Hey friends! I’m Akash 👋.

Welcome to Missives, where I write about startup strategy across software and fintech. You can always reach me at akash@earlybird.com.

Thank you for reading! If you enjoy these, please share them with your friends and colleagues 🙏🏽. Wishing you a great week!

Current subscribers: 3,203

The market is incredibly efficient at creating supply seemingly out of thin air to meet demand. This happens at both the asset level and the company level across nearly every asset class / sector.

Q3 cloud earnings are in and optimisations are not abating.

In the early days of this market cycle swing, investors predicted all manner of recoveries - V-shaped, Nike Swoosh, you name it. Many had us already some way up the curve by now.

We’re in Q4 2023 and the requisite green shoots of consumption that would presage budget loosening and an amelioration of software purchasing have been patchy, at best.

Enough time has passed for fintwit to satirise the ZIRP era of 2008-21, which was itself just an accentuation of a 40-year secular decline in interest rates beyond levels that the free market would divine.

Irrespective of the shape of the recovery, any assumption about the nature of the recovered state needs to take into account a momentous sea change: the cost of capital has irreversibly increased and most investors practicing the craft today haven’t deployed capital in higher rate environments.

‘Everyone who has come into the business since 1980 – in other words, the vast majority of today’s investors – has, with relatively few exceptions, only seen interest rates that were either declining or ultra-low (or both).’

‘I believe the scarcity of veterans from the ’70s has made it easy for people to conclude that the interest rate trends of 2009-21 were normal.’

- Howard Marks

To look into the future with any degree of clairvoyance, we need to first internalise how ultra-low rates affected capital allocation and risk premiums.

