ICONIQ: The Nexus of VC, Hollywood and Silicon Valley

Differentiation through an unparalleled network

It was the best of times, it was the worst of times

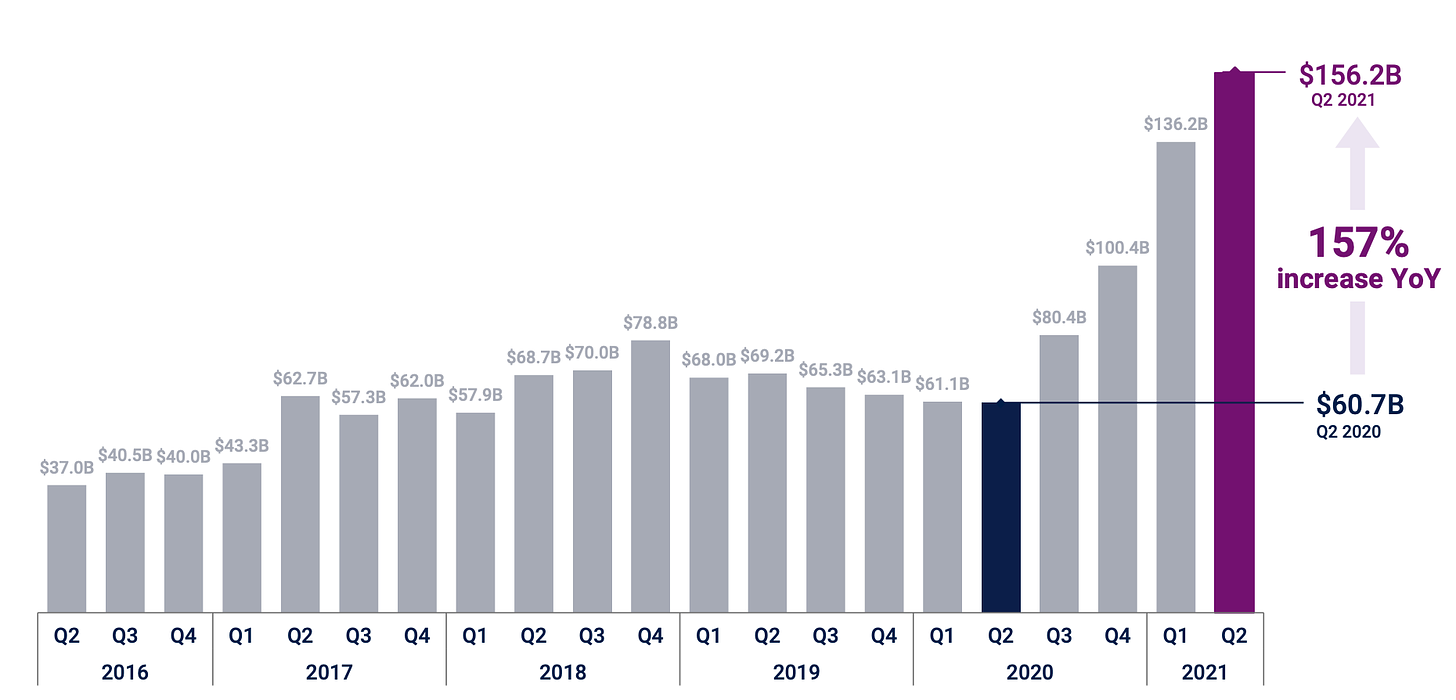

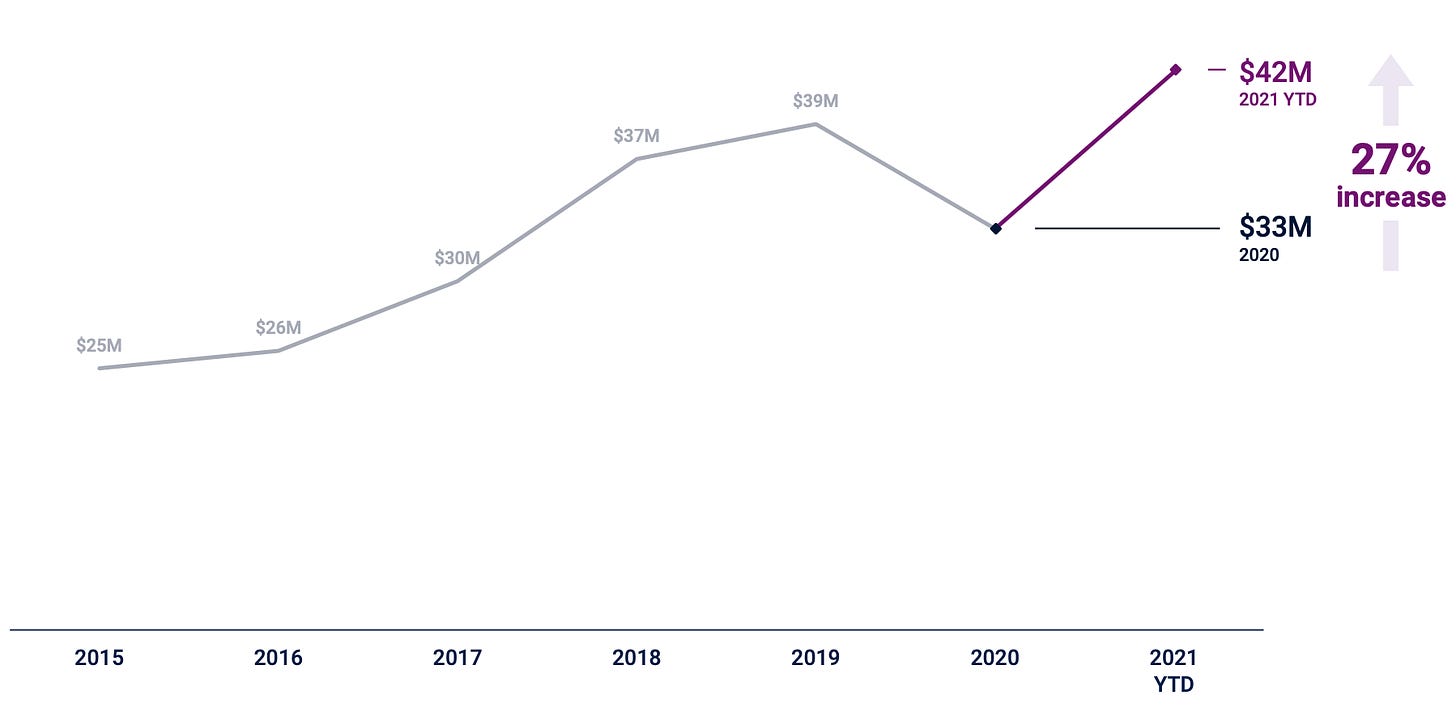

As an asset class, venture capital is undergoing a seismic explosion in growth. As many more astute observers have remarked, COVID induced step changes in society at previously unimaginable rates, touching every aspect of society including healthcare, education, government, and ecommerce. Many venture-backed companies are beneficiaries of these tailwinds, propelling them to unprecedented growth rates, as James Wise of Balderton noted:

The events of the last 18 months, coupled with a long-standing environment in which lower interest rates and lofty public market valuations have driven dry powder further into illiquid, alternative assets, have made venture capital an ideal destination for investors seeking alpha. We’ve seen a commensurate flourishing of fund managers deploying capital on behalf of these LPs, each asserting that they are uniquely positioned to defy the industry’s historical concentration of returns.

Later-stage funds are becoming multi-stage and backing companies from seed to IPO, early-stage funds are raising growth funds to do the same in an inverted order, hedge funds and private equity funds are swimming upstream (as we noted last week), and even superangels are raising monster funds to lead rounds on their own.

Let’s imprint on ourselves the environment in which funds are operating today: fundraising volumes and values are shattering records, valuations are going up, and there are few signs of a calming of this tide.

What does this mean? Mark Suster weighed in this week.

However, to be a great VC you have to hold two conflicting ideas in your head at the same time. On the one hand, you’re over paying for every investment and valuations aren’t rational. On the other hand, the biggest winners will turn out to be much larger than the prices people paid for them and this will happen faster than at any time in human history.

A plausible endgame 5-10 years from now is a further accentuation of the historical stratification of venture returns; fewer funds get into the best companies and the rest are overpaying for companies that won’t move the needle for their funds.

Several leading investors have opined on how this all plays out.

