Outcome-based selling with David Wyatt, Aiven

Aiven CRO and former VP EMEA of Databricks, Mulesoft

Hey friends! I’m Akash, an early stage software & fintech investor at Earlybird Venture Capital, partnering with founders across Europe at the earliest stages.

I write about startup strategy to help founders navigate their company-building journeys, from inception to PMF and beyond.

You can always reach me at akash@earlybird.com if we can work together.

Current subscribers: 4,140

Today we’re speaking to David Wyatt, CRO at Aiven.

Thank you to Nick Cochran, last week’s guest, for the introduction!

David Wyatt is the CRO for Aiven, cofounder of Celero Ventures and advisor/investor.

His number one priority is empowering people to incubate, grow and scale successfully in a hyper-growth environment.

Having been first on the ground for some of the fastest growing and most successful enterprise software companies, he’s been fortunate enough to hire amazing human beings and build award winning teams, that have delivered phenomenal results and outcomes for all of those involved.

He has been the founder in EMEA twice for two of the top ten fastest growing enterprise software companies (Mulesoft / Databricks) of all time 0-400 people and 0-1000 people in EMEA with multi-billion value exits/IPO. In addition he’s turned around complex businesses and took them through M&A and business transformation, with triple digit growth and strong exits.

The Highlights

Optimisations are not behind us, but this is a forcing function for focus and termination of runaway projects, with the added tailwind of AI

Outcome based selling - akin to solution selling on steroids - started at Mulesoft and increased ASPs significantly, reframing the typical salesperson’s incentives in favour of delivering customer outcomes

Companies combining strong self-serve bottoms-up traction with the enterprise sales gene need to view the latter as ‘strategic partnerships’ and make their technology as easy to use as possible

David structures his teams with technical account managers that advise on projects - from beginning to end - and complement customer growth teams, who encompass all the functions that get customers to value

The Partner ecosystem is key, and it’s the responsibility of the vendor to equip partners with what playbooks they need for buyers to perceive the partnerships to come as part of a ‘strategic partnership’ with the vendor

Software sales has transformed over the last three decades in a consumption world to incentivise smaller lands and maximisation of customer value and projects going into production

A product organisation needs to be in sync with customers but a company needs to have a narrow vision to avoid becoming all things to all people

David, it's a time of mixed signals in the public and private markets. Net dollar retention and growth continue to decelerate, CAC paybacks are still increasing. At the same time, companies are more efficient now.

Earnings calls suggest the majority of optimizations in cloud workloads might be behind us. As we enter into Q 224, it'd be great to get your take on where we are in the market cycle.

I personally don't think the optimization days are that far behind us - I still think they're very much upon us.

If I look at the last fiscal year, every customer that we worked with was all about optimisation.

The interesting thing is the dynamic of where we're going with AI. There's a lot of hype around AI, but I also think there are a lot of positive things coming out of it. Directionally, businesses want to do more things.

They want to innovate, they want to accelerate, and they want to do things that are differentiating. And everybody's using AI as that lever.

The interesting thing though is that everybody thinks AI is the solution, but AI is absolutely useless without data, and what you put in is what you get out. One thing we champion at Aiven is high quality data harnessed into one single platform.

We are seeing a massive proliferation of open source technologies - as that extends out, what you're seeing is people are putting more data capabilities on these open source technologies.

I don't see optimisation going away, but I am seeing a proliferation of open source technologies specifically to manage data, because AI will not work without good quality, high volumes of data being managed in a platform.

The other key trend that we're observing is obviously post ZIRP, companies have had to become fitter, and that's also manifested in their go to market motions and how they've streamlined them. In your view, what were some of the excesses that we saw in the ZIRP era, and what have been the most successful efficiency drivers in the last two, three years that you've maybe yourself instrumented?

You had a lot of runaway projects. Everybody spun all these initiatives up and not every initiative was managed or measured or led to a strategic objective of an outcome that was important for the top line of the company.

I think what's happened is, as a byproduct of that, lots of companies have asked:

What's important to us and what's our major priority and focus?

