Letting Product Guide GTM Sequencing

Reaping the rewards of a product portfolio and indexing your market

Thank you to all of you who have been reading my writing over the last year or so. We’ve crossed over 1,000 readers and it’s hard for me to stress just how thankful I am.

Each reader means a lot, as does your feedback. Please always feel free to reach out to chat - these posts are intended to be conversations with my readers.

Most historians of venture capital like to trace the origins of the financing model back to the whale hunting expeditions in the 18th and 19th centuries. Huge spoils awaited those who took on the risk as well as those who financed them.

A software company’s pursuit of enterprise accounts has some parallels.

In software investing, we use the concept of animal hunting to map ACVs and commensurate GTM strategies. Landing whale-sized accounts can alter the course of your company, aside from the obviously larger ACVs - they act as lighthouses for the rest of the vertical, demonstrate your product’s enterprise-readiness (SSO, admin controls, etc.), rarely churn as integrations/workflows deeply embed/make the product hard to rip out, and provide the most reliable future budgets for expansion.

SMB SaaS companies almost invariably grapple with when to go upmarket, not if.

There’s an argument for letting the product strategy guide the GTM sequencing of when to go upmarket. Focusing on smaller lands in the early days that don’t compromise focus or velocity of execution against your product roadmap may be one of the best ways to reach PMF and scale (and there are many), and eventually harvest enterprise accounts much more easily.

Let’s unpack the merits of this strategy.

The Product Efficacy Curve

Most products have a non-linear trajectory when it comes to delivering value to customers. Certain features or modules drive most of the value, whilst others are incremental. This chart from Jared Sleeper illustrates this dynamic well.

Founders in the A phase are hoping that delta between A and B is as steep as possible, justifying A’s length. They’ve delivered a best-in-class point solution. Thereafter, the company layers on adjacent products, driving expansion and new business by offering enterprise buyers a bundled offering.

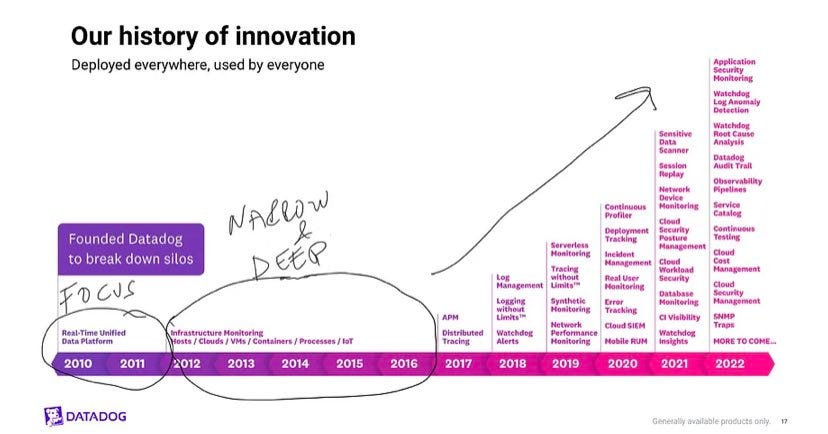

Take a look at Datadog’s trajectory.

We can clearly see a playbook at work - a laser focus in its first few years on the core product, which translated to category leadership, product moats and finally a position of strength from which to cross-sell other modules.

