Refining the ICP with David Apple

Ex-Head of Sales and CS at Notion and VP CS at Typeform discusses how to discover and iterate on the ICP

Join 1,900+ founders, operators and investors for Missives on software, fintech and GTM strategy by subscribing here:

Today’s post is the first of many interviews and guest posts to come. If you enjoyed today’s piece, please share it with friends, comment and subscribe!

Today, we’re speaking to David Apple. David was the first Head of Sales and CS @Notion, GM US and VP of Sales and CS @Typeform, and CRO @Zingtree. David is currently taking a sabbatical spending most of his time making angel investments and being an advisor to early-stage B2B SaaS start-ups.

A few weeks back we discussed the importance of focusing on your ICP and segmenting your customer base. We’re lucky to hear how David has approached this at Notion and Typeform to great success!

You can find David on LinkedIn and Twitter.

Akash: In a previous presentation you gave at SaaS School, you talked about the importance of customer interviews and surveys in defining your ICP. For early stage companies that haven't yet nailed their ICP, what are the ways founders can get maximum value out of these qualitative customer interviews - e.g. is it the data they should go into the meeting with the framing of the questions and using reference points to establish more objective data points, or having the right people join the founder in the meeting (e.g. product marketing)?

David: When the objective is to create/refine your ICP, the way to get maximum value out of customer interviews is to tailor your questions to learn about your customers' job-to-be-done (JTBD). I don't recommend spending much time talking about your product, but rather understanding what problem your customer hired your product to solve for their business. With that in mind, the themes of the questions I ask are:

How did they discover your product?

What initial problem did they want to solve?

What was the motivation to change from the pre-existing solution?

What was their “Aha” moment?

What was their decision criteria and alternatives explored?

What's their current use case(s)?

What do they love the most/least about how your product improves their business?

Have they ever considered leaving?

Akash: Given that founders typically go into these meetings with preconceived notions of customer problems, how do you iterate on different hypotheses?

David: While the majority of the interview should be non-leading open questions, at the end of customer interviews I like to add questions that test a specific hypothesis. For example, when I was at Notion, my initial hypothesis was that I should try to sell Notion to HR teams because their use cases were most likely to organically spread Notion across the entire company. I tested that hypothesis in my first dozen customer interviews and found that it was most likely wrong. For the next dozen interviews I tested other hypotheses which helped shape my Sales strategy to land our first Enterprise customers.

Akash: At Typeform your team managed to granularly define the ICP of Waldo by tracking retention data along different parameters like company size, location, title, use case and a few more. In your experience, how precisely should companies define their ICP (i.e. how many parameters)?

David: Defining an ICP is a critical step in creating marketing and sales strategies. While it's important to have a thorough understanding of your target audience, it's also possible to overcomplicate the process by being too granular and including too many parameters.

There is no fixed number of parameters that companies should use to define their ICP. To start, I recommend focusing on the 2-5 parameters that have the most significant impact on retention and revenue based on an audit of your CRM. When analyzing your CRM data, try to understand if customers from a specific industry or company size or geography are more likely to buy your product and/or more likely to have a higher LTV?

Akash: At some stage we’d probably see diminishing returns by adding more parameters?

David: That's right, there is a law of diminishing returns to keep in mind. Not only will too many parameters make your ICP unnecessarily complex, adding too many parameters will inherently exclude groups of potential leads which in turn can make it more challenging to generate leads and grow your business.

The key is to strike the balance between having enough parameters to define your ICP accurately while avoiding making it too complicated to execute your marketing and sales strategies.

Akash: Having identified the ICP, the next piece of advice we often hear is that the product roadmap should be oriented around the jobs-to-be-done and use cases for that ICP. To that end, what are some best practices for communication between Product/Engineering and Sales/Marketing teams for feedback from the ICP to be incorporated into the product roadmap?

David: Absolutely! The ICP should ideally become an alignment tool that is used company-wide. The best way I've found to influence Product/Engineering is creating a "Customer Voice" report/presentation. In our day-to-day operations, when we collected customer feedback we would also tag the feedback by customer profile. This means that when analyze customer feedback we can filter it by our ICP and help Product cut through the noise to address the specific needs of the ICP.

