Mastering Solutions Engineering for Enterprise Sales with Zaki Bajwa, Snyk

Global Vice President, Solution Engineering @ Snyk, formerly of Stripe, ServiceNow and VMWare

Hey friends! I’m Akash, an early stage European software & fintech investor.

I write about startup strategy to help founders & operators navigate their company-building journeys from inception onwards.

You can always reach me at akash@earlybird.com to exchange notes.

Current subscribers: 3,930

Today, we’re covering an essential component of enterprise sales: solutions engineering.

Software GTM literature has largely focused on SDRs and AEs in pre-sales, when solutions engineers are often the true unsung heroes that help companies go upmarket into the enterprise. We’re very lucky to be getting a masterclass in solutions engineering from Zaki Bajwa, who has built world-class SE orgs at VMware, ServiceNow, Stripe and now Snyk.

Zaki brings 20 years of enterprise scale GTM experience at high tech firms like ServiceNow, Stripe and VMware with a strong background in FSIs working at leading financial firms such as DTCC/Thomson. He has built teams which consult with Fortune 2000 companies in the field of AI Developer security, digital commerce, designing and delivering scalable architectures for delivering amazing customer experiences. He enjoys building high performing teams to deliver business value to enterprises, highlighting customer examples and strategic roadmaps. He is based in NYC and is a NYer at heart.

Key Takeaways;:

Here are some of the main insights from the conversation, if you’re short on time:

Choose companies based on tailwinds, phase, and leadership. When you’re deciding which companies to join, assess what market tailwinds a company is exposed to. Decide what stage of company building allows you to thrive. Orient yourself towards leadership that has a track record of success.

Most sales happen between the 20 yards lines. Solutions Engineers (SEs) are instrumental to the enterprise sale, taking an introduction to a prospect from the AE through to contracting, proselytising tech stakeholders into champions in the process.

As you go upmarket, sales become more consultative. Enterprises demand prescription. How is this software solving a problem? How is this going to fit into our environment.

Solutions Engineers are the voice of the customer internally. SEs are at the coalface and are a well of rich insights on product-market fit, pricing, product cross-selling, and much more.

The AE/SE relationship is crucial. They have to establish trust and be able to divide and conquer accounts - the AE can win over the business champion, whilst the SE focuses on the tech champion.

Performance measurement is across pre and post-sales. Modern SE orgs evaluate SEs on pipeline activity, new business, but also upsell/renewal.

Technical product sales invariably become about business value. Even for highly technical B2D products, as you go into the enterprise the sales motion orients around business value.

Zaki, I'd love to start by asking what frameworks you used to decide each of your career moves and how you came to be the Vice President of Global Solution Engineering at Snyk.

Yeah, great question.

Coming out of college, you're lucky just to get a decent job, right? So that was my mindset. It's like, let me go land somewhere.

The funny thing is, I started as an actuary major and had a two year actuarial training program. After a month and a half into that program, I hated it - sitting behind a desk, analytics, data. It wasn't for me.

So I quit and went into Computer Science, which was my minor. Then, I got into a company called DTCC early in my career.

The one guidance I would give to folks early in their career is: go broad.

Go get a role that allows you to touch a variety of different domains so then you can figure out what resonates with you, what gravitates to you.

So that's sort of early in your career, but then specifically to my career, when I started to selectively decide where to move, I've always looked for three main things.

Number one is: is this company or industry leveraging the current market tailwind? Is the market tailwind behind them?

If you look at VMware in 2006/7, cloud was just starting off. Without virtualisation, cloud would never happen. So market tailwind at the time was cloud.

Then in 2015, the whole world was moving to the SaaS subscription model - ServiceNow captured that whole SaaS tailwind.

And then in 2021, when we were in the middle of COVID, the whole world was moving to digital commerce. I was always looking outside in - what does it mean to buy a car on your mobile or order a cup of coffee? What's happening in the back end? So the tailwind at the time of COVID was digital commerce, right? That was Stripe.

And then likewise, when I got to Snyk, it's all about what tailwind is Snyk leveraging: it's AI security. The whole world is leveraging AI. Now, how are you going to secure that?

So cloud, SaaS, digital commerce and then AI are all market tailwinds that you don't control. With the companies you're looking at, you need to have an honest conversation with yourself to say, is that company going to leverage that market movement as a tailwind?

That's step one.

Step two is: Phase Two.

In enterprise software, we call it phase one, phase two, phase three, phase four. Phase one is zero to $100 million in revenue. Phase two is $100 million to a billion. Phase three is a billion to $5 billion, and phase four is $5 billion plus.

