Software Production Functions and Recombining Ideas

The role of building blocks and ideas in the software production function

Hey friends! I’m Akash, an early stage European software & fintech investor.

I write about startup strategy to help founders & operators on their company-building journeys, with occasional interviews of leading GTM operators.

If you’re a founder or operator, you can always reach me at akash@earlybird.com to exchange notes!

Current subscribers: 3,860

ZIRP reflections continue as we calibrate what the software production function will look like for the post-ZIRP class of software companies.

Labor and capital are the classic inputs into a production function to describe economic output.

Michael Mauboussin

Michael Mauboussin published a new paper recently studying the drivers behind increasing returns with scale.

Economic theory has largely coalesced around the notion that perfect competition eliminates pricing power, margins and market share.

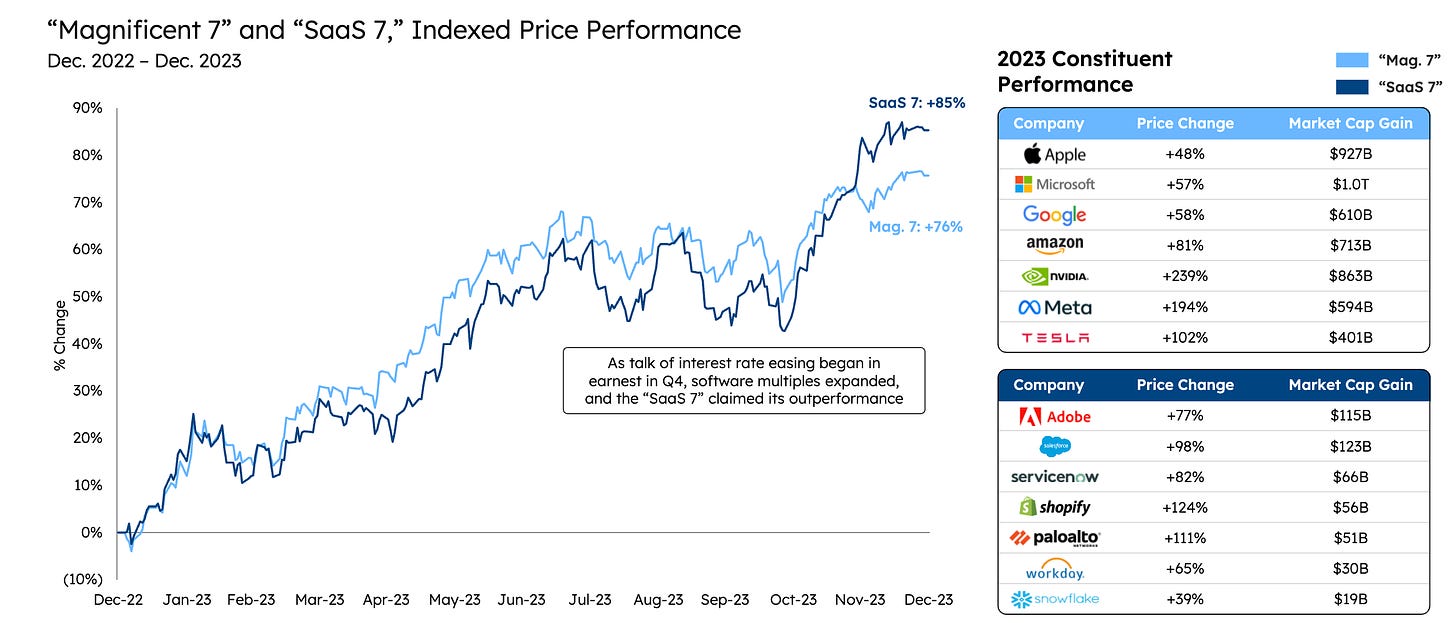

Yet, the Magnificent Seven seem to go from strength to strength - if you slice it down to Microsoft, Nvidia, Meta and Amazon, increasing returns at scale are even more evident.

