Charles Schwab's asset-heavy path to compounding

The Amazon of Financial Services and its lesson for consumer fintech

Hey friends!

I’m Akash, an early stage software and fintech investor. I write about startup strategy for founders and operators.

You can always reach me at akash@earlybird.com to exchange notes and share feedback.

Current subscribers: 3,580

Happy new year, friends!

I hope you all had a replenishing break - I certainly did and now I’m recharged and excited for the year ahead.

I’ve written a bit about the new normal we’re operating in.

Looking forward, I think 2024 and beyond is set up to produce some of the most enduring companies in software. I’ll save the rehashing of the macro stats on IT spend, cloud penetration, moving from pilot to production with GenAI in the enterprise, and so forth, although all of those are valid reasons to be hugely excited.

The compelling overlay to these tailwinds is that a lot of the company-building playbooks that were refined as SaaS matured are being revisited.

Will software be more closely coupled with services? Will we see more companies start multi-product right out of the gate? Will the Series A SaaS company org chart see the most upheaval yet?

I’m excited to go on these quests with all of you this year.

Akash

Back to regular programming.

Back in October 2022, Coatue published a report on ‘Who stands to win over the next decade’ in fintech.

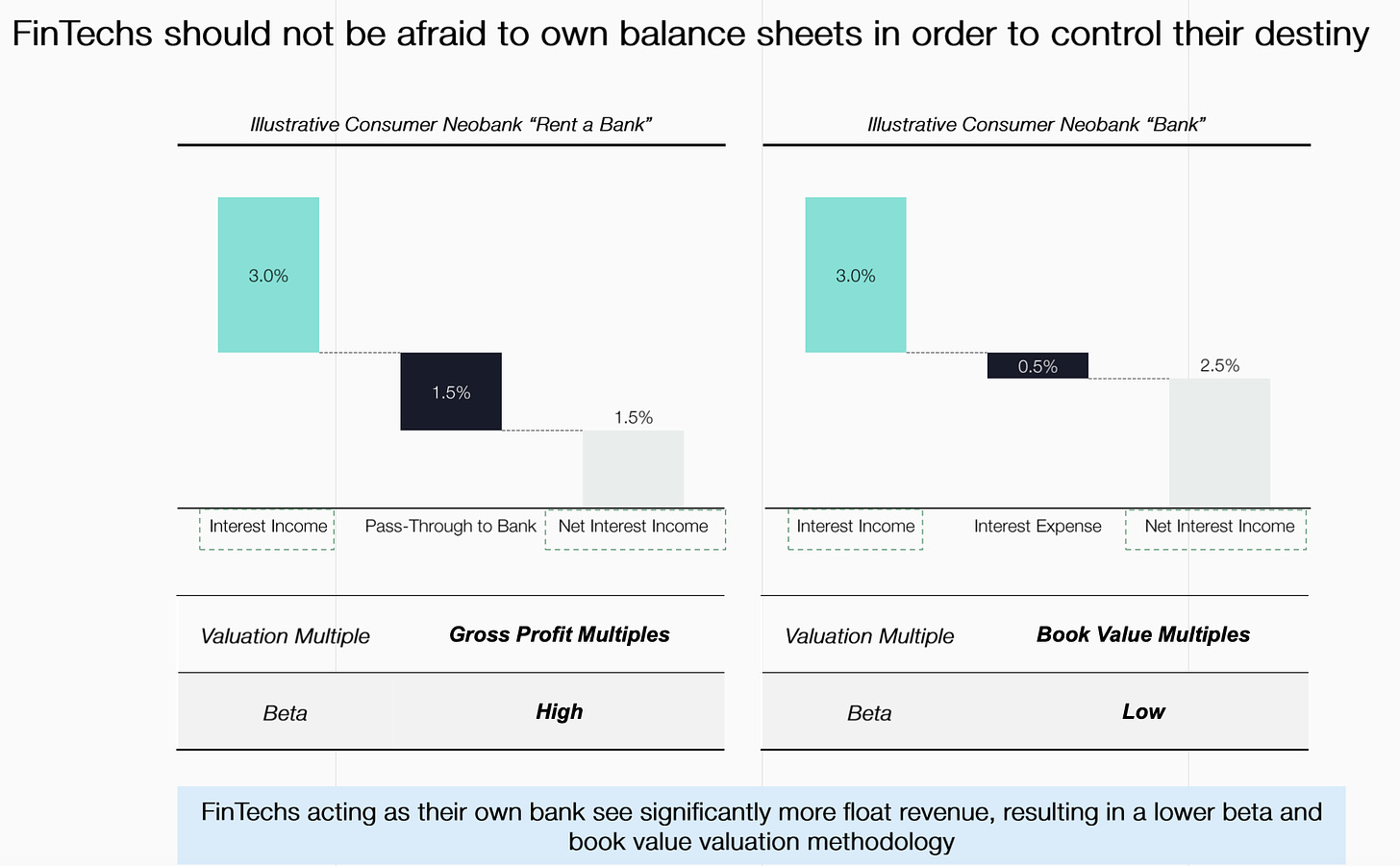

One of their more contentious arguments was the case for asset heavy business models that leverage balance sheets.

The logic is that the costs of owning licenses (the regulatory capital requirements that come with them) are more than offset by the margin expansion they confer.

Despite these merits, asset-heavy/balance sheet business models are often derided by investors - the multiples are too low, scaling challenges with respect to reg cap requirements and risk posture, etc.