There have been a lot of resets. Companies have narrowed their vision - we've done it too. You have to narrow your vision to what you're truly trying to be. What are your strategic objectives? What are the pillars and foundations that support those strategic objectives and how do you measure that with KPIs. The companies that are structured, managing and measuring what they do and where they focus, they're the ones that are going the right way.

You can look at public markets.

Ten years ago, nobody even looked at profitability.

Now you need to grow like hell. You have to have a really good rule of 40, you need to have strong profitability, you need to have good retention of your customer base. You have one of them fall off the line and your quarter goes out, the shareholders will pull you apart and you'll get a dip. Every software company is trying to beat and raise every quarter.

The hurdle rate for software purchasing has gone up - what you need to do to convince buyers to procure your tool. I know that one thing that you're driving at Aiven, but also in the past, has been outcome based selling. Can you elaborate a bit on that?

I was the first really to start doing outcome based selling. There was no such thing as outcome based selling when we started.

It's a very public, widely used thing now. It was founded at Mulesoft and it was by myself and a few great leaders, Matt Kilgus, Will Bosmer and Simon Palmer.

We were pretty small and we were struggling to grow. Our ASP was tiny. We were doing integrations - connecting A to B. We were very project focused.

We concluded that we've got to figure out how we get more strategic to the customer.

Then it was like an obvious lightning bolt that we need to figure out what the outcomes were of that business - which is solution selling on steroids, really.

We thought about what the outcomes actually are. But we didn't just think about selling the outcome. We said, how am I actually going to deliver the outcome? So we created two things.

One was outcome based selling, the other piece was outcome based delivery. Then we build a conjoined plan with the customer of how they're going to get to the actual outcome.

You see most salespeople in particular who close plans, and then they don't care about what the customer is trying to achieve.

With outcome based selling, you had a mutual success plan which ended in the customer receiving their outcome and working backwards from that. Then we'd implement a whole strategy and a formula of delivering those outcomes with a framework that the customer saw that would make their life a lot easier. We came with an operating model, we came with a technology, and we came with insight, best practices.

And outcome based selling was basically built around that framework. And the partnership with the customer was therefore much more strategic. The ASP went up by about 10x within months.

Frankly, that's how we took the company public and we did something very similar at Databricks and we're doing something very similar here.

I think we'll probably end up talking about consumption models in a bit, but I always say with consumption software, particularly in the data space, where you're trying to service the enterprise, SMB, mid market: there's no PLG motion or enterprise selling.

It drives me crazy when you see companies talking about PLG and tying it purely to SMB. PLG is about making it really easy for customers (developers) to access your technology.

Whereas enterprise selling is about driving more strategic partnerships so that those developers can be one of many inside a company, but also so they can maximise the value of a platform and share learnings, best practices and capabilities in the platform.

Many operators ask me the same thing when they're trying to develop a bottoms up community motion and at the same time develop that enterprise sales muscle, which is, as you outlined, the strategic partnership mindset.

Often these two cultures can be somewhat at odds. At least that's how we think of many other companies that have been started with a culture of bottoms-up motions that have had to digest that enterprise sales culture. Can you share your insights on how organisations can have both of these running in parallel?

PLG is an adoption capability where you're getting developers to use your technology. Simplicity is at the core of that. You want a developer to go on your platform, download your technology, use the toolkit on the platform and to be able to deliver things easier.

You want them to come back and back again. But you also want that developer to go and tell whoever is sat next to him or her, that this technology is really great, you should use it too. So we're trying to create great tools, best practices and capabilities.

You do that two ways.

One is that the technology needs to be really easy to use. It needs to be agile, it needs to be comprehensive, what they need to deliver their capabilities. Enablement is at the core as well. So you need to make enablement accessible. Give them the learnings, give them the best practices and share them.

Second is to make it frictionless. If you get strategic relationships with the customer, where that developer doesn't have to think about contracts or commercials, but they don't also have to think about education, they don't have to think about which partners to work with, because that gets provided with the partnership that they have with the vendor.

The other component is engagement. I know you spoke to Nick Cochrane and I think one of the things he talked about was customer success.

I kind of don't care if it's customer success or solutions architects, but having that adaptive capability where you've got expertise in the continued lifecycle of the relationship is really critical to success. And you know that if that developer gets stuck, they've got those best practices, they've got those learnings, they can call upon someone to advise them on the journey. The other part of it is being proactive with ideation. So getting in on projects at ideation stage and helping developers think about how to use the technology in a better way because that will make them more successful.

