The Future of Customer Success with Databricks' Nick Cochran

Weaving Customer Success Into Your DNA In A Consumption World

Hey friends! I’m Akash, an early stage software & fintech investor at Earlybird Venture Capital, investing across Europe.

I write about startup strategy to help founders navigate their company-building journeys, from inception to PMF and beyond. You can always reach me at akash@earlybird.com if we can collaborate or to share feedback.

Current subscribers: 4,110

Today we’re speaking to Nick Cochran, Global VP at Databricks, about the future of Customer Success.

Nick Cochran, an entrepreneurial leader with over 20 years of experience in business strategy, team building, and revenue growth, currently Global VP - Practice Leader at Databricks where he leads a new function focused on enhancing customer outcomes in a consumption-first business model.

As a founding member of Databricks EMEA, Nick has held various executive roles running the APJ & EMEA CS, PS and advisory teams, contributing to the growth of the business to over $1.6 billion in revenue.

Previously, he played a key role in building Mulesoft's EMEA Customer Success practice from the ground up, achieving a 10x increase in ARR and a successful IPO. Additionally, Nick co-founded Data Scout, a successful Cloud MDM solution acquired by Informatica in 2012.

Outside of his corporate roles, he advises and invests in tech startups, providing founders with best practices and support in their customer & GTM strategies.

Nick holds a degree in Business Administration from Nottingham Trent University.

The Highlights

Customer success will become embedded into a company’s DNA rather than being a standalone function

Instead of generalist CSMs, we’ll see specialists that revolve around different parts of the customer journey, from onboarding to activation

In a consumption world there is no pre and post-sales - it’s a continuum

Focus on getting customers to value and other proxies that are upstream of revenue

At Databricks, the Product Managers go straight to the customers to canvass feedback, a sign of a healthy product organisation.

As more businesses move to consumption models, the goal is to give management confidence in the levers they can pull to drive certain metrics

Nick, to set a bit of context, we know that retention came under sharper focus the last two years as acquiring new business has been significantly harder. Net revenue retention has decreased across the board.

That's meant that customer success was given more importance to prevent churn and contraction. As such, we’ve seen customer success also increasingly reporting to sales. Can you articulate for us your view of the importance of customer success, especially for consumption based software in the new environment we find ourselves in?

I've been working in customer success for about 14 years. Most of that time has been in the data and tech domain.

To my mind, we've been on a journey with customer success.

Customer success was arguably created by Salesforce 2006-7. Looking forward, best of breed companies will have integrated customer success into their core values.

At Databricks, being customer obsessed, being partner obsessed is one of our core values and that applies to decisions that we make in the field, enforcement of contract terms, the way we work with our customers.

So I actually have a really provocative, strong view that we're coming to the end of having a customer success department or a customer success function in organisations. To drive true net retention you need to be earlier in that customer lifecycle - it's not just a post-sales event.

Everything you do needs to be focused on the customer's outcome. Designing the product, the roadmap, integrating AI into your solution, all of those things. Customer success, a skill set is still required.

We still need that lens and customer advocacy within the organisation. But I think that should become almost part of organisational DNA, especially in the new companies that are going to be really lean, small teams, using AI from day one in their development cycles.

Retaining customers and getting them to success with their outcomes is super important, but I think you'll find it will become much more customer journey focused. You’ll have the right person at the right time rather than a sort of generalist CSM role in the future.

On the point of reporting into sales - I think there are pros and cons to that. I've lived in both worlds. I actually think that in a mature organisation at our scale, I actually don't think it matters so much. I think during the growth phase, though, it's handy to have the friction between the two organisations.

In that context we realise that customer value outcomes (in production) become of life-or-death importance in consumption business because consumption is revenue. Increasingly consumption led organisations will focus more on revenue growth and let the traditional commit contract, and arguably renewal or upsell, be a byproduct of consumption. So the focus has to be on getting the customer into production, and placing the customer first in every thought, design decision, process will be key.

