Hey friends, I’m Akash!

Software Synthesis analyses the intersection of AI, software and GTM strategy. Join thousands of founders, operators and investors from leading companies for weekly insights.

You can always reach me at akash@earlybird.com to exchange notes!

As enterprise deployments of AI come into sharper focus in 2025, founders have been exhaustively studying Palantir’s business model and go-to-market approach.

The new paradigm of AI-native software companies can learn a lot from Palantir’s blueprint, but the lesser-known C3.ai also offers lessons for founders.

C3.ai’s non-linear journey to Enterprise AI

C3.ai is a >$4bn public software company trading at a 10x forward revenue multiple that IPO’d at the end of 2020. The company was founded by Thomas Siebel in 2009 - that’s right, that’s the same Thomas Siebel behind Siebel Systems, the pioneer of the CRM category before it was acquired by Oracle in 2006.

C3.ai started out focused on focused on carbon footprint management (the "3" in C3 representing "measure, mitigate, monetise"). It was effectively an energy company and rebranded to ‘C3 Energy’ in 2012, focusing on the utilities and oil/gas industries.

Then, in 2016, the company rebranded again to ‘C3 IoT’, shifting focus to IoT and predictive analytics for manufacturing, finance, and healthcare. TPG Growth and The Rise Fund led a $100m round in 2018 valuing the company at ~$1.4 billion.

In 2019, the company rebranded once again to C3.ai, shifting focus to enterprise AI. After the December 2020 IPO the company reached a peak market cap of $10b.

In 2023/2024 the company positioned itself for LLM workloads through the launch of its Generative AI suite as well as deeper partnerships with the hyperscalers and GSIs.

At the time of the IPO, the company’s ACV was $4m, as close to Palantir’s $5m as any public software company comes.

C3.ai also happens to have lots of connections in Washington, which has helped it penetrate the federal government as a vertical (the largest employer in the US).

The company no longer reports customer count, but reasonable estimates suggest significant customer concentration with Baker Hughes and Shell, both of whom have been working closely with C3.ai for many years and could end up churning as they develop their own capabilities in-house.

With those caveats in mind, it’s worth lauding C3.ai for penetrating the Oil/Gas, Manufacturing, Defence, and Energy verticals as effectively as they have, as well as the recent re-acceleration of the business. They may not be on the same trajectory as Palantir, but there are still lessons to be learned.

Sometimes, Palantir is an anti-fraud tool; sometimes, it's a compliance tool; sometimes, it's for managing supply chains to increase production and control emissions.

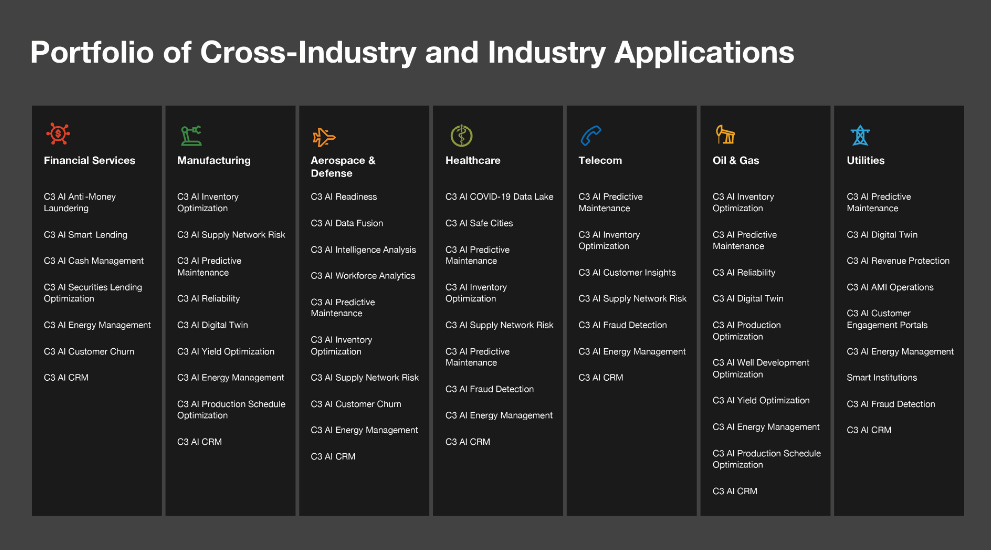

Byrne HobartLike Palantir, C3.ai is a horizontal platform that is different things to different customers.

Fundamentally, C3.ai is an end-to-end platform, handling everything from model development to training and monitoring. The platform comes with preconfigured applications, like predictive maintenance.

That’s the first lesson - solving one problem extremely well before going broader. Predictive maintenance for industrial equipment in the oil & gas and utilities sectors was shrewd because:

The problem was significant (equipment downtime is extremely costly).

The ROI was easily quantifiable (reduced downtime = direct cost savings).

Data was readily available (sensor data from equipment).

Existing solutions were often inadequate.

Another lesson is how, like Palantir, C3.ai went for a full-stack outcome-based selling approach. Going after the Fortune 500 meant consolidating all of the point solutions that would be needed to deploy AI, such as:

Data Wrangling: Automated data ingestion, cleaning, and transformation.

Model Selection: Provided pre-built models and automated model selection tools.

Deployment: Simplified the process of deploying models into production environments.

Monitoring: Offered tools for monitoring model performance and identifying issues.

To effectively reach enterprises in verticals like Oil and Gas, Utilities, Energy and Manufacturing, C3.ai pursued a partnerships approach.

