TAM Mirages

Traversing through the idea maze in non-obvious markets and approximating market size on problem value

Join 1,900+ founders, operators and investors for Missives on software, fintech and GTM strategy by subscribing here:

If you enjoyed today’s piece, please share it with friends, comment and subscribe!

“When a great team meets a lousy market, market wins. When a lousy team meets a great market, market wins. When a great team meets a great market, something special happens.” Andy Rachleff

The conventional wisdom in tech is that markets trump teams and products. Great markets ought to pull products out of the startup, so much so that even a primitive version of the product should meet the buying threshold for enough potential customers to build a successful venture-scale company.

There are obviously large markets where capital is abundant like AI, cybersecurity, data infrastructure, and then there are non-obvious markets. The markers of a non-obvious market are sudden technology shifts that birth a wave of new applications, markets where the right distribution channel hasn't been developed, and crowded markets where a sufficiently compelling product has yet to come to the fore.

Most builders and investors have a pernicious bias when it comes to non-obvious markets catalysed by sufficiently compelling products. Even the most esteemed investors have time and time again come to regret their type 2 errors - falsely concluding that a market isn't big or attractive enough to support multi-billion dollar outcomes.

In the process of building their company entrepreneurs will navigate through the idea maze for their market, observing the graves of companies that came before and their missteps, the structural impediments to further passage, and the route that leads to treasure.

“Either you're in the maze and you're looking where lots of other people have looked and most investors or most other founders who have explored that space thoroughly will say, ‘Hey man, there's a wall there.’" Garry Tan

“This is where the historical perspective and market research is key; a strong new plan for navigating the idea maze usually requires an obsession with the market, a unique insight from deep thought that others did not see, a hidden door." Balaji Srinivasan

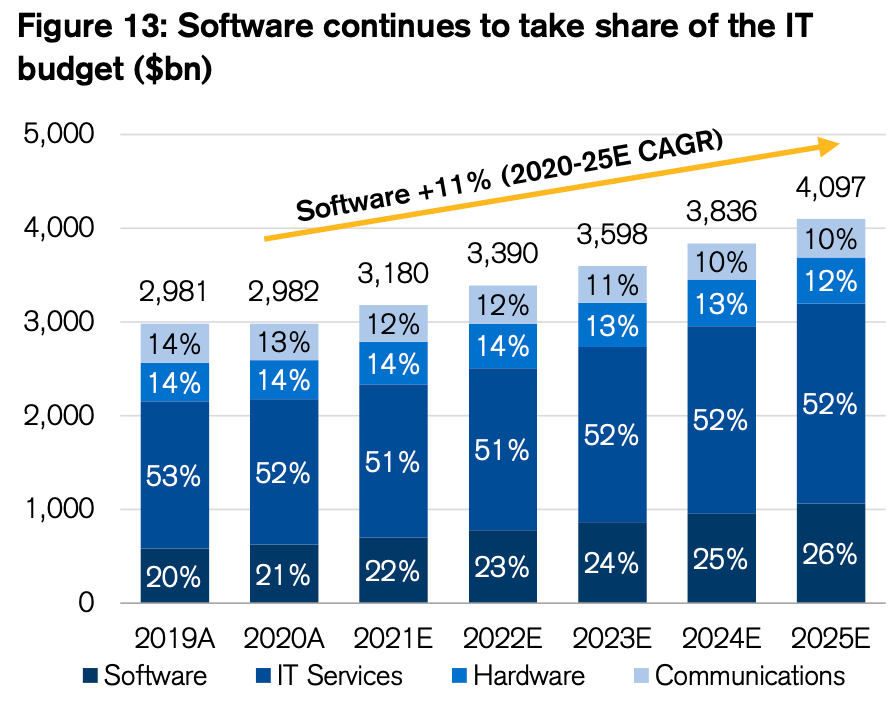

As software continues to eat into analogue industries, the predisposition is to take an ex-ante view of Total Addressable Markets with proxies like IT spend in a given industry.

This approach precludes one from gauging the true market opportunity. IT spend is often a function of the quality of the existing software solutions, rather than the size of the problem and the budgets allocated towards solving it through labour or other means.

“When we invested in this company in beginning of 2014, if you had looked at the "TAM" the total addressable market for what they were trying to sell, you would have looked at and you would say, $100 million? Which is not venture scale. Why was it $100 million? Because that's all that the industry was spending on software to solve that problem. Why? Because the only software available was terrible software.” Hunter Walk

Companies hire software to do specific jobs - if the software isn't significantly superior to the existing modus operandi to warrant the cost of purchasing, implementing and training, then software penetration is necessarily going to represent a fraction of the problem value. Great software products overcome inertia and catalyse IT spend where it didn't exist before, ultimately resulting in lower CACs and higher LTVs.

“So, it's developing that product maturity that then allows you to minimize your cost of customer acquisition and ultimately, if you're building great software, LTVs should be infinite.” Chetan Puttagunta

This dynamic is particularly pronounced in vertical SaaS, where there is a vicious circle of horizontal solutions failing to address the unique needs of customers and therefore investors and entrepreneurs renouncing these markets as unfit for new software.

The founders of enduring vertical SaaS businesses like ServiceTitan and Procore all made the same observations as they traversed through the idea maze: although there were plenty of software solutions ostensibly catering to their target verticals, all of them had the pitfall of being unable to deliver truly great products for their customers that addressed their problems in a sufficiently compelling manner.

“Procore‘s* founder, Tooey Courtemanche, realized that the construction industry was woefully underserved by existing software products. He took advantage of new SaaS technologies and mobile connectivity on the job site to build an elegant way for the construction industry to collaborate in the cloud.” Bessemer Venture Partners

“The reason why something like ServiceTitan didn't exist until now is because this market has always consistently been underserved by every type of vendor, whether technology or otherwise. Contractors just can't use these off-the-shelf, generic, horizontal solutions because their workflows are a little bit unique. They need software that is specifically designed around their workflows, and that's where ServiceTitan shines.” CEO Ara Mahdessian

Declaring markets as too crowded or too small on the basis of extant spend on software underestimates the latent demand for better ways of completing jobs-to-be-done and the potential for great products to anneal a market into sustaining venture-scale outcomes.

Interesting Reads

Growth Lessons for Early-Stage Fintech Infrastructure Companies

Jareau Wade (formerly early employee at Finix) has an excellent Substack on payments and in this post dives into his key learnings from an earlier stint in payments infrastructure and his key learnings on gaining traction as a provider of mission-critical infrastructure.

Efficiency as the Primary Operating Principle

Craft GP Michael Robinson shares a range of measures companies can take to improve cash and sales efficiency to be on surer footing through the stormy waters ahead.

AI Platforms, Markets & Open-Source

Elad Gil magisterially extrapolates current trajectories in model scaling to simulate future market structures in AI.

Hhhypergrowth analyses one of fintech’s most successful case studies of software and payments bundling and the GTM and M&A that has seen Bill.com deliver best-in-class NDR and growth.

Your Guide to Product-Led Sales

Jesus Requena of Figma talks to Kyle Poyar about the role of Figma’s growth marketing team in assisting the sales motion on top of Figma’s PLG foundations.

Tweets

Great read! You’ve got to do the bottoms up price x quantity on who you think could be your buyer, not who the buyer is yesterday