The Right To Conquer Mid-Market

Sage, Quickbooks and the contest between Product and GTM advantages

Hey friends 👋! Join over 2,100 founders, operators and investors for Missives on software, fintech and GTM strategy by subscribing here:

To the regular readers, if you enjoyed today’s piece please share, comment and subscribe!

The majority of SMB SaaS companies grapple with when to move upmarket, not if. As we've discussed before, one approach is to let the product roadmap guide upmarket timing - build a product portfolio for the core ICP, readying a feature set that enables more efficient enterprise sales, simultaneously saving precious engineering resources that would otherwise have been ploughed into endless customisation requests in premature enterprise RFPs.

Equally, enterprise vendors are reticent to concede smaller customer segments, particularly if their product can be packaged in a lighter-grade manner to acquire a portfolio of these customers with smaller lands, underwriting sufficient expansion across these logos.

On their respective journeys upmarket and downmarket, vendors from both ends of the spectrum will first seek to harvest the mid-market, a typically underserved segment that has distinct requirements from their smaller and larger counterparts.

The clearest manifestation of the nuanced requirements of the mid-market is the GTM motion; unlike micro SMEs where the purchasing decision maker is often one individual (the entrepreneur), 50+ employee companies will start to involve multiple stakeholders in a purchase (thus necessitating a multi-threaded sales approach). Where SME software is purchased directly, software for the mid-market is typically purchased via resellers and third parties, a muscle and network that SME software vendors haven't developed to the extent of their enterprise counterparts.

The other dimension of note is the product itself - the winning formula in the mid-market combines both the elegant, self-serve product design of SME software and the more enterprise-grade, team features (security, SSO, audit logs, collaboration) of enterprise-wide adoption.

Victory in the mid-market confers lucrative spoils: selling to the mid-market comes with a healthier difficulty ratio (deal size relative to sales cycles), more robust budgets than SMEs, higher propensity to adopt products in a bottom-up fashion than the gates of the enterprise, and a generally underserved segment with less direct competition.

The Mid-Market Accounting Opportunity

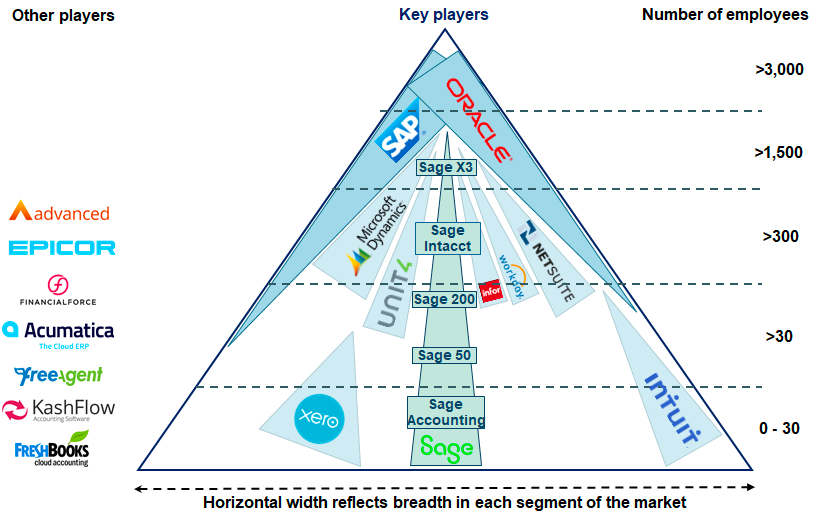

A market where this battle for the mid-market is being fought is in accounting software, where Intuit and Sage are both making concerted efforts to cater to the neglected mid-market of 30-200 employee companies.

Sage has a claim to serving customers across the spectrum with different tiers, but in the low-end of the market (0-30 employees) it is Xero and Intuit's Quickbooks that dominate. Between 30 and 200 employees, companies' needs evolve from simple bookkeeping to more sophisticated accounting needs, but short of the breadth of an ERP (companies can usually add on other modules, APIs or third party apps to replicate an ERP's functionality).