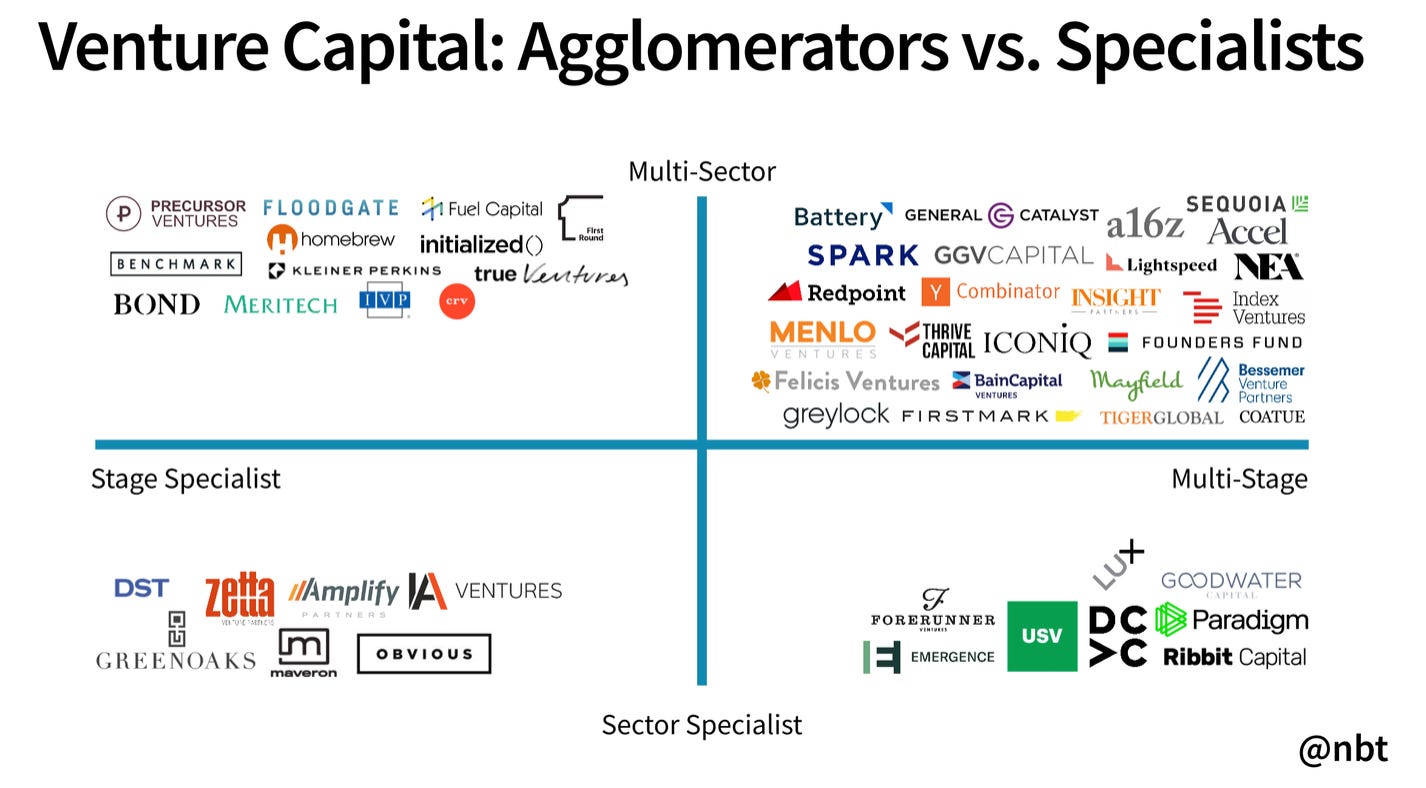

Nikhil Basu Trivedi predicted a bifurcation of venture funds along the dimensions of sector specialism, stage specialism, or being a one-stop destination for your financing needs from inception to ringing the bell at the NASDAQ.

Everett Randle predicted a squeezing out of the middle, analogous to what happened in retail. These are the funds that don’t offer signalling/brand, exhibit inertia, or a reticence to adapt their practices and processes to the new environment.

