Investing in Partnerships: Distribution Capex

The increasing influence of partners in SaaS purchasing and investing with conviction

Welcome to the 50 new Missives subscribers who joined us! As always, I look forward to reading your comments and feedback. If you aren’t subscribed, join 1,700+ founders, operators and investors for weekly missives by subscribing here:

As the software purchasing landscape continues to adjust to headwinds, one of the trends that’s accelerating is the influence of partners on buyers.

Research from G2, the world's largest software marketplace, found that software buyers are placing more trust in social proof when assessing software vendors, i.e. their peers, reviews, and their wider network. Purchasing is also transitioning from being largely direct to a mix of third party marketplaces and resellers.

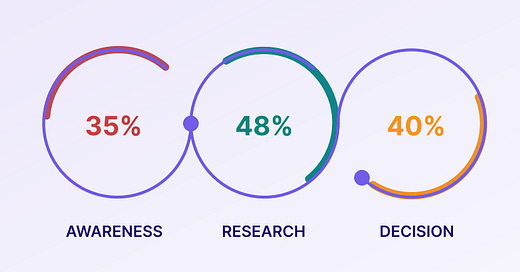

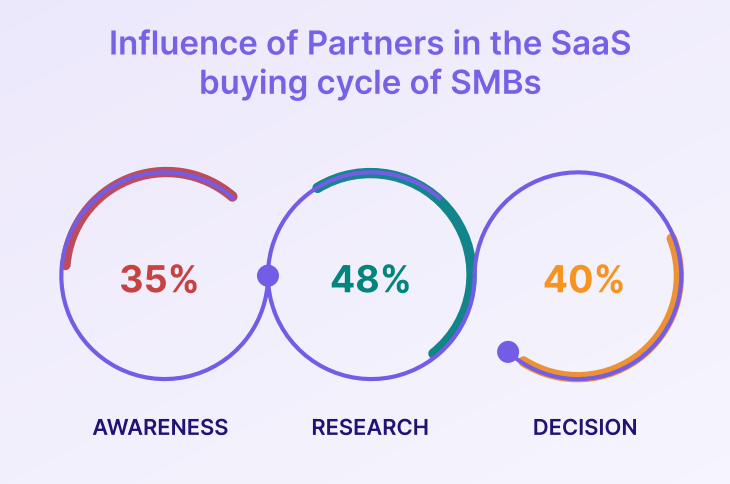

This dynamic is particularly pronounced in SMB software, where buyers lack the resources to diligently discover and evaluate vendors. Research from Zomentum highlighted the importance of partners in SMB purchasing across the spectrum, closely following peers and colleagues as the key sources of awareness among SMBs for software.

Bill.com's partner network drives more than 50 percent of its customers and 45 percent of revenue - to put that into perspective, Bill.com is projected to eclipse $1bn in revenue in 2023.

