A guide to embedded payments with Maximilian Lehmann, Senior Vice President @ Nium & Scout @ a16z

A masterclass in embedding payments for SaaS platforms and marketplaces

👋 Hey friends! To the regular readers, thank you for reading as always! If you enjoy these Missives, please share it with your friends and colleagues 🙏🏽.

To the new readers, I’m Akash and welcome to Missives. Every week I analyse trends and go-to-market strategies in software and fintech. You can find me on akash@earlybird.com.

Current subscribers: 2,875, +30 since last week

The manufacture, distribution, and sale of financial services INDIRECTLY will be one of the most important changes to the landscape in the next decade. Dan Kimerling

It’s been nearly four years since ‘Every Company Will Be A Fintech Company’ was published. In that time, much ink has been spilled about the size of the opportunity, the ARPU expansion potential, and the prioritisation of different products.

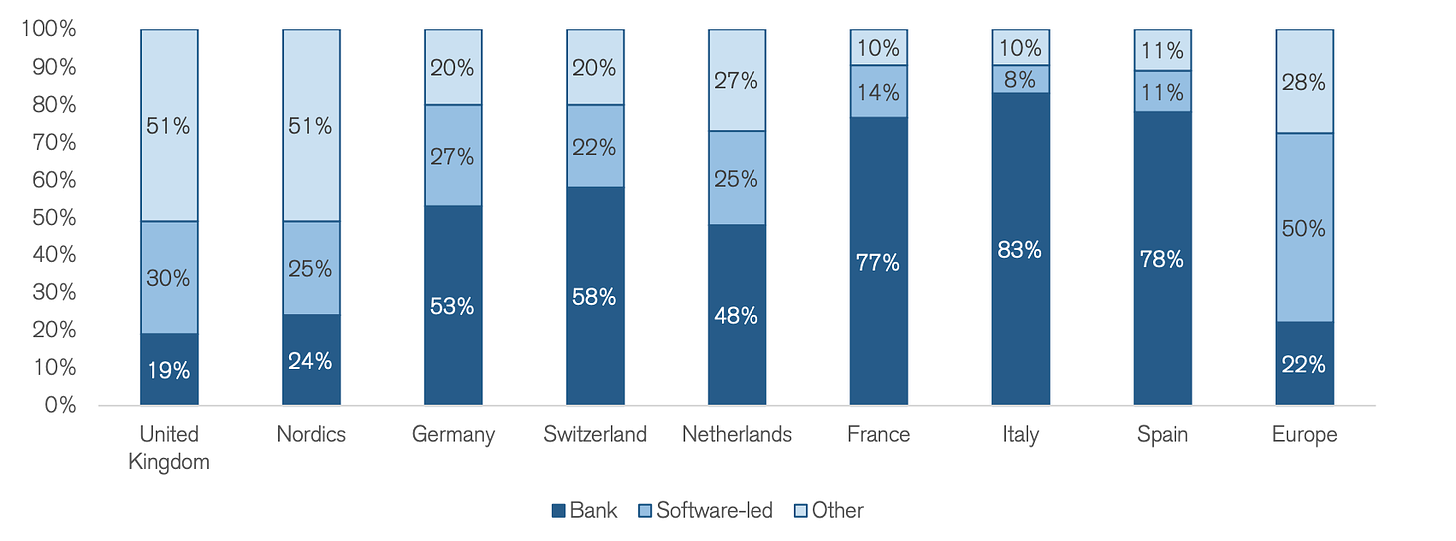

Yet, we’re still in the early innings of the embedded finance revolution, especially in Europe.

