Product Marketing as fuel for Category Creation

Defining a new category for your company is a useful strategy in this market

Of late, the tech echo chamber has been discussing a wide range of topics. Gone from the menu are the tired posts around lengthening runway and focusing on unit economics. Also now out of season are the threads around COVID-induced acceleration being a massive exaggeration, and that the new normal isn't so different to the one we had before, after all.

Recent rumblings are about category saturation, the venture asset class being too large relative to the returns it can deliver, and the eventual winnowing down that is necessary.

It's the first of those that we'll discuss today. Category saturation is the notion that most categories of SaaS are crowded and yet another entrant would simply be competing a race to the bottom on sales & marketing spend in an attempt to differentiate themselves from their competition. It's a pretty bleak backdrop to be operating in as a founder, especially if the external perception of your company is irreversibly tied to a category that falls into this definition.

The antidote to category saturation is category creation - why position yourself as a competitor to a vast array of incumbents and startups, when you can proclaim yourself as the creator of an entirely new category, with your company accruing the cherished position of the leader? This is a playbook that requires an intense focus on product marketing that is able to extricate your company and its supposed new category as far away as possible from the existing buckets that a prospective buyer holds. When done well, it can yield compounding advantages and moats that are very difficult to break down.

Market-Creating Innovations

'Market-creating innovations' transform complex and expensive products and services into simple and more affordable products, making them accessible to a whole new segment of people in a society who we call 'nonconsumers' Clayton Christensen

Although Clayton Christensen's most venerable work was of course The Innovator's Dilemma, his contribution to the study of the role of innovation in the growth of emerging markets deserves more attention. In The Prosperity Paradox, Christensen wrote about investing in certain types of innovation that create jobs for the local economy and ‘pull’ the required institutions for those innovations to flourish.

Market-creating innovations are the transformation of expensive P&L cost items into product lines that deliver a service in a cheaper, faster and better way - essentially, software eating the world writ large.

In Christensen's work, he goes on to describe how this type of innovation addresses entirely new, latent TAMs that were out of reach for the preceding paradigm. This is the sort of stuff that gets investors and founders salivating.

A new act of B2B Sales

The notion of anointing yourself as the leader of a new category has been executed to great effect by several exceptional B2B software businesses in the last few years.

Take Modern Treasury, a product that automates payment operations. The CEO Dimitri took to Twitter a few weeks ago to take stock of how his business has ushered in an entirely new category that has since seen significant venture dollars deployed across different geographies*.

Or let's take Vanta and its compliance automation suite of products. Vanta's core achievement of taking what was previously a manual, expensive and laborious outlay (SOC-2 compliance) and transforming it into a turnkey API fits Christensen's formula to a tee. As Mario Gabriele wrote in his excellent essay on the company:

Founded in 2017 by Christina Cacioppo, Vanta is the quintessential disruptor. It has axially altered the way companies prepare for security audits, reducing the timeline from months to weeks. It has also created a brand new category and changed the cost structure of an entire industry, lowering prices by as much as 90%.

The same formula applies for WorkOS and the problem of enterprise-readiness, Monte Carlo and data observability, Contentful and headless CMS, or Gainsight and CS... I'd wager that if you ran through some of the largest API-first B2B SaaS companies, you'd find this playbook at work in most cases.

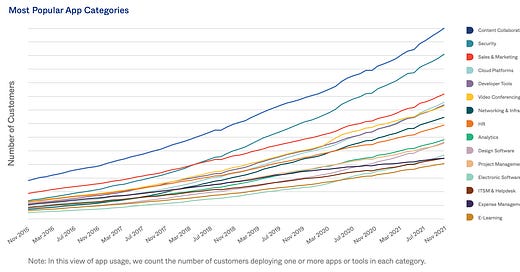

One rebuttal you could make is that all the categories have already been well defined. Let’s take Okta’s annual Businesses At Work survey, which charts app usage across their customer base.

Although there are 15 broad categories of apps mapped out, Okta notes that customers with over 2,000 employees use on average over 187 apps! As we’ve talked about before, best-of-breed point solutions always show a way of retaining enterprise spend even in times of budget cuts.