For consumption based models, we've seen many different best practices shared. These include having a land account exec and then a separate expand account exec, logo based quotas, removing the dichotomy between pre and post sales. Could you share some of your best practices and learnings on how to make consumption based businesses succeed in how they structure their go to market?

I've pretty much done it the same in the last few years. I've got someone who owns the engagement and that means the continued deliverables - I've called that person customer growth. It sometimes gets attached to sales, but it's not about selling. The customer growth person for me owns solution architecture.

We have technical account managers, but they are advisory on project deliverables, getting the customer successful, but they understand the technology, so there's no fluff. It's about actually doing critical things for the customer, but understanding how that maps to the technology as well. And that's really important.

And having that continued relationship where you're at the start of a project, the end of a project - there's always going to be another project. The relationship now is a series of projects - they become tied to a platform relationship.

At the core is the platform. That platform then needs to be surrounded by continued best practices and engagement. So I think the customer growth officer is critical to driving customer engagement.

Customer success, customer outcomes, enablement, all the capabilities and best practice sharing comes under that division and it's really important.

You also need to surround that with a partner ecosystem. And now today, the hyperscalers have got more power than you've ever seen before.

It's kind of interesting with the dichotomy of the different hyperscalers, but they have got a lot of power and are very central in the nervous system of most of our clients' DNA. So we have to work in tandem with the hyperscalers because we're cloud based only. Then the SIs, GSIs, RSIs, all those partners that work in that ecosystem with us and the hyperscalers.

That means repeating all the best practices and skills that you've got in your growth organisation upon your partners, because customers want partners that have those skills.

The other thing that we're doing now is we're introducing verticalization. We've actually got some very clear verticals which we're really leaning into. The next stage for us is developing industry templates and solutions, messaging capabilities that are repeatable so you can be a lot more relevant to the customer.

Are you a proponent of underselling initially, so that you can reduce friction, increase logo velocity, and then hopefully expand them by many multiples?

I am a proponent of land and expand.

I was born into perpetual licenses because I've been around a while, right? I am glad to see the back of those days of forcing customers into big deals from the get-go. Sales was quite an aggressive sport then. You're a lot more respected going into a meeting than you were 25 years ago.

25 years ago, people had spent a year and a half trying to close a big deal. That was the reality. Maybe twelve months if they’re good. And if you were really lucky, six months.

So you'd spend twelve months working a deal as a salesperson. Now the reality is in a consumption world, you can get a customer using your technology really quickly. Now they might spend five grand a month, but that's absolutely fine because then the job of the salesperson now is to understand the projects that the customer is trying to deliver.

They're going to understand what the customer needs to be successful. They need to understand the tools and capabilities they need. They need to know what best practices they need.

And they pull in the people around them to focus on customer success. Now the salesperson is not interested in getting their deal, running away, and buying the Porsche 911. What they're actually interested in is this continued relationship that never ends.

The behavior is different now because they're interested in the outcome of the customer. Because they know if the customer is successful, they'll continue to do well. And if I'm the customer, I want to know - my salesperson wants to make me successful.

We spoke to Nick about how Databricks’ product managers bypass the field sales team and speak directly to accounts to collect feedback. Another way that manifests is how many private previews they have in flight at any given time. So that's clearly one of the hallmarks of a leading product organisation.

What's your general take on how intertwined product and engineering should be with customers? In terms of the dialogue with customers (e.g. how at ZoomInfo they encourage all their engineers to join calls with prospects). How do you see that?

I think it's mission critical - you have to be customer obsessed, thinking about what they're trying to do and what they're trying to achieve.

A product preview is absolutely critical before you GA anything. Also, customer advisory boards are great sources of the truth regarding what the customer actually wants.

A lot should come from the field as well. Through enablement folks, through sales folks, through SEs.

But products and engineering should be reaching out to customers, should be engaging with customers, looking at trends and behaviours.