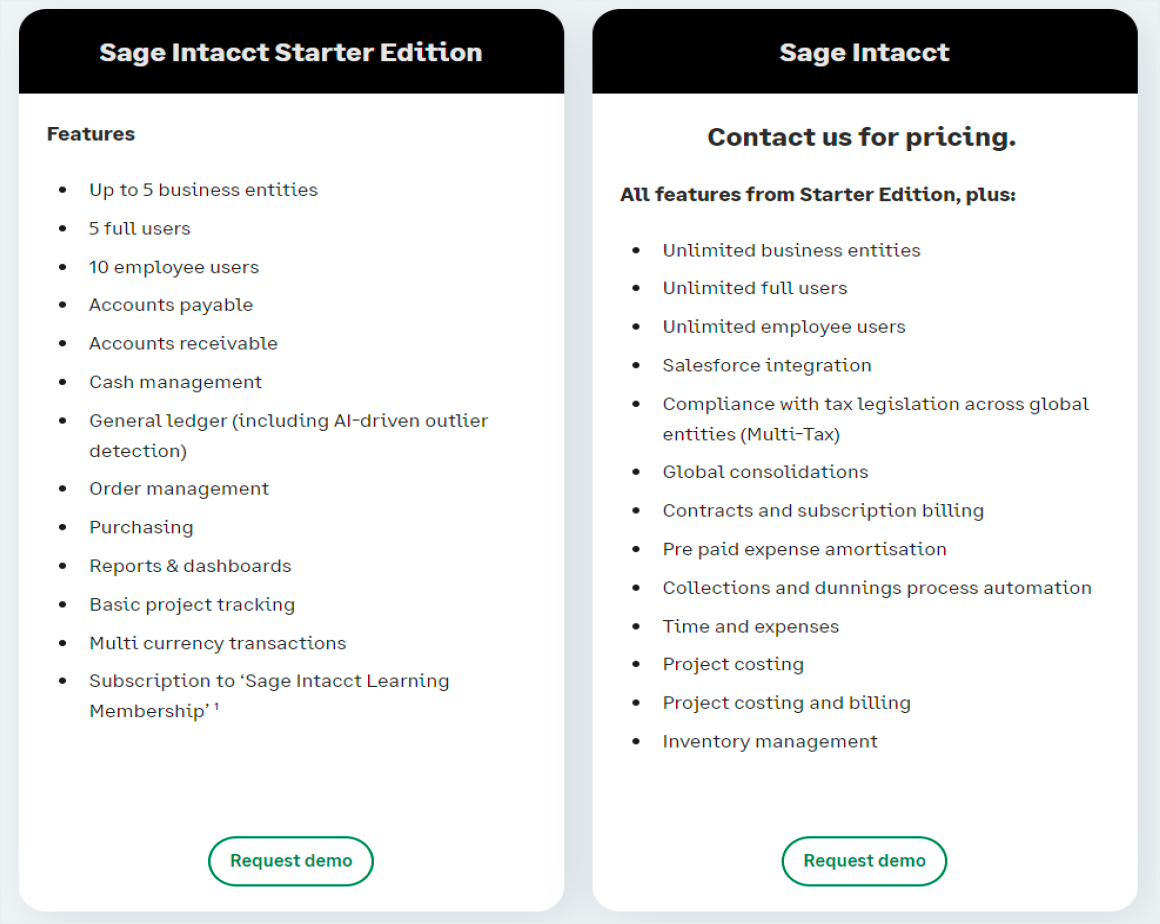

Sage 50 and 200 are cloud-native solutions that ostensibly serve the middle-ground in the feature set between Sage Accounting and Sage Intacct, but to further solidify its efforts in the mid-market segment, Sage is launching a lighter-grade version of Intacct, Intacct Starter. Intacct, an acquisition in 2017, is widely considered as best-in-class in the small enterprise segment for financial management software, and for a subset of the mid-market (100-300 employees), may well outstrip any offering from the downmarket competitors.

