👋 Hey friends, I’m Akash! Software Synthesis is where I connect the dots on AI, software and company building strategy. You can reach me at akash@earlybird.com!

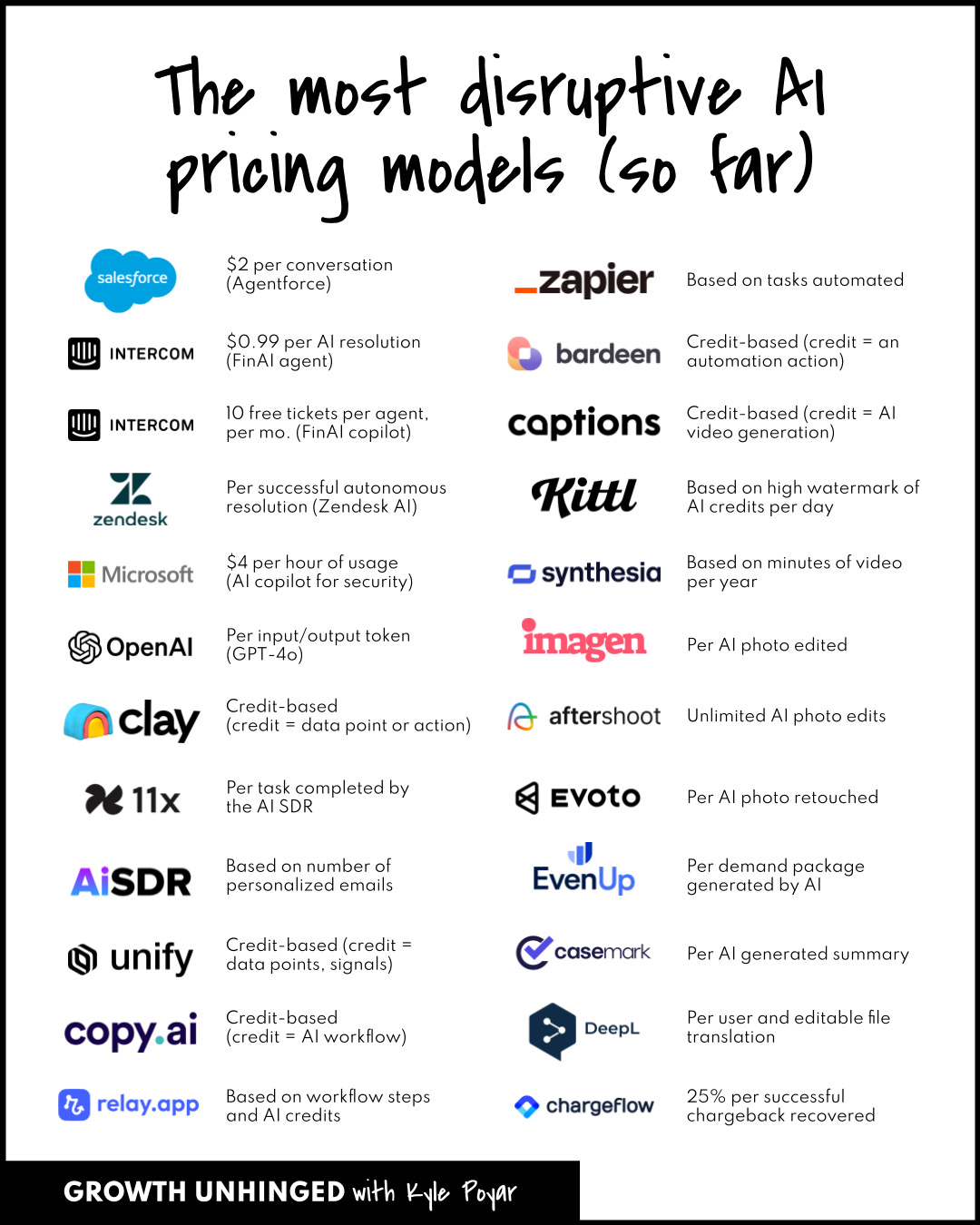

Salesforce GA’d Agentforce last week with a sticker price of $2 per conversation, which aligns with data suggesting buyers prefer the unit of consumption in customer service to be per conversation, not per resolution.