Mark Suster recalled a prediction from a16z’s Scott Kupor in his piece:

Years ago Scott Kupor of a16z was telling me that the market would split into “bulge bracket” VCs and specialized, smaller, early-stage firms and the middle ground would be gutted.

So, let’s take stock. The majority of funds have historically failed to meet return expectations. Rising valuations, and increasing competition are only making it harder to outperform. A logical extension of this is that funds have to differentiate themselves to win.

Among the vectors of differentiation that are most commonly cited, a network is surely the most commoditised? Most firms can introduce you to investors for your next round. Some can help you hire people. A few help you land customers. Can it really set you apart from the rest?

ICONIQ: the allure of a network like no other

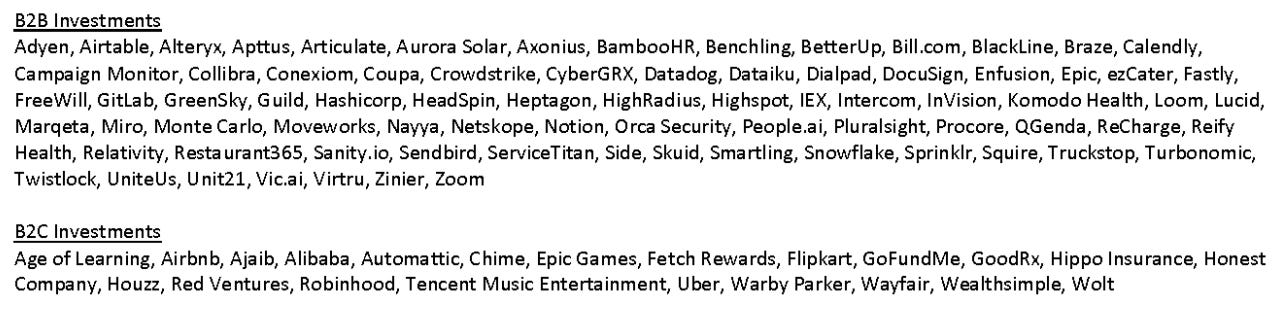

I count a hundred or so companies there. When they’re all bunched together it’s easy to gloss over the significance of some of these names, so let’s recite just a few of the notable ones that have crossed over into the public markets.

Adyen

Snowflake

Zoom

Flipkart

Robinhood

Marqeta

Uber

I’ve clearly omitted several names that can already be reasonably claimed as home-runs, but I hope that illustrates my larger point: this is an incredibly impressive portfolio, even more so when you consider that the firm behind it hasn’t even been around for a decade.

This is the portfolio of ICONIQ Growth, the venture capital arm of ICONIQ Capital.

ICONIQ Capital is a family office serving some of the most influential people in Silicon Valley. Founded in 2011 by Divesh Makan, Michael Anders and Chad Boeding, ICONIQ has now amassed $67 billion in assets under management and expanded beyond the family office into venture capital and real estate. ICONIQ raised their first fund to invest in private tech companies in 2013, and is now said to be raising their sixth fund of $3.75 billion, focusing on fintech and enterprise software.

In that time, ICONIQ Growth has muscled their way into hugely competitive deals, often co-investing alongside ‘tier-1’ funds or leading rounds, undoubtedly often securing allocation at the expense of prestigious VC firms from the Valley. How, one might ask?

Well, it turns out ICONIQ is absolutely unparalleled in one dimension above all: when you take investment from ICONIQ Growth, you can comfortably assume you are accessing one of the most powerful networks in the world.

ICONIQ serves a clientele intersecting Hollywood, Silicon Valley, and high finance. Mark Zuckerberg, Justin Timberlake, Chamath Palihapitiya, James Murdoch, Satya Nadella, Sarah Friar, Henry Kravis are but just a few of ICONIQ’s clients; I picked these names out to stress the plurality of sectors and eminence represented, but at last count this list has over two hundred names of similar influence and cachet.

In a world where every firm is marketing themselves and their brand, ICONIQ keeps a low profile (in fact, just writing this piece gives me pause, considering their alleged previous efforts to quash a Forbes piece). Brian Solomon of Forbes and Rob Price and Meghan Morris of Business Insider have previously chronicled the making of Divesh Makan and ICONIQ in great detail, so I’ll keep it short.

