Join over 2,200 readers including founders, operators and investors for Missives on software investing, GTM and strategy here.

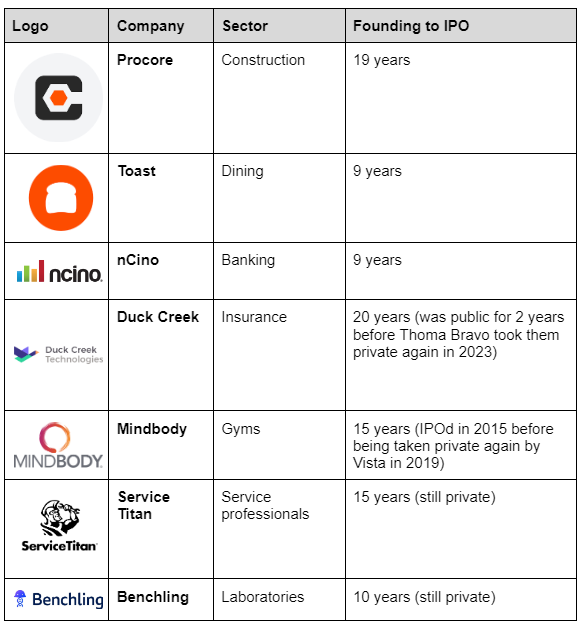

Vertical SaaS companies tend to take longer to exit - even the very best (Toast, nCino) took 9 years to IPO, whilst companies like Mindbody, Procore and ServiceTitan took 15 years or more.

Yet, vertical software markets exhibit a few characteristics that make them particularly attractive: winner-takes-most dynamics (Veeva has 60% market share vs Salesforce’s 20%), stickiness and longer refresh cycles, latent cross-sell potential, and higher terminal margins. Mark Leonard, founder of the $40 billion vertical SaaS acquirer Constellation Software, wrote in a 2009 shareholder letter:

Our attrition rates also illustrate the long-term nature of our client relationships. Attrition due to the loss of customers in 2009 was ~4%, suggesting that our average customer will stay with Constellation for 26 years.

The median time to exit is largely attributable to the ‘layer cake’ formula of landing accounts with a control point (software for the front-office, such as a CRM, or for the back-office, such as general ledger accounting) and then expanding these accounts with a product suite, i.e. payroll, insurance, payments (and even extending through the value chain).

Parker Conrad and Rippling have recently popularised the concept of a compound startup, which entails building multiple different products in parallel and solving larger business problems that span distinct business systems, rather than point solutions.

Multi-product suites may well be destiny for horizontal SaaS tools as well (78% of public companies with > $5bn of market cap are multi-product), but building as a compound startup or a platform of compounding greatness is a Darwinian adaptation Vertical SaaS companies have had to adopt from their inception due to constrained TAMs.

Much of the recent discourse on moat-trajectories in AI is focusing on vertical-specific applications, i.e. Harvey, Ironclad, Bloomberg GPT. Evidence continues to accumulate arguing that smaller models trained on higher quality, domain-specific data are more performant on various dimensions than larger models (latency/accuracy/cost).

As that enquiry continues, there are many more second-order consequences of AI worth unpacking.

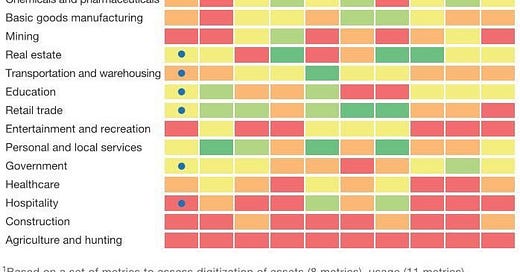

One of these is the degree to which AI will radically enhance existing vertical SaaS tools and accelerate the digitisation of shadow markets that are largely offline.

Despite the growing list of Vertical SaaS centaurs, pen and paper continue to dominate many industries.

I couldn’t help but notice that many of the business operations (accounting, order mgmt., inventory counting, and clearance) still heavily rely on pen & paper and old clunky machines that print out sheets to be checked by office managers.

Small business owners are not oblivious to the merits of software, but they will not seek it out when things are working just fine.

It’s not that the business owners don’t know that they are operating at a suboptimal level or that tech integration could be further deployed - but many of them think the current workflow process “works.” Moreover, the initial time and effort required to onboard & learn an entirely new technology could imply 3-5 days of “down days” in the business or even longer.

Does an autonomous agent product with a natural language interface that can perform the central nervous system functions of a small business (e.g. payroll, bookkeeping, accounts payable) deliver a sufficiently superior solution to the status quo to drive adoption? Furthermore, given that vertical SaaS vendors see significant market concentration, they would be well placed to deliver on the promise of a marketplace of autonomous agents that are interacting with each other on behalf of their SMB owners (all under the privacy and security of the platform).

Another strand worth investigating is the implications of software development efficiencies. Github Copilot and many other code-generation models have already shown remarkable results in terms of efficiency and productivity gains. Vertical SaaS companies have historically tended to be less capital intensive (e.g. Veeva raising only $7m before going public) as it is, but will AI obviate the need to raise external funding altogether if leaner teams can deliver the same product suites? Independent of funding requirements, will the product suite engineering lift be truncated, thereby reducing time to exit from 9 years?

Maybe, maybe not. Compression of software development costs will likely accentuate the importance of existing markers of success: exceptional founder-market fit and distribution excellence. Defensibility was never really down to the product itself by all accounts, but rather the management team’s proximity to the end customer and what this entailed in terms of integrations, industry-specific requirements, and the unique go-to-market channel mix to scale and assert category leadership.

This leads me to my final thought: will AI revolutionise traditional top-down, outbound sales and by extension Vertical SaaS GTM motions? After all, vertical SaaS is sold, not bought. Tomasz Tunguz has already alluded to the possibility of AI transforming account-based marketing, but another element undergoing rapid change is the research process for AEs. LLMs will empower Sales reps to conduct research more effectively across disparate data sources (e.g. Zoominfo, Apollo, LinkedIn), an activity that the best-performing sales reps spend a significant proportion of their time on. Given the proliferation of AI-enhanced go-to-market software, it’s very plausible that CAC paybacks are meaningfully reduced.

Far from conclusions, these are but a few thoughts on how AI might impact company building in vertical software. I’d love to hear what you think about these arguments or if you’ve been thinking about other second-order effects.

What I’m Reading

Generative AI: An Asteroid Impact Event on B2B Software by Christoph Janz

One of the questions I’ve been thinking about lately is whether the AI platform shift is more analogous to the mobile or cloud shifts, and the consequences for value capture between infra and apps.

Preserving data wealth in the midst of the great LLM arms race by Ziv Reichert

Ziv makes a compelling case for realising the latent value in our data in the age of AI - most of us have seen the Shoggoth meme depicting the friendly exterior plastered onto the monstrous results of unsupervised learning on low quality data.

Picking Your Market: Vertical TAM & Concentration by Tidemark Capital

Tidemark’s Vertical SaaS Knowledge Project is an invaluable canon on company building in vertical software. Determining which markets to pursue is a challenging exercise; Tidemark conduct an analysis to highlight markets that have the most fragmentation and by extension the most appeal.

As a vertical saas operator, thank you for writing this. I've shared it with my management team

Cannot agree more and wish I‘d read this before our conversation ;)