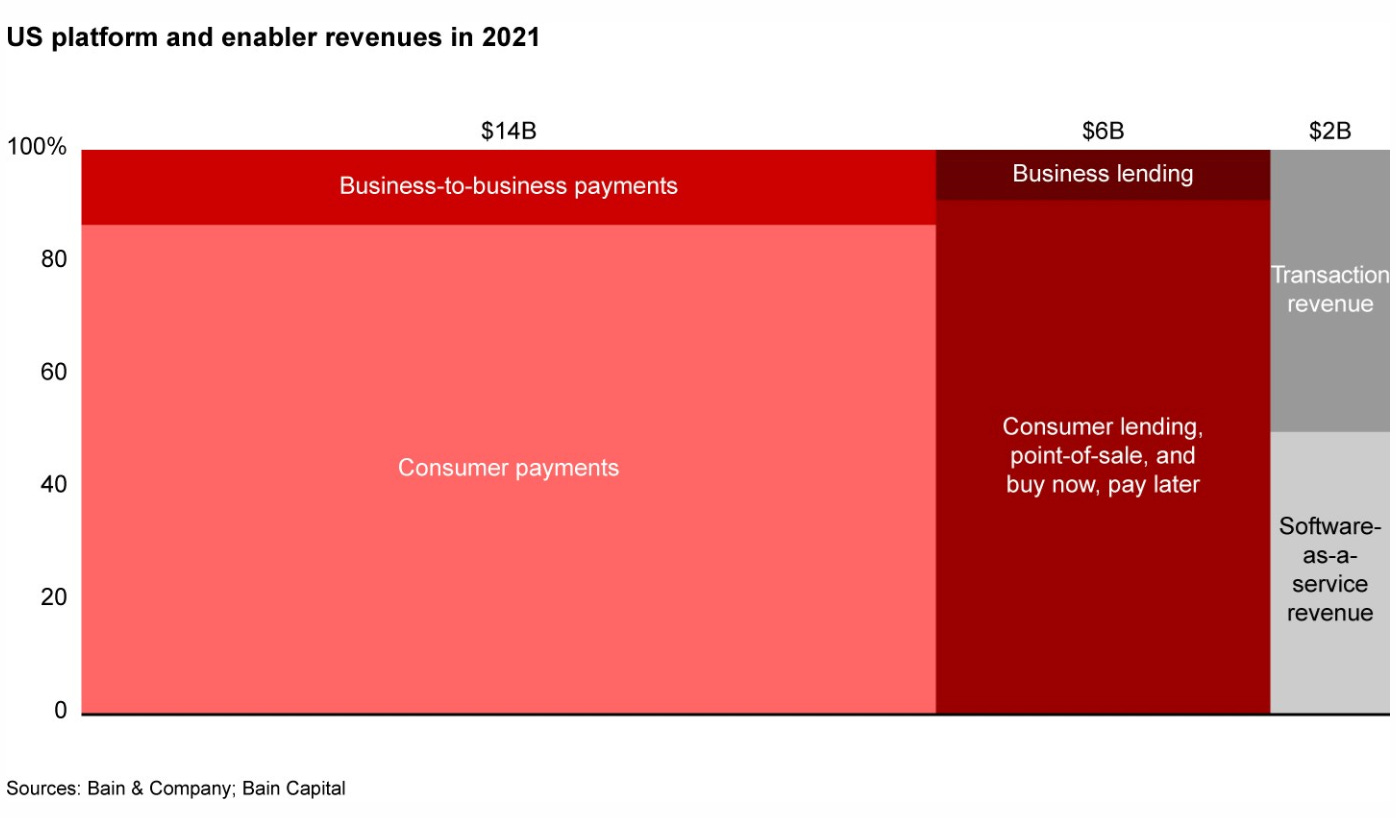

The bundling of payments with SaaS is well underway in the US, where payments is one of the largest segment of embedded finance, which in sum is expected to reach $51bn of revenue by 2026.