Pushed to the frontiers

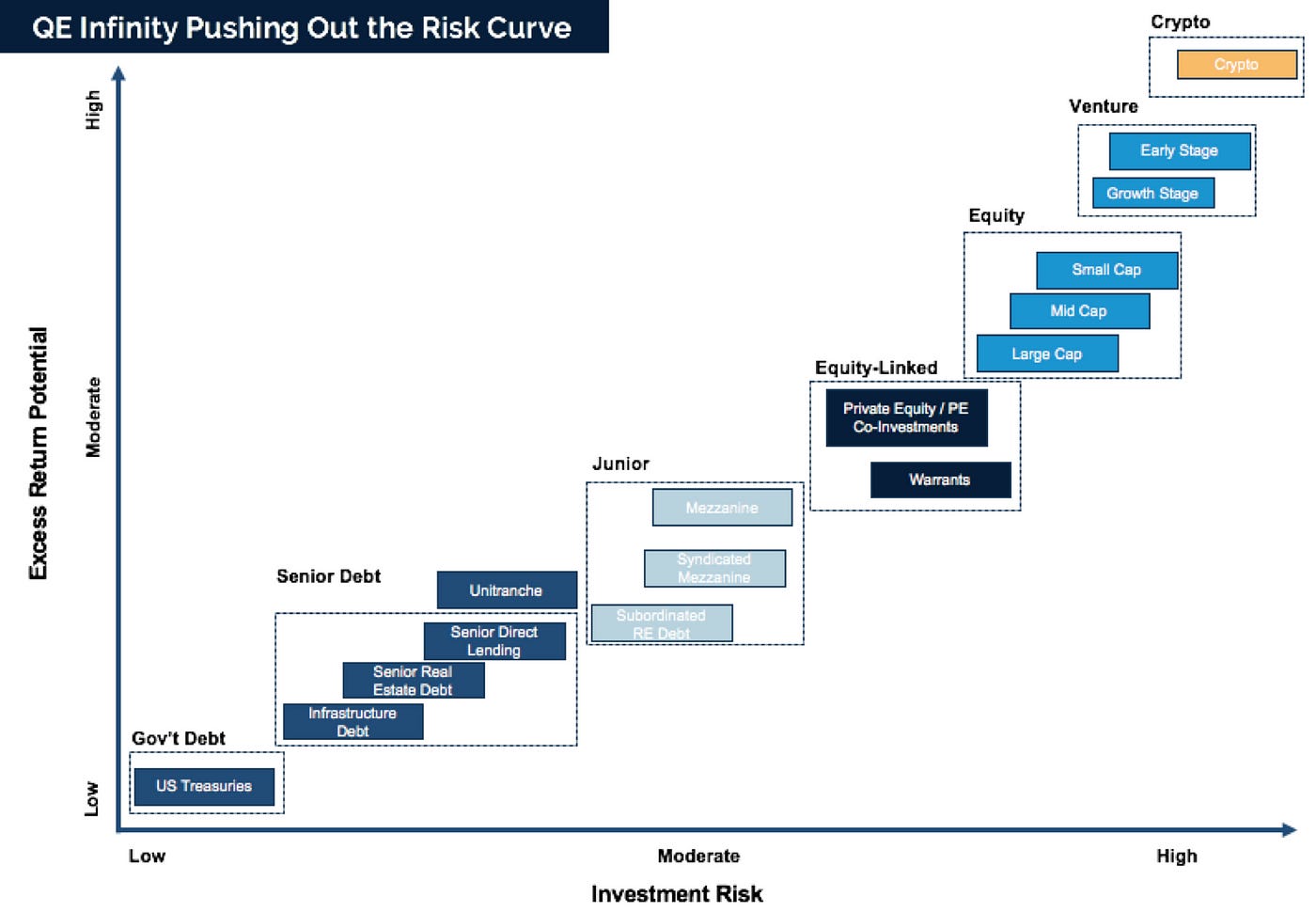

“QE Infinity turned your savings account into your checking account, the bond market into your savings account, the equity market into the bond market, the venture market into the equity market, while giving rise to the crypto market as the new venture market.”

As Justin of John Street Capital puts it so eloquently, the ZIRP era triggered a reframing of asset classes and their respective risk profiles. It was in some senses a shifting of the investing Overton window; the illiquid asset class of venture became the equivalent of liquid equities, and highly volatile equities were incredulously equated to fixed income securities that come with contractual yields.

Yield-hungry institutional capital ploughed into higher risk strategies and allocation to alternatives increased several fold.

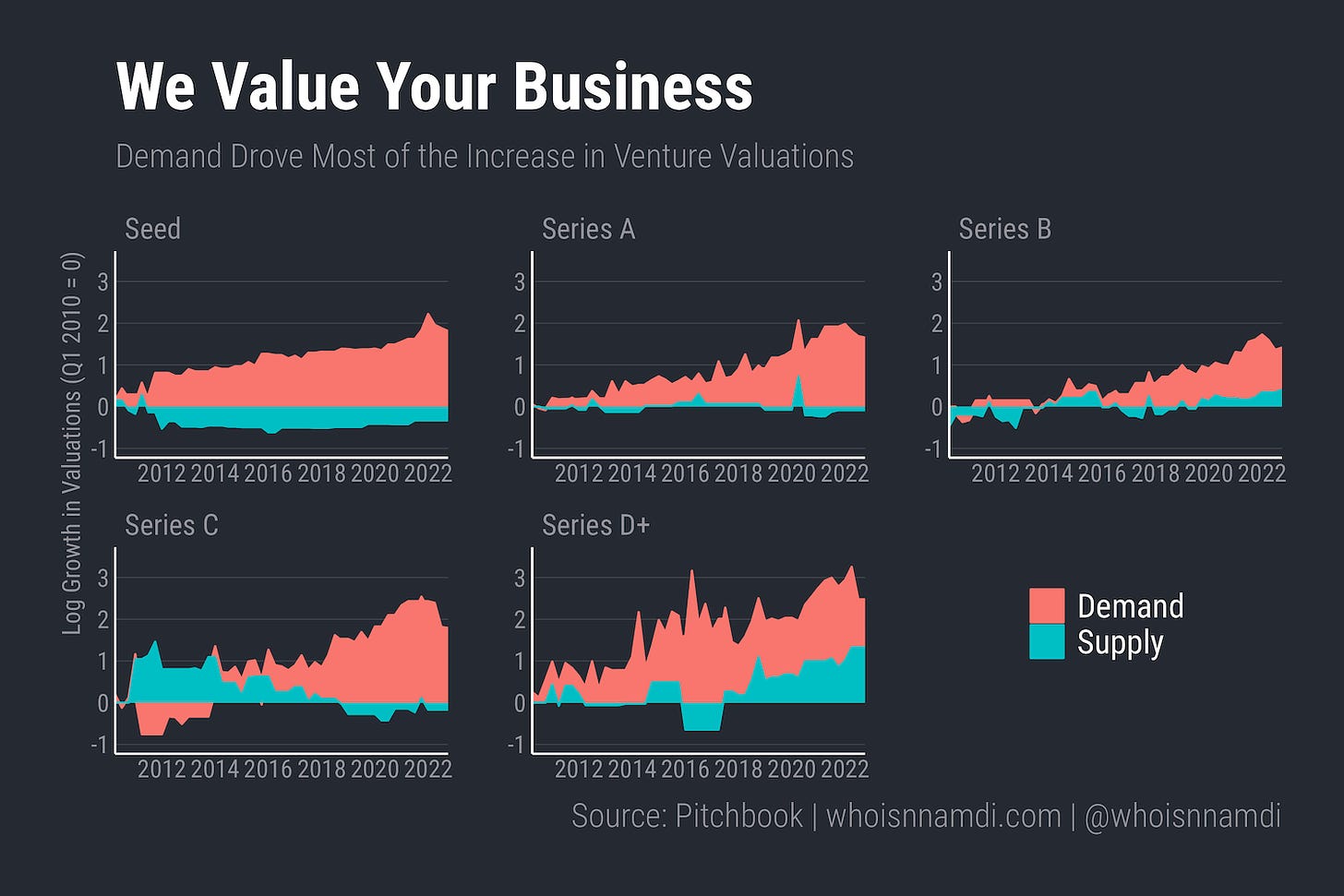

The result was an increase in assets under management in the private markets, not least in venture capital. LPs seeking higher yields armed GPs with largesse and this in turn drove a surge in valuation across stages.

‘Demand is, or at least has been, king in venture over the last decade.

To the degree founders are starting more venture-backable companies, it's largely driven by the cold, rational calculus that investors are much more eager to buy up equity in private companies today than they used to be.

This explains much of the growth in the venture ecosystem over the last decade: more deals get done and those deals are more expensive because of surging investor demand.’

The barriers to entrepreneurship have indeed never been lower, but these conditions have only seen marginal gains in the last decade. It’s the dollars injected into technology and venture that has outstripped any compression of supply constraints by orders of magnitude.

Admitting that the last forty years were a period of secular rate declines is not the same as arguing that future rates will be much higher than they are today. It’s just accepting that the ultra low rate environment that gave rise to much of the global venture ecosystem over the last four decades is not coming back and we’re heading into a new world.

‘If you grant that the environment is and may continue to be very different from what it was over the last 13 years – and most of the last 40 years – it should follow that the investment strategies that worked best over those periods may not be the ones that outperform in the years ahead.’

- Howard Marks

Risk Curves in Venture

I’ve clearly been reading too much of Howard Marks as I now invoke yet another of his essays, but ‘Fewer Losers, or More Winners’ is a brilliant analysis of how alpha is generated.

Howard boils it down to two ways:

Fewer losers

More winners

Embedded in this view of alpha generation is an assumption that investors can be intellectually honest about the risk curves of the asset classes they invest in.

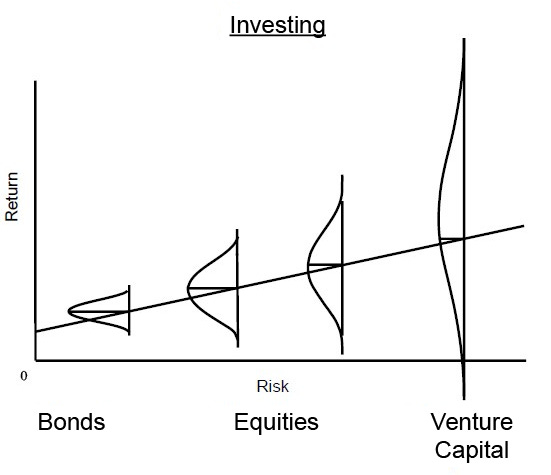

The power law of returns in venture is widely acknowledged, but there is merit in being much more granular in your mapping of the risk curve based on the stage you’re investing at, particularly in the new environment.