Intuit, following acquisitions of Mailchimp and Credit Karma, has sought to unify its broad product portfolio around a SMB operating system, encompassing Finance, S&M, Payroll and other functions. Quickbook Advanced is Intuit's flagship mid-market product, catering to 20-100 employee companies and supported by the portfolio of adjacent products. Given Intuit's heritage in building for the true micro SME, they are well placed to be pulled upmarket and continue delivering low-touch, self-serve products at palatable price points, with an ecosystem of solutions to become the one-stop shop for their customers.

It's worth noting that pricing and packaging for both Sage and Intuit have been instrumental in their success of thinly slicing the market and deepening penetration.

The Right To Win

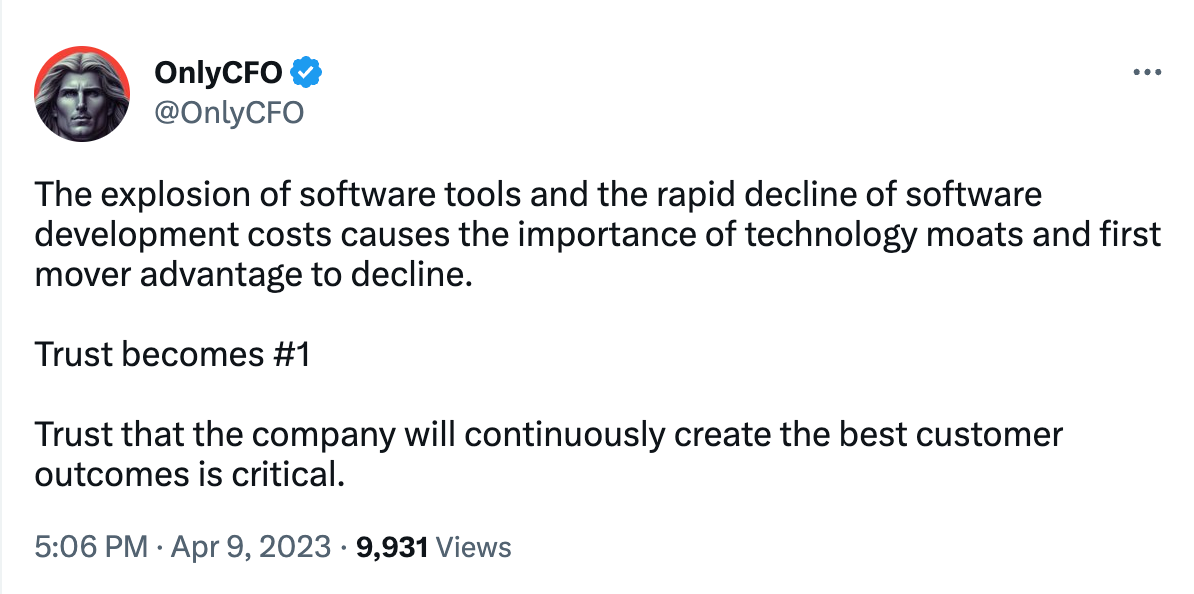

The battle between every startup and incumbent comes down to whether the startup gets distribution before the incumbent gets innovation - Alex Rampell

The aphorism of startups attaining distribution capabilities before incumbents develop innovation muscles is useful for analysing the respective probabilities for downmarket or upmarket entrants to win in the mid-market segment.

SMB SaaS vendors moving upmarket lack the GTM foundations (partner/third party network, multi-threaded sales), but possess the product excellence that could conceivably ensure stickiness as customers graduate upwards. Enterprise vendors moving downmarket remains very rare, as although they command the GTM advantages of an established partner/reseller network, the metamorphosis required to ship consumer-grade products (as is the case for mid-market buyers who still place a premium on this) is often one step too far for the talent and organisational structures that deliver multi-year implementations for systems of record software.

Generalising from this example, the principle question is about which set of advantages is the stronger foundation to build upon, from an acquisition and retention perspective. What are your thoughts?

Interesting Reads

Five Takeaways from the April 2023 AI Economy

Lux Capital’s Grace Isford shares some observations on the AI stack, noting that the infrastructure layer is vulnerable to margin compression.