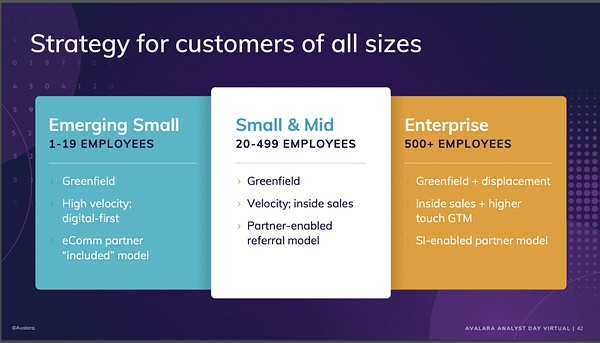

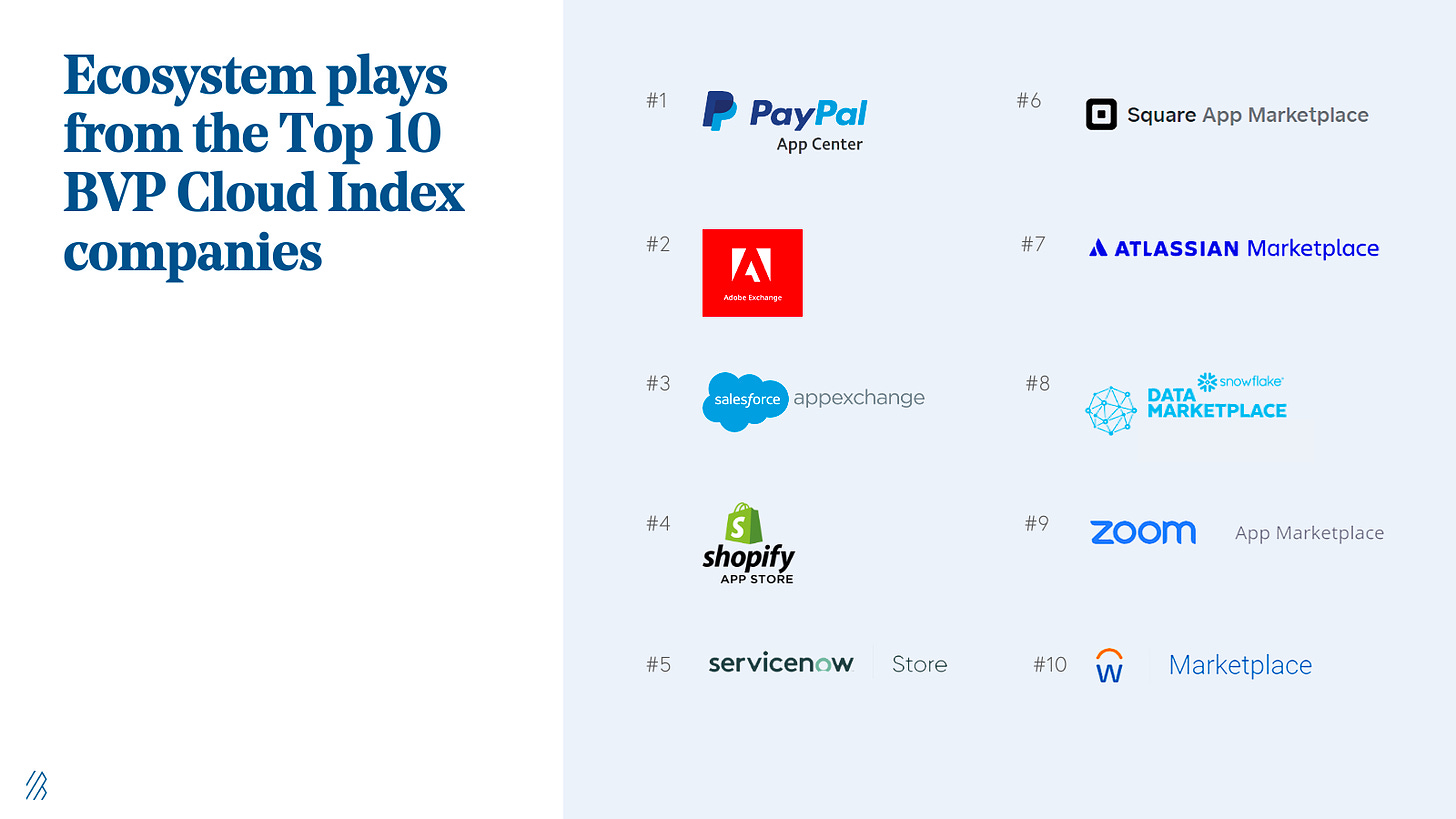

Partnerships were key to cost-efficient growth for companies such as Atlassian, Hubspot, Shopify, Salesforce, Okta and many others.

Large platforms have the scale to build ecosystems around (e.g. app marketplaces) which drive referrals, whilst others leverage resellers or value-added partners to distribute their product, particularly for complex products. Partnerships can also be an effective international expansion strategy, as Atlassian has demonstrated.

The principle permeating any channel partner strategy, however, is the alignment of interests and value creation between vendors, partners and customers.

Aaron Levie, CEO of Box, noted that the biggest determinant of effective partners was the net impact Box had on the value they were able to deliver to customers:

What we basically discovered is the partnerships that worked are the ones where the seller on the other side had a better experience being able to work with their customers.

I think, when we look back, the impact of partnerships are the ones where our partner was able to deliver more value for their customer and it wasn’t just a distribution channel. It wasn’t just being able to get more feet on the ground trying to sell our solutions.

Bill.com's accountant network consists of accounts who endorse the product to their customers and those who use it themselves to serve their end customers. Okta relies on a matrix framework to prioritise partners, assessing criteria like enterprise readiness and alignment with Okta’s values. Simply, partners who see an uptick in acquisition and retention from layering on your product will have every reason to sell your product.

With this lens in mind, one way to identify channel partners is to examine the value chain in your industry - what infrastructure enables your application? Buyers typically purchase software piecemeal to meet their Maslow hierarchy of software needs, with layers sitting on top of each other. The layers directly below your software are natural complements that are best consumed as a bundle with your product - think procurement software married with SaaS purchasing.

Once the channels have been identified, it's important to acknowledge the long paybacks of investment in partnerships. When CEO René Lacerte first went out to build Bill.com's network of accountants and banks, the merits of allocating resources to strategy were not self-evident. René toiled for several years to the chagrin of investors, pitching to thousands of accountants and the large banks, all the while admitting that it would take years before these partnerships would deliver value for both parties:

‘We’re going to have this first meeting, and we’re probably about three to five years away from this having a big impact on our business’

In time, René won JP Morgan, Intuit, and thousands of accountants as partners, and the rest is history.

Reframing investment in channel partnerships as GTM 'R&D' institutes the level of organisational patience required to eventually reap the rewards of partner networks.

Matt Plank, Rippling's first Sales hire and now VP of Sales, told Sam Blond of Founders Fund about the long-term rewards awaiting those who invest in partnerships early:

Over time, it’s smart to identify other channels and partnerships that drive behavior and demand, as these pay long-term dividends. Brokers and accountants were two of the channels that Rippling identified would help them scale quickly, so they invested in them from early on.

Once you’ve made your picks, remember the importance of conviction in your chosen channels; they won’t work immediately. Partners won’t show up and send you massive volume on day one. You have to invest a lot of time to get a channel going, to get referrals, to acquire customers…and then work on customer satisfaction.

Once the channel partners are up and running, equipping them with the apparatus needed to effectively champion your product (e.g. training, materials) helps partners ramp up and and become an evergreen asset to your pipeline.

In the early days, a concerted customer-success effort focused on partners is paramount. During this critical period, thinking of partners as early PoC customers is the most helpful lens - shortening time to value and demonstrating a tangible impact on the end customer’s NPS are the foundations of an extremely sticky partner network.

Akash - Really good essay; thanks for sharing. Love the "R&D for GTM" angle.

In terms of "Channel," people throw that term around so loosely. We should get more specific that channel means 2 things: 1) Distribution point for your product AND 2) Point of sale.

For most SaaS Start-ups & Scale-ups, their "Channel strategy" does not clear the above hurdles. They should talk about their Ecosystem Strategy as a way to develop the market, amplify their brand, extend functionality and drive referrals. There's a ton of value in those activities that is separate and distinct from a "Channel" play.