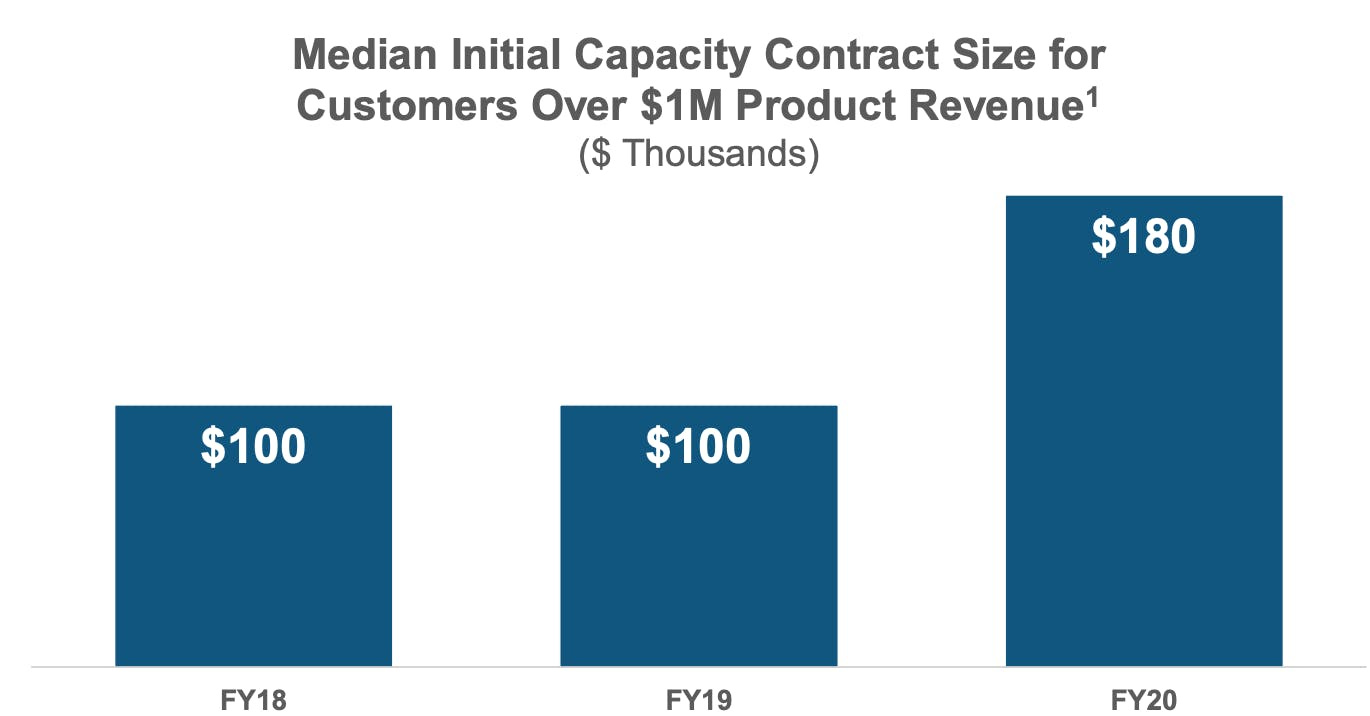

A more pronounced example of this flywheel is Snowflake, who have consistently demonstrated 10x expansion starting with smaller lands of $100k, or elephant-sized accounts.

Those smaller lands allow for lower customer friction. Customers can spend whatever is right for them, allowing Snowflake and Databricks to get involved with the customer and then create even more value over time from new use cases and additional products.

Ed Sim enunciated this point as a key lever to pull in the face of the headwinds in IT buying:

Small lands always work to get under initial budget numbers with a goal to get the customer addicted to your product for expansion in better times. Small lands also help avoid the problem of getting multiple approvals and signatures to close a deal.

Not only is deliberately underselling a much more lucrative pricing strategy in the long-run, I’d argue that smaller lands go hand-in-hand with keeping a laser focus on product and R&D, at the expense of stretching yourself too thin across different GTM streams, too early.

Frank Slootman, CEO of Snowflake and formerly CEO of ServiceNow, advocates against pursuing opportunities that require extensive customisation and therefore drain your team and derail the product from its roadmap.

“Most opportunities are threats to your focus — so you have to choose your customers carefully. A lot of it is relationship. Building chemistry with CIO/team, ensuring that you’re executing well but pushing back. Bending over backwards trying to appease every customer request or solve every problem is a disastrous strategy for a startup.”