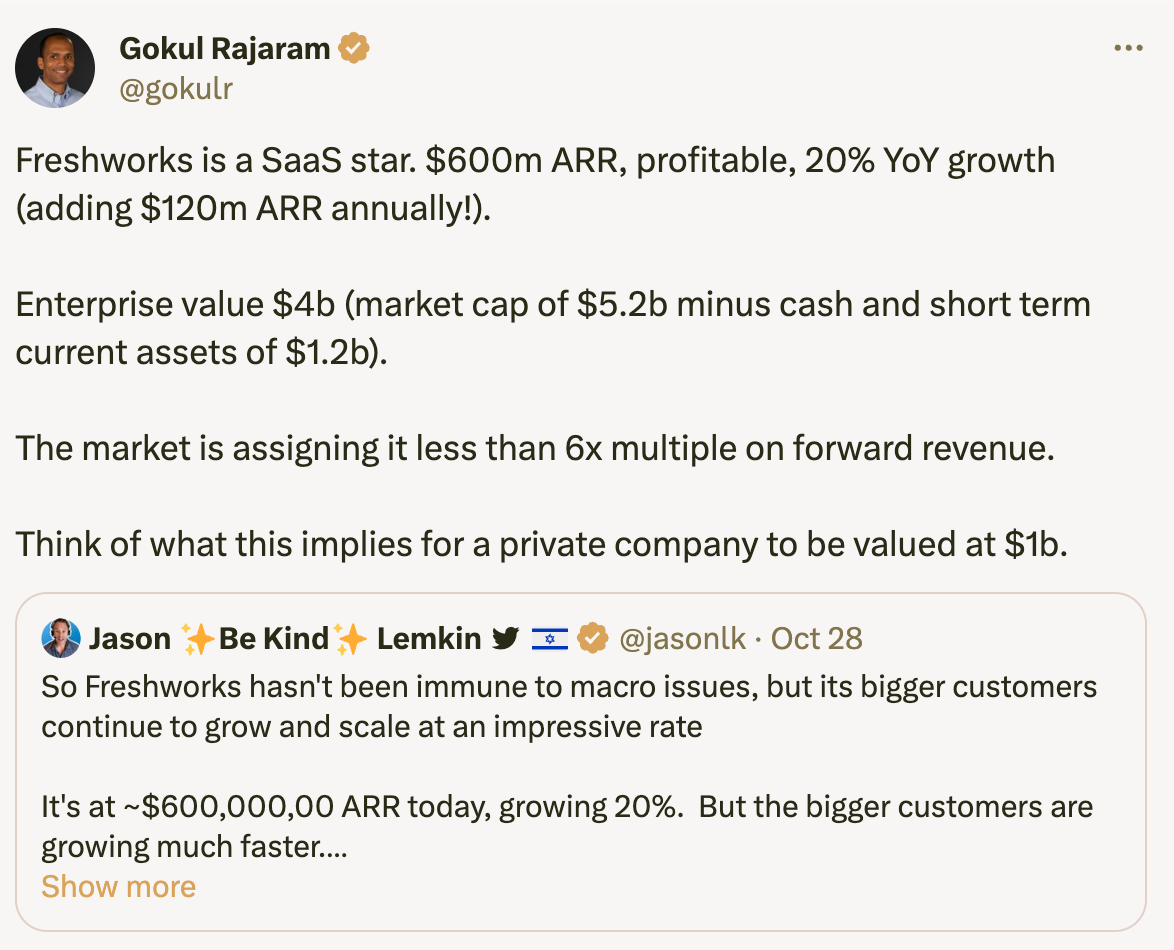

Most seed stage investors have remarked on how valuations have been immune to the wider correction and have even increased since the macro swing.

‘Seed-stage valuations have generally been left-unchanged, and I could argue even they’ve gone up since the beginning of 2022.