There's only been 15 enterprise software companies that have made it to phase four+. 15. You know the names: Adobe, Oracle, VMware.

So I am not a phase zero/one person. I'm also not a phase five person.

That's one of the reason why I've left every company I've left: they're too big. So I’m a phase two person - where you look at a company that has the aspiration and the potential to get from $100 million to one, two, three, four, five billion in revenue.

I need some level of foundation with a potential for growth, and if I see it, I jump into that - because that's where I can bring the most amount of impact.

The third one is, you have to believe in the leadership team you're working with at each one of those companies.

When I looked at the founders of VMware: super intellectual, great engineers, they knew the product better than anyone else.

Then you go to ServiceNow - folks know Frank Slootman and his leadership team and what they've done in the past, what they've done since.

The Collison brothers, they speak for themselves.

And then likewise here at Snyk, you look at Peter and the C-suite that he has with him. They've done similar execution at four other companies before, successfully.

As they say, people follow people - just like I've had folks join me at various companies throughout their careers, I make sure I'm working with leaders that I believe in.

So those are probably the three main things that I look for when I'm looking at a new opportunity.

Thanks, Zaki - it's clearly worked out amazingly so far.

Let’s dive into the subject matter - a lot of our readers wouldn't have studied the role of solution engineers in enterprise sales. As a kind of primer, could you outline what the role of solution engineers is in a typical enterprise sales cycle.

Yeah, I think it's a super critical role for various reasons.

If you look at the value chain of the sales cycle from:

How do we get in front of clients and discover what their business needs are

What their business pains are

What their requirements are

Being empathetic to those customers, not just from a business value, but also a technical value

That's phase one of any good enterprise sales motion.

Second is, once you understand their needs and wants, how do you then design the right solution for them based on their needs? What works for them? Where do they get the most ROI?

Third is, once I've defined that solution, I need to make sure internally that I'm aligning and promoting that solution to all the different stakeholders.

Then you transition from pre to post-sales - here's the value it's going to give you, now let's get it embedded in your environment.

Then the last stage is how do we realise that value in terms of upsell, cross sell, renewal.

If you look at that value chain, SEs have a role to play in each one of those.

To use an american football analogy, most of the sales, happens in between the 20 yards, right? So first 20 yards is where the introduction happens, and the last 20 yards is where the procurement and the contract happens, but the main execution is in the middle. That's where the SE comes in, where they're building a tech champion.

They're making sure there's vision alignment, they're making sure there's solution alignment. There's realisation of ‘how do I get this deployed, how do I get to value?’. SEs own the tech champion relationship which is critical for this middle phase of the sales cycle and, just as important, 90% of future customer references will be done by these tech champions.

To expand on the importance of the SE in the enterprise sale, do you see a sort of spectrum where SEs become much more important as you increase ACVs and solution fit starts to matter more?

Yeah, I think you're spot on there.

There's a couple of aspects there, especially as you get into the enterprise sales motion. The reason Fortune 2000 companies interact with SEs more is that they want SEs to really guide them, consult them, prescribe for them.

In our case we have 3000 customers - customers want to learn from other customers. They want to know ‘what have you done with others that I can learn from?’ Where have they succeeded, where have they failed?

In enterprise sales motions, that consultative prescriptive approach is not only what SEs bring to the table, but our customers are requiring us to bring that to the table.

Most enterprises struggle with:

‘I can take your product out of the box, but now I need to configure it or potentially customise it to my environment’.

What is your guidance there? There's no playbook for that. This is where the SE, knowing that environment, really has to guide the clients to say, ‘here's how you configure and customise to your needs’.

So one is prescribe, the second is helping them configure and customise.

Then the third one is more of an internal value to the company - the SE is almost like the canary in the coal mine for a company.

What I mean by that is, how do you determine if:

My product market fit is working

If my pricing structure is working the right way

If my packaging structure is the right way

If I'm doing multi-product sales, whether my ‘better together’ motion is working the right way

When do I go and build a specialist sales team versus overlay sales team versus a core team?

How do I engage partners?

How do I engage the ecosystem?

So all of these aspects of a true go to market, the SE sits right in the middle of that.

Meaning if you're launching a new product, the SE team has a nose to the ground and they can tell you whether product market fit is landing, if pricing is working.

‘You need to tweak that model. Packaging, let's make it better with this other product.’

So that's what I mean by value to the company - it’s that interlock of an SE with all of these other functions: marketing, finance, pricing, packaging, training, enablement, M&A. That's where the SE really shines if they do that well.