The only thing I would say as a caveat, is that companies still need to have a narrow vision because there's some companies that have reacted to every customer request and there's lots of them. They used to be really successful companies 15/20 years ago. Those companies now are hardly heard of. They're still ticking along, but they are limping along and they're still hanging on to install bases they've had for years.

They are trying to hang on to them by a thread and their customer attrition is terrible because they've built these product mothballs because they've reacted to every single customer demand. So you've still got to be narrow in your vision, you've still got to innovate, but you've got to prioritiSe.

And the way to do that is get feedback from the customers and see what the commonality and repeatability is.

*Aiven is an Earlybird portfolio company

Charts of the week

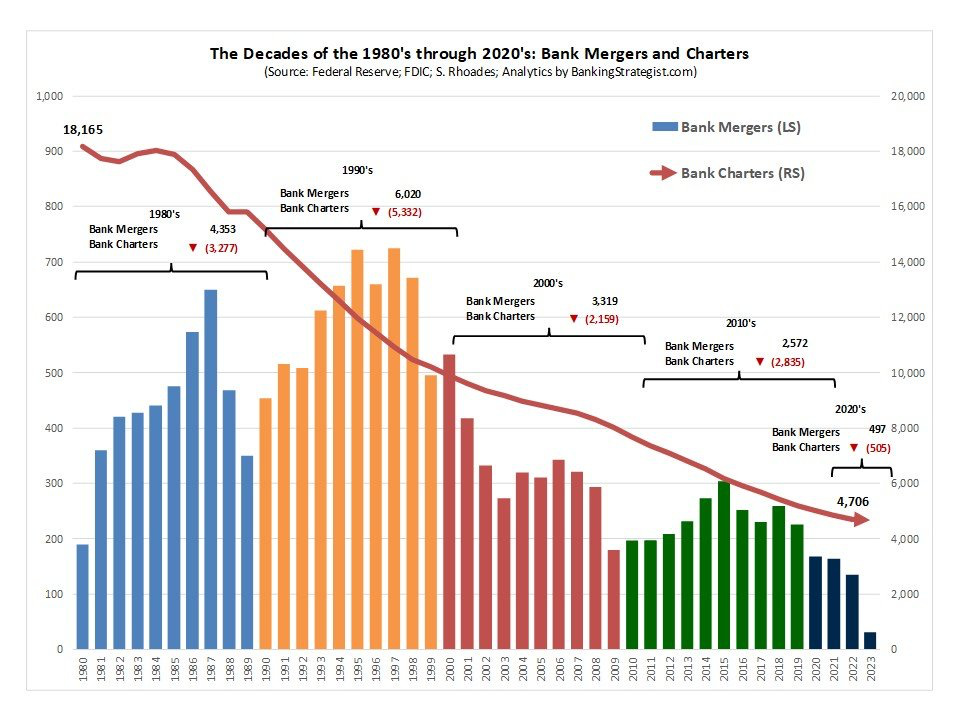

The US banking industry is undergoing consolidation, with many ramification for fintechs