Baker Hughes Partnership

BakerHughesC3.ai formed to deliver AI solutions for the oil and gas industry.

Focusing on predictive maintenance, production optimization, and inventory management.

Baker Hughes took a minority equity position in C3.ai and gained a seat on C3.ai's board.

Shell Collaboration

Shell selected C3.ai as its strategic AI software platform.

C3 AI Reliability now includes Shell's predictive maintenance technology for control valves and critical equipment.

Open AI Energy Initiative is a joint initiative with Shell, Baker Hughes, and Microsoft to create an ecosystem of AI-based solutions for the energy industry.

Koch Industries Partnership

Koch selected C3.ai to enable and accelerate digital transformation across its diverse group of companies.

Initial focus on C3 AI Reliability and C3 AI Production Schedule Optimization[20].

In 2022, the contract was renewed and expanded to a five-year agreement, allowing Koch to build more custom enterprise applications and deploy additional C3 AI applications.

Other notable partnerships

Microsoft: Strategic partnership to integrate C3.ai solutions with Microsoft Azure.

Raytheon Intelligence & Space: Alliance to accelerate AI-driven transformation of the military.

McKinsey & Company: Strategic alliance to accelerate enterprise-scale AI transformations, initially focusing on energy, manufacturing, and financial services sectors.

Accenture: Collaboration with Baker Hughes, C3.ai, and Microsoft on industrial asset management solutions.

Capgemini: Expanded partnership announced in November 2024 to deliver enterprise AI solutions across industries.

Partnerships with the hyperscalers (especially cloud marketplace listings) and GSIs are table stakes in enterprise sales, but C3.ai went further and developed partnerships with industry-leading companies, accruing credibility from executives as it expanded within verticals.

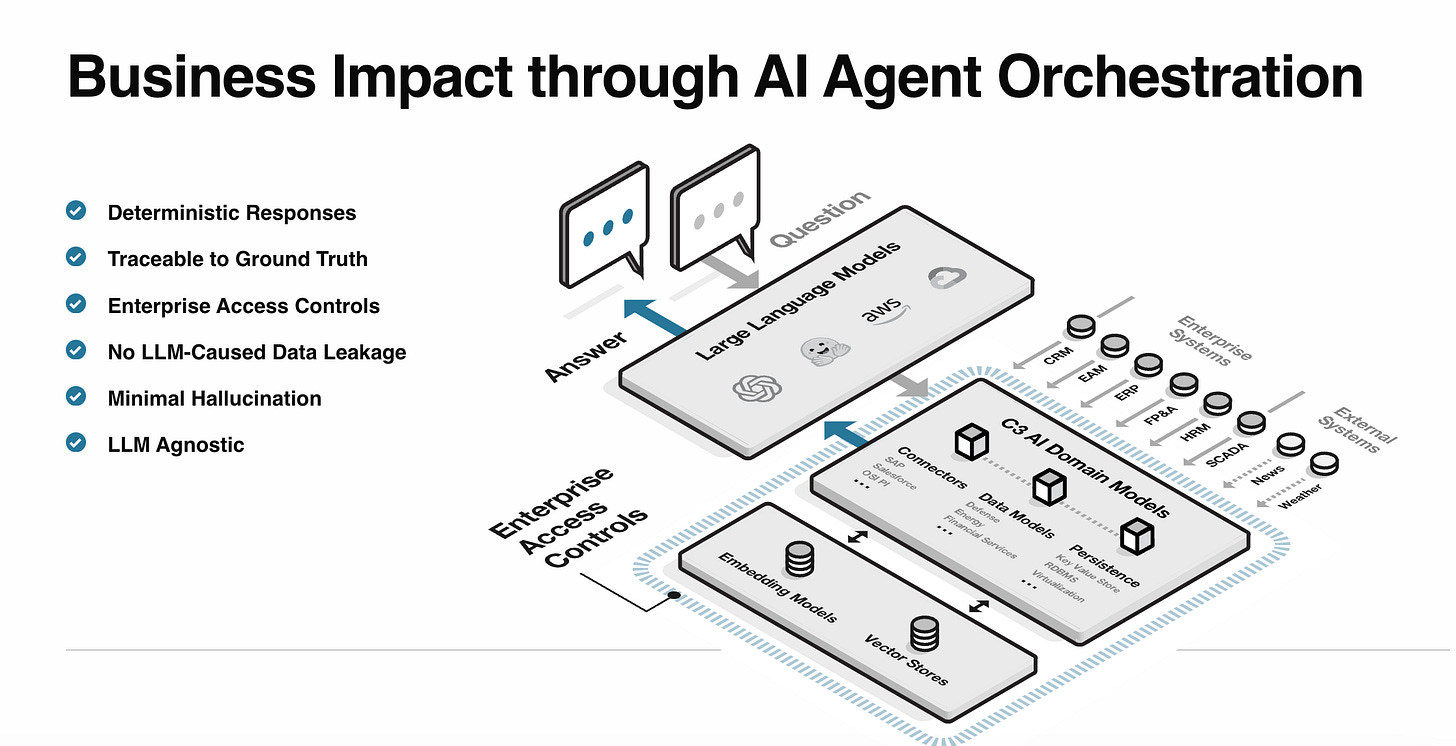

Lastly, the way the company positions the strengths of its Generative AI platform highlight what really matters in the enterprise: reliability and explainability.

There’s a whole lot more to be learned here, but I’ll leave you with that homework!

@shriman001