The last few days have been hard to bear. I hope that this week begins with better news, but in the interim I’m hoping that all of you are coping well and that we can all weather this storm.

Join 2,000+ founders, operators and investors for Missives on software, fintech and GTM strategy by subscribing here:

If you enjoyed today’s piece please share it with friends, comment and subscribe!

The conventional wisdom in investing is that truly great returns lie at the intersection of being non-consensus and right. Andy Rachleff, co-founder of Benchmark, enunciated the merits of being non-consensus and right as drawing less competition, thereby giving startups more time to develop capabilities to differentiate.

In the private markets, companies in this quadrant are the closest thing to arbitrage by dint of healthier entry prices relative to consensus investments.

At the same time, the real money in this business is made by being non-consensus and right: being correct when everybody else disbelieves. This happens all the time. For every deal that Sequoia does, it’s possible that Benchmark, Andreessen or somebody else passed on it. For every deal that Andreessen does, maybe Sequoia didn’t want to pay as much, so they passed on it. Naval Ravikant

In times of excess capital, the merits of non-consensus investing are intuitive. Investing in consensus companies, even if you're right, invites a torrent of capital into a category, suppressing returns for the asset class.

We have seen over and over again how excess capital can lead to crowded emerging markets with as many as 5-6 VC backed competitors. Reducing this to 2-3 players will result in less cutthroat behavior and much healthier returns for all companies and entrepreneurs in the market. Bill Gurley

Q4 2022 presaged a sharp decline in the venture asset class to a healthier, sustainable size where categories are not overcapitalised. With LP sentiment having deteriorated, funds will slow down deployment to stretch deployment periods and delay having to raise their next funds, particularly in absence of DPI.

In this new normal, there's an argument to be made for the merits of consensus investments: consensus investing in capital-constrained environments increases the likelihood of raising follow-on funding successfully.

Whereas in venture capital, it turns out being consensus right is probably even better than being non-consensus right. Alex Rampell

If a company and category is intractably non-consensus, it's an uphill battle to convince downstream investors to inject capital. The amount of capital required to scale is likely greater than the pool of non-consensus specialists. It follows that all companies are on a continuum from non-consensus to consensus.

Rick Zullo of Equal Ventures wrote a brilliant article discussing how early stage investors are only able to assess moat-trajectories - the same applies to consensus-trajectories at the earliest stages.

So it's fine if you're a non-consensus and then it trends towards consensus, but if the investment is non-consensus long enough, that's actually great for public markets, typically. It's not great for the private markets because you tend to need somebody else to believe and actually coalesce around what is your consensus. Alex Rampell

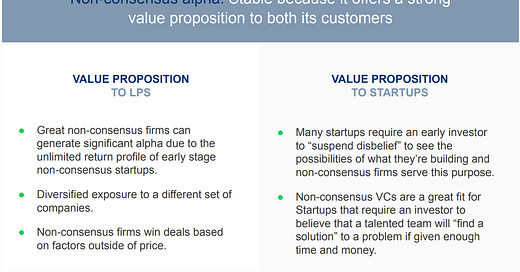

QED identified four stable points for venture firms: Scale, Late Stage Specialist, Non-Consensus Alpha, and Solo Capitalist.

For founders addressing certain markets, a non-consensus specialist is the best fit at seed. Non-consensus specialists will uniquely share an entrepreneur's vision of the world, mobilising the requisite resources to help materalise the vision in ways that consensus late-stage or multi-stage funds simply can’t.

This is where we play, pre-product market fit for companies deploying technology across complex sectors that are non-native to traditional venture.

We find that founders in these industries often struggle to fundraise prior to achieving product market fit and we’re not surprised. The industries they operate in are complex and its hard for an investor to develop conviction in something they don’t fully understand. Rick Zullo

All investors and founders begin with an assumption of being non-consensus in some shape or form (otherwise someone would have tried this product design, GTM or business model by now and succeeded, surely). In theory, companies should prosper in the isolation of being non-consensus, forming sustainable moats over competitors by the time they become consensus investments.

As such, all companies are always on the path from non-consensus to consensus. Companies with bigger deltas and higher velocity paths to consensus drive power laws. Post-consensus, the generalist late-stage VC playbook is most accretive to scaling.

Interesting Reads

The next 5 years of vSaaS Investing w/ Bowery Capital

Thomas Robb speaks to Bowery Capital who are some of the most thoughtful vertical SaaS investors in the market; some interesting insights on typical scaling timelines, pathways to becoming Operating Systems, and choosing the right industry.

Kyle Harrison of Contrary makes the salient point that moats are simply illusory for most of a company’s journey, and that product velocity is the best determinant of retention and growth.

How Citadel harnessed the weather to claim hedge fund crown

An inside look at how Citadel’s 38% return in 2022 was partially attributable to recruiting from the sciences and an investment in analytics (specifically weather).

Sammy at Blossom Street parses the key insights from a report published by Bridge Group on SDR and AE performance, with some interesting data points on experience and compensation.

Brandon Gleklen of Battery Ventures makes the case for human processes that are augmented with GPT.

Tweets