The Partnerships Handbook with Stefan Ross

Head of Partnerships EMEA & APAC @ Pigment discusses the importance of becoming partner-first, addressing digital transformation mandates, and helping your partners get promoted

Hey friends! I’m Akash, an early stage software/fintech investor. I write about startup strategy for founders & operators.

You can always reach me at akash@earlybird.com to exchange notes and share feedback!

Current subscribers: 3,750

Today we’re revisiting partnerships, a recurring theme in my writing.

I’ve written before about how partnerships needs to be reframed as distribution capex and the increasing importance of cloud GTM alliances. Billy Robbins of Jellyfish has shared his views with you on how the channel is a chapter of the book on business development. It matters to scale.

Every now and then you have an epiphany after meeting someone, and Stefan was definitely one of those people. I hope you enjoy this deep dive into partnerships, alliances and the channel as much as I did.

Stefan Ross leads Partnerships across EMEA & APAC for Pigment, a Series C scale-up which enables people and organisations to make better decisions. Currently residing in Edinburgh, he brings nearly a decade of industry experience from high-growth environments like Celonis.

Scaling global sales and consulting/technology partnerships from 0-1 is his expertise.

Defining Alliances

Stefan, alliances have been defined as a type of partner relationship whereby alliance partners collaborate with you to help you sell software. And this is key, they do not sell your software. I'd love to hear how you define alliances and how you might distinguish it from channels and partners and the other adjacent terms.

The first thing that I would say is, the terminology within partnerships is generally convoluted. I think there are many differences of opinion in what the terms mean.

My view is that partnerships is the umbrella term which encompasses cloud and marketplace partnerships, tech partnerships, and consulting partnerships.

When we talk about alliances generally, some organizations see them as as strategic partnerships. However, I've also seen job roles, which is just ‘Partner Alliance Manager’, or an ‘Alliance Director’ or ‘Head of Alliances’, and these encompass everything. There needs to be a degree of standardisation on what the different terms entail.

To me, alliances are more strategic.

It refers generally to large important individual partners, often referral/co-sell relationships, whereas partnerships is the umbrella term which can contain everything (types of partner and different GTM motions with them).

The last term you referred to was the Channel. My view is that by channel we mean a re-sell or broadly a ‘sell-through’ motion. That would be where I've had most experience with regards to channel. But yet again, I've seen ‘Head of Channel’, I've seen ‘Channel Manager’, which in job specs can cover end-to-end partnerships.

Partnerships is broad end-to-end. Alliances are strategic partnerships, and that can be across any type of partner, and then the channel is de facto ‘sell-through’ partners like resell.

Partner-First Companies

One thing that really struck me in a prior conversation we had was how you described whether a company is a partner first company or not. And this is, of course, key for a company to be aligned and not have channel conflicts, but also allocate the requisite resources to alliances or partnerships. Can you explain in a bit more detail why you think it's important for a company to come to that determination if they're partner first or not?

The short answer to the question is that lack of clarity creates a huge amount of inefficiency and productivity loss.

The long answer: Let's take the example of consulting firms…

Consultants are invariably involved in software purchasing cycles, whether we want to engage or not. They are particularly prevalent within enterprise segments as tools are bought as part of a transformation story.

Often vendors feel the need to be involved with partners because they [consultants] are influencing customer purchase decisions, which, when engaged without conscious planning, can create lost time in channel conflict, misaligned objectives between that of the consultancy and vendor (e.g, I want to sell ARR today, whereas the consultant wants to advise on a journey to solve complex organisational issues).

Rather, software companies need thoughtful foundational structure/organisation to win jointly with consultants.

Upmarket, consultants will act as a trusted advisor to executives with a position to inform + educate which often translates into advisory work, change management and implementation. They understand intimately the fundamental problems of the business (e.g., CFO - profitability, working capital optimisation, cashflow preservation etc.) and can translate this into a tooling requirement on a multi-tech stack, think ERP, CRM, EPM etc. They often view individual software as a supporting component within their tool box.

Partners can help sell bigger (especially multi use-case), quicker, and with higher win rates as value can be more precisely communicated.

To be successful in partnering, the GTM organisation needs to be set up for this win-win. You can’t look to scale professional services whilst seeing partners as a vehicle to bring business and help. Incentives aren’t aligned…

Sales reps need to understand their place in the value chain and rather work with partners as an extension of internal teams like pre-sales. Hiring ‘partner-friendly’ reps can help here whilst also instilling a culture of proactive engagement with partners.

The same thoughtfulness applies to technology partnerships; are we going to build out XYZ adjacent capability or will we partner with another vendor to address a broader market need?

Partnerships are not only top of the funnel. Understanding their measurable impact across the GTM motion can be helpful in conveying the benefits of a partner first strategy. Win rate, cost of sale, deal size, retention, sales cycle length etc…

Falling in the trap of pure sourced opportunities or sourced/closed is a mistake. May as well look at a referral partnership!

This all comes down to executive perception on partnerships.

All of these considerations need to be made upfront because otherwise it will lead to monetary loss through inefficient use of time, friction in the market - ultimately it'll stifle growth.

So, what do you want? As the old saying goes, you can’t have your cake and eat it.

Serving Transformation Mandates

We often see companies look to go upmarket at the earliest opportunity and at the same time acknowledging how enterprise is very different to the mid market.

In a recent conversation, you stressed to me how enterprises purchase so differently and often will rely on partners when they're procuring it. Given that often, especially consulting partners build strong relationships with executives and really hold the keys to transformation mandates, can you expand a bit on this and share some insights on how as startups start to sell to the enterprise, should factor in the importance of partners for the enterprise?

There's no problem having a point to point solution. I think that if you have a point to point solution and are trying to sell into enterprise, you might be met with a bit more difficulty in getting access to the customer and also being able to articulate why your tool is relevant to their pain points and their problem. Value-based selling is key.

When you look at, say, large enterprise organisations and take a typical buyer, the CFO's office, who's often just holding the purse strings for all spend with an organisation, what are the biggest problems that they have? You'll see it doesn't tend to translate to specific point to point problems, but rather a specific process or use case.

It could be working capital optimisation, it could be cash flow preservation, something broad which transcends multiple tech stacks. Understanding those pain points and also as mentioned in the previous answer, the trusted advisor they turn to. Consultants are more often than not, a trusted advisor to executives. Their role is to help articulate clear solutions to broad company challenges. Commonly seen in the form of a finance (or other) transformation. Having your tool top-of-mind when it comes to the solution story and leveraging their help to articulate the ‘why’ your tool supports in solving these complex problems can be the difference between a small & large deal or any at all.

My biggest advice to organizations and startups that are positioning themselves within software is to articulate as best as you can, how does your tool roll up to the fundamental problems within that CFO's office? Could be CIO's office, could be CTO's office, could be Head of HR's office, CMO.

Sometimes partnering with another vendor to offer a ‘complete solution’ with the help of a consultancy to articulate the ‘why’ can be lucrative, especially if playing against broad platform tools.

And I think what most organisations find is that they need to partner with those strategic consulting players. And that's why, going back to the previous point, understanding whether you are going to be ‘partner first’ or not will be helpful for you, because there needs to be a mutually agreed set of ambitions and motives for you to partner with that organisation to fulfill said goal.

Multi-Product Platforms

How do you see a company's position evolving as they become multiproduct and therefore may become to believe that they can alone solve that transformation mandate's needs and having to rely less on other vendors as part of a bigger story.

Do you see companies, as they go multiproduct, start to rely less on partners because they can claim to solve an enterprise CFO's needs with their product portfolio?

My view is you double down on partners. So I'll just use data points. Look at SAP, they transcend multiple tech stacks.

Look at the size of SAP practices at Deloitte, at KPMG, at Accenture. Huge. Absolutely huge.

So if you're wanting to implement a digital transformation, you have a lot of advisory work, you have change management, and that is all outside of the expertise of most technology companies. So I think more than ever you need to double down on those partnerships because it becomes more enticing to the consulting player too.

