Hey friends! I’m Akash 👋.

Welcome to Missives, where I write about startup strategy across software and fintech. You can always reach me at akash@earlybird.com.

Thank you for reading! If you enjoy these, please share them with your friends and colleagues 🙏🏽. Wishing you a great week!

Current subscribers: 3,380

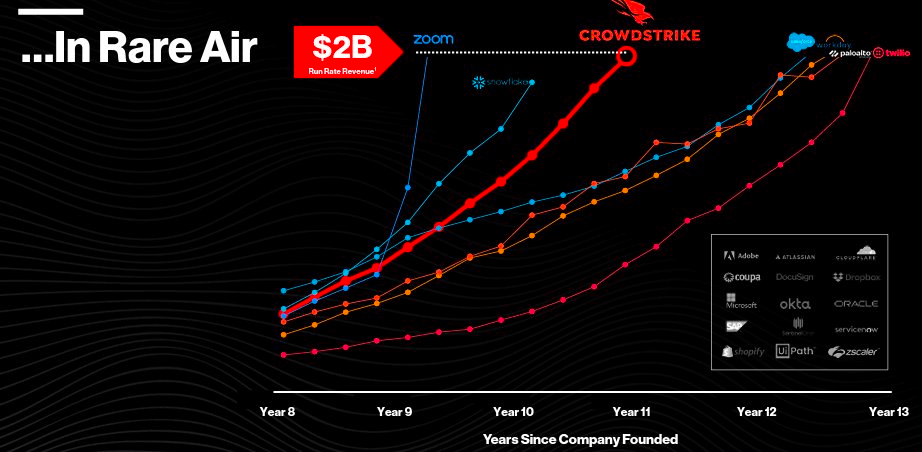

Crowdstrike and Snowflake are in a league of their own.

Of the companies that have reached over $2 billion in ARR, Crowdstrike and Snowflake are the only companies to have grown 50% annually at this scale.

A common denominator in this compounding growth at scale is distribution through the hyperscalers - Crowdstrike and Snowflake are two of the leading Independent Software Vendors on the cloud marketplaces.

Borrowing from cloud budgets

Enterprise software spend will surpass $1 trillion for the first time in 2024, in large part due to continued utilisation of cloud services which is expected to grow 20% in 2024.

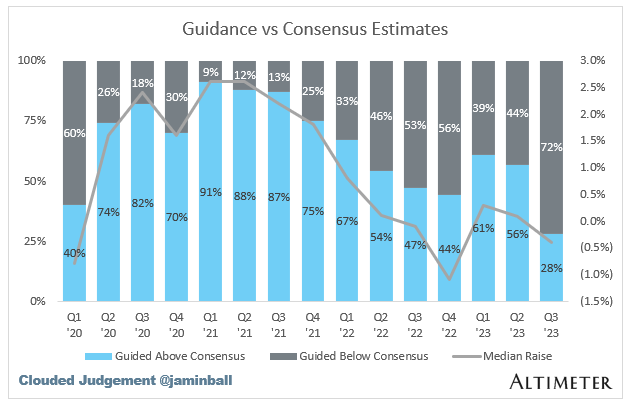

This is against a backdrop of continued deceleration and downward revisioning of forward estimates for public software companies.

One of the largest and most robust budgets in the enterprise is the spend they commit to with their cloud providers. Let’s unpack this.

In Q3 earnings the hyperscalers continued to stress the headwinds of optimisations are not going away. Enterprises typically commit upfront to certain thresholds of cloud spend. As they continue to optimise their cloud costs, they can shift their software purchasing to the cloud marketplaces in order to meet their spend commitments.

‘Budgets are tightening and a lot of our enterprise customers are using their pre-committed cloud security contracts to buy enterprise software and software from ISVs. So the ability to do flexible payment plans, financing, retire that pre-committed spend has been a really significant a way for us to accelerate and amplify our transactions.’

Jessica Alexander, Senior Director Cloud Technology & OEM Partnerships, Crowdstrike

Asked why buyers are increasingly using the cloud marketplaces as a purchasing vehicle, Jabari Norton, former VP WW Channels, Partners, & Alliances at Sumo Logic, described three key variables:

Consolidation of vendors

Budget tightening and pre-committed spends with the cloud providers; being able to leverage that committed spend

Ease of procurement

This trend is particularly observable in infrastructure software, where cloud marketplaces are an increasingly important purchasing vehicle and where the take rate is largely countered by the lower cost of sales for these transactions.

Snowflake were pulled to the marketplaces by their enterprise customers and is listed on both Azure and AWS’ marketplaces.

In October, Crowdstrike announced that it was the first cybersecurity ISV to exceed $1 billion in AWS Marketplace sales since listing on the AWS Marketplace in 2017, where it also enjoys ACVs that are 140% larger than other GTM channels.

