Subscribe for Missives on software strategy and technology trends below. As always, if you enjoyed this please share it with your friends and colleagues:

‘AWS might have made it easier than ever to start a technology company, but a flood of S&M-bound venture dollars have made it harder than ever to build a technology brand.’

Secular increases in SaaS CAC are not abating.

The long-term operating target for S&M spend for high quality software companies is 25 cents of every dollar of revenue, yet as Snowflake climbs to a 17x multiple it continues to invest over 50% of revenues in S&M. S&M spend as a % of Opex has also proven obstinately high for the very best software companies, including Confluent, MongoDB, and Monday.com.

The ballooning of the venture asset class and the adverse consequences in the form of category saturation will take time to unwind, but in the interim cost-efficient acquisition channels are imperative.

In this context, I’ve been thinking about Aashay Sanghvi’s reflection on emerging enterprise software distribution channels:

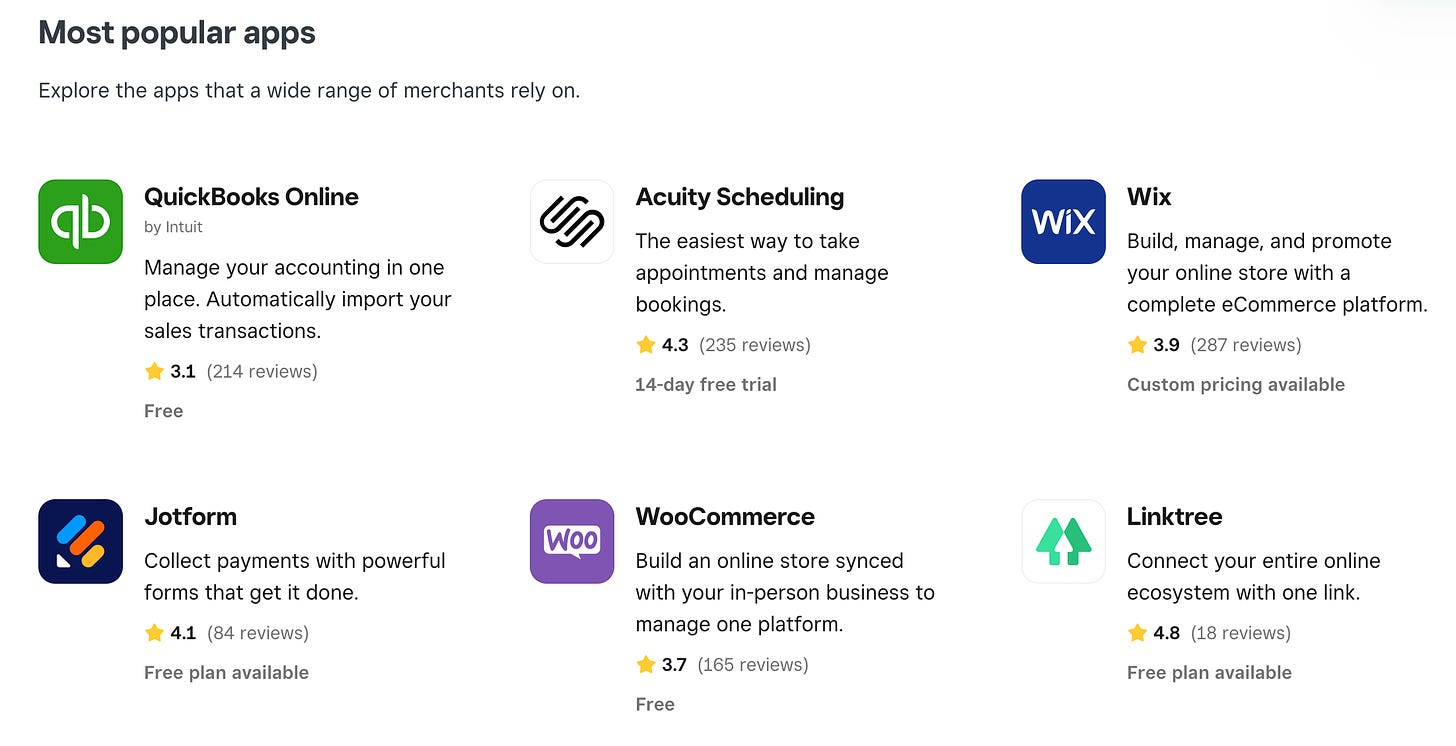

A broad taxonomy would be integration pages and app marketplaces; ecosystems of third party apps are a canonical ‘second act’ on a company’s $100m > $1bn ARR journey. One framing of this symbiosis is that growth stage companies provide early stage companies with distribution in exchange for lock-in.