If you have a great product and you're moving to becoming multiproduct, the premise is the exact same - you can have a slightly bigger piece of the transformation. This means that the GTM, the upsell, the cross sell is more lucrative for the consulting partner, but also for yourself.

Types of Alliances

I've written previously about how cloud alliances are an important channel for B2B SaaS. Can you talk about what other types of alliances are very common? You also mentioned earlier academic alliances, that's not often well known. Can you enumerate some of the more common alliances?

I think that partnerships in general are a more immature part of the organization relative to sales or presales or delivery or customer success. And because I think, again, going back to the point, most organizations don't know how they want to leverage it.

I put it into three core buckets for most software companies:

you'll have consulting partners,

you'll have technology partners,

I'll even have cloud and marketplace as a separate vertical.

And then if you look at the horizontals, which is motions, you might have a classic referral, co sell motion, you'll have maybe a resell, or maybe you'll say, well, I want to open up my platform for asset building for partners, which is a motion that could open another monetisation strategy, which may transcend across different types of partnership.

And then you've got subsets. So within consulting, you'll have boutiques, you'll have regional consultants, and then you'll have global large players. For your technology partners, generally it's those that are adjacent which complement.

Aligning Incentives

In your time at Pigment and Celonis you’ve worked with global system integrators and consulting partners, the whole spectrum. What advice can you share for startups that are looking to maximize the success of their partnerships, especially where those partners may have worked with other vendors in that same category before? How do you create the right alignment of incentives?

Specifically for GSIs, it’s important to understand their highly matrixed organisation to be successful. Especially if you have competitors also vying to work with the same GSIs.

There are individual member firms which on a country level have a lot of autonomy. And in some, there will be independent entities. Then you have individuals who are striving to become a Partners in that organisation.

That is the career path, the ultimate trajectory for people who see a long career within the lives of the Big Four. Now, to become a partner, you need to have your business case. You need to have your contribution to the business.

That's going to be: what is your growth vehicle that's going to be positioning you to create your business case to become Partner. Now that is an exciting place and that's why the Big Four have lasted so long and why they continue to thrive. Their structural model is built in a way that they're always looking for the next best thing and they have to maintain their relevance for their customers.

If they're the trusted advisor and they're not understanding what's at the cutting edge, what's next, what's new, then their relevance is diminished. I think that structurally they're designed in a way that they'll want to be curious.

And the question for startups is how do you entertain that curiosity?

I don’t think quite enough GTM leaders understand the motives of a GSI.

They tend to just go to the place that their competitor is. And yeah, there could be interest however, it’s often easier to find a new champion to build their business case with you. These organisations are huge…

Deloitte had 400k+ employees, Accenture 700k+. So you're looking for that innovator, that early adopter within those organisations. And it's difficult to say where they sit, which service line?

Do they sit in risk advisory? Do they sit somewhere else? You're looking for those people that will be willing to take up a bet, if you like, on your tool, your technology.

It's not exclusive for these relationships with the likes of Deloitte. GSIs are not exclusive. They are a series of partners who have built their ownership in the company and many are vying to do so each year. So it becomes a sort of traditional sell as to why you're relevant in the market. And the more that you've got your name out there, the more you'll become relevant to them.

Metrics of success

At scale, what % of an enterprise-focused company’s new business should be coming from Alliances, in your view? Short of this, how do you align the board on the right measures of success in Alliances?

If I were a partner-first executive. I would be tasking my Partner Leader with, how do we drive 40%+ new business with our partners. It will absolutely be a multi-year strategy crossing Consulting, Technology and possibly Cloud partnerships.

I would also be focused on metrics across the sales funnel - not becoming obsessed with top funnel sourced/opportunities (important but not exclusive).

Metrics such as;

Win rate with partners vs without (%)

Average sales cycle length with partners/without (days)

ACV ($)

Cost of sale

Monitoring expansions where partners are present

A successful partner strategy will invariably improve each of these metrics.