The speed at which incumbents are adopting consumption pricing is indicative of the fact that any cannibalised seat revenues will be more than offset by agent consumption revenue, which aligns value by replacing more expensive labour.

analysed this trend in an excellent breakdown:As we move from software augmenting workers to replacing them, various implications emerge.

The unit of value

Buyers will discern whether they derive value from agents completing work or on a success basis.

Customer service is the clearest example of where the latter is preferred (as measured by case deflection rates and successful resolutions), but the definition of success needs to be expanded to encompass various second order variables like NPS, repurchase rates, customer loyalty, etc. It’s harder to orient a reward model towards these sorts of indirect variables.

For other types of work like sales, buyers are likely to value each unit of work completed like messages sent or emails booked, which are upstream of the ultimate successful outcome. Where the status quo of the workflow typically has multiple human stakeholders involved, buyers are likely to view agent workers in a similar vein so as to avoid attribution issues.

Forecasting and billing

Broadly speaking, software companies with consumption models have been more cyclical with quarterly earnings seen as indicators of the health of IT budgets, given buyers’ ability to rationalise spend faster than multi-year seat-based contracts.

The wholesale adoption of consumption pricing in software will have implications for how vendors forecast forward-looking revenue and how CFOs try to bake in predictability into their software spend.

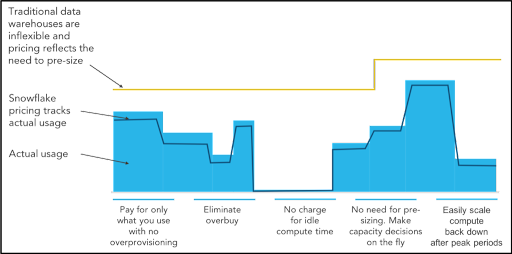

Realising the value alignment of consumption-based pricing will mean vendors having to embrace true elasticity, ensuring buyers have complete flexibility over every unit of value they consume. Many vendors will likely look to emulate the forecasting and billing infrastructure that Snowflake built:

Because operations including suspend, resume, increase, and decrease are essentially instantaneous, customers can precisely match their spending to their actual usage, without carrying headroom for unexpected usage or worrying about capacity planning at all.

Buyers will look for vendors to offer cost governance controls above real-time metering and provisioning:

For organizations that want to control spending, Snowflake gives you a robust toolset for cost governance and control. Users get full visibility into historical and predicted usage patterns and can set alerts or hard limits on consumption at a granular level. Limits can be set for daily, weekly, monthly, or yearly consumption limits. At the discretion of each company, those limits can be informational notifications or hard caps that prevent further usage when quotas are reached.

At scale vendors will report LTM and NTM revenue, remaining and current RPOs.

Batched inference

Vendors offering work that is ‘always on’ in nature will likely look to improve their margins by batching inference calls and getting volume discounts from the foundation models.

Packaging multiple workers

Horizontal platform vendors will experiment with pricing and packaging to formulate different packages with varying price points per worker.

Vendors will likely adopt penetration pricing to grab market share in the first few years, accumulating data on consumption patterns that helps inform packages that have blended prices with higher margins.

Enterprise Software Metrics

Hybrid models are likely to prevail over pure consumption or seat-based models in the medium term.