One's value to the client, but the other is value to the company as well.

I think that voice of customer is so underrated.

I've seen some benchmarks on how AEs and SEs can best collaborate to yield higher ACVs and win rates, and what a culture of strong collaboration looks like.

But for many readers who won't be familiar with the role of SEs, as you've outlined with us, could you share some best practices of what AE/SE collaboration should look like.

Yeah, the SE and AE should be completing each other’s sentences.

I always tell SEs that if you're in the same meeting with your AE 80% of the time, then you're doing something wrong. You should be able to divide and conquer.

Whether they’re talking to executives and you're talking to technical champions or vice versa, that's the sort of relationship they should have.

AEs take a client to a vision match in an early sales cycle with executives. The executives, a lot of times, are going to lean on technical champions or CIOs, as we were talking about earlier.

That's where the SE needs to get that mind share while the AE is getting more senior exec mind share, and then bring those together. That's the divide and conquer I'm talking about.

Then that follows through the entire, not just sales cycle, but delivery, success, renewal, expansion, et cetera.

I think that's where:

a) The relationship is super important

b) You should be fairly independent.

But that requires a level of trust, a level of execution and success for you to say ‘I trust you to go have that conversation while I go have this conversation’.

So forming that trust early between those two is super critical. Then, deciding what is your strength? What is my strength? Where do we come together, where do we go apart and how do we continue to go along that?

I always tell people in a AE/SE relationship, there's three levels of strategic planning you need to do.

There's a regional plan - so if you're tied into the UKI market, what is your regional plan as an AE/SE team to go after that market? Your top accounts, your partners, your ecosystem vendors: how are you going to bring all that together?

From there you get into the specific account plan. So say Tesco is a customer of yours. What's the account strategy for that account? Go build that out together. Once you define that account strategy, number three then is the five opportunities that exist in that account. So you go from regional planning to account planning to opportunity planning.

And this is where the role of the AE/SE is so critical, where they have to come together on those plans and be able to execute them both independently as well as together.

You touched on the other stakeholders that SEs would eventually channel insights to internally, like on pricing and marketing. Could you just expand on that a bit and outline all the stakeholders typically that the best SEs would interface with.

II think it all starts with pipelines in any sales org - business development. This is working with sales and marketing on pipeline activities and productivity. Whether it's events in the market, whether it's one to many workshops, webinars, or thought leadership exercises. The measurement there obviously is pipeline that goes quickly into deal progression, and stage progression into customer engagement.

You can measure that through the aspect of closed/won business.

Second is all around customers obviously being the key stakeholder.

Third is, those learnings. Back to your point on learnings from the field, how do I now bring that back to the product?

Product Management, Product Marketing, R&D, even Finance and others that are going to learn from that. So those are the cross functional partners that you must engage with.

Fourth is enablement: how do we enable our sales teams or SE team or professional services?

Next one is talent: here's what we're learning from our clients, from our marketing endeavours, from our enablement of our peers. Here's the type of talent we need to go either build or buy. In this context, buy means let's acquire them, and then build means here's how we train our early in career folks into this kind of capability.

Then the last one is our biz dev or M&A function. SE team and leaders play an enormous role in both organize and inorganic expansion through providing customer feedback on what gaps we need to fill in our product strategy. If it’s through an acquisition than they play a major role in due diligence to full assimilation of the entity.

With a lot of roles that are not quota carrying, it can feel like performance measurement isn't an easy exercise. So how do you think about the KPIs that should be used for SE performance measurement?

So there are probably three main ones.

One is pipeline development - pipeline generation, business development.

Second is obviously closed business - at the end of day, we're primarily a pre-sales function.

Third is actually renewal and upsell.

If I just pause at those three and dissect those further.

So pipeline is not just top of the funnel, but how are you progressing the stages of the pipeline? What are you doing uniquely as a SE function to do stage progression? Helping marketing, helping sales, helping inside sales. So one is all around pipeline progression and how you measure that for SE productivity.

Second one is deal closure, but deal closure is a very good lagging indicator.

There's a lot that needs to happen for you to get there. Are you doing more PoCs, or are you doing more workshops that are more consultative? And as a company matures in product maturity, your POC to workshop ratio has to go down.

Less POCs and more workshops, because you start to get more consultative. As an enterprise sales leader, to go from a phase two company to a phase three and four, you need to get much more consultative and prescriptive.