Early-stage is perhaps a more attractive stage to deploy smaller dollars these days – a friend remarked everyone wants to gamble, but no one wants to sit at the whale tables just yet.’

- Semil Shah

We can slice this even further - it’s the very best seed deals that are seeing an increase in valuations, whilst deals outside the top decile have been much more vulnerable to the market correction.

Hunter Walk posits:

‘I’m defining Top 10% and Second 10% as “degree to which their founders, markets, and milestones pattern-match for the average seed investor.”

This is obviously imperfect and to truly segment quality would take 10+ years. But think of this as equivalent to average salary of Top 10 picks in the NBA draft vs picks 11-20. I’m saying that 11-20 were hit harder by the downturn where as before they were often evaluated similarly by the venture community and rewarded commensurately.’

Let’s trace some of the antecedents.

The risk curve of a growth investor has had to be redrawn in the new environment where the upside is not as large as we once thought, nor is it as accessible as it once was. Multi-stage funds raised large vehicles in the halcyon days and these dollars need to be deployed.

There’s a general flight to quality across asset classes and the manifestation of this in venture is the competition for top decile founding teams and markets at the seed stage. Dispersion is widening.

Why are the Top 10% less impacted? Well, the obvious reason is they look like better risk/reward opportunities, but I think it’s also because generally the better brand name firms are doing the Top 10% deals. They have stable capital bases, care less about the different between a few hundred thousand dollars in entry price, and so on.

The risk curve of a seed investor is fundamentally different to that of a growth investor. Valuations can spiral to outrageously high levels but still look cheap in the long-run - growth investors would envy that asymmetry.

‘One of the most attractive parts of Seed-Series A venture is regardless of macro environment they can only be bid up so much; and if a company goes on to IPO or sell in a meaningful way those differences are negligible.’

Alpha generation in venture accrues to those that can increase potential returns with a less than commensurate increase in risk.

‘If alpha is the ability to earn return without taking fully commensurate risk, investors possessing it can do so by either reducing risk while giving up less return or by increasing potential return with a less-than-commensurate increase in risk. In other words, skill can enable some investors to outperform by emphasizing aggressiveness and some by emphasizing defensiveness.’

- Howard Marks

In the short to medium-term, multi-stage funds will increase activity at Seed and Series A given the attractiveness of early stage asymmetry. Early stage specialists will need to pay up to invest in top decile teams. More prudence will be applied to the remaining 90% in order to improve the plummeting graduation rates to Series A.

In the long-run, early stage venture will likely continue to institutionalise as growth funds become smaller in terms of size and headcount.

Early stage venture will not only be competed at the 0 to 1 phase but also at -1 to 0. Here’s

describing ‘Inception Investing’:“Inception Investing” means engaging with founders well before they incorporate, helping them battle test and iterate those ideas, helping them pre-sell some of the initial hires, and leading those rounds upon company formation so founders can run fast out of gates and not spend months trying to raise capital.

South Park Commons’ business model is helping founders at the -1 to 0 stage. Many communities or venture studios for exited founders are similarly acting as fertile grounds for potential entrepreneurs to explore ideas, meet cofounders, and validate assumptions.

Higher rate environment or not, great people pursuing great markets will continue to be the most prized combination in technology investing.

Reading List

Where are the opportunities for new startups in generative AI? Christoph Janz

Further Thoughts on Sea Change Howard Marks

The Most Contrarian Bet in Venture Capital

Every Software Business Has the Same Playbook Evan Armstrong

Navigating the LLMops landscape: What you need to know Insight Partners

Quote of the week

‘Thomas Edison failed in his first 100 attempts at making the light bulb...but he learned every time about what didn't work. We don't mind the failures. The key is to make the cost of experiments as low as possible. It's like flipping a coin where heads you win and tails you don't lose much. Flip enough times and the odds are that you'll come out ahead.’ Ho Nam

Thank you for reading. If you liked it, share it with your friends, colleagues, and anyone that wants to get smarter on SaaS, Fintech and GTM. Subscribe below and find me on LinkedIn or Twitter.