Having seen it play out both ways. I think in a consumption world, again at our scale, everything is coming back to one point, so I don't see as much risk if you do have customer success function in that reporting into the CRO or into sales.

It makes so much sense that over time the winning businesses will be customer obsessed throughout the organisation.

One thread that’s interesting is the role of solution engineers and solution architects and how they sit alongside customer success. We recently spoke to a Zaki Bajwa, Global VP of Solution Engineering at Snyk, and we discussed at length how AEs and SEs collaborate, especially in pre sales. In post-sales, I'd love to hear your view on best practices and even the importance of CS and SE collaboration.

This is a really interesting point, and this touches on some reorganisation that we've just been through. About 18 months ago, we decided that having a CS function separate from our sales engineering function wasn't really working for our customers in a consumption world, because we don't really have pre and post-sales - in a consumption world, it is a continuum.

We have a customer journey that goes from first conversation through to a point at which the customer decides they want to work with us. Then it's all about driving business value through project or use case delivery and execution. So you have this sort of flywheel effect of more projects and more use cases based on that initial success reference that you have.

When we looked at that, we were getting quite confused with pre and post sales as well. So we looked at that and we realised that we had a kind of swiss army knife in our CSEs, customer success engineers. They were doing three things: they were helping our customers on board, they were helping educate our customers, and they were helping accelerate use case execution or delivery.

What we actually found is when we looked at the customer journey and where those tasks were required, we could focus individuals into those roles. They mapped quite well into other parts of organisation anyway, so we ended up splitting the CSM into three discrete roles.

We have a shared technical services team now that's very focused on onboarding customers. That's a point in time thing - just get them up and running, help them with the DevOps at the start.

We have a very big training team with a very strong curriculum on AI and Databricks. So we have a bunch of folks in there that help our customers build learning maps, integrate with their learning solutions, and help people build their careers with Databricks and get certified.

Then the third function was the Delivery Solution Architects that we that we designed to work with our customers once they decided to use Databricks. So from what we call a technical win through to production, and they work in that space.

The constant is our solution engineer, which we call a solution architect, and our account execs. We have a two in a box on every account, AE+SA. And then we have this specialist team that's available maybe for 30, 40, 50% of our customers. What we had to do was design the touch points of the customer journey and the tasks so that we became more of a team and we were able to pass the ball fluidly between the teams.

So to go back to your question, the solution architect was the original swiss army knife at Databricks. They did everything in the very early days and then we created these other roles. We've now gone full circle in my view, and all of our technical resources in the Databricks field team are now architects of some shape or form.

So we have a family of Solution Architect roles, with majors in product, delivery, industry and so forth. They all have the same technical baseline in terms of ability and they're fungible for the customer. But we have these majors, these skills that are across the team, and they operate through that whole continuum of what used to be pre and post-sales, but now it's much more fluid.

That's really insightful and speaks to the fact that you became so oriented around the customer journey and the degrees of specialisation that the team should have.

One evolution we’re seeing is that product led growth is just significantly harder, even for those few companies that successfully executed it a few years ago. They've moved to product led sales. There's a notion of the sales assist role, that's a new type of persona being hired specifically to help product qualified leads convert.

And there have been many operators like Allison Pickens who’ve said that the role of a customer success is more or less indistinguishable from what a sales assist hire may do. Do you agree with that? Do you also see CSMs being easily reassigned for such sales assist roles in the product activation motion?

We've long ignored our long tail. Historically we came up with a monthly run rate number that converted into what we would call a customer and everything below that we didn't look at other than maybe marketing and educational campaigns.

That was typically because that number meant it got to the point where it wasn't on a credit card anymore and it tended to need to convert to some form of contract with procurement involved. This year, in the last sort of twelve months, we've run some pilots in this area and we are working with some technical folks, our BDR team in conjunction with the sales function.

I think where I struggle a little bit is, and this is more to do with the fact that we're very technical, the CS folks we have mostly have a Computer Science degree. I can't see the leap, but certainly we can see the opportunity in helping those customers. We looked at the drop off rates in those customers - we used the event logs to understand how people get onto the platform and it's clear that people need help at that point. There were a lot of lot of trials - trial and fail, trial and fail.

