Developing a Pricing Engine for SaaS Products

Pursuing product-market pricing fit, demand curves, and price discovery

Thank you to the 1,550+ subscribers reading this today. As always, your comments, feedback and support are invaluable.

There's a rich literature on precisely measuring the indicators of product-market fit. A company's life can be demarcated into pre and post product-market fit (PMF), the conventional wisdom goes.

In contrast, early stage companies often neglect pricing as an afterthought, at their peril. Pricing is not a wrinkle to be ironed out after all the PMF bells start ringing, but is in fact a core dimension of PMF. Madhavan Ramanujam, author of Monetising Innovation and one of the foremost experts on pricing, criticised the hollowness of PMF validation that doesn't incorporating pricing to Lenny Rachitsky:

So if you didn't put pricing as part of your product market fit validation, you're often hearing what you want to hear. It is truly about understanding whether customers are willing to pay for your innovation and willingness to pay is a proxy for, do people actually value your product?

The concept of product-market pricing fit, introduced by Madhavan, rightfully posits pricing's importance at parity with PMF. As an overarching principle, it encapsulates the discipline of weaving pricing into every aspect of the company, from seed to IPO.

The merits of developing sophistication in pricing as a SaaS company compound over time. As an early stage company, it helps you derive price points that set you up for success as you grow your product set and expand into new categories. As a company navigating the transition from serving SME to enterprise, having a pricing muscle helps you tactfully traverse the psychology of software purchasing. Determining the prioritisation of features for your product roadmap on the basis of willingness to pay mitigates against sinking engineering time into superfluous features.

As we head into a year shrouded in uncertainty (IT budgets, macro headwinds, exogenous shocks), developing pricing discipline will add another string to the bow of founders navigating through the next 12 months. There are various facets to take into account.

Willingness To Pay

Michael Mauboussin, one of my favourite guests of the Invest Like The Best podcast, recently discussed his latest research with Patrick O'Shaughnessy on the interplay between market share and return on investment.

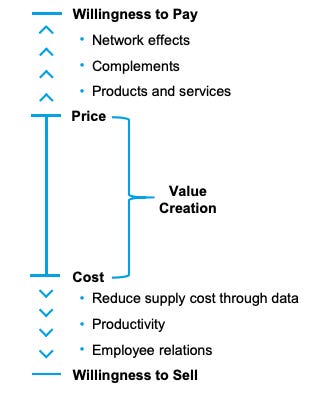

One of the principal takeaways is the concept of a 'value stick', framed by HBS professor Felix Oberholzer-Gee. A value stick is a visual framing of the levers companies can pull to create value - on the one end, you have Willingness to Sell (lowest price an employee or unit of supply is willing to sell its service for), and on the other you have Willingness to Pay (highest price the customer is willing to pay for a product).

The delta between willingness to pay and price, and cost and willingness to sell, represent surface areas that sustain value creation (particularly for mature companies where growth tapers off and margin expansion becomes the key driver of value creation, h/t @BucknSF).

Though both sound plausible vectors, increasing Willingness To Pay (WTP) is the most effective lever to pull, argues Oberholzer-Gee. As you increase the willingness to pay, you accrue market power and are able to set a higher price for your products, eating into the consumer surplus that you would otherwise expect to see in competitive markets.

The inputs to a higher WTP (e.g. network effects, complements) are for another post, although I'd certainly recommend that you read Michael's research in full.

The key takeaway is to think about PMF through a Willingness To Pay lens. As Madhavan told Lenny:

You actually don't have a choice whether you'll have a pricing conversation with your customer. The only thing in your control is when you will have it.

I hope this is the biggest takeaway for your audience, you cannot prioritize a product roadmap without having a willingness to pay conversation.

Founder-led sales for early stage enterprise software companies are hard enough as it is, but the effort can be largely undone at the pricing stage if you've not been able to establish willingness to pay for the features that drive most of the value for your customers.

In his time working with hundreds of companies, Madhavan has found that 20% of the features drive 80% of the willingness to pay. Ergo, focusing your product roadmap on these key features is the most customer-centric strategy, rather than naval gazing about features.

Instilling pricing discipline

Weaving pricing discipline into the fabric of your company is a cross-functional exercise, as Naomi Ionita (Partner at Menlo Ventures and an early pioneer of the PLG motion) told Lenny:

If you are a PLG company like companies I worked at, this was the product growth org that I ran. So the combination of PMs and data scientists, folks like that to iterate on pricing. If you are an enterprise SaaS business, of course, sales and finance and rev ops play a role.

Having identified the right actors across your company to set the pricing strategy, the next step is to determine which of the three main pricing strategies is most suitable for the stage of your company. The three main pricing strategies are Penetration, Maximisation, and Skimming (again, h/t to Madhavan).

