Sales forecasting 101 for early stage B2B SaaS companies: Jackie Karmel

Former Head of Sales @Retool and Sales Leader @Stripe

Hey friends! I’m Akash, an early stage investor at Earlybird Venture Capital, partnering with founders across Europe at the earliest stages.

I write about software and startup strategy - you can always reach me at akash@earlybird.com if we can work together. I’d love to hear from you!

Current subscribers: 4,310

I recently caught up with Jackie Karmel, formerly of Retool and Stripe. She’s now a hands-on GTM advisor and we had a great discussion on the process of sales forecasting. It’s a practice that doesn’t get enough attention among early stage founders, so we broke down some of the key insights founders should have in mind.

Jackie Karmel is an independent consultant, working as a hands-on GTM and sales advisor for fast growing startups. She spent the last decade building and scaling sales teams for companies like Stripe and Retool. If you’d like to learn more about how she puts these forecasting practices into place, she’d love to hear from you.

Jackie, to start, could you tell us why forecasting matters? What purpose does it serve for early stage companies when the GTM foundations are starting to be laid?

Building a cadence of forecasting is helpful on many fronts. These are the top benefits I typically see:

Helping with prioritisation

Early days in sales, it’s challenging to know which type of deals to prioritise. Even once you’ve figured out your ICP, there’s still work to do to understand your sales cycles and often you’re running various sales motions at once e.g. trying to build a pipeline with large companies that you know will have potentially larger ACV but a longer sales cycle vs smaller opportunities which you can close quickly to build run-rate. Forecasting these deals rigorously will help the team better understand what to prioritise from a product development standpoint, where to direct your sales efforts and how to think about hiring according to the needs of the pipeline.

Culture of accountability

Building a regular cadence of asking reps (if you already have them in seat) to commit to delivering a revenue number, brings accountability into the process. You may not be 100% accurate every month but getting into a rhythm of forecasting deals, accurately updating close dates/next steps and so on builds a culture of ownership and accountability early on.

Setting realistic expectations

Using a framework to forecast deals forces the person running the deal to ask tougher, more nerve-wracking questions of their prospects to ascertain how realistic the opportunity is e.g. asking the prospect “do we feel it’d be viable to move forward to signature in xyz timeframe?”. Or, “I’m working on the assumption that provided we prove out XYZ, you will sign in May and we’ll onboard you in June, is this the same timeline that you had in mind?”. Often we can shy away from these types of questions for fear of rejection but it’s much better to know upfront and forecast accordingly.

Building a predictable revenue engine

By following rigorous forecasting processes, you start to build predictability into your revenue stream. If you know, for example, sales will be very slow in the summer months, you can forecast accordingly and also use that as an incentive to create urgency to bring opportunities to fruition in May and June. Paying close attention to the pipeline and understanding when deals will land provides founders with a view for true health and therefore reliability and predictability of the pipeline.

At what stage should companies start forecasting? Is it post-PMF or after the Series A? Who is involved in forecasting in addition to the founder?

It’ll be very dependent on your product, ICP and sales motion. If for example your product has proven PMF and you are selling into SMB, you are likely able to get up and running with building out the pipeline fairly quickly and therefore getting into forecasting as early as possible can be helpful. If you are selling into Enterprise and expect a lengthy sales cycle, forecasting may be more tricky to do at the start but it can still be a good idea to get into a habit of estimating when a deal will land and what key milestones you should be hitting to keep to that timeframe.

Anyone involved in the sales cycle should be involved in forecasting. You may even need to loop in Product if you’re building a specific product as part of the deal, so that they can start to understand the expectations of the prospective customer. In the very early days, it’s great for everyone in the business to have visibility into the pipeline and to understand what type of prospects the product is resonating with. This will ultimately inform the overarching strategy for the coming months and quarters.

How frequently should companies forecast and what are the merits of different cadences?

Ideally get into the habit of a weekly forecasting meeting where the sellers (or even just the founder) puts up the revenue number they’re committing to for the month and the key deals that’ll make up that number.

Depending on your stage, forecasting a month out is helpful, e.g. commit for May is X and we’re going to deliver it with xyz opportunities. When you get a bit more confident in this approach and as the sales team scales, you can move to a quarterly forecasting motion, with regular check-ins weekly to ensure everyone is on track.