Let’s invert the vantage point and look at this from the buyer’s perspective. The typical enterprise buyer knows that he needs to procure software for each of those 15 broad categories Okta pointed out, but what he doesn’t know is the other problems the enterprise faces and which of those are distinct enough from the others to warrant its own allocation of their annual IT spend.

Make no mistake, it’s not easy to educate a buyer on the possibility of buying software for a set of problems that they were resigned to as perennial cost centres. The challenge is to enlighten the buyer on the impact a software product can have on various top and bottom-line parameters - i.e. it’s not only about cost optimisation, but also about upside in revenue, via faster GTM/product iteration/international expansion, for example.

Therefore, a key tenet of the category creation playbook is product marketing, a function with potential that remains largely underutilised.

Nailing the narrative

Product Marketing is slowly but surely gaining the recognition it deserves in the GTM canon. Europe in particular is lagging behind the US in having a well refined playbook for OKRs that acknowledge the value that Product Marketing Managers can drive and how they fit into the wider marketing org.

The task of crafting a narrative around a new category is precisely what a PMM is best placed to deliver. As Rory Woodbridge, Director of Product Marketing at Pleo wrote:

Crafting a narrative for your product - and giving other teams what they need to tell this story too. You’ve got to convey the value of your product to your specific target audience, in a way that makes clear the unique reason they should choose you over their current solution - and all the competition.

It all boils down to two core focuses of a PMM: positioning and messaging. These are core to the business and permeate every outward-facing function, as consistency in how you’re pitching yourself to the market is paramount to crystallising a new category.

Product marketing has to articulate a succinct message around the acuity of the problem you’re solving, why your solution uniquely addresses it (and that it’s inevitable that the buyer will need software for this in the future), and the tangible benefits they will attain from activating the product. To further convince a prospect, demonstrate your knowledge of the value your product will generate by giving them examples of ‘speed to initial evidence’ as part of the pitch, which speak to how quickly existing customers are engaging with the product and deriving value.

Once this messaging has been formulated, it needs to become the house line across the GTM org, right from SDRs to AEs to CS - this is key to driving word-of-mouth as your customers become champions to the wider ecosystem.

Another strand of this consistent messaging is the growth in content marketing - not just another company blog, but a destination for your customers to learn about the problem and your solution in more depth. Many of the great category creating companies excel at having a writing culture where different teams contribute posts to further educate buyers. Continued excellence at content marketing will eventually benefit from SEO and can drive both quality lead generation for customers and hires.

Category creation is a quintessential education sale.

Category leaders steal a march

Yes, it takes longer, but once you've carved out a new category for your company to reside in, the odds for renewal and expansion are in your favour as every potential competitor will be benchmarked against your company as the leader. Enterprise software buyers will invariably go for the brand that's best known for that category, very infrequently stepping back to assess the wider vendor landscape. Tomasz Tunguz captured this best:

I’ve watched buyers in new categories. They prefer the best known brand, the one synonymous with the category. They will work with the leader for a few years before deciding to re-evaluate if things aren’t going well, justifying a change with the attitude: “I’m working with the leader in a new category, let’s see how things evolve.”

In the current market environment, as the incessant stream of venture funding slows down, it’s less likely that companies will easily raise capital when positioning themselves as being differentiated from existing customers on marginal features. No one wants to back the horse that’s third in a race, whatever proxy you use to measure progress.

Defining a new category, whether that’s by addressing a truly greenfield market and problem or by serving underserved customer segments with a 10x better product, confers a story to your company in which you are the protagonist. Customers, employees and other stakeholders will continue to ascribe that category to your company for a significant amount of time, during which time you need to execute on finding product-market-fit and scaling to sustain that perception - but in the interim, the halo helps a lot.

Thanks to Pranav Sood and Ellen Humphreys for feedback.

Some additional reading if you’re interested!

4 Key Takeaways for Sales and Marketing from SaaStr

Marketing Budget for B2B SaaS – a CMO’s Guide