Penetration pricing seeks to maximise market share by undercutting on price; this fits well with PLG and land and expand motions, where acquiring customers with small lands would normally translate to significant expansion multiples down the line (as we've covered before). Maximisation seeks to optimise for revenue growth in the short-term, perhaps most appropriate for customer segments where you don't envisage significant expansion or upsell opportunities. Skimming in the pursuit of profit maximisation is far less common for early stage companies.

Depending on the stage of your company, a particular strategy will be most accretive to value creation. Seed to Series B companies, pursuing PMF and beginning to scale, will fare best with a Penetration strategy that affords them a broad customer base, tight feedback loops, and mindshare. Growth stage companies can begin to weave in Maximisation and Skimming strategies as they crescendo beyond $100m ARR and rotate to efficiency.

With your strategy in place, the next most important step is to determine how customers define the unit of value your product confers. Mike Marg, Partner at Craft Ventures, simplifies this test to:

When a huge customer uses our product, what is true compared to a small customer using our product?

The answers range from more seats, to more API calls, to more storage. The goal is to see customers naturally eclipse the limits that they initially agreed on, and fork out their credit card to move into the next pricing tier. This is the measure of the value customers are deriving from your product.

Once you have a large enough customer base, the unit of value will become apparent. Units of value are ideal for usage-based pricing, but one can also experiment with 2-part or 3-part tariffs to capture more value.

Pricing also has to align with your marketing and positioning. This is known as the marketing mix, which emphasises the importance of knitting Price, Product, Placement and Positioning into one coherent strategy. Tomasz Tunguz has written about the example of Expensify, who positioned their product as a prosumer UI for expense management, intended for bottom-up adoption, and at a price point to match. Architecting a pricing strategy can't be done in a vacuum, it must be aligned with product marketing, the training given to the AEs/CSMs, the sales team's compensation structure, and a host of other factors.

Before aligning pricing with product marketing, companies have to determine how to pitch their product - are they creating value or saving costs? Arguments in favour of value-based pricing are that cost-based pricing creates natural opponents to the purchase (as often the pitch entails displacing headcount) and creates a natural ceiling for willingness to pay at the salaries of employees. In a recessionary environment like our current one, we’re inevitably going to see IT spend consolidation across enterprises, making a compelling case for a cost-based pitch. In any case, if a company does pursue a value-based pitch, quantifying the impact (e.g. on productivity, margin, performance) is paramount to convincing CFOs to part with a portion of their budget.

Price Discovery

Having built rigour and sophistication around the discipline of pricing, companies are well equipped to tackle the thorny problem of price point discovery.

Deciding which of subscription or usage-based pricing is appropriate for your product is for another post (though one rule of thumb is to think about whether usage of your product is 'always on' or episodic), but pricing a unit of value or a monthly/annual contract can be more scientific than the trial-and-error methods most early stage companies use today.

Madhavan proposes several frameworks in Chapter 4 of Monetising Innovation (please do read it), but the kernel of the chapter is to use reference points to anchor the conversation with customers.

"Okay. Hey, do your customers, do you use products like Salesforce in your install base?" "Yeah, I do use." "Okay, Salesforce was indexed at 100 in value. Where do you think we are in terms of the value that we bring to your, let's say, day to day business operations?" That people can answer all day long.

In existing markets where competitors have already primed buyers on price parameters, marking up existing benchmarks is relatively straightforward. Companies creating new markets with few direct comparables would benefit most from this line of questioning as it teases out the relative value of your product versus another piece of business-critical software, in this case a CRM.

Once you've derived a narrower range of price points, measuring price elasticity is key. The best way to inform your demand curve and price elasticity is to iterate. For instance, ask customers about their propensity to purchase at specific price points on a scale of 1 to 5, continuously iterating until you move the dial. Over time, run experiments across segments and track different cohorts of customers (with different price points) to track the impact of pricing on renewals.

The Van Westendorp Index, famously used by Superhuman to find their $30 price point, distils price elasticity down to four survey questions:

At what price do you think the product is priced so low that it makes you question its quality?

At what price do you think the product is a bargain?

At what price do you think the product begins to seem expensive?

At what price do you think the product is too expensive?