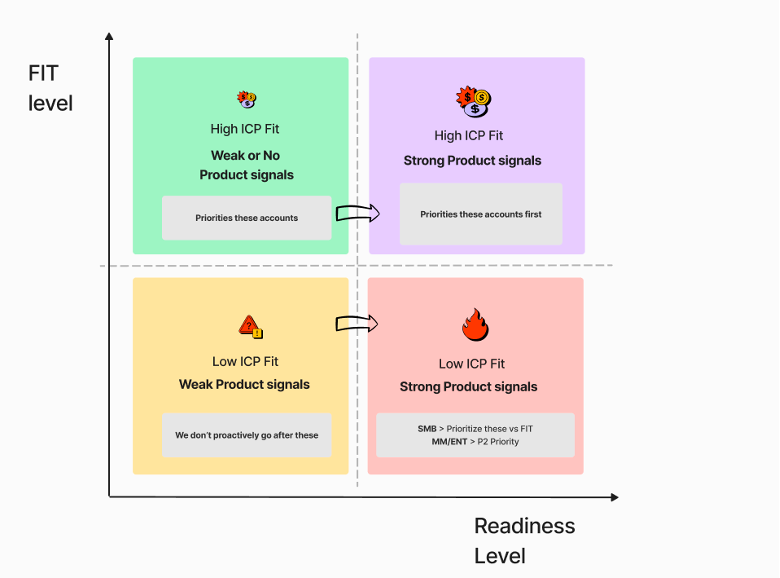

Akash: When it comes to prioritisation of leads, companies will typically develop a matrix with 2 dimensions - product usage and ICP fit. If your company is seeing more leads with low ICP fit but high usage, or high ICP fit but low usage, what would you recommend as the right steps to get as many leads as possible into the high ICP fit/high product usage quadrant?

David: At Notion and Typeform we had two sources of leads to prioritize: (1) new "contact Sales / demo request" leads, and (2) existing users.

When prioritizing new leads, we used a 2-dimensional matrix based on the anticipated initial deal size (i.e. how big is the expected initial deployment), and the potential longer-term deal size (i.e. the total potential ARR for the account).

When prioritizing existing users to proactively reach out to, we used a "PQL" (Product Qualified Lead) score where a user would get points based on their behavior, profile, and other criteria (e.g. how many other users with the same email domain are using the product). Once a user reached a certain PQL score they would become a Sales lead and we would proactively engage with them.

To answer your question: I always like to follow the mental model of "build it in a lab before you scale it in a factory". As such, in the scenarios you described of a consistent mismatch between ICP fit and product usage, I'd invest the time to speak with a dozen leads that seem to fall outside of what I thought was ideal (which is not scalable). Based on the learnings from those conversations, I would either iterate on my definitions of ICP fit / product signals, and/or iterate on my 1:many engagement to drive better adoption (which is scalable).

Interesting Reads

Retention Benchmarks and Insights From Studying Over 2,100 SaaS Businesses

Sid Jain at ChartMogul performed a comprehensive analysis on median and best-in-class retention rates along many axes like ARPA and ARR.

How Software Companies Can Get More Bang for Their R&D Buck

Value-based resource allocation is imperative as companies move beyond their first product; the advice shared here is useful for companies looking to implement rigour into their R&D allocation processes as product portfolios mature.

Don’t Settle for Less Than 100% NRR from SMBs (Updated)

Jason Lemkin recites examples of best-in-class SMB SaaS companies that have managed to avoid the NRR trade-off of serving SMBs (Bill.com at 131%!).

Startup Decoupling & Reckoning

Elad Gil provides a clairvoyant perspective on the reckoning to come for a large proportion of companies funded in the frothy heights of 2021.

The Bus Ticket Theory of Genius

As more observers become autodidacts in the context of the AI spring, this essay from Paul Graham on cultivating genuine interests is as timeless as ever.