This is precisely what whale-hunting amounts to, if it’s done too early. There is an appropriate scale and time to do it, but there are plenty of valid reasons to stay focused on SMBs longer than the conventional wisdom would have you think.

Indexing all the way

Selling to SMBs makes sense for a whole host of well-understood reasons - faster sales cycles, lighter product requirements, founder-led sales, tighter feedback loops, etc.

What’s less discussed is the merit of indexing your TAM by capturing SMBs cheaply and scaling with them.

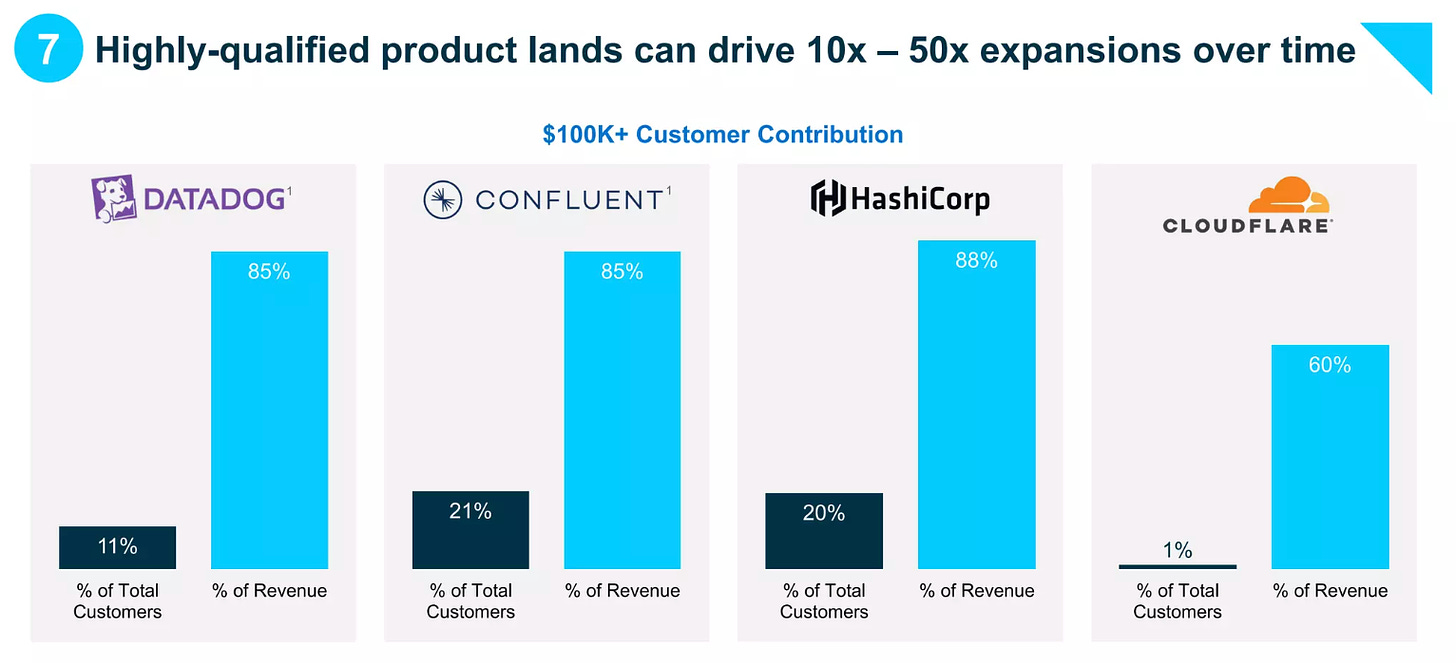

As we’ve outlined, customer concentration is a pretty common end state for some of the largest SaaS companies once they have built out their product suite and up/cross-sold their larger customers and managed to drive 10-50x expansion. In other words, software monetisation exhibits the power law.