In my second metric of deal closure, I look at how those deals were won. Were they won with just showing the product all day long, or were they won with me being highly consultative and prescriptive through workshops and other such events?

Measurement number three is in this consumption utilisation based model.

In the world that we're in the days of pre and post-sales is gone.

That's where the last metric of NRR renewals or upsell comes into play. What role is the SE playing to make sure that customer not only goes live, is getting value, but then is potentially acquiring more to expand the value that they're getting.

A lot of SEs end at ‘hey, deal done, here you go.’ That's where a lot of struggles happen. And I've had that struggle at VMware, ServiceNow, Stripe and even Snyk.

So, how do you get them past that point, especially in this environment where new bookings aren't easy to get by and expanding your current customer and retaining them is so important. Every enterprise company today is facing both a top line revenue growth challenge and a retention challenge. Every company is facing that, irrelevant of what they may be telling you.

Given these ways of measuring performance, how do you think about compensation or incentivisation?

Back to those three measurements of pipeline, new business and renewals and upsell.

You have to align SEs to that, specifically the last two ones; we are playing a role in pipeline progression, but pipeline creation is one area you can measure. That's typically the marketing, sales and partner teams are focused on that and measured on that.

If you go to new business and then renewal/upsell, those are measurements that we put in place for SEs. And the measurements are going to differ by the size of the company.

So say you're an SE in EMEA, you may be measured on the EMEA number, then you may be measured on the UKI number, then you may be measured on FSIs in UKI.

The focus starts to really narrow down as the company matures.

Ideally you want targets to be tied to a finite number that you can measure and hold people accountable for, and allow them to either hit or beat that number. I'm not a fan of every SE being measured on a wide number, because then it's a much less of a meritocracy.

My goal has always been: let's get to a finite, targeted focus. If an SE is supporting two SEs or three AES, let's get them aligned to that number and hold them accountable for that.

Ideally, a more refined, finite quota is better for higher accountability and a better chance for them to earn more due to having a core focus.

Given that renewals can play a big part of performance measurement, how do you see that attribution split between Customer Success and SEs? I can see how SEs and AEs work together in pre sales as a really close alliance, but does that same alliance apply then in the post sales?

The ratios will differ a bit. If you look at one example of variable comp, 60% of that is tied to new revenue capture for that team that you're part for, that AE/SE team that you're part of.

Of the remainder, 20% is renewal and then 20% is the regional number that you're aligned to, also net new.

So I’m incentivising you on 20% out of the total 100% on renewals - but for a CSM, it'll be the opposite. 80% should be on renewal and 20% should be on net new.

Renewal is a leading indicator for net new if done right. In my case, net new is potentially a leading indicator for renewal, but I have to get net new first.

They both have a shared incentive. Back to my point on like pre and post-sales, they both have a shared incentive.

Now no one can say I don't deal with renewals, I don't deal with net new. They both do, and they need to work together to make that happen seamlessly. A lot of companies struggle with that balance and trying to get that model tweaked the right way.

The final question to ask here is: if you were to give an answer on how the importance of an SE org might vary by different dimensions, like whether it varies by the technicality of the product. Do you think that is a key dimension? If not, do you think there are other dimensions that you can measure the importance of an SE org by?

Generally, if you go category by category, I think less about the product or the technical depth of the product.

For example, we sell to developers a security product.

Those are two very special domains where I need technical people to go have that conversation. But then as a company grows and you realise you're going to go more and more upmarket and your product isn’t a PLG product. PLG is: developer went online, opens a free account, and then we upsold to them. We hardly did that at Snyk.

We've always gone into the CISO or the VP Engineering. The more you go from these practitioners of developer security to more executive, you have to start to really get to that consultative, prescriptive world. So the point is, the higher up you go in a segment, whether it's Fortune 50 to Fortune 500, Fortune 2000, the Russell 2000, the higher up you go in the client categories, the more you're going to need business and technical specialists coming together to share with customers the best practices of others that they can learn from and adopt.

So it's less about the product depth. I've had super technical products at VMware that we then eventually sold to the CIO as a business value outcome or personal value outcome. Same with ServiceNow.

‘This is cool, I can do my front end portal and the bells and whistles of tables and forms’. We sold that as a business workflow engine, helping you do your innovation much faster. Same with stripe.

Stripe went from ‘I can easily talk to a developer all day long on the intuitive, natural, ease of use of our APIs’ to telling a CFO how they get faster top line revenue and better unit economics with developer productivity and quantify that for them. So you go from this technical value to business value.