Last week, Brad Gerstner and Bill Gurley discussed how Tech has grown from 5% to 15% of global GDP over the last 15 years, largely owing to faster growth rates.

As software companies get fitter and stack new S-curves of growth, later stage companies become highly effective capital allocators - which is why we’ve seen Tech outstrip the rest of the economy and continue to compound in the public markets.

One way to think about the software production function at scale is:

One mental model of a SaaS business is that it is a big incremental revenue generating machine. Engineers, product managers, account executives, and marketers are hired. Products are built and sold and incremental revenue comes out the other side and is added to the existing base of recurring revenue.

Good SaaS machines are investment constrained - if more dollars are poured in, more dollars come out the other side. The best SaaS businesses are geared to return the same or more dollar for dollar as they scale. Buck on Software

Early Stage Production Functions

Discovering the software production function as a company scales is somewhat like discovering laws of physics - it’s out there to be found.

In ‘Increasing Returns’, Mauboussin discusses ‘recombination of ideas’ as one of the drivers:

‘Innovation is the result of recombining ideas to allow inputs of the production process to be transformed into greater output.

The more ideas there are as building blocks for innovation, and the ability to manipulate them computationally, lead to the potential for faster growth and increasing returns.

Innovators can also use successful products as building blocks for future recombination. Some of the world’s most valuable companies did not exist 30 years ago because the building blocks, such as the internet and sufficient computing power, were not around and the problems they solved were yet to appear on the horizon. Businesses come and go because of change in the available building blocks and in problems in need of a solution.’

The interplay between building blocks and applications is well documented (e.g. here, here, and here). One school of thought is that applications beget infrastructure - in the case of the Magnificent Seven, most have straddled both applications and infrastructure to assert their increasing returns and take destiny into their own hands.

At the earliest stages, the production function for product market fit is far less mathematical.

The notion of recombining ideas is a relevant input, though.

On the one hand we can embrace learnings from prior platform shifts, like how the emergence of distribution channels lagged the introduction of new technologies, and on the other we can reason from first principles on how entire workflows should be redesigned from the ground up with this new technology at our disposal.

The ability to recombine existing ideas to conceive of innovations that truly move the needle for customers beyond competitors is a key input in the early stage software production function.

The ability to sustain it past PMF, in a period of such flux, is a type of process power that few companies attain.

As software creation and switching costs compress, the ability to best leverage building blocks from third parties and lean into your core competencies is paramount.

Imagine moving from Gmail to Outlook, or HubSpot to Salesforce, with a prompt. Imagine the new app’s AI spinning up templates for your business and cleaning up your data, making the switch feel like a fresh install. You could afford to move every time one of them released a new feature.

Everyone’s grappling with how AI affects business models and distribution channels, but those who can recombine ideas and building blocks with the fastest learning rate are likelier to thrive.