Given the opportunity cost of serving enterprises (the investment in the organisation’s GTM/Product/Engineering teams, diverging product roadmaps, etc.), these dynamics present compelling evidence to simply continue indexing your market (perhaps with a PLG or product-assisted GTM) in the SMB segment, thereby significantly cutting S&M spend to pursue enterprises. As you efficiently continue catching SMBs, the next whale is likely to be swimming in your next haul.

Said differently:

Here, land and expand is effectively an indexing strategy — land at as many organizations with as little investment as possible. Every once in a while you'll land a Google, a Facebook, or an Amazon (both figuratively and literally) which will drive a disproportionate share of revenue - Nnamdi Iregbulem

Another way to get bigger and bigger accounts over time is of course to target startups and grow with your customers. Zendesk is extremely successful at employing land-and-expand strategies, but the company has also been fortunate enough to acquire customers such as Twitter, Uber and many others when they were still pretty small - Christoph Janz

The budget that would have been invested on the heavy lift to start going upmarket can be reinvested into the product, strengthening its core differentiation and right-to-cross-sell in the future.

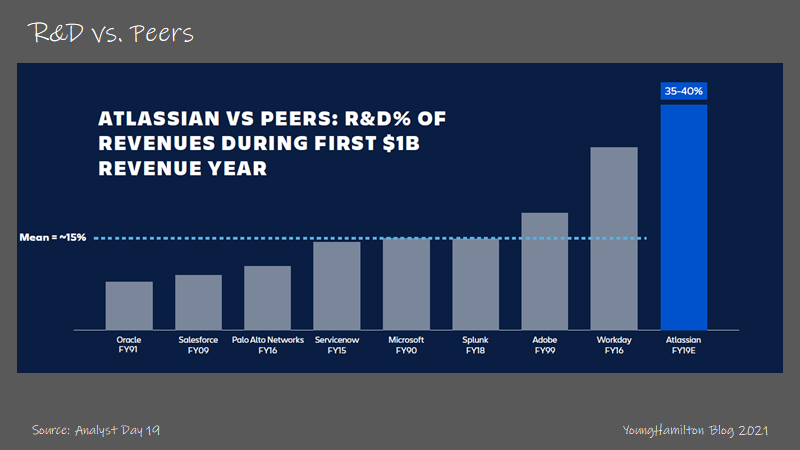

We can look to Atlassian as an example of this playbook at work, a company that prides itself on its PLG motion and reticence towards top-down enterprise sales. Atlassian continues to far outstrip its peers when it comes to R&D spend, which manifests in the form of a second-to-none product velocity.