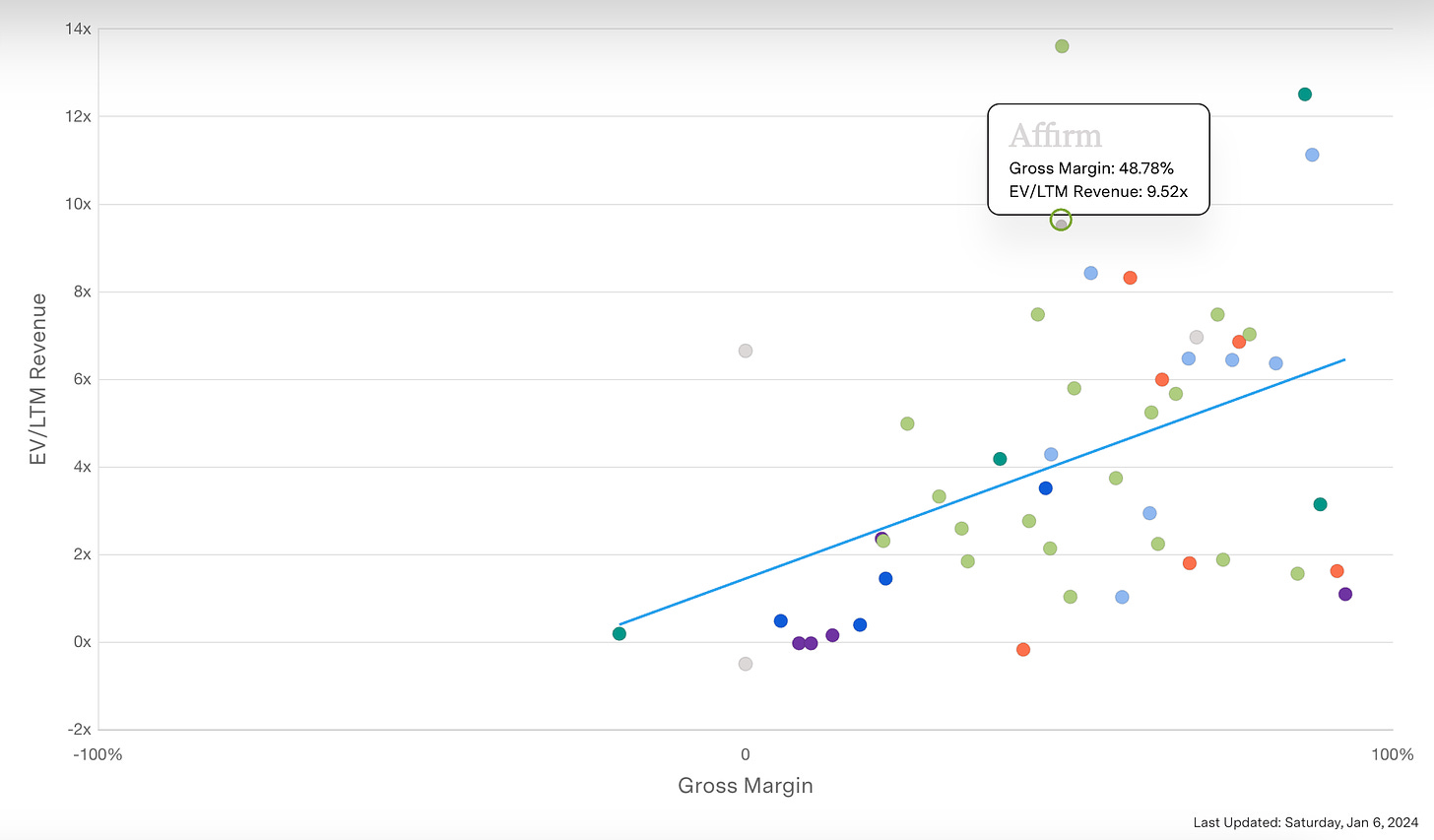

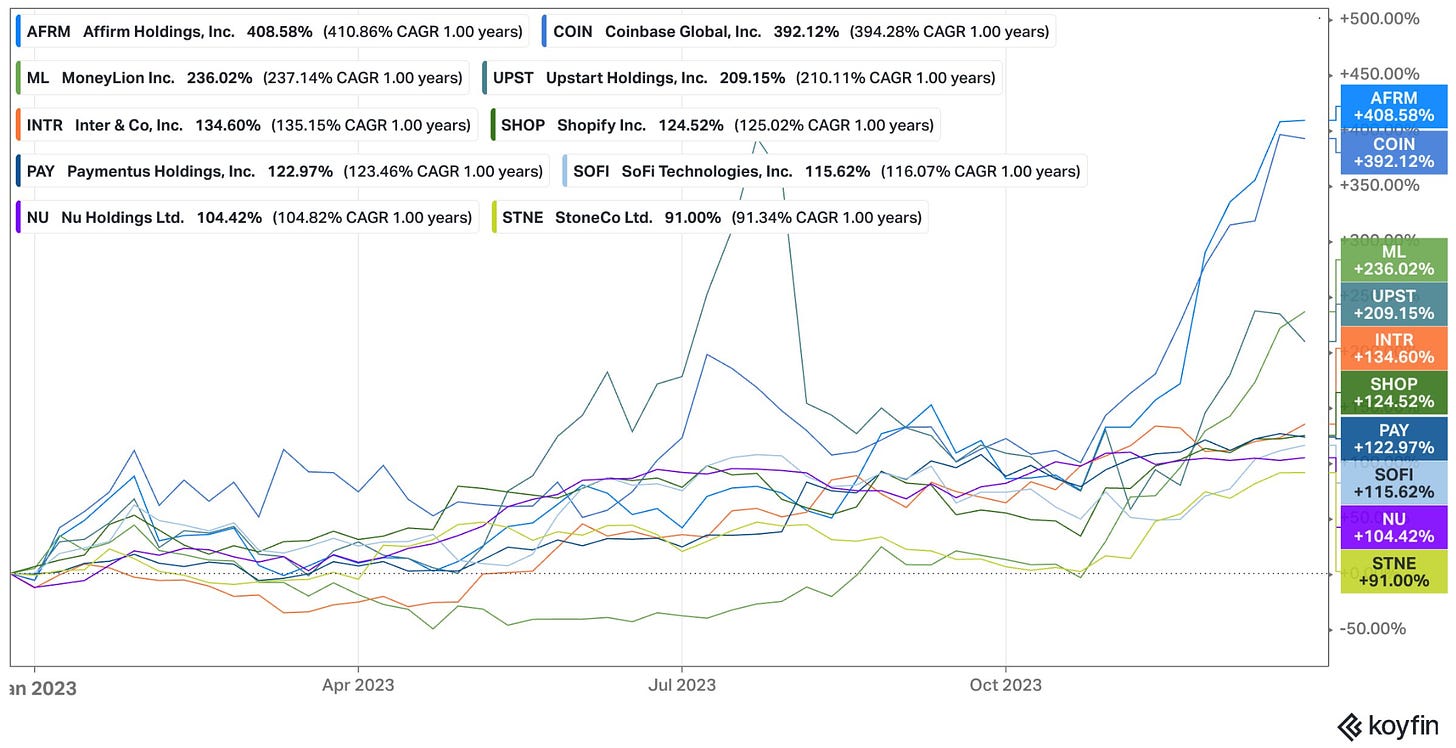

Higher rates were naturally going to be a boon for balance sheet models, and the public markets have borne this out in the last 12 months.