To truly underline the salience of the cloud marketplaces:

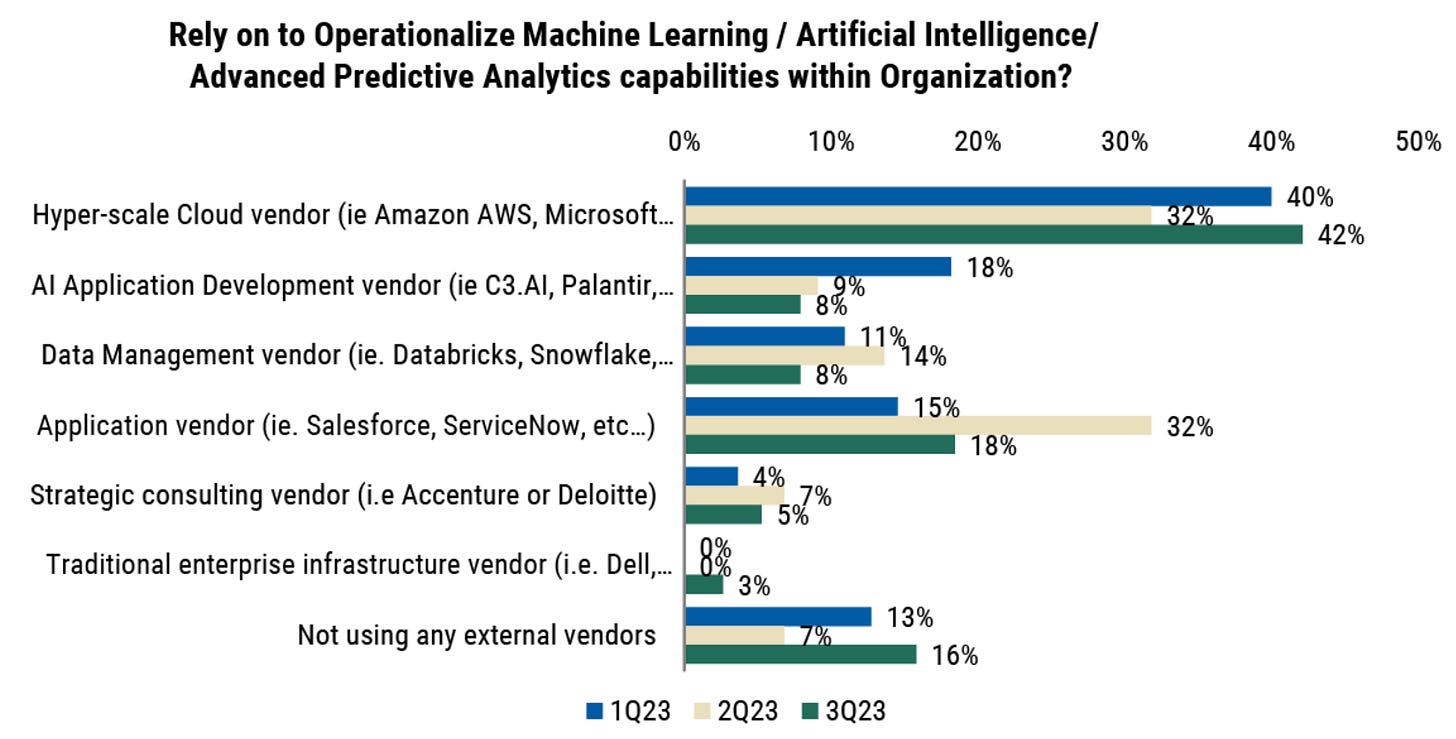

42% of CIOs who have not yet deployed AI/ML use cases into production are looking to leverage hyperscalers

37% of those who are beginning to deploy AI use cases are relying on the hyperscalers

State of Cloud GTM

Cloud marketplaces will become an increasingly important purchasing vehicle for software, and the team at Tackle.io have produced an excellent report on the State of Cloud GTM in 2023.

I’ve captured my key takeaways below, but the report is definitely worth reading in full.

Listing incentives vary by size

Companies that are building upon their product-market fit are obsessed with meeting customer demand, whilst companies in the scaling phase are looking to accelerate sales cycles and remove friction from the purchasing process. Those in the $100m+ ARR range become highly sophisticated in how to get maximum value out of this channel.

Stronger relationships yield better incentives

Continued investment of resources and time in this channel yields significant incentives from the hyperscalers.

AWS’ ISV Accelerate, GCP’s Partner Advantage Program, and Azure’ IP Co-Sell Program all include some combination of marketing support, discounts, co-branding, priority access to co-sell support teams, reduced listing fees, and more.