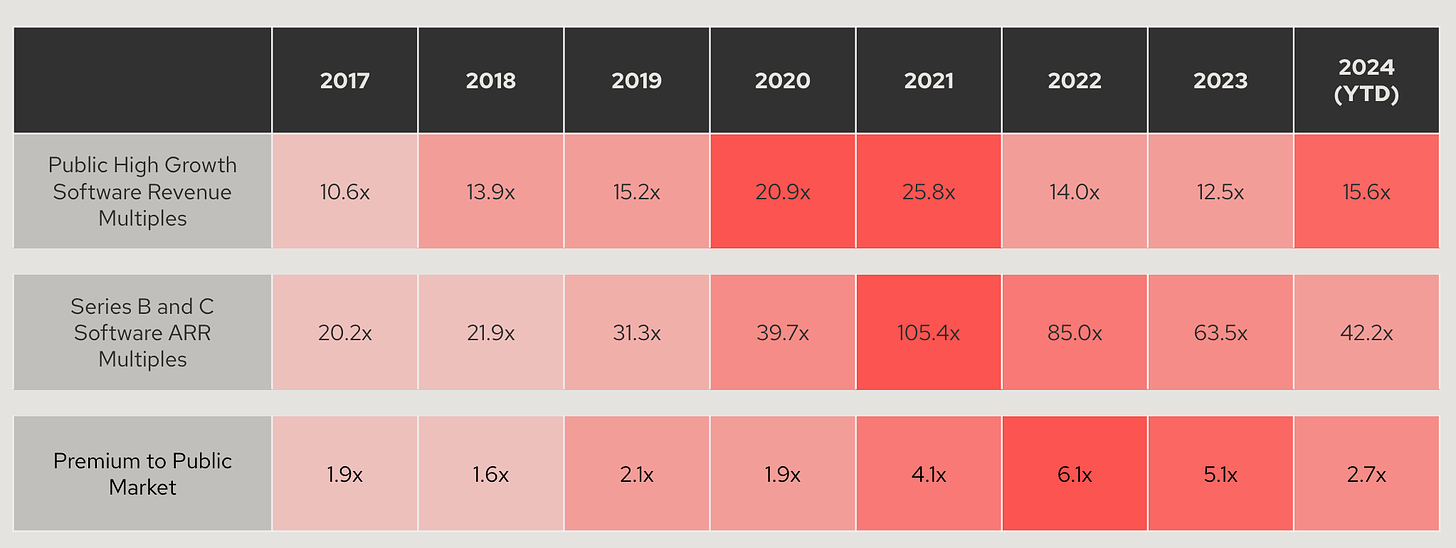

The spread between public and private software multiples is compressing

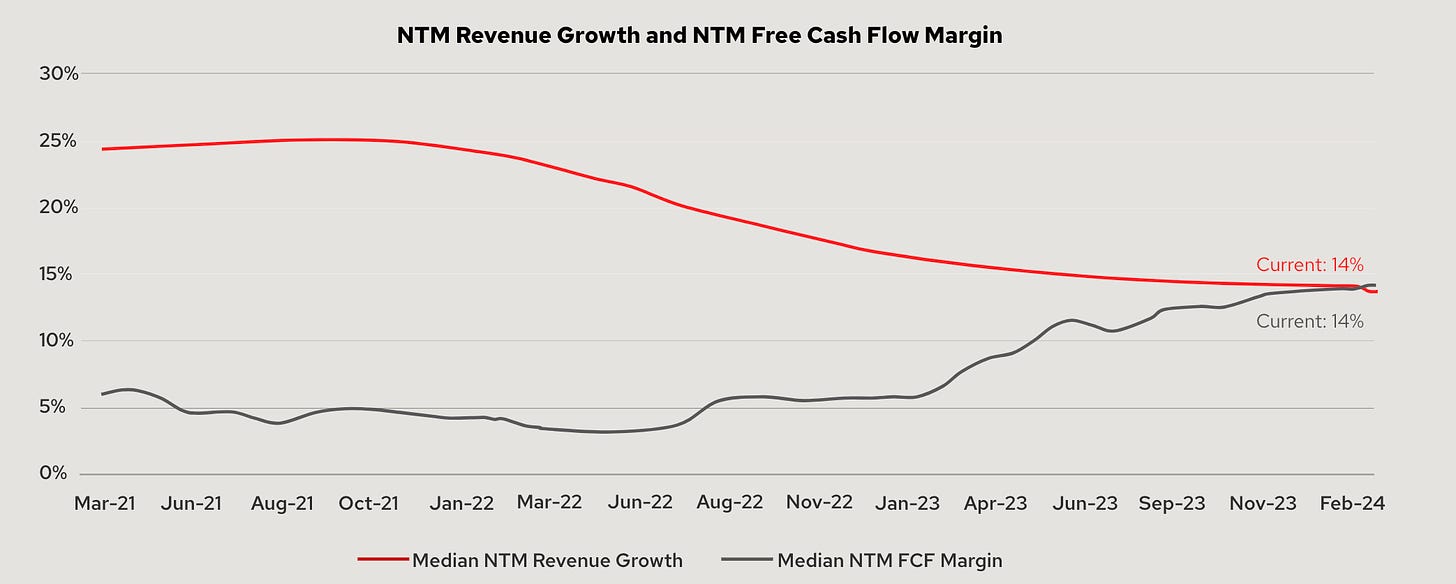

Growth deceleration continues, albeit at a slower pace, as companies have leaned into efficiency