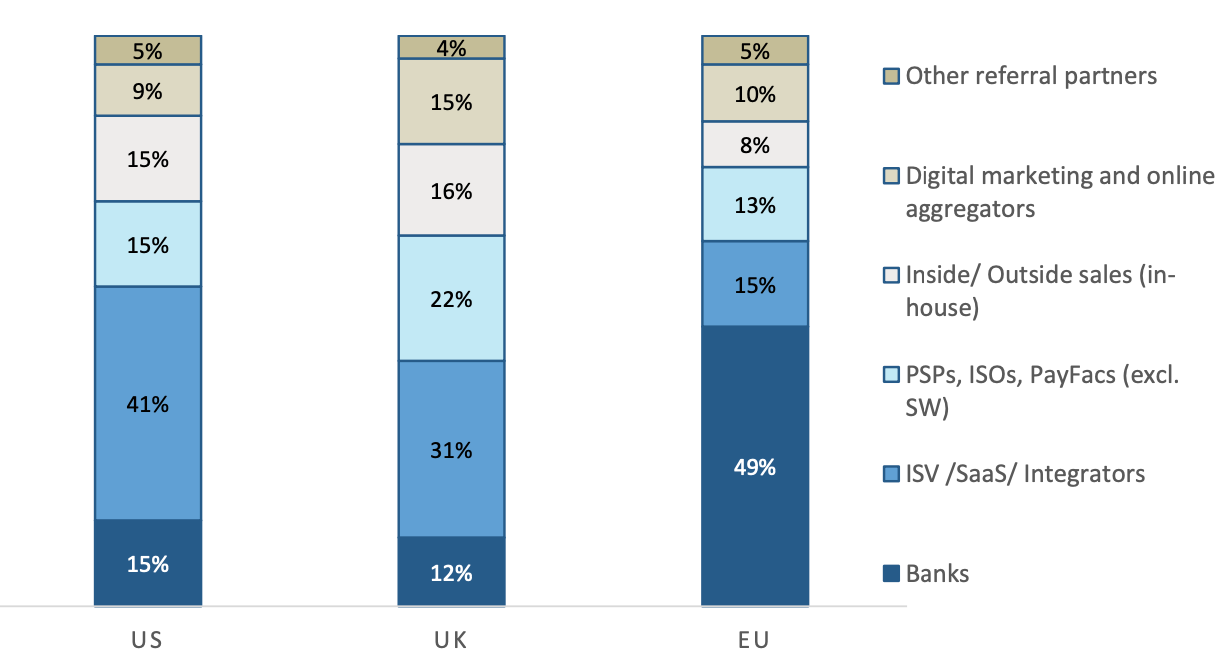

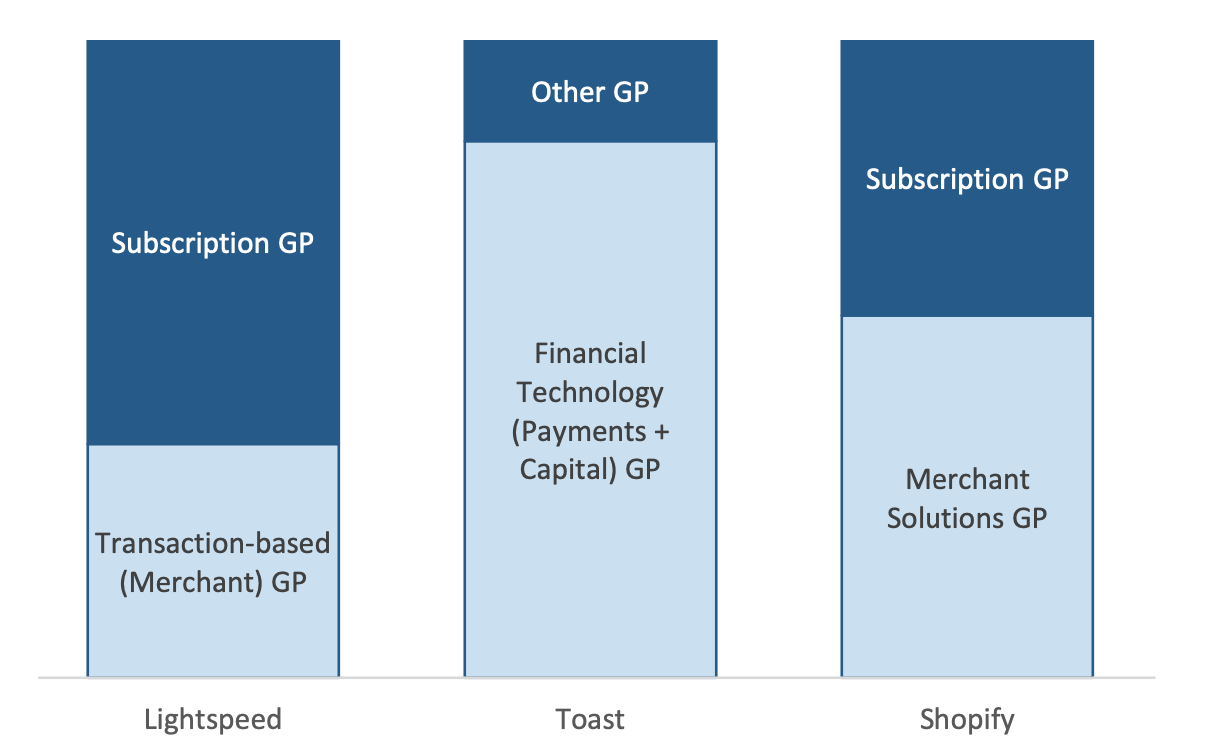

Software-led distribution of payments has become the second act of several listed software platforms like Lightspeed, Toast and Shopify, representing an evolution of how payments has historically been distributed via banks and ISOs.

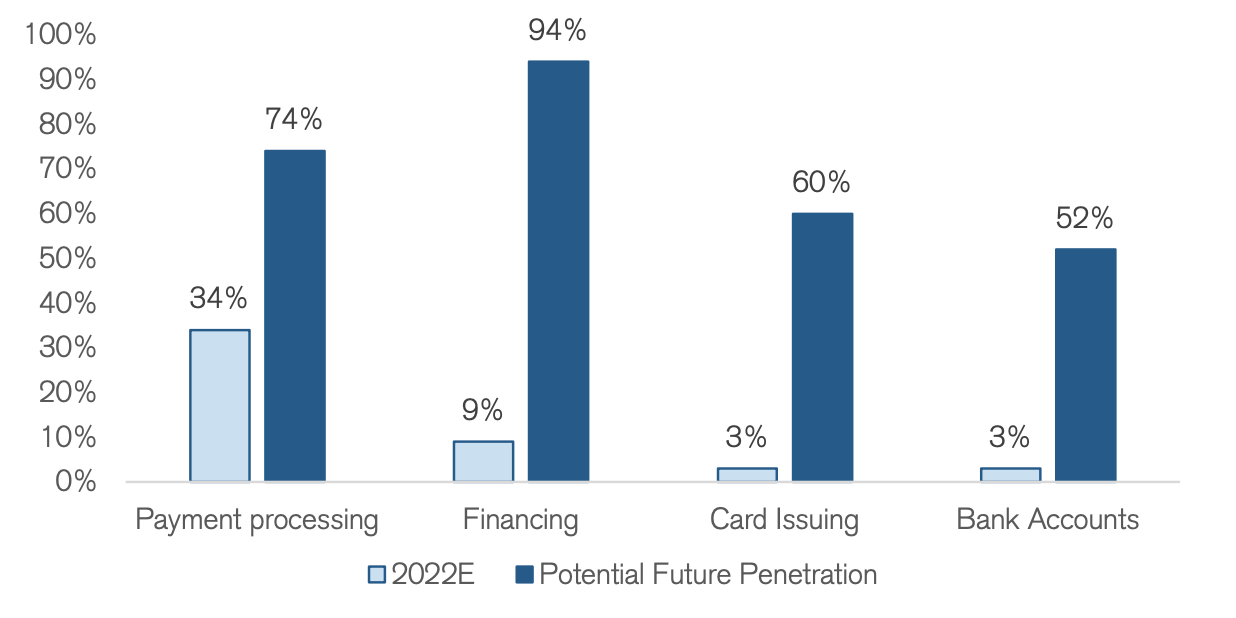

Whilst embedded payments penetration leads the way when it comes to embedded financial services, the modern acquiring giants (Adyen, Stripe) have built out product suites to capitalise on the natural cross-sell opportunity for capital, cards and accounts.