For certain categories of application software like Sales & Marketing tools, clear leaders like the Zoom and Salesforce App Exchanges come to mind. For data tools, cloud warehouses/lakes like Snowflake are pre-eminent, as well as the hyperscalers (AWS, Azure, GCP). Horizontal enterprise application software vendors have natural synergies with RPA giants like UiPath.

Up until recently, a fifth of every venture dollar was going into fintech - fintech founders feel the burden of unit economic stresses more acutely than most. Ergo, incubating novel distribution channels is key.

An excellent case study is Xero, the accounting software provider. Founded in New Zealand in 2007, the company successfully expanded into Australia, UK, US, and more, supports over 3 million customers, and is currently valued at c. $11bn. A big component of Xero’s success has been its platform of partners.

It became almost a part of Xero’s brand—being very open about wanting to work with others because we win, the customer wins, and our partners win, which is the way to go.

As its app marketplace matured, APIs become more developer friendly and clusters started to form. The result was billions of dollars of cost-efficient value creation for Xero’s partners:

If someone’s coming to our app store or working with us, they’ll always look at that label, that API connection, or that extra subscription they’ve got and go, “Wow, that’s the best CAC we could ever spend.” There are app partners in our ecosystem that have hundreds of millions of dollars valuation, billions of dollars valuation, and they’ve got 30%, 40%, 50% of their customers with Xero.

Xero’s partner ecosystem oriented around the goal of serving small businesses with the software they needed to run their business, starting with accounting and expanding outwards from there - in some cases it made sense for Xero to build new SKUs, and in others it made less sense.

When you started to stitch up the data, it brought the product alive to another level, but as we went further out, we found this long tail of amazing opportunity as well that was just never going to be feasible to get into.

Similar synergies are evident at PayPal, Block, Wise, and other listed fintechs - adjacencies to the core value proposition for their ICP, increasing the gravity of their platforms.

Ramp has a marketplace of lenders (e.g. Capchase) and accounting vendors (e.g. Pilot).

Starling offers its checking account customers a financial product marketplace spanning credit, mortgages, insurance and wealth management.

Rippling’s app marketplace of 500+ apps encompasses the entire spectrum of application software from HR to Finance to IT.

Klarna’s partner ecosystem includes PSPs and technology providers.

As we’ve discussed before, investing in partnerships is akin to R&D for the long-term durability of the GTM motion. Platforms accrue the lion’s share of the value, but from the perspective of an early stage company, fishing in a late-stage company’s captive customer base must be one of the top considerations for customer acquisition in the current climate (as Xero’s partners have found).

The challenge is identifying the right marketplaces that will drive high intent traffic and then allocating the requisite resources from an account management perspective to extract maximum value from listing.

I’d love to hear your thoughts on further fintech distribution channels that I’ve missed and your experiences on navigating the listing process - surprisingly, there is little literature on how to expedite the process.

What I’m Reading

Do You Want to Manage or Do You Want to Invest?

Charles Hudson of Precursor Ventures asks the question of GPs as venture funds scale into territory where management supersedes investing responsibilities.

Using Generative AI to Unlock Probabilistic Products

Anish Acharya of a16z poses a loose framework for how to incorporate LLMs into fintech products based on tolerance for probabilistic outputs. Given that JP Morgan is exploring adding ChatGPT to Chase, many thorny questions will be raised around how to navigate various trade-offs around accuracy and the stochastic nature of the models.

SlopeGPT: The first payments risk model powered by GPT-4

Slope, the B2B Payments company, found GPT-4 meaningfully additive to its risk models as it was able to more accurately categorise revenues and expenses for the customers it was underwriting.

Buffett-backed Nubank reports record revenue on steady user growth

Nubank has grown ARPU by 30% YoY to $8.6, further cementing its multi-product expansion. There’s a sizeable greenfield opportunity in payroll-attached lending too, which they’ll be going after shortly.

Alan’s plan with Generative AI

The French insurtech Alan and it’s executive team have wholeheartedly embraced LLM capabilities inside their organisation, starting with workshops on how to boost productivity and efficiency. The initial gains may be marginal, but setting the right culture of curiosity and eagerness to learn will yield innumerable benefits in the medium-term to organisations who adopt this posture.