Affirm’s EV/LTM multiple is only surpassed by Shopify, Coinbase, and Xero in the public fintech universe.

Perhaps one of the most successful companies to have embarked on the asset-heavy path is Charles Schwab.

With a market cap of >$120bn and $8 trillion in assets, Charles Schwab derives c. 50% of its revenue from net interest revenue.

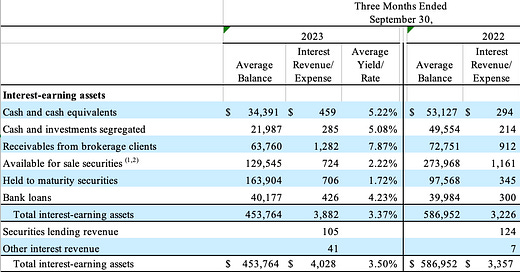

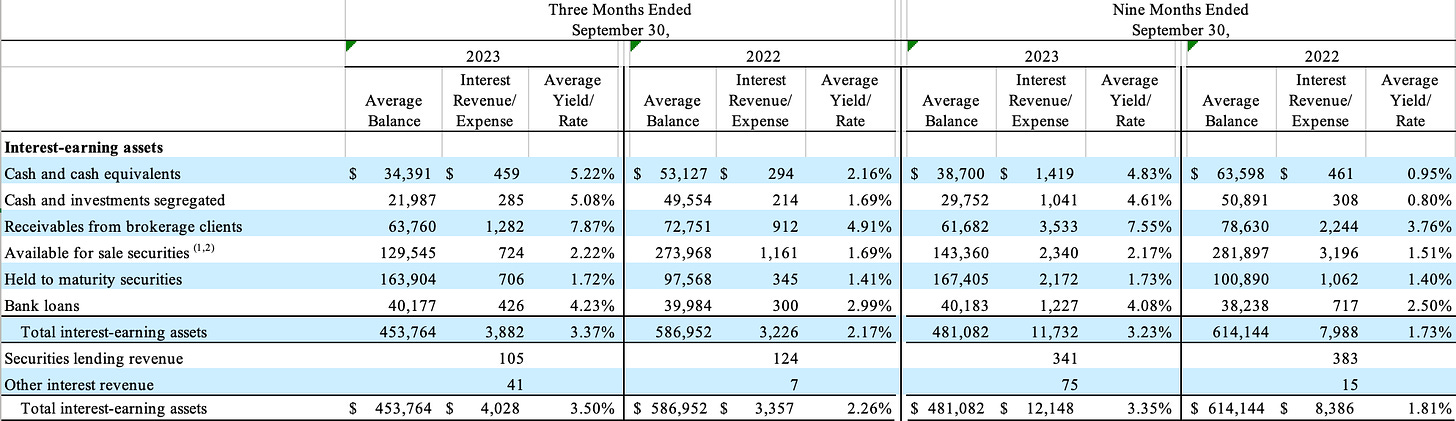

The impact of higher rates on Schwabs’ earnings was plainly observable in their latest filings.