And yet, much of Europe remains greenfield.

Max Lehmann has over 15 years experience working in payments and fintech, much of it specifically helping software platforms and marketplaces develop their embedded finance roadmap. Today, we have the great privilege to hear Max’s insights on the current embedded payments landscape, how platforms should weigh up the pros and cons of pursuing increasing ownership of payments, and the criteria to optimise for.

Thank you Max for your wonderful insights!

Max was previously Senior Vice President at Adyen where he was responsible for Adyen’s fastest growing business unit, Platforms and Financial Servies. Prior to Adyen, Max was Vice President at Boku selling alternative payment methods to global enterprise customers from San Francisco and Singapore.

Today, he has settled in Amsterdam with his wife and two kids and is part of the leadership team at Nium, a global fintech platform that enables businesses to send, spend, and receive money across borders.

Operator during the day, VC at night, Max is also an investment scout at Andreessen Horowitz, one of the leading venture capital firms in Silicon Valley.

Max, you’ve had a fascinating career in payments, from carrier billing at Boku to enterprise sales and financial products at Adyen, now to cross-border payments and payouts at Nium. One common thread at Nium and Adyen is of course the range of financial services products you’re selling to platforms (e.g. accounts and cards) to serve the needs of sub-merchants - can you give us a sense where enterprise marketplaces and platforms stand today when it comes to their attitude to adding financial services products? Is it an education sale, or do they grasp the benefits very fast?

Thank you Akash. Maybe first of all: when I started my career, I didn’t really plan to end up in payments and financial services in general; but after almost 15 years, I am still loving it. The market is in constant change, so it never gets boring. A great example of how an entire industry can change in almost no time is the enterprise marketplace and SaaS platforms industry, indeed. While companies like Shopify, Ebay or Uber have embedded financial services already a couple of years ago in the US, you can see now 3 major trends:

In the US, financial services sold by software platforms expand to all platforms in all industries with more use cases (started with payments and now ranges from issuing cards, offering working capital and bank accounts all the way to payroll financing).

Growth can be explained easily: Platforms, particularly those catering to specific industry niches, possess an extensive understanding of their clientele. This enables them to offer customized financial solutions, such as assessing customers' eligibility using their past payment records or distributing debit cards that allow clients to utilize earnings from their transactions.

Other regions are catching up (most notably UK, Australia, EU), but it is still early compared to the US, so here definitely more work on the educational side

SaaS Platforms that serve mostly offline businesses (think food and beverage cash registers, hotel property management systems, accounting and billing systems for gyms, etc.) see the value of embedding financial services as well and have started to move away from a typical referral model to an embedded model - starting with payments.

Main reason for this shift is that companies like Adyen and Stripe are making embedding payments very easy. Where platforms used to set up entire engineering and finance teams and acquire appropriate payfac licenses in every region, it can be done today without any additional license and with a fraction of people. That’s why I’ve seen, especially in vertical SaaS (software for a specific industry), incredible adoption of embedded financial services. However, here again, you see that US based companies like Toast are much quicker in adopting and much more education is needed outside of the US.

One of the key considerations of a marketplace or platform when choosing to work with a payments vendor is of course the experience of their sellers or sub-merchants. Beyond the burden of KYC’ing them, can you share some insights on what other dimensions sellers are most concerned with (e.g. instant payouts)?

My experience is that most sellers/users are small businesses or even individuals. That means resources to run their business are limited. They don’t have a payments team, a treasury or an operations team in most cases. Onboarding / KYC needs to happen in minutes not days. They can’t afford to wait. So providing automated onboarding capabilities as a platform is key.