So we ran a pilot.

We can see we can do it at an appropriate investment level. So going back to my first comment about customer success functions no longer existing, I can see the opportunity for people that could have been CSMs to build a career in the go to market function in a software company starting in that role as well.

What we've generally seen is this shift where CSMs are focusing earlier in the account's life. As opposed to the historical paradigm where they were very focused on gross retention and avoiding churn, there's a focus now on consumption, much earlier in the customer's life focusing on expanding those accounts.

In my previous company, the CSMs, we had carried the renewal quota, carried upsell quota as a variable compensation plan, and also had services commissions. So they were very sales oriented CSMs. We deliberately haven't done that at Databricks.

This is down to our Chief Customer Officer's vision. In the very early days, we've kept customer success separate from the commercial arm of Databricks. So our sales team is responsible for all of the commercial conversations, renewals, everything else we have now at scale - for example, a renewals team that manages the risk and the reporting internally of the forecast.

The customer success team was much more focused on getting the customer to value as a leading indicator. If they're in production with use cases, they're much less likely to churn. For a while we ran dual forecasting there - reporting the customer health as a kind of balance to the sales forecast.

Now we don't because of the changes we've made, but I think we've seen more value and we can ascribe more value to the role of the people in customer success tasks, even though we don't have that function anymore. So people focusing on driving customer value and customer outcomes, we can ascribe value to the work they do because they are accelerating three critical metrics for us, which also are valuable to our customers.

User growth - when a customer has made a decision to invest in Databricks, they also want to see usage grow within their organisation, usage growth around product.

Multi-product - being successful with Databricks as a platform rather than as a point solution or a smaller solution.

Revenue - For Databricks it's revenue growth, but for the customer it's that product growth. They're making a commitment typically to use the software and we want them to be successful and build their careers with the outcomes they’ll deliver.

They want to achieve business value. They're not going to do that unless they're using the software. So we need to help them get to business value.

This nicely leads to the sales compensation question, where there's been a shift in the last couple of years. We've seen perhaps, as you mentioned also at Databricks, a transition from upfront commitments to incentivising new logo acquisition and consumption and expansion of those accounts. Particularly in the last few years many companies were oversold upfront and then they right size anyway to the level that is appropriate for them.

After the reorg, can you share what you regard as the best practices for compensation for different teams across the funnel.

Our chief revenue officer always bridles when we use the word oversold! I think that a lot of times customers don't understand the complexity of what they're trying to achieve and then fail to execute on that.

We've been on a journey this year. So our CSMs and CSEs historically were on a corporate bonus structure. We've seen in the shift to consumption that actually everyone is aligned to incremental consumption growth.

So net retention of consumption, gross retention of consumption are very important metrics for us. And we use net retention and gross retention across a number of leading indicator metrics that show us that the key metrics are users, learners, logins. If those change, then it has a downstream impact on consumption. But we've now aligned everyone on consumption.

So we do have some specialist roles within the organisation that have tweaks within that. So maybe their job is to help customers really understand Gen AI. So there might be a little tweak there, maybe their job is to onboard new customers, might be a little tweak there.

But fundamentally aligning our entire go to market on one compensation approach, you can feel it walking the halls. It's really changed everyone's perception of what they need to do. It aligns everyone to the North Star, working together to make sure that the customer is enabled and has the capabilities to not have surprises because the customer doesn't like consumption surprises.

When consumption goes out of control, it might look good for us on the day it happens, but actually it causes problems for us. So the more we can do to enable people to have control, and I think we look for kind of steady revenue growth, efficient revenue growth that's good for the customer and that's good for us. And it aligns everyone on the same comp plan.

I think there's a discussion to be had around how you're evaluating how well you're doing on all the key proxies for customer value. So of course, net revenue retention, gross revenue retention, NPS, customer lifetime value, there are various proxies you could use to evaluate performance against specific targets.