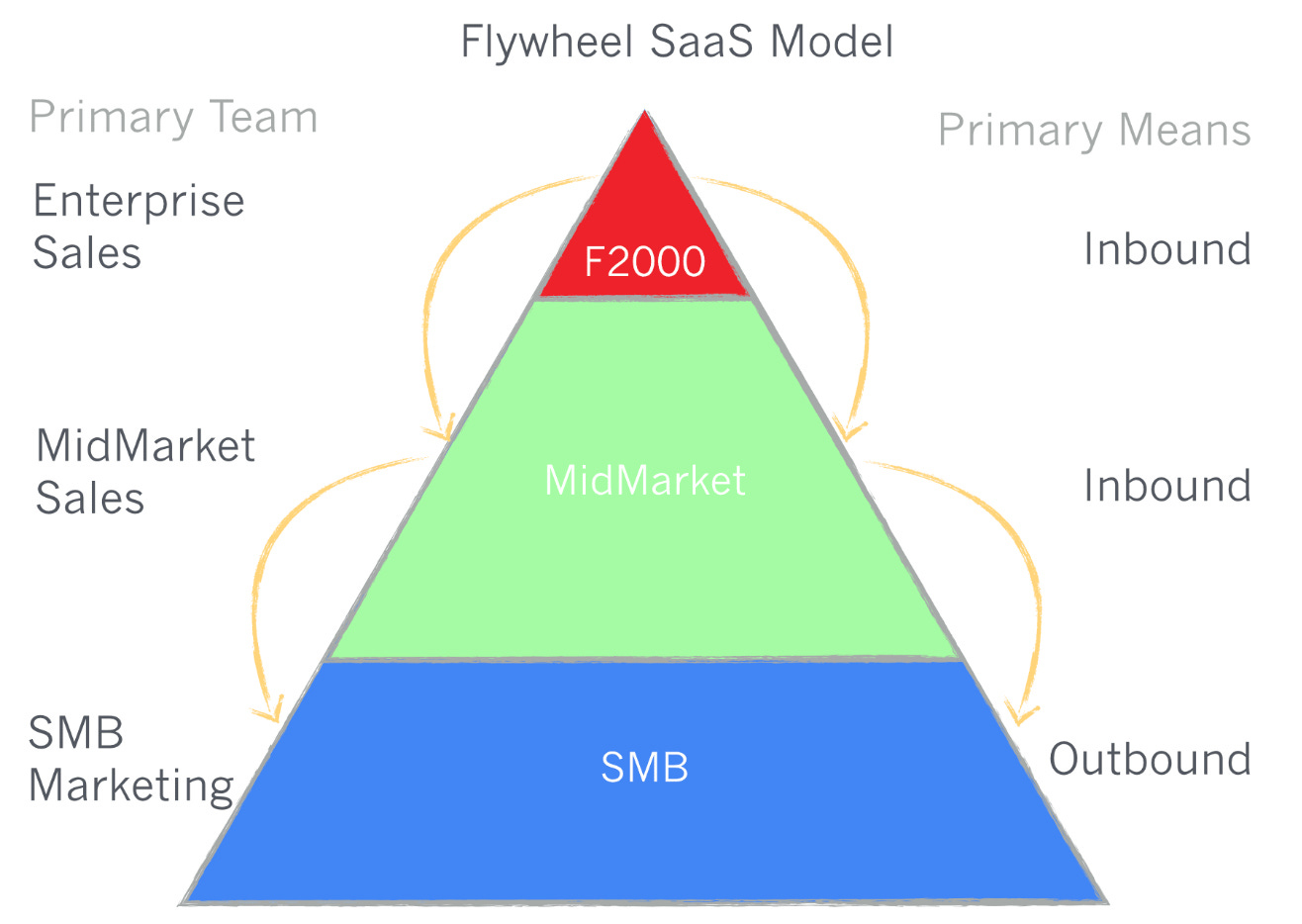

It’s no surprise, then, that Atlassian espouses the Flywheel SaaS GTM philosophy.

This framework inverts the traditional SaaS sales playbook: enterprise sales teams only farm existing customers instead of hunting for new business, whilst SMB marketing is responsible for ALL of the outbound.

The SMB marketing team hoovers up businesses of all shapes and sizes, and it’s the responsibility of the mid-market and enterprise sales teams to capitalise on activation rates across the customer base.

Much like a VC doubling down on the winners in their portfolio.

Bottom Line

There’s no one way to sequence product and go-to-market strategy, but in a capital constrained environment there’s a compelling case for letting product and R&D guide the timing of when to go upmarket.

The degree of focus afforded to you by continuing to serve the SMB segment (much more capital efficiently) will lead to compounding returns down the line, as this focus will be most conducive to laser execution on the product roadmap.

Then, once the company is in a place to offer the buyer a bundle of features/modules and superiority in many buying criteria, sales efficiency will be significantly higher than if the company had gone upmarket earlier. Finally, as is now clear, you’re likely to have caught some whales throughout the interim period by indexing the SMB segment of your TAM, especially if you serve startups. Even better if you’re in a market where the underlying use cases for your product continue to multiply, as you can then price your product on usage, invariably growing ACVs over time.