Bank deposits account for c. 70% of Schwabs’ funding.

Andrew Hollingworth explained the merits of Schwab’s balance sheet to Matt Reustle on the Charles Schwab Business Breakdown

So by definition, you might be earning 10s, 20s, 30s basis points in terms of what you're getting from that bank to basically say thank you for sending that deposit base to them. That's rather different to earning 150 basis points, what Schwab earned in 2020, up to sort of 250 basis points, which is what they earned in 2019. Or even 400 basis points, which is what they earned before the credit crunch.

These are big differences in margin. And when you start to look at those, you can then start to see why the vast majority of the business is able to be funded by that line alone. Well, that line just doesn't exist or would do anything like the magnitude for an asset-light business.

It’s controlling their destiny.

‘Fintechs acting as their own bank see significantly more float revenue, resulting in a lower beta and book value valuation methodology’.

Coatue

Ansaf Kareem, formerly of Lightspeed, wrote in his widely shared post on fintech valuations:

If you take Robinhood and Charles Schwab, we can see that AUM / EV gets us 7x and 5x respectively, despite Charles Schwab having a much larger scale likely due to Robinhood’s growth potential. However, if we look at the companies through the lens of AUM / Active User, a much clearer picture emerges as we see that Charles Schwab maintains $22K / Active User vs $5.4K / Active User at Robinhood. In this case, we see that Charles Schwab’s ability to monetize its client base is much higher, likely giving it a higher valuation advantage.

In principle AUM / Active User is a useful proxy for latent monetisation potential. In practice, Charles Schwab eschews commissions on trades or other products and optimises for net interest revenue.

Again, Andrew Hollingworth:

And I think that's where the analogies come, is that this is a company that's trying to do everything. It talks about win-win monetization for the customer. It talks about no trade-offs. What it means by that is no trade-off between paying a low price, or no price for doing something and still getting excellent service. This is a business that's set itself up to try and do an excellent job for the customer, in whatever the customer asks it to do

Schwabs’ suite of products oriented around driving up its deposit base of savings accounts (markedly different to current account deposits with traditional banks, and the concomitant stickiness) earns comparisons with Amazon.

That's where the Amazon analogies and things are relevant, in the sense that in order to do everything that Charles Schwab do, and only to make money on that small slither of capital that's sitting there when the customer doesn't do anything with it.

Schwabs’ ability to subsidise its suite of financial services products in the singular service of deposit and NIM growth is a scale play, as was Schwab’s acquisition of one of its biggest competitors in TD Ameritrade and the reformulation of the combined monetisation strategy.

Charles Schwab is an instructive case study that gives a blueprint for how value will accrue in consumer fintech. Neobrokers are already beginning to converge with neobanks by securing bank licenses, and it will be interesting to see how attach rates developed across different entry wedges.

Reading List

Replacing "Non-consensus and Right" with "Differentiated and Good" for Emerging VC Managers Charles Hudson

Insights from Dropbox, Adobe, and Salesforce

Evaluating Product Investments

An introduction to RAG and simple/ complex RAG

Quote of the week

‘To paraphrase another great VC...the key is to have a little teflon coating so that you don't get jaded...you have to have the ability to fall in love - with technologies, entrepreneurs and companies - even after you've had your heart broken. Great VCs are just as passionate as the entrepreneurs. It's personal, not just business.’

Ho Nam

Thank you for reading. If you liked it, share it with your friends, colleagues, and anyone that wants to get smarter on startup strategy. Subscribe below and find me on LinkedIn or Twitter.