How do you stack rank between some of those metrics and maybe others when you're deriving the targets for the teams at the heart of it?

The revenue metrics are always super important, but we really try and understand upstream of what's happening within our customers. So I just touched on the previous question on users. So we look at monthly average users, we look at monthly learners, 90 day learners, we look at net retention, net consumption growth, but we look at it almost at a use case level rather than in aggregate.

We look at different cohorts’ behaviour as well, different business units. So we try and get some of the nuance into that as well, so we really have a good understanding of what's happening upstream because you can't fix consumption in a quarter.

You need six months, really. So we need to be much better armed to know what's coming than reacting to the events as they happen. So we have a lot of metrics there that we look at, a lot of instrumentation that we look at to try and figure out what's going to happen.

And then as we've now shifted to more of a consumption model, we're really focused on identifying kind of stages in that pipeline because it's a different pipeline. The historical SaaS pipeline of lead to commit was very well understood and there are some industry standard metrics that you would aim for in terms of coverage and so on. Shift that to a consumption model, you're looking at projects with the same lens, but how many projects do you need in the onboarding stage to achieve that number with that customer? How do you think about that? So really trying to get to that level of understanding where we really understand truly what the pipeline is.

And then with all of those metrics and data, we want to be at a point where I touched on this before, management really understands that if this is here, you do this thing to move this lever to fix or adjust that. So really our executive team has the levers they need to maintain our commitments to our board and to our investors.

There's a component you touched on earlier, which is multi-product adoption and becoming more of a platform over time. How do you view the balancing act of increasing consumption of a single product and in parallel also driving new SKU adoption.

Yeah, I think that we might be a case study for this, given the amount of innovation, the product releases that have come from Databricks. I think every year we've had a new product even when we were really small. Delta was 2017/18, and that for me, was the first new product released in my tenure.

But then we followed up with MLflow, and we've moved on through DB, SQL, Serverless, Gen AI. The list goes on.

We know that customers need to build their lake house in a certain way, typically, and they tend to start with data engineering.

We tend to start with migration, because the customer can see the value they've got. This thing they're paying for today, it's inefficient, it's old, but they achieve business value from that. We can move you to a modern lake house architecture and get you to that point of value faster, cheaper.

So we tend to start a lot there, which would be Delta Spark, data engineering type workloads. And then we work our way up to find those incremental use cases that you can build on top of that data, or lake house if you like, moving more into machine learning, Gen AI, SQL type of things. So our teams really understand that and know how to build up from those core ETL data lands into adding new projects on top, but they know how to go the other way as well. Customers using Mosaic ML and the associated pre-training or fine tuning LLMs are somewhat unique in this context, so our team has had to adapt to this market demand as well.

And then oftentimes our customer success team are really engaged with customers in that delivery solution architect role or other sort of post-sales roles in the consumption world. They work super closely with customers on awareness and private preview access. So we have a very open engagement with customers.

Our product team actually ignore the field to speak to customers, which I think is a really healthy thing. So our PMs don't go through the account exec to speak to a customer. They just have a direct relationship.

I think that accelerates innovation and then we create new product for those customers and the product ships through the field to customers and then gets released. So there's a huge amount going on. I mean, at any stage, there are lots and lots of private previews in flight with customers.

And so I think the field team just naturally works in that way. But it's super critical. And I think we do see at the back end, if you look at our core product pillars, customers that use six of our core products tend to be growing faster in their lake house journey than perhaps their competitors or other organisations.

It's remarkable that you've had such a great velocity and such a product centric organisation.

We touched on some assumptions about whether customer success will exist as a real standalone function in the future, but as we transition business models where pricing is done against outcomes rather than seats, what are some of your biggest predictions for customer success in the future?

So I think that we touched on this with the first question. I think that we're going to see smaller, more dynamic startups be able to build an amazing company with 15 people. I think in doing that they'll be able to be really niche.

So where SaaS broke up monolithic software companies, I think you'll see this new generation chip away at the SaaS companies and break them up further. In doing that, what they'll realise is that, and we've seen this as you bring new things to market at the beginning, it's high complexity and you need an expert to really understand it.