Cloud GTM is a nascent channel early in maturity

Compared to 2022 when 44% of sellers expected to generate more than 10% of their revenue through a cloud marketplace, only 26% said they expect this level of revenue contribution through the marketplaces in 2023’s survey.

This is in large part attributable to macro but also reflects where we are in terms of best practices for operationalising this channel.

Co-sell and marketplace listing are symbiotic

A partnership with the hyperscalers requires the marriage of co-selling and marketplace listing. A partner motion without a marketplace listing defangs the channel.

This is why AWS merged its marketplace and partner organizations into a combined team focused on partner success and Microsoft declared that all ISVs must have a marketplace listing to attain the most compelling benefits of its partner program.

Success in Cloud GTM requires enablement and process

Jabari Norton identified the CEO, CRO and CFO as the three key executives that need to be bought into a Cloud GTM strategy for it to succeed.

Internal enablement is key. The most important steps here are:

Sales team education

Dedicated resourcing

A stronger “better together” story

Enabling Cloud Partner field sellers on their offerings

Resourcing and bandwidth continue to be bottlenecks to wider Cloud GTM investment, but we expect the hyperscalers to make the co-sell journey more seamless with CRM support.

It’s a company-wide endeavour

For a majority of companies the Cloud Alliances team will own the Cloud GTM, but its success is predicated on being a cross-functional initiative. Sales in particular will share a lot of the responsibility on the co-sell motion.

The most important additional stakeholders are:

C-suite - CRO, CFO and CEO at a minimum

Finance & Operations – For AEs not to rebel against this channel, it’s important that operations and finance implement process and system integration.

Marketing – Marketing is key to co-branding and delivering a story of ‘better together’ whereby the cloud vendor benefits from increased cloud consumption as a result of usage of the vendor’s product.

It’s a journey that requires a distribution capex mindset

We’ve talked before about how nurturing channels requires a reframing to ‘distribution capex’.

The journey to getting a Cloud GTM strategy up and running is at least six to nine months and continues thereafter as vendors mature.

This entails continued investment in building a dedicated cloud sales team, and measuring KPIs at QBRs.

‘We do measure sales cycle. So just time to transaction and look at the difference of marketplace versus not.

And then we measure just percentage of business going through the different various marketplaces and the growth on that.

We also measure the number of joint registered deals that are approved between us and the AWS seller.’

Colleen Kapase, VP of WW Partner & Alliances, Snowflake

Software buying will shift to the cloud GTM by a magnitude that justifies investing early.

It’s still early but tooling is already emerging to enable this channel - earlier this week, Suger announced a $3.5 million seed round with Craft Ventures and a number of others. Suger’s stated mission is to address the last mile of realising the value of cloud marketplaces, encompassing listing, contracts, metering and billing.

Alliances

Before wrapping this post up, I wanted to give some attention to the Alliances function in the GTM org.

Dave Kellogg has a crisp definition:

Alliances are a type of partner relationship. Alliances partners collaborate with you to help sell your software, but — and this is key — they do not sell your software.

This is a key distinction.

Channel partners and Alliance partners are both partners, but Channel partners sell your product whilst Alliance partners refer deals to the vendor. A co-sell relationship with a Global System Integrator (alliance) is different to a resale relationship with the same GSI (channel).

At scale (>$50 million ARR), Dave suggests that 20% of leads should come through alliances.

Despite their importance, the best practices of alliances (cloud, strategic, etc.) remains understudied. We’ll dive into this in a future post.

Before finishing today’s post, I wanted to give a mention to the great work

and are doing with their Cybersecurity x SaaS bootcamp. They’re hosting their third cohort of the Cybersecurity x SaaS Bootcamp Starting 11/27.Join top SaaS operators, investors, founders, and VCs to learn, engage, and network with each other:

Cybersecurity Industry Overview (cloud vs. network security, Crowdstrike, Palo Alto Networks and many more)

SaaS Metrics and Modeling (ACV, ARR, NRR, Billings vs. Bookings, and FCF margins)

Interactive models, frameworks, and worksheets

Top Tier Guest Speakers (CISOs, CFOs and VPs)

Live Q&A, Community and Networking (All alumni get added to a Cyber + SaaS slack group)

Reading List

Tobi Lütke The Observer Effect

The Next Billion Developers Sequoia Capital

2023: The State of Generative AI in the Enterprise Menlo Ventures

Reinforcement learning: The security layer for LLMs Will Bennett

Quote of the week

‘My attention is the most liquid and valuable resource that I have.’ Tobi Lütke

Thank you for reading. If you liked it, share it with your friends, colleagues, and anyone that wants to get smarter on startup strategy. Subscribe below and find me on LinkedIn or Twitter.

Very well researched! And thanks for including us!