Welcome to the 50 new Missives subscribers who joined us last week!

If you aren’t subscribed, join 1,700+ founders, operators and investors for weekly missives on software, fintech and GTM strategy by subscribing here:

Your feedback is the most rewarding part of writing Missives, and so I’d like to get your input on an additional section for interesting articles, threads or reports I’ve read that week (like the one at the bottom of today’s edition).

Early stage founders have to process noisy data when making critical decisions on product roadmap prioritisation and customer selection. When sales is founder-led, the tight relationship between the founder and customers generates a torrent of information for a founder to process when making these decisions.

In a higher cost of capital environment that rewards capital efficiency and top-line growth, the bar for investments in product and GTM has gone up - founders need to stay focused and invest wisely.

Customer segmentation and the Ideal Customer Profile (ICP) underpin effective capital allocation in product and GTM. Mapping a product's value against different segments helps determine which investments in product drive the highest return, whilst precise articulation of the ICP equips the GTM org to scale customer acquisition.

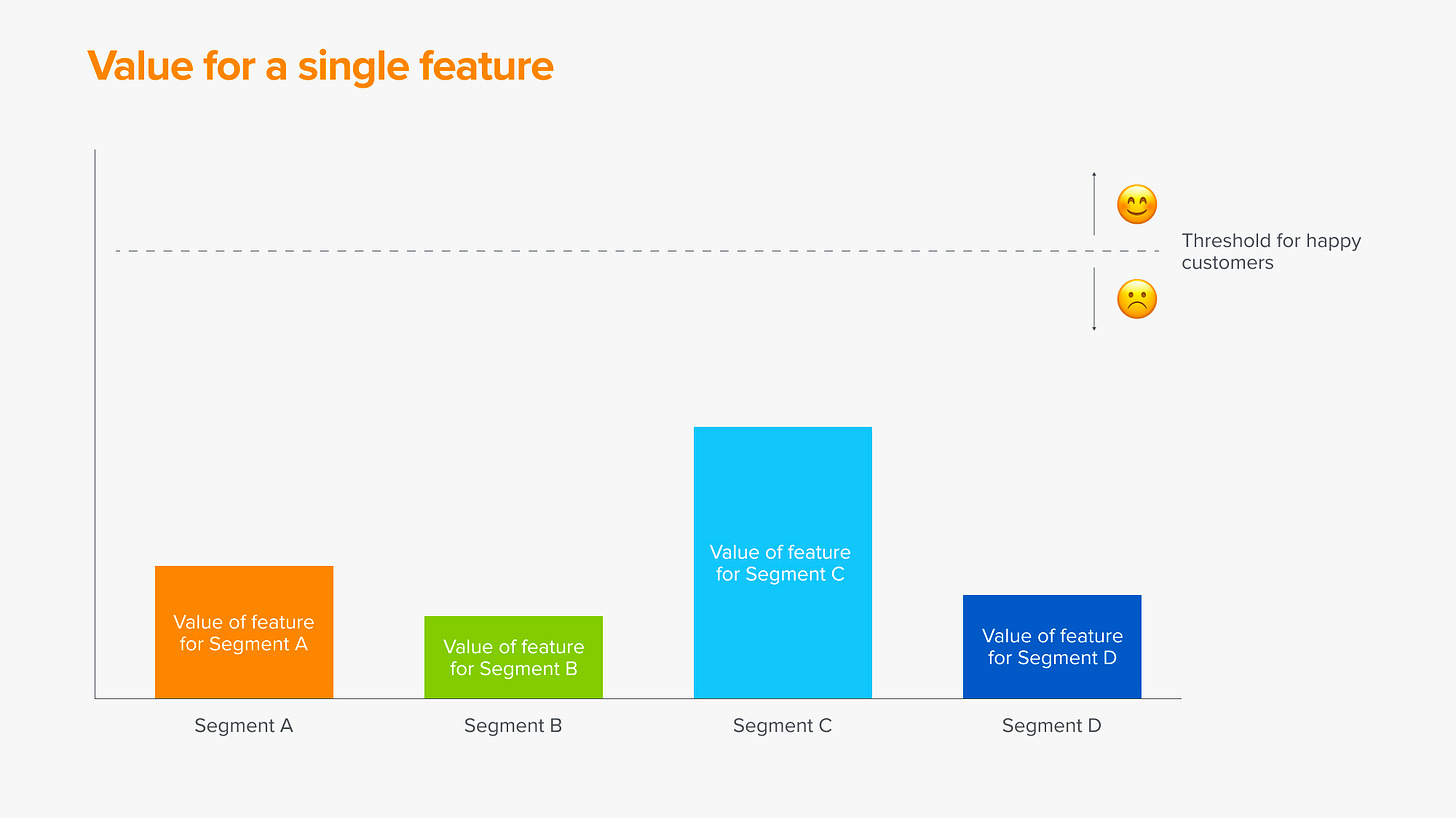

Pricing expert Madhavan Ramanujan described segmentation as understanding how your customers' needs vary and packaging accordingly. Conducting a needs-based segmentation of your customer base will provide insights on which feature have an outsized impact on customer happiness.