So back in the day when we released Delta, there was one person who knew Delta better than anyone else in the whole company. And so he was the person you went to with Delta. Now everybody at Databricks and most of our customers know Delta inside out and we don't need that specialisation.

So all of the Delta knowledge is now self service and documented. So I think if you add AI into that mix, you'll see the specialists be able to kind of teach the model how to teach the customers or to simplify self-service into the product. So I think you'll see customer success being truly integrated from design into the product. That's how they'll compete, because they won't need a team - they'll be much more efficient.

Then I think we'll see more organisations shifting to consumption, even where consumption isn't a natural consideration.

There'll be a proxy for it in their business where rather than sizing and selling a certain number of licenses and they're trying to fill into them, I think that might shift on its head and it'll be much more of you sell what you need, get them successful. Sell what you need, get them successful. And I think it'll be more piecemeal in that regard.

Margin focus will force software companies to be more efficient in their customer engagements - one way to do this is to map customer outcomes, to tasks, to specialist customer facing roles with attribution (of value, revenue, impact) so the management can clearly see which levers to pull to drive what outcome with customers, and also which roles can be a scale/service model, and which are direct.

As a result of these shifts I think the traditional concept of pre and post-sales will become a footnote, and we will have a different “pipeline” view aligned to consumption with this focus on first project and then a flywheel of consumption expansion, where value is realised when each project is live but no real delineation of pre-sales and post-sales specialisation.

So I think that in the future the concept of commit SaaS models will have completely gone away and therefore the need for customer success as a function to secure that will go away.

Thank you, Nick.

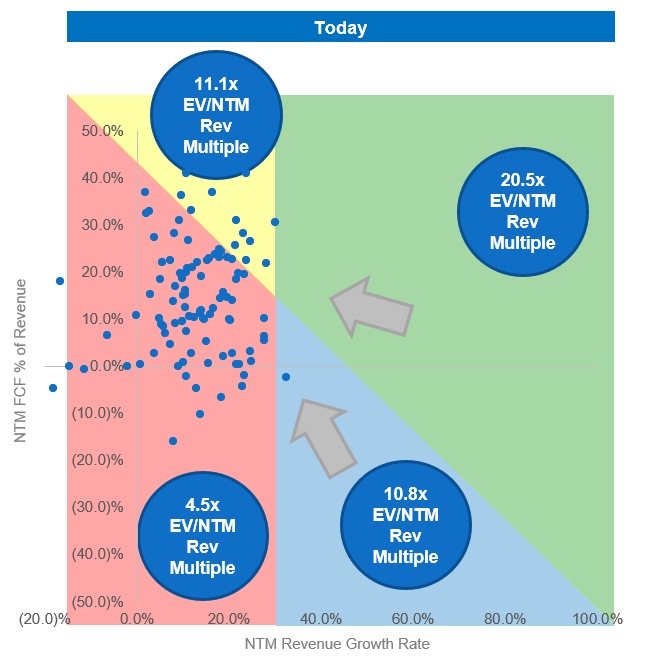

Charts of the week

In a drive for efficiency, growth has ground to a halt across the public software universe

Datadog among the lowest on quota attainment as they’ve gone multi-product - a DevOps focused GTM org has to adapt to sell to more personas

Reading List

Where Have All the Green Dots Gone?

Improving LLMs: ETL to "ECL" (Extract-Contextualize-Load)

A few "Sell Work, Not Software" updated thoughts

Model commoditization and product moats

Quotes of the week

‘Cybersecurity is a difficult business. CISOs and the practitioners (SoC teams) have very different priorities than DevOps and operate in a completely different world for the most part. Just because they might use internal teams to solve their logging problem, doesn't mean the same thing as seeing you as a viable vendor for mission critical security applications.’

The Deal Desk

Thank you for reading. If you liked it, share it with your friends, colleagues, and anyone that wants to get smarter on startup strategy. Subscribe below and find me on LinkedIn or Twitter.