And same here at Snyk. We're talking about AI, where we're helping customers innovate faster while being secure. I can quantify that for a CFO or a Head of Engineering.

One is the level of companies that you're selling to, two is the different personas that you're chatting with, and three is you want to go from this technical value to business value. In all three of those movements is where the SE really comes into play.

Yeah, I think that's an amazing point that all starting roads lead to similar destinations as you go up market. That you have to combine business value with technical value.

Stripe, early on, didn't need SEs.

They have the best PLG engine in the world. A developer goes online, they look at their API, they open a Stripe account, take the APIs, plug it into the ecommerce environment. They make money, Stripe makes money.

But now Ford that wants to design a customer app where you can reserve a car, customise a car, buy a car. The intricacies of that architecture, that guidance is where the SEs come into play. It's no longer about ‘just take my APIs and plug it in’.

So it's that business initiative, business outcome. You know this, every industry is being disrupted by newcomers. I was just talking to someone at another car company and they were worried about what Tesla is doing to them.

We know retail, Amazon did this ten years ago. Pharma, you have new disruptors. Telecom, there's massive innovation. Fintech is disrupting banking, right? So every industry is being disrupted.

Those executives want to know, ‘how do we innovate faster, how do we do it in a much more secure manner?’ So that's the guidance they're looking for from us. And that's where the SE comes into play.

Zaki. That's a master class in solution engineering.

Thank you for doing this.