Segments can be sliced by use cases, value derived from the product and buying process. Information must flow freely between the Product and GTM teams in order to have a real-time pulse for each segments' perceived value of a proposed feature.

The guiding principle for feature prioritisation is whether the proposed feature elevates a segment to happiness (or bliss). Customers that reach a state of bliss are going to champion the product internally and externally, driving healthy NRR and top-of-funnel growth, and tight feedback loops for further product investment.

The next step after the segmentation exercise is to define the ICP and apply it as a filter for feature requests and customer selection.

The ICP has to serve three purposes:

The ICP should enable me to identify a good prospect quickly.

I should be able to simply convey the ICP to someone else in such a way that they can find other ICPs.

The ICP should be defined so systems can be built to identify them.

Reaching the right level of granularity is key, as erring too far will either act as a rate-limiter for acquisition channels or be too vague to be an effective filter. This is all the more important at the transition point from founder-led sales to a sales team.

“Segmentation is not enough,” says Asonye. “A vague ICP is ‘Series B technology companies.’ An extremely detailed ICP has the company stage, company industry, buyer persona, current solution, and potentially, trigger events too. ‘Companies who are experiencing X, who look like Y, who have previously tried these three solutions and need the product to do A, B, and C ’ is a good starting point.” Meka Asonye, formerly of Stripe and Mixpanel

Former Okta CPO Eric Berg noted the importance of the ICP as a guiding principle for product investments through the company's growth from seed to IPO:

Very early on, there are going to be things that you’re going to build specifically for customers to get them live. But as long as you’re constantly interacting through your sales channel or marketing or customer advisory boards, you’ll get a good sense of what the larger representation of your ICP needs, and whether those specific features are aligned to that roadmap

Clearbit have demonstrated the value of ICP refinement in their data-driven GTM motion; after conducting a segmentation exercise, Clearbit used an ML-based tagging system to qualify company descriptions against the stated ICP, thus filtering for high-signal leads.

With a precise definition, marketing can triage channels to drive high-intend leads to the top-of-funnel (TOFU) SDRs and BDRs would hand over ICP leads to AEs to convert, before CS would take over and farm these accounts for expansion. This is all table stakes, but channeling these efforts towards ICP accounts has a compounding, downstream impact on acquisition and retention metrics.

Everyone in your company should share a common understanding of who your customer is. Erica Schultz, Confluent

Segmentation and ICP refinement is an iterative process; Retool founder David Hsu took a hypothesis of their ICP and stress-tested it before landing on a precise definition that oriented product investments and scaling of the GTM org.

Barr Moses, CEO of Monte Carlo, continued to track the ICP even as the company scaled:

I’ve never seen a company before track the percentage of new bookings that belong to the ICP the way Monte Carlo does. Barr’s narrow scoping of the customer persona limits the product roadmap scope setting up the team for success, focuses the GTM teams’ efforts, and spins a flywheel of more repeatable processes ever faster.

When executing a category creation playbook, inventing the ICP is part of effective product marketing; dbt labs created the ICP of analytics engineers, for example.

The headwinds facing software place more importance than ever on allocating capital in service of specific segments and the ICP. A product suite strategy for TAM expansion is still part of the platform playbook, but should follow after sufficient penetration of the ICP.

Interesting Reads

Product Led Sales Benchmark Report

Just as pricing is no longer simply subscription or usage-based, GTM is no longer just PLG or sales-led - hybrid motions are far more prevalent, combining the best of both. This report covers this and much more, including data on how best-in-class companies compensate their GTM org under a Product-Led Sales philosophy, using human touch-points in the acquisition and expansion journey, and the creation of a new PLS role.

Datadog: The Archetypal Example for SaaS Product-Led Growth

Aakash Gupta covers Datadog’s founding story and subsequent zero-to-one product and growth journey in intricate detail. Given that Datadog is one of the best performing cloud companies around at the moment, this is well worth a read.

How Cheap a Product Can You Have And Still Have Salespeople?

Jason Lemkin dives into the maths behind what ACVs can justify an outbound sales organisation. This is a grey area that few founders and investors have measured with this level of precision.

Get Ahead Of The Future: An Interview With Amjad Masad

Fascinating interview of Replit cofounder Amjad Masad on the coming obsolescence of large swathes of the white collar population and the implications of Copilot for 10x engineers.

How CFOs build a Goldilocks "just-right" budget

Budgeting exercises are just behind us, but with the headwinds ahead it’s crucial to continue refining the budget in order to reach the ‘Goldilocks’ zone of being within reach but setting the right aspiration.

Thanks for reading. Please subscribe, comment, and share if you enjoyed this piece and want to receive more missives on software and fintech strategy. As always, please reach out if you want to have a chat about today’s post or any previous ones - you can find me on Twitter too!