Beyond onboarding, access to capital is the predominant concern. Users need to pay their suppliers, freelancers, staff, fill up their car etc. every day, so what that means for platforms is:

Industry is already at T+1 settlement in the US and T+2 everywhere else, so make sure to stay within these timelines and but also offer instant payouts, ideally 24/7 to allow for more flexibility (platforms can charge for that service)

Platforms need to take payout stability into account. If a platform misses a payout to a user, it becomes a problem. That’s why I see large platforms decoupling acquiring and paying-out to separate providers. Platforms need backup solutions in case a connection is down

Beyond regular settlement flexibility & stability, give your users other options when it comes to liquidity. Issuing a debit or credit card with industry specific benefits (like cheaper gas for Uber drivers or rebates at suppliers for restaurant owners) or offering working capital is a great way to help users out in their daily lives.

As an extension of this question, what are the criteria that a marketplace/platform payments vendor would be evaluated on in an RFP? Authorisation rates, up-time, payment method coverage, and multi-currency support would probably be a few of the variables, but are there other salient ones?

There are more general areas of every RFP like company history, merchant footprint, funding, compliance, etc., but typically, there are 5 major areas that are specifically relevant to platforms. Here a couple of key questions every platform should ask itself:

Payment capabilities: how can a platform acquire funds from users. Everything from cards, local payment methods, online vs. online processing, risk and fraud services, tokenization, etc., play a role. It all starts with payments.

Onboarding and verification: how does the onboarding of users look like? How fast can users onboard? Is onboarding automated? Is there flexibility when it comes to the integration (API-based vs. hosted)? How can I migrate existing users (if the platform has already onboarded users with other providers)? What are the data requirements per user (individual/business/transaction thresholds)?

Funds flow: how do the funds flow for the platform and users? Do I get collection accounts in different currencies? Who is acquiring the funds? How does split payments work? How are users set-up (virtual wallets)? How do I move funds between users? What happens when there is a chargeback/refund/etc.

Settlement: how flexible can a platform be with settlement? Does the provider allow for scheduled payouts (real-time/instant, daily, weekly, monthly) vs. API-based payouts, what are the modes of payouts (bank accounts, cards, wallets)?

Reporting, customer service and other value added services: what notifications do I get as a platform? What dashboards? How does customer service look like for the platform, but also for the user? Daily vs. monthly reporting? Does the platform issue tax reports for users (1099Ks in the US, Dac7 reports in the EU, etc.)?

We’ve seen plenty of examples like Shopify where P&Ls have become inverted to be heavily reliant on payments/transactional revenue rather than software. More and more platforms face this strategic juncture of how many non-core responsibilities (compliance, onboarding, risk scoring etc) the platform deems worthwhile to in-source for the potential upside. Can you give us a framework (in terms of scale for example) for how you advised SaaS platforms to think about the trade-offs of taking more and more of payment processing in-house versus simply referring leads to a PSP?

In short, referring business to a PSP or a bank is a dying business practice in my opinion. If the platform is set-up in the US or Europe, then I recommend embedding payments from the get go and not even start going down the route of referring business to PSPs or banks. There are 5 main reasons in my POV why embedding payments makes sense:

PSPs like Adyen or Stripe offer embedded payment capabilities (including all licenses) out of the box.

Referring business to a third party diminishes the user experience. As a platform you want to own the end-user relationship end-to-end and not leave “the last mile” to a legacy provider

Your own users are willing to pay more for a non-stop experience

SaaS companies make more money now with payments compared with their own software product

Investors love payments as it adds stability to cash flow and predictability to the business. As one VC friend the other day said: “I am not investing in SaaS anymore that don’t run payments themselves”.