We must slow down the race to God-like AI

Ian Hogarth’s paean to cooperation and prudence regarding AI is the most thought-provoking piece that I read this week.

Aashay Sanghvi lists some of the tooling and platforms that act as potential enablers for tomorrow’s generational companies - as Chris Dixon would say, the tools developers are hacking away with on weekends today is what we’ll all use in 10 years.

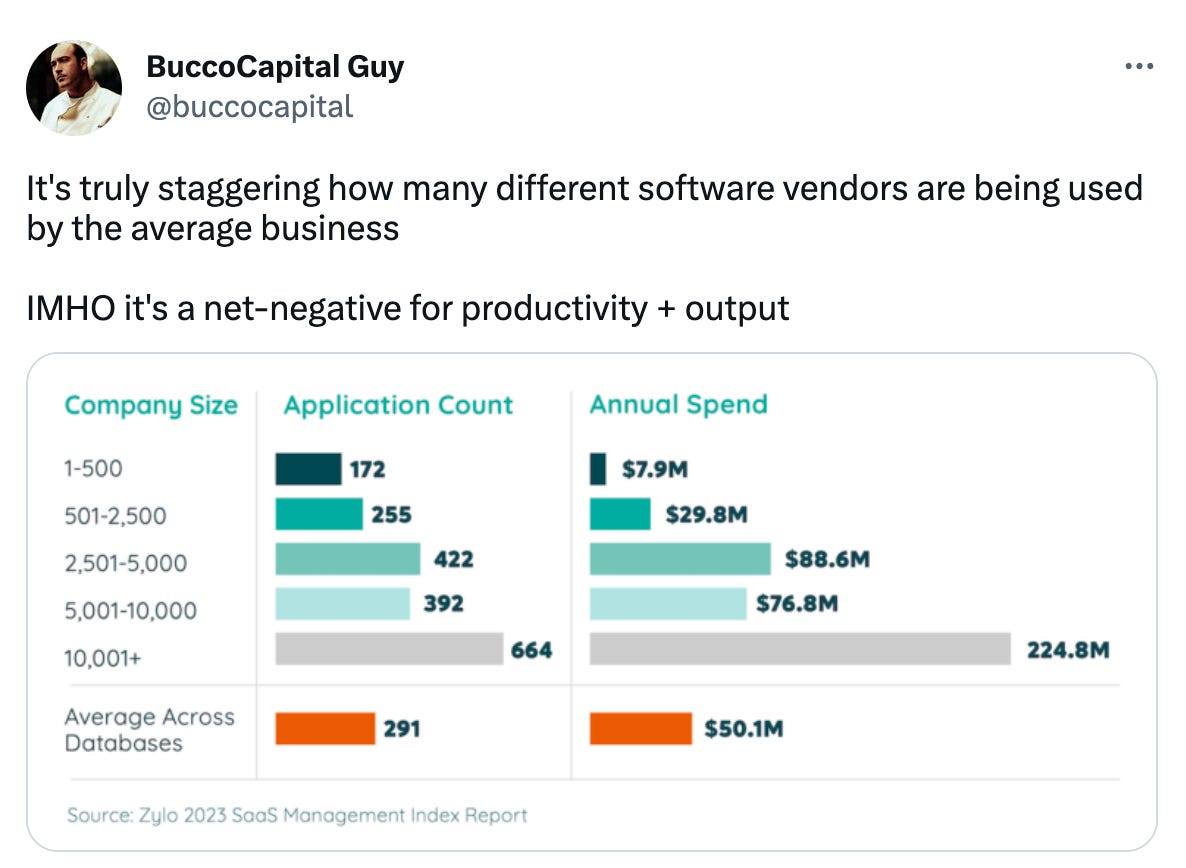

Spencer Peterson calls out the saturation of tech and more specifically categories in software, drawing a sharp contrast between 2013 and 2023 and what it takes as an entrepreneur and investor to build an enduring business.

Zscaler’s inability to transition from a top-down sales motion to one serving developers bottom up, as well as from selling into IT to engineering, is a case study worth studying.

Tweets

Great article, thanks for writing.