so if that's true what does system integration look like in the future that's going to be quite different so then I think it allows you to create more single panes of glass that are actually truly integrated.

Market commentary is positioning AI as a tailwind for system integrators like Accenture, Capgemini, but it’s a very real possibility that breakthroughs like the Gorilla’s research obviate the need for system integrators when LLMs are capable of expediting the integration process and making lengthy implementations a far more vulnerable moat for incumbent SoRs.

Vertical SaaS vendors vying to become the operating system for their industry can compound the benefits of vertical iPaaS solutions with latent LLM capabilities such as the Gorilla’s model to 1) deliver all critical integrations to serve the customer from back to front-office, e.g. Intuit for that vertical, 2) use natural language to intelligently orchestrate different applications via APIs.

As always, you can reach me at akash@earlybird.com if you’re thinking deeply about integration roadmaps and the intersection of unified API/vertical iPaaS providers and LLMs.

The great team at Focal opened submissions for their programme, check it out below:

For any founders raising Pre-Seed to Series A over the next few months, apply to Focal to pitch thousands of VCs and angels in one go, generating a ton of investor inbound. Alumni raised from the likes of Lightspeed, GV, 20VC & SOMA Capital. It's like YC but without the accelerator. Application deadline: 18th September. To apply, visit gofocal.vc.

🗞 Reading List

Will AI Accelerate Vertical SaaS Adoption?

Seed Market Evolution During A Downturn

We must shape the AI tools that will in turn shape us

Who owns “growth”? It’s complicated.

Your life should be on an accelerated learning curve

🗯️ Quotes of the week

An intake of knowledge without necessarily being required to do anything with it is powerful and allows you to reflect and contemplate versus apply

Adam Singer

It is conceivable that a different version of the future will play out: that as the frontiers of AI research advance in the years ahead, new architectures are developed that prove themselves better suited for particular domains. Perhaps, for instance, transformers continue to dominate the field of language processing for years to come, while a novel architecture soon displaces transformers as state-of-the-art in robotics.

Rob Toews