That’s just what I’ve seen in my years at Adyen working with hundreds of software platforms. If that’s not convincing enough, here a general framework to help SaaS platforms think through:

1. Business Model and Value Proposition:

Consider as a platform whether payments are a core part of your value proposition (or if you can make it one). If seamless payment integration is essential for your customers (it almost always is), in-house processing might be the right thing to do

Analyze how much your users value the convenience of integrated payments combined with your product offering. If it can become a key differentiator to offer a bundled solution, in-house processing makes a lot of sense.

2. Control and Flexibility:

Evaluate how much control you need over the payment experience. In-house processing provides greater control over the user interface, data, and customization options.

Consider whether you want to control the end-to-end customer journey, including payment-related features and optimizations or want to give this critical task away.

3. Revenue and Margins:

Assess the potential revenue streams from payment processing (my experience is that payment processing can bring about 1.5x to 2x of additional revenue of what you currently processing in ARR). However, evaluate whether the additional revenue justifies the investment and effort required to build and maintain an in-house solution and team of at least 5 people.

Consider the potential impact on margins. In-house processing might provide higher margins compared to referrals, but it also comes with increased costs for development, compliance, and maintenance.

4. Technology and Expertise:

Evaluate your technical capabilities. Do you have the resources and expertise to build and maintain a reliable and secure payment processing system?

5. Risk and Compliance:

Assess the level of risk associated with payment processing. Understand the regulatory landscape in the regions you operate in. Although, you typically do not need specific licenses, you got to understand the in-and-outs of payments when it comes to potential regulatory questions (for instance, PSD2, PayFac license, etc.)

Consider whether you're equipped to handle fraud prevention, chargebacks, and compliance challenges on your own / i.e. develop a support framework with your PSP from which you source these services

6. Customer Experience:

Gauge the impact on user experience. Ensure that your payment solution meets user expectations for reliability, security, and ease of use.

Consider how the payment process aligns with your overall user journey and customer satisfaction.

7. Partnerships and Integration:

Determine if you want to partner with PSPs to provide a more comprehensive embedded financial ecosystem or if you prefer to source each services separately (like payouts).

If you have an existing referral partner and heavily rely on that partnership, make sure to have an open dialogue and come up with a migration plan (for instance, start by embedding only new users).

8. Long-Term Strategy:

Align the payment processing decision with your long-term strategic goals. Consider how this decision will impact your future growth and diversification plans, especially if you have broader ambitions with launching financial services (for instance, by offering working capital). Payments data then becomes a necessity for lowering your own risk issuing credit.

9. Cost-Benefit Analysis:

Conduct a thorough cost-benefit analysis comparing the expenses of building and maintaining an in-house solution against the fees and costs associated with using a PSP.

10. Building an ecosystem and customer stickiness

In my experience, small and medium business owners have to fight day in, day out with 10-15 (sometimes more) different software tools to keep their business up and running. The easier you can make it as platform to offer an all-in-one solution, the more value and stickiness you provide to your users. They will thank you as they can concentrate selling their product and not have to worry about yet another party in their ecosystem.

When it comes to the needs of marketplaces and platforms, onboarding, payment processing and payouts stand out as the key jobs to be done. How do you think about the different schools of thought favouring either a unified approach or a best-of-breed approach? That is to say, should platforms be shopping for specific vendors for each of these needs or would they be better off with a single end-to-end vendor?

If you are starting out as a platform or a marketplace and/or scale it all the way to $1Bn in GMV in a handful of regions, then I recommend selecting a best-of-suite / unified approach. Most providers, but certainly Adyen or Stripe, can help platforms to grow their business to that size with minimal impact on your team or finance operations.

Pros: Simplicity, seamless experience, streamlined operations, strong vendor relationship, single point of contact,

Cons: Limited customization, less innovation in each area, single point of failure, lock-in, less leverage

Once the $1Bn mark is reached and/or the platform decides to go global, my experience shows that several platforms start replacing services in the value chain by best-of-breed providers (like Nium for payouts only).