Charts of the week

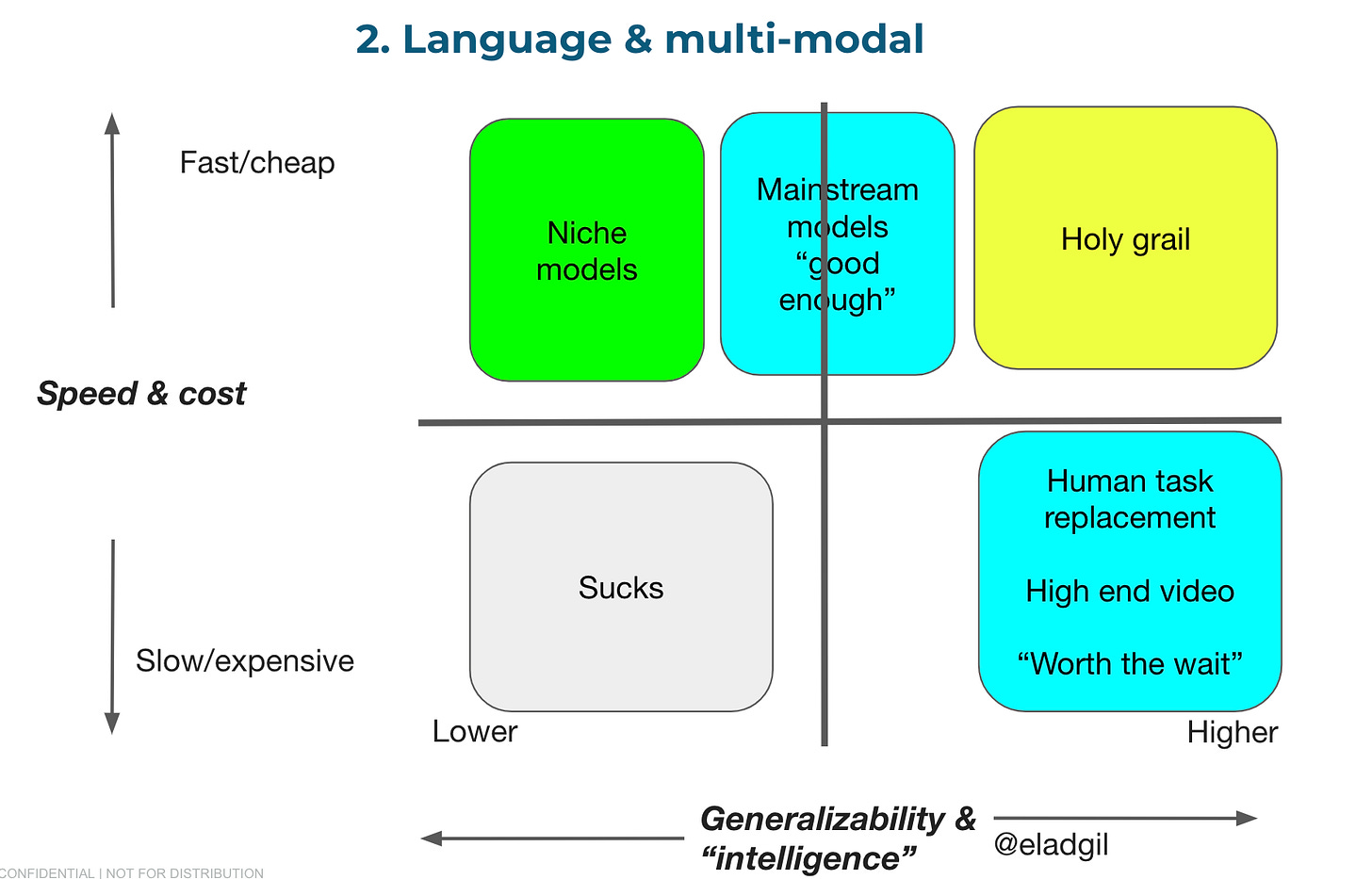

Foundation model taxonomy

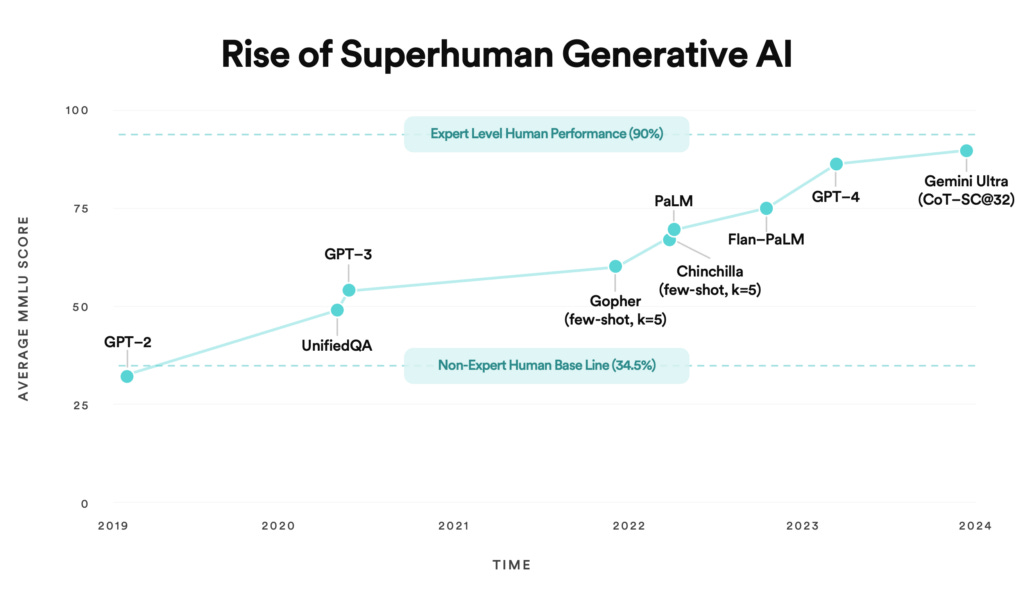

Rate of model improvement is astounding

The Goldilocks Zone of Supply driving Demand in a marketplace

Reading List

Legaltech x AI: The Lightspeed View Lisa Han, Lightspeed Venture Partners

B2B Product-Led Growth Non-Negotiable: TEAM Network Effects

Small Differences and Consistent Compounding Alfred Lin, Sequoia Capital

Every time OpenAI cuts a check for training data, an unlaunched competitive startup dies. Without a ‘safe harbor,’ AI will be ruled by incumbents. Hunter Walk, Homebrew

Why 2024 Will Be the Year of Inference

Founder Market Fit Clint Sharp, Cribl

☁ $DDOG: Derisking the Growth Story

The Best Way to Drive Demand in Marketplaces is Hiding in Plain Sight

Quotes of the week

AI caught everyone’s attention in 2023 with Large Language Models (LLMs) that can be instructed to perform general tasks, such as translation or coding, just by prompting. This naturally led to an intense focus on models as the primary ingredient in AI application development, with everyone wondering what capabilities new LLMs will bring.

As more developers begin to build using LLMs, however, we believe that this focus is rapidly changing: state-of-the-art AI results are increasingly obtained by compound systems with multiple components, not just monolithic models.

In the enterprise, the sooner you come to grips with the fact that the product does not, and will never, sell itself, the sooner you can start down the path of learning the critical skills required to sell your product.

Clint Sharp, Cribl

Thank you for reading. If you liked it, share it with your friends, colleagues, and anyone that wants to get smarter on startup strategy. Subscribe below and find me on LinkedIn or Twitter.