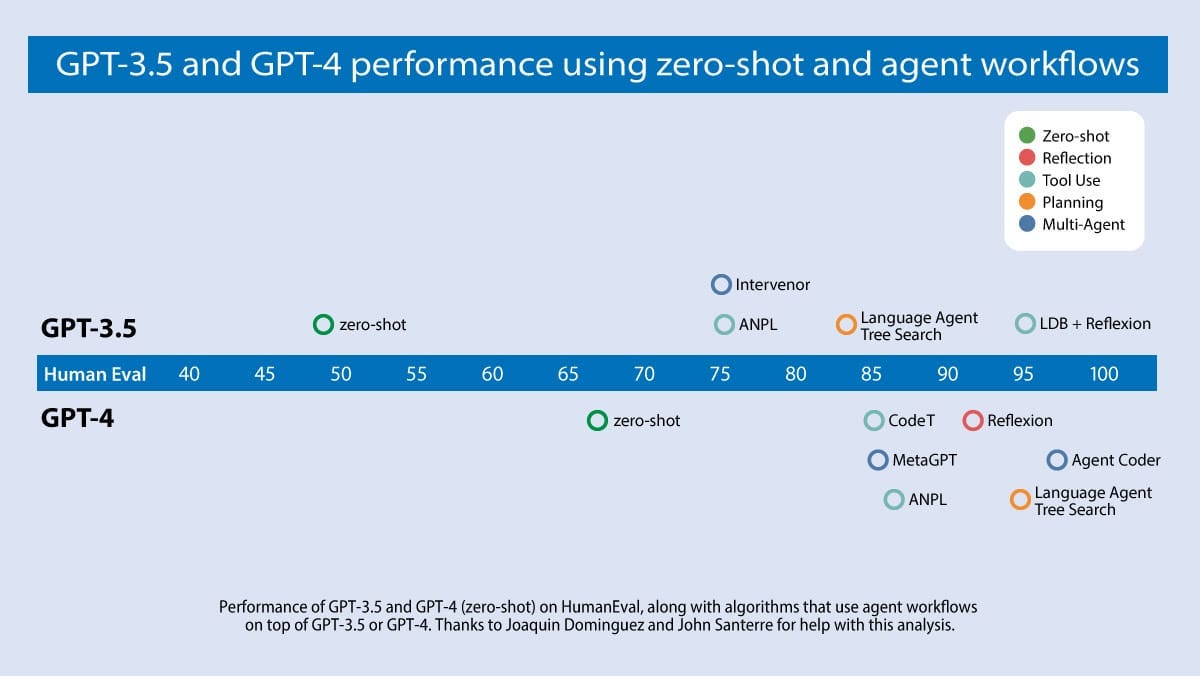

Compound systems (h/t Matei Zaharia) will unlock much larger performance gains than pure model scaling, especially for cost-sensitive enterprises

Reading List

Fintech can save the American banking system. Regulators should help

What if LLMs change the business model of the internet? Tomasz Tunguz

The rise of full stack employees Alessio Fanelli

Killer Apps Jack Altman

Quotes of the week

‘The Durbin Amendment created a similar dynamic, which ultimately accelerated the creation of the large consumer neo-banks like Chime and Cash App. With non-Durbin-exempt interchange capped at $0.22 and 5bps, large banks like Chase, Wells, and BofA could no longer profitably service consumers who primarily monetized via spend (and by extension interchange) vs via net interest margin.

This created 2 effects; first they stopped competing for these consumers in most customer acquisition channels, effectively cratering customer acquisition costs for Durbin exempt competitors.

Second, because of their high core banking costs (if I remember correctly FIS/Fiserv charged banks something like $3/month per account for their core banking system, regardless of whether the accounts were active or not) they began churning these customers either by charging overdrafts, closing accounts, raising minimums, or other tactics, which made lower income customers far more open to new banking solutions.’

Thank you for reading. If you liked it, share it with your friends, colleagues, and anyone that wants to get smarter on startup strategy. Subscribe below and find me on LinkedIn or Twitter.

How do I find out more about this outcome based selling mentioned in this piece?