Pros: much higher degree of customization, innovation, scalability, domain expertise

Cons: new integration, increased vendor management / coordination

However, it’s not only specific vendors that replace an unified approach, I also see that a lot of platforms start to in-source elements like onboarding/KYC to tailor these services to their specific (market) needs.

One thing that can go easily under the radar in payments is the role of consultants. We typically associate consultants with software selection, but of course they do play a big role in how enterprises identify the right payment partner for their needs. Can you give us some insights into the importance of consultants in payment processor shopping?

In the rapidly evolving payments landscape, having a consultant's guidance can be invaluable in avoiding pitfalls, capitalizing on opportunities, and making informed decisions that drive growth and customer satisfaction. Especially when platforms start to embed financial services, it can be done with minimal resource impact (see below), but since in-house knowledge needs to be built up over time, consultants are an important resource to consider to fast track payments strategy, product strategy and vendor selection.

What I’ve learned, though, is two things:

It's important for platforms to partner with consultants who have a strong track record, relevant experience, and a comprehensive understanding of the payments ecosystem.

Incentivisation of consultants plays a major role when engaging with them. Consultants should be paid according to project outcome (for instance, launch payments in a new market). Negative example are consultants that promise to cut cost selecting vendors and then over optimize on prize without forgetting the long-term quality & stability that a vendor can bring.

We know of large merchants like Uber and Airbnb that have large payments teams and have built a lot of tooling in-house for tasks like orchestration - what is your view on how to staff up a payments team as your platform grows - is there a certain size that is economical and should be augmented with software, or should the team continue to scale linearly with volumes?

Since no prior licenses, onboarding, payments or risk scoring expertise is needed to set-up embedded payments, it can be done with minimal resources.

I recommend, though, at least: 1 payments owner, 1 product specialist, 2 developers, 2 dedicated customer support reps.

I’ve seen platforms scaling up to $1Bn GMV/year with this set-up, especially if the scope is only in one region, one product (i.e. payment processing without any other financial services) and in one industry (for instance, beauty salons).

Once the platform reaches that volume threshold or expands in scope (like adds more regions), it typically starts to add more people, add additional payment companies, thinks about getting a financial license for more control and begins to think about in-sourcing services like onboarding or payouts.

My general advice is:

Start Lean: Begin with a small team covering essential roles like payment operations and fraud prevention.

Scale with Growth: As transaction volumes increase, expand the team to manage higher demands and customer inquiries.

Complexity Matters: More complex payment flows might require a larger team to handle intricacies.

Strategic Focus: Once payments become big enough to your business, a larger team might be needed for control and innovation.

Technology and Automation: Invest in internal tools and automation to boost efficiency, potentially reducing the need for a linear team expansion.

Collaboration: Work closely with other teams like engineering and customer support for seamless operations.

Continuous Review: Regularly assess team structure and adjust based on changing needs and advancements.

There is no good formula how big a payments team should be in the end of the day, but the size of your payments team should always align with your platform's growth, complexity of products, and strategic objectives as a company (for instance, do I want to offer financial services and not just payments).

🗞 Reading List

5 Ways to Drive Expansion and Increase NRR w. Mark Kosoglow

The Benefits of Writing; Base Hit Investing Comeback

How to escape competition -- Building enduring application-level value with LLMs

AI startups: Sell work, not software

🗯️ Quotes of the week

That danger is to approach these initial startup financings through the lens of the local maxima for our business model and not the first principles view into how much the company needs to get an adequate product into market or have the time to introduce a better solution. There is increasing evidence to support that startups may raise a little more, not less, upfront. Aashay Sanghvi

I have this line, posting is the last great American meritocracy. The American Dream lives in posting. And I think that's true. I really do. I think the last true and total meritocracy, you can post your way into any room in the world. If your takes are interesting and people think what you have to say is compelling, you can be an anonymous account, I mean you've had anonymous accounts on the show before, and you can just go anywhere. And you really don't need anything other than a smartphone. Jeremy Giffon