Charts of the week

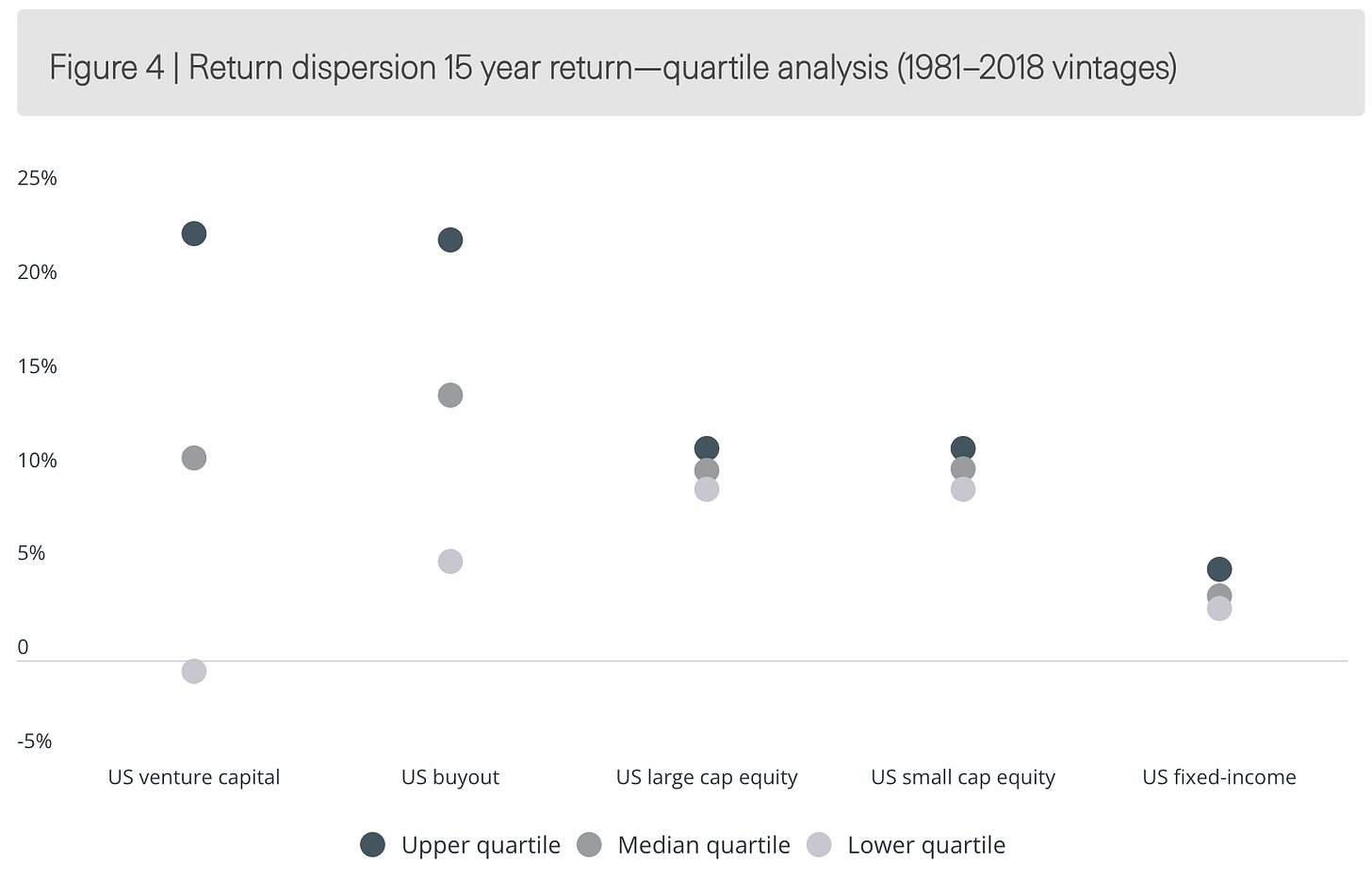

Venture Return Dispersion

Emerging Managers have a history of being the best in every vintage

Leverage on your developers is paramount

Reading List

It's Never Been More Important to Understand Your Capital Provider's Business Model

Speakeasy | The Internet of SDKs

Google's Gemini Advanced: Tasting Notes and Implications

State of SaaS Pricing with Alvaro Morales, CEO of Orb

AI agents as a new distribution channel Kojo Osei

Quote of the week

‘I love Hayek’s word “malinvestment,” because of the validity of the idea behind it: in low-return times, investments are made that shouldn’t be made; buildings are built that shouldn’t be built; and risks are borne that shouldn’t be borne.

People with money feel they must put it to work, since cash yields little or nothing. They drop their risk aversion and, as discussed below, compete spiritedly for lending or investing opportunities with higher potential returns.

The investment process becomes all about flexibility and aggressiveness, rather than thorough diligence, high standards, and appropriate risk aversion.’

Thank you for reading. If you liked it, share it with your friends, colleagues, and anyone that wants to get smarter on startup strategy. Subscribe below and find me on LinkedIn or Twitter.