What do you consider the appropriate confidence intervals to be for early stage forecasting? Should it be 90% confidence, or does this vary by stage?

It really does vary by stage.

I’d expect 90% confidence levels for any deal you’re committing to deliver (sign) in a given month. Of course things happen and deals move around but if you’re continually missing the forecast you’ve said you’ll deliver at the start of every month, it’s time to look at your sales process (probably your qualification of opportunities), to ensure that the deals you’re forecasting are truly viable in the timeframe you’re expecting going into the month.

How do pipeline review meetings factor into the forecasting? If the forecasting cadence is weekly or daily, do the pipeline reviews typically lead to revisions of the forecast on a regular basis?

Ideally the pipeline review is the opportunity for the rep and the manager/founder to go deep on top deals in order to provide guidance and an extra layer of strategic thinking. It can be helpful as a way to spot gaps and blockers early in a deal cycle and look to course correct. It’s a chance also for the rep to answer some tough questions on the piped opportunities to sanity check the deal is the shape it ought to be given where it is forecast to land.

When it comes to the forecast review, ideally we have a decent view of the forecast going into the month and this doesn’t vary huge amounts week on week. We check-in on where we’re at every week towards the forecast and aim to improve our accuracy every month until we feel confident in delivering on the pipeline that we start every month off with.

Are there any key differences in how forecasts should be run at enterprise-sales focused vs SMB sales companies?

With Enterprise, we probably want to be looking at forecasting a quarter out, since the sales cycles tend to be longer. We’ll also need to allow for a longer ramp for new AEs. The forecasting process and rigour in Enterprise is very important since a few deals can swing the quarter and so knowing when they’re most likely to land is very important from a planning perspective too.

SMB deals tend to be higher velocity and larger volumes of opportunities and therefore running weekly forecasting sessions can be helpful to aid reps prioritisation and keep deals moving along at pace.

In the current environment when new bookings are harder to come by, are you seeing companies involve Customer Success more in forecasting, to derive more reliable estimates of expansion ARR? Does the same apply to other post-sales GTM functions like solutions engineers, implementation teams that have visibility into likelihood of retention and expansion?

Yes definitely! Everyone in the GTM responsible for revenue should be involved in the forecasting process and have the same accountability around delivering their KPIs. Customer Success can play a key role in forecasting since they are likely very in sync with how their customers buy, what the triggers are for expansion and any potential roadblocks to overcome in order to grow the account.

Lock-step partnership between Account Executives, Account Managers and Solution Engineers has never been more important to ensure a customer can grow in the timeframe you originally outlined when they first buy in to your product.

Thank you Jackie!

If you’d like to know how Jackie can help you, please get in touch with her.

Charts of the week

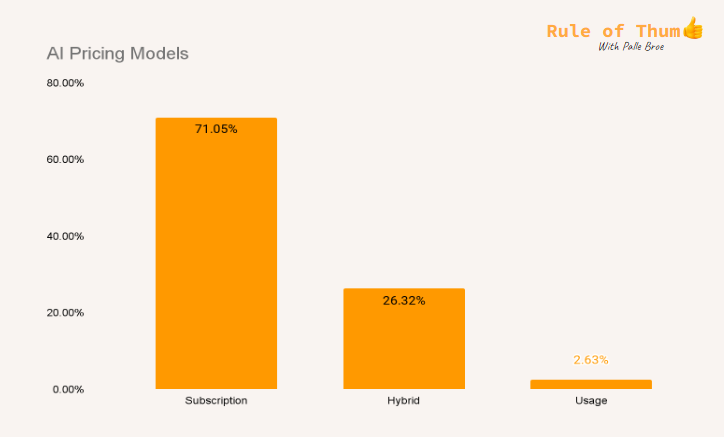

We’re still very early in the ‘selling work’ business model evolution, as evidence by current pricing models of AI applications

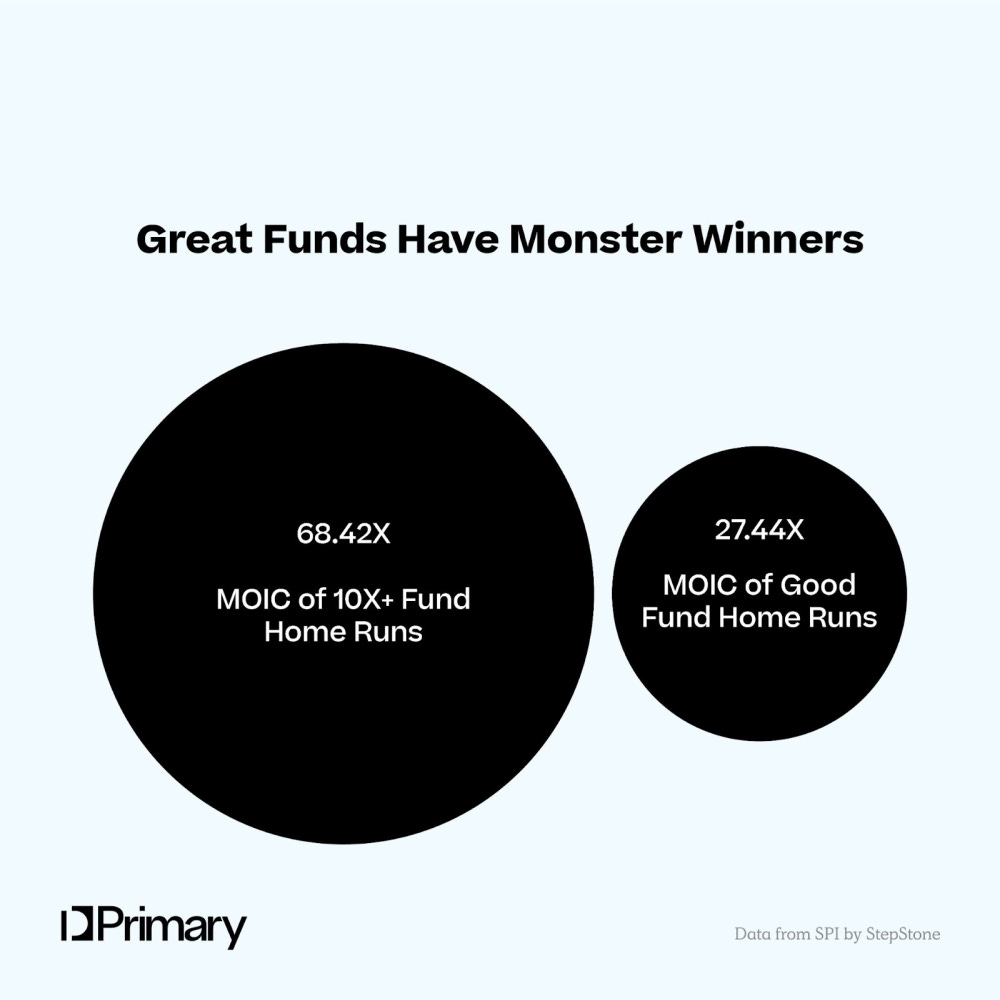

The best venture funds have disproportionately larger outliers than second quartile funds

Reading List

ServiceNow - Scaling to $10bn in ARR by

Rubrik S-1 - Burning the Boats in Data Security by Tomasz Tunguz

Big Winners and Bold Concentration: Unveiling the Secret Portfolio Returns of Leading Venture Funds by Jason Shuman

Quotes of the week

‘I think of open source as a very, very difficult strategy that I do not recommend other people to adopt — we did it because of our academic roots. I sort of liken it to playing baseball and having a strategy that you’re going to hit two home runs in a row after each other consecutively. The first home run is going to be your open source home run. You’re going to give away the software, and it better be a home run. “Home run” here is defined as the whole world loves it and downloads it, otherwise you’ve accomplished nothing, you’ve just given away your intellectual property for free and accomplished absolutely zero. So that’s home run number one. It’s necessary for the strategy, it’s not sufficient for succeeding.

Then you need to hit another home run in Peter Thiel’s parlance another Zero to One that’s 10x better than the open source project. So that’s the home run, if it’s 10x better than the open source project, that one you keep proprietary and you run with that.’

Ali Ghodsi on Stratechery

Thank you for reading. If you liked it, share it with your friends, colleagues, and anyone that wants to get smarter on startup strategy. Subscribe below and find me on LinkedIn or Twitter.