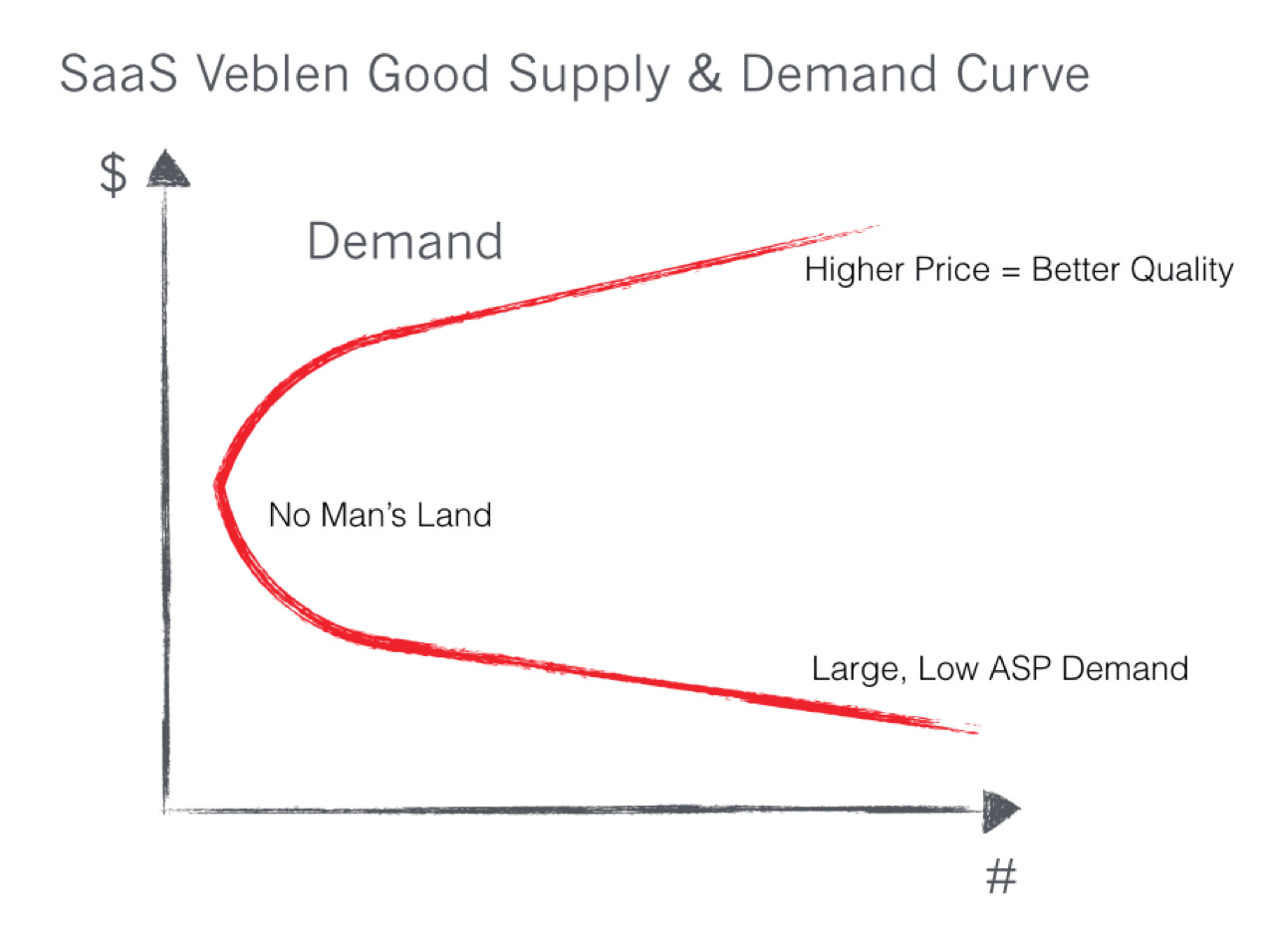

The first of these questions gets to the heart of segmentation, an indispensable part of diligent pricing. Pricing and packaging for different customer personas is as important as varied marketing for different personas (think again of the 4 Ps in the Marketing Mix). An SMB SaaS startup moving upmarket will do well to adhere to the principle of SaaS products acting as Veblen goods.

Zendesk found this out the hard way, learning that a modest increase in the price for their enterprise tier was nowhere near as effective as the 10x more expensive price they offer today; enterprises are comforted by higher price points as they provide assurances of enterprise-grade security, access rights, single sign on, etc.

Closing thoughts

With the apparatus in place to reach product-market pricing fit, sustaining it is key. Revisit your pricing strategy every 6 months; consider pricing as dynamic as the new personas, markets and products you launch or address, with constant interplay between these endogenous variables.

Just as companies obsessively track product usage data and other proxies for PMF, founders must treat pricing as a data-rich domain that can not only drive meaningful top-line impact but is fundamental to their company's success.

The companies best able to harvest data about willingness to pay and price elasticity will make more data-driven product roadmap decisions, and ultimately acquire, monetise and retain their customers more successfully (h/t to Madhavan again, who is writing about the latter in his next book).