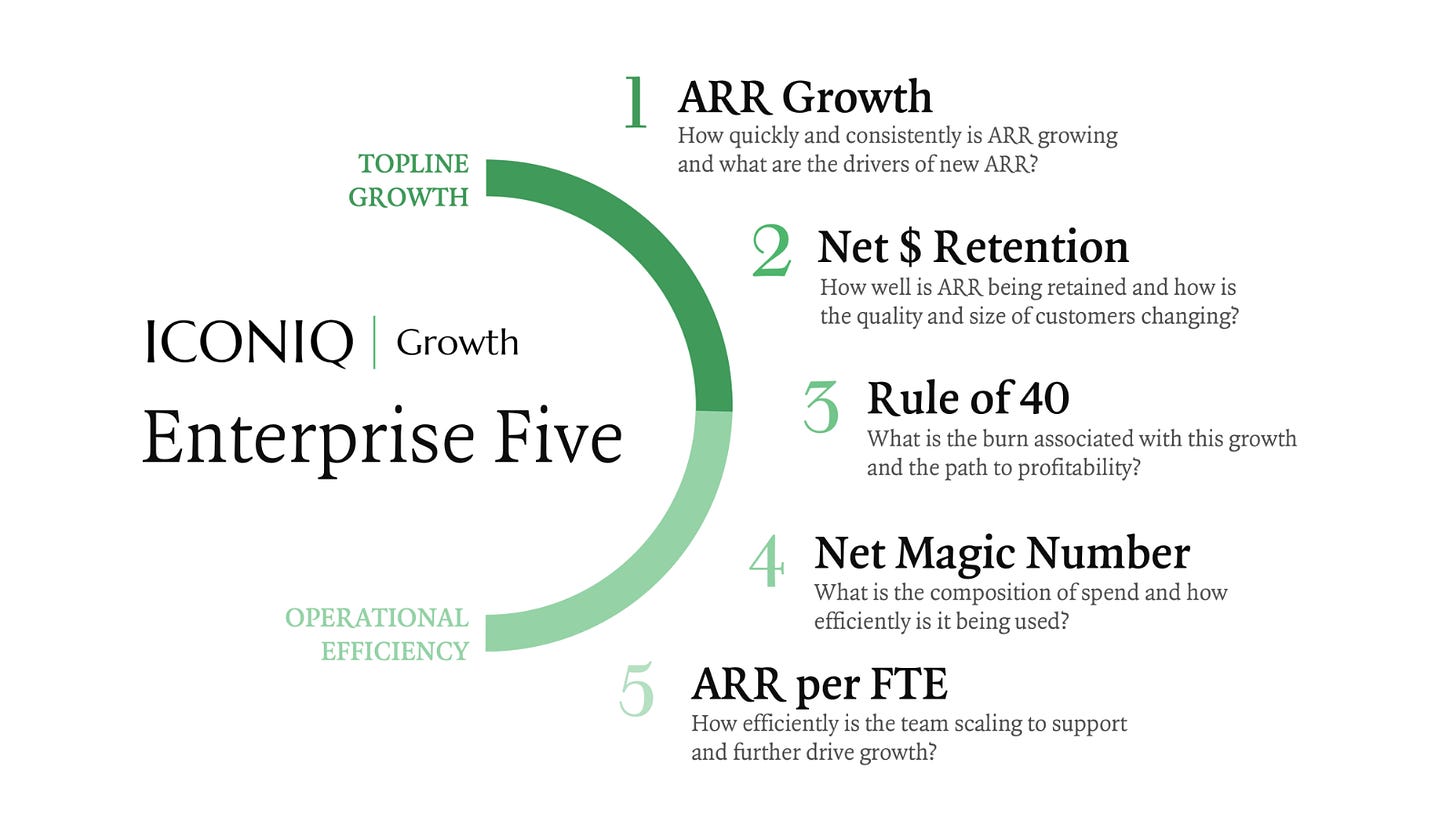

In that scenario, investors will need to assess top-line revenues that are a combination of recurring revenue (and all the beneficial properties that entails) and consumption revenue (with the volatility that brings).

Enterprise software metrics predicated on ARR will need to revised:

NRR will be closely studied as it becomes a more real-time indicator of customer health, whilst a reframing of ‘ARR per FTE’ will reflect better on organisations that are able to align their functions towards product adoption and repeated usage (e.g. product teams having a revenue quota).

As companies blitz past typical ARR growth rates, we’ll have to devise new software benchmarks for growth as we eat into services spend.

Thank you for reading. If you liked this piece, please share it with your friends, colleagues, and anyone that wants to get smarter on startup strategy. Subscribe and find me on LinkedIn or Twitter.