In terms of aligning the board and executives it’s about data, data and data. Terms ordinarily associated with partnerships e.g, ‘Influenced ACV’ are vague and do not win the approval of leaders who are unfamiliar with successful partner GTMs. Constant education of board/executives on the impact partnerships can have on a metric level is needed.

Ensuring partner team resources have a measurable contribution to growth is a good starting point.

Charts of the week

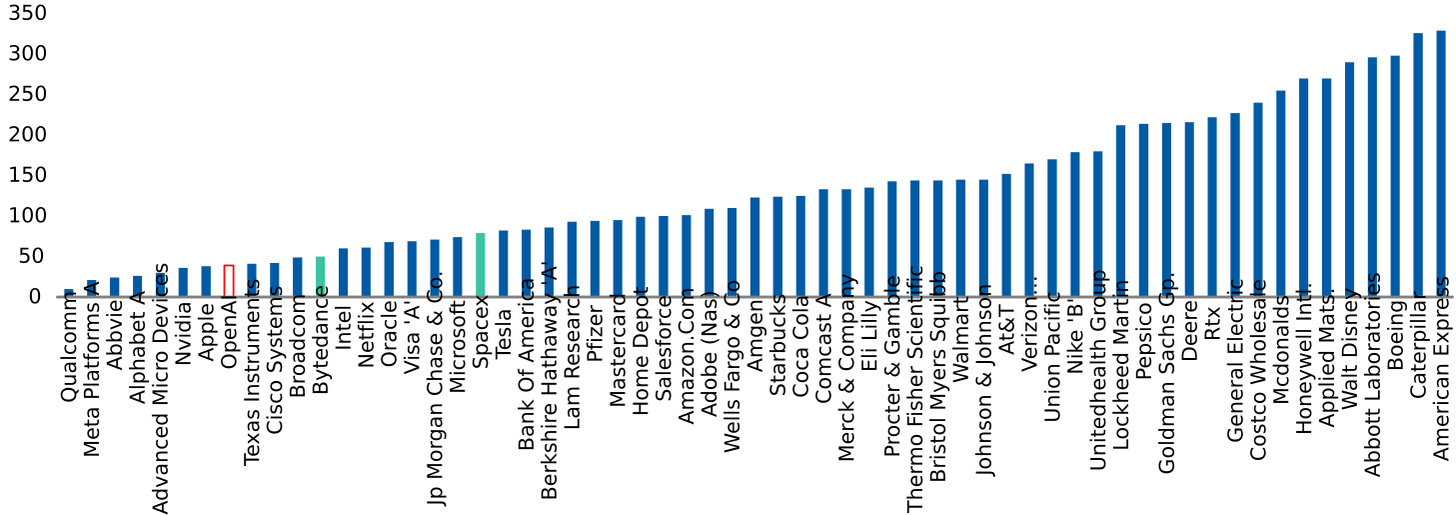

Speed (months) from $10bn to $100bn valuation

Initial expectations of platform shifts and average underestimation

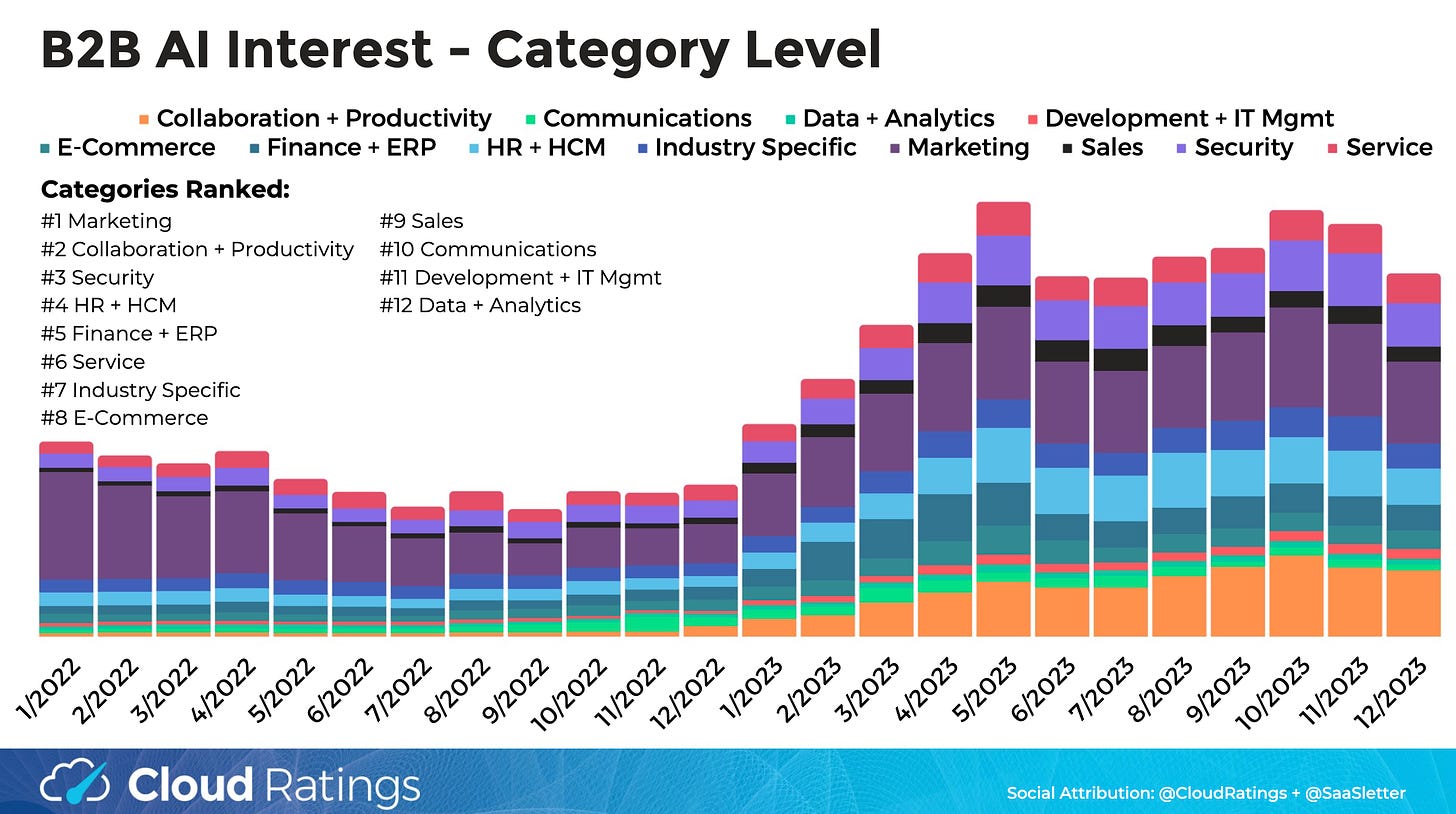

Stack ranking interest in AI-native products (from friend of Missives)

Event

I’m part of a community of fintech and DeFi operators started by my dear friend Giorgio, who are starting pitching sessions with founders.

Founders of Fintech or DeFi startups can present to a group of top notch fintech and DeFi operators, angels and investors (list here: https://lnkd.in/ehH78XjW).

A first batch of startups will be chosen to pitch at the event in London in March ‘24 - with an outstanding panel. (Startup Applications close 15th of February).

Reading List

Ten AI Insights from Databricks, Anyscale, and Microsoft

The Knowledge Economy Is Over. Welcome to the Allocation Economy Dan Shipper

Vertical Software 2.0 Louis Coppey, Point Nine

AGI Trades Daniel Gross

Quote of the week

‘As the problem space itself is evolving, you're defining the solution, but there's a lot of value to doing that because you can actually change the way people think about that problem and think about solutions. [...] You're playing at a harder level, but you're also doing something potentially much more impactful.’

Thank you for reading. If you liked it, share it with your friends, colleagues, and anyone that wants to get smarter on startup strategy. Subscribe below and find me on LinkedIn or Twitter.