Divesh Makan was born in South Africa around 1974 and graduated with a degree in electrical engineering from the University of Natal. After some time in consulting at Accenture, he went on to complete an MBA at Wharton in 2001, an inauspicious time to be returning to the workforce as the dot-com bubble burst. Makan landed at Goldman Sachs in their wealth management practice in San Francisco, and from here on there was no looking back.

Divesh began to cultivate a network of future icons well before they gained prominence, including Mark Zuckerberg, Sheryl Sandberg, Dustin Moskovitz, Chamath Palihapitiya and many others. Facebook’s success was undoubtedly his big break, as it spawned a bevy of prospective clients with allegiance to Makan. He went out of his way to offer the best service for his clients, going beyond just managing their estate or finances to taking care of all of their life admin. He would facilitate introductions in his network, recommending Sandberg to Facebook. The seeds were being sowed for a seat at the highest of tables.

Fast forward to 2008 and Makan left Goldman (the nature of the departure is disputed by both sides), landing at Morgan Stanley, joined by eventual ICONIQ co-founders Chad Boeding and Michael Anders. The roots of ICONIQ were starting to emerge and in 2011, not long before Facebook’s IPO, Makan, Boeding and Anders left Morgan Stanley to found ICONIQ.

Rubbing shoulders with tech billionaires

As we noted, there’s an abundance of capital chasing very few exceptional businesses that will deliver exceptional returns. As a buyer of a product (VC), founders now have a long aisle to peruse. Some will claim to be hands-off and come with less dilution, others will claim the opposite, many will be in the middle, and so on. Even Tiger Global, though, at least tries to add value in some way (in this case by hiring Bain consultants).

With ICONIQ you get the chance to rub shoulders with icons of Silicon Valley, each ostensibly a contact you can leverage for the benefit of your company. As Brian Solomon wrote back in 2014:

Key to Makan's pitch is bowling over wannabe Zuckerbergs with raw star power. Before Iconiq led a $40 million Series D round last May for social media software firm Sprinklr, Makan invited founder Ragy Thomas to dinner with three famous billionaires.

"When someone like Iconiq wants to invest, you can't say no," says Thomas. "They can probably connect you to anyone in the world."

Aaron Skonnard, cofounder of e-learning startup Pluralsight, received a similar "join Silicon Valley's inner circle" pitch from Makan before Iconiq participated in the firm's $135 million Series B round.

"They don't want operational involvement," says Skonnard. "They just want to connect and network and give more access." He and his wife recently flew in to San Francisco from their home in Salt Lake City for a quarterly Iconiq networking event "where all the magic happens."

How has this product performed? Well, the proof is in ICONIQ Growth’s returns, which have have steadily improved over its five funds to deliver genuine alpha, enticing enough to attract institutional investors outside of the family office’s clients, such as the Canada Pension Plan Investment Board.

Let’s zoom back out to the state of the venture market. Every firm is selling value add beyond capital to win deals in a market that’s hotter than ever. How do firms add value? There’s the a16z model of a platform that supercharges every function of your business, which has been replicated to varying degrees by firms all over the world. Then there’s the pitch of choosing firms based on the pedigree of the firm for signalling value; being Sequoia-backed isn’t going to lose its sheen anytime soon. Then there are a variety of other pitches about helping with go-to-market, traversing regulation and what not. ICONIQ is a hark back to years gone by, when a rolodex was the single most valuable asset to move the needle for your firm.

Will Griffith set up ICONIQ Growth in 2013 and continues to lead the division today, having previous been a General Partner at TCV. Other notable team members include Matthew Robinson (formerly of Battery Ventures and TCV), Yidrienne Lai (also formerly of TCV), Doug Pepper (formerly of Shasta Ventures), Aditya Agarwal (formerly CTO of Dropbox), among others.

ICONIQ predominately continues to invest in the US at Series B and later, with little evidence of them swimming further upstream in terms of stage.

ICONIQ has been looking to plant a flag in Europe since the start of the year, searching for someone to lead their European investment efforts. Their European investments to date include Collibra, Wolt and Adyen. Whether they’ve found their candidate is unclear, but it only seems a matter of time until we begin to see them crop up much more in Europe..

That’s all for today folks 👋! Please do share if you enjoyed today’s read and reach out if you would like to share any ideas for